Will COVID-19 Leave Lasting Economic Scars?

Researchers and policymakers are wondering whether the economic losses associated with the COVID-19 pandemic will prove temporary or persistent. Examining the housing crisis of 2006–09 may provide some clues. Despite the fact that the housing crisis represented a temporary demand-side shock, it had lasting negative effects on employment and GDP in regions most exposed to the boom and bust in house prices.

Countries around the world are facing widespread economic disruption from the COVID-19 pandemic and the social distancing measures taken to curtail the spread of the virus. In the United States, unemployment has soared to historic levels and GDP growth has fallen sharply. Policymakers anticipate that many of these effects will be temporary and that economic activity will return to more normal levels once the threat of the virus has passed. With that in mind, researchers are exploring whether the economic losses associated with this disruption will be short-lived or long-lasting.

While the response to COVID-19 has shuttered entire subsectors of the economy, so far the pandemic has not irreparably damaged capital or labor productivity. On one hand, this fact suggests that losses in employment and output could be temporary as businesses are able to resume operations once the immediate threat has passed. On the other hand, even temporary shocks to the economy can have lasting effects. In remarks about the crisis delivered on May 13, Federal Reserve Chair Jerome Powell noted that "the record shows that deeper and longer recessions can leave behind lasting damage to the productive capacity of the economy."1

The housing market crash of 2006–09 presents an instructive example. Like the novel coronavirus, the housing market boom and bust did not directly damage capital or labor productivity. Despite this fact, the U.S. economy took a long time to recover.2 As this Economic Brief will explore, local responses to the housing crisis left scars on employment and GDP that lasted years after the initial shock to the economy had subsided. Studying the response to the housing crisis may provide some clues of what to expect in the aftermath of COVID-19.

Scars of the Housing Crisis

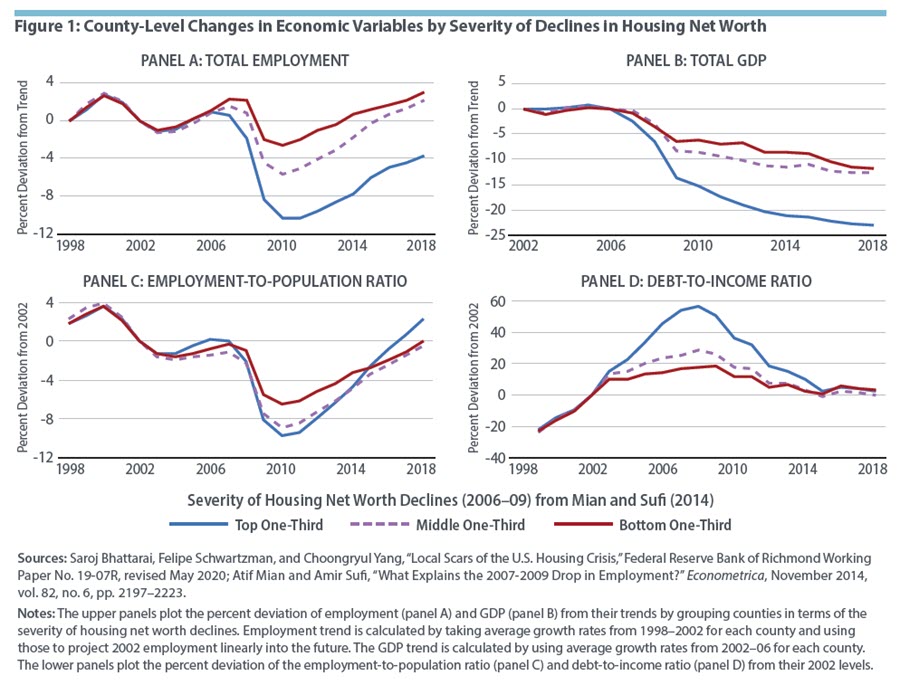

In a recent working paper, Saroj Bhattarai, Felipe Schwartzman, and Choongryul Yang examine the local effects of the 2006–09 housing crisis.3 Following the example of Atif Mian and Amir Sufi, they calculate the change in household net worth due to housing for each state and county.4 Sorting counties into three categories in terms of the change in housing net worth that households experienced in 2006–09, Bhattarai, Schwartzman, and Yang find that counties with the greatest losses in net worth also suffered the greatest losses in employment and output. Those effects persisted long after house prices and household debt-to-income ratios had largely returned to precrisis levels. (See Figure 1).

As can be seen in panels A and B of Figure 1, employment and output in the worst-hit counties remained below precrisis levels in 2018. Bhattarai, Schwartzman, and Yang find that a 10 percent negative housing price shock in 2006–09 resulted in 3.3 percent lower employment and 4.6 percent lower output in 2018 compared with 2006. Panel C of Figure 1 shows how these economic scars persisted despite the fact that labor market slack, as measured by the employment-to-population ratio, returned to normal around 2014. Likewise, measures of household wealth, such as the debt-to-income ratio depicted in panel D, returned to normal a few years after the crisis even in counties that experienced the largest boom and bust in housing.

Why did the housing crisis have such persistent effects on employment and output? Financial or wealth shocks can have lasting demand-side effects associated with household deleveraging.5 And it is possible that the housing boom and bust permanently depressed productivity, which would hamper long-run growth.6 Bhattarai, Schwartzman, and Yang ultimately reject these hypotheses, however. After controlling for other shocks during 2006–09, using a series of control and instrumental variables, it becomes clear that household deleveraging eventually ended and labor productivity was not significantly affected by the housing market disruption. The long-run effects of the housing crisis must have another explanation.

Local Adjustments

Figure 1 points to the role that local population adjustments to the housing crisis may have played in the persistent decline in employment and output. The employment-to-population ratio and unemployment rate eventually recovered to precrisis levels, but total employment remained depressed in the counties that experienced the largest housing shock. In a seminal 1992 paper, Olivier Blanchard and Lawrence Katz found that regional labor market adjustments to economic shocks can have long-lasting or even permanent effects on employment.7 They documented that after a negative shock, local labor market slack (measured by the employment-to-population ratio or unemployment rate, for example) doesn’t recover because employment growth accelerates to make up previous losses. Rather, workers migrate to other states that are less impacted by the shock, reducing the pool of employable labor.

To see how employment responded to the housing crisis of 2006–09, Bhattarai, Schwartzman, and Yang looked at how the shock affected different counties and different sectors of the economy. Unsurprisingly, the construction sector exhibits a clear boom-bust pattern, with employment rising prior to 2006 and then contracting sharply afterward. In contrast, other sectors of the economy did not experience significant growth in employment during the boom phase but did exhibit losses during the bust. Bhattarai, Schwartzman, and Yang find that these negative effects were short-lived in nontradable sectors, including retailing and hospitality, and more persistent in high-skilled sectors, such as professional and business services, education, and health care. (See Figure 2.) Additionally, counties that were growing faster before 2006 suffered larger losses in employment and output after the housing bust.

Reducing wages in response to a shock can mitigate some of the job losses, but Bhattarai, Schwartzman, and Yang found no evidence of declining wages in most sectors during the housing crisis. This wage rigidity suggests that local labor markets had to adjust entirely through increases in unemployment, or labor market slack, in the short run.8 In the long run, this adjustment was followed by population movement as workers in the hardest-hit localities moved to regions that were less impacted. Thus, Bhattarai, Schwartzman, and Yang find that the persistent negative local effects associated with the housing shock are the result of labor mobility.9

Conclusion

Bhattarai, Schwartzman, and Yang show how local labor market adjustments to temporary economic shocks can leave lasting scars on employment and output. To the extent that much of the economic effects of the COVID-19 pandemic will be through a large but temporary reduction in demand for certain goods and services, the long-term impacts may operate through similar channels. Additionally, the finding that regions that experienced the largest housing shock also suffered the deepest long-run losses suggests that regions facing larger shocks from the pandemic may also experience larger persistent losses in employment and output if workers migrate from those regions to less-affected areas.

Tim Sablik is a senior economics writer and Felipe Schwartzman is a senior economist in the Research Department at the Federal Reserve Bank of Richmond.

Jerome H. Powell, "Current Economic Issues," speech at the Peterson Institute for International Economics, Washington, D.C., May 13, 2020.

See Olivier Coibion, Yuriy Gorodnichenko, and Mauricio Ulate, "The Cyclical Sensitivity in Estimates of Potential Output," NBER Working Paper No. 23580, October 2017; Carmen M. Reinhart and Kenneth S. Rogoff, This Time is Different: Eight Centuries of Financial Folly, Princeton, N.J.: Princeton University Press, 2009; Òscar Jordà, Sanjay R. Singh, and Alan M. Taylor, "The Long-Run Effects of Monetary Policy," Federal Reserve Bank of San Francisco Working Paper No. 2020-01, January 2020.

Saroj Bhattarai, Felipe Schwartzman, and Choongryul Yang, "Local Scars of the U.S. Housing Crisis," Federal Reserve Bank of Richmond Working Paper No. 19-07R, revised May 2020.

Atif Mian and Amir Sufi, "What Explains the 2007–2009 Drop in Employment?" Econometrica, November 2014, vol. 82, no. 6, pp. 2197–2223.

Veronica Guerrieri and Guido Lorenzoni, "Credit Crises, Precautionary Savings, and the Liquidity Trap," Quarterly Journal of Economics, August 2017, vol. 132, no. 3, pp. 1427–1467.

For an example of how temporary shocks can affect long-run growth through this channel, see Diego Anzoategui, Diego Comin, Mark Gertler, and Joseba Martinez, "Endogenous Technology Adoption and R&D as Sources of Business Cycle Persistence," American Economic Journal: Macroeconomics, July 2019, vol. 11, no. 3, pp. 67–110.

Olivier Jean Blanchard and Lawrence F. Katz, "Regional Evolutions," Brookings Papers on Economic Activity, no. 1, 1992.

Other studies have documented downward wage rigidity in microeconomic data. See John Grigsby, Erik Hurst, and Ahu Yildirmaz, "Aggregate Nominal Wage Adjustments: New Evidence from Administrative Payroll Data," NBER Working Paper No. 25628, March 2019; Stephanie Schmitt-Grohé and Martín Uribe, "Downward Nominal Wage Rigidity, Currency Pegs, and Involuntary Unemployment," Journal of Political Economy, October 2016, vol. 124, no. 5, pp. 1466–1514.

If much of the adjustment takes place through population movements, regressions at the county level might not be appropriate because individuals may live in one county but work and shop in another so that loss of employment in a locality need not be borne by the local population. To address this concern, Bhattarai, Schwartzman, and Yang conduct the same analysis using core-based statistical areas, which are collections of counties linked by commuting. They find the same general patterns.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.