How Do Small Business Finance and Monetary Policy Interact?

Economists at the Richmond Fed, the University of Virginia, UC Irvine, and Purdue analyze how monetary policy affects the creation of lending relationships for small businesses and vice versa. Bank loans are an important funding source for small businesses, but many small businesses have no access to them. The researchers develop a search model that analyzes the supply and demand for lending relationships. Understanding the key role these relationships play in the economy can help central banks develop optimal monetary policy responses to crises like the Great Recession and COVID-19.

Small businesses (those with fewer than 500 workers) employ almost half of the American labor force.1 But unlike large businesses, they are often unable to borrow in the corporate bond market or raise capital in the stock market. Most small businesses must finance their investments either internally, from retained earnings or the owners' personal funds, or externally, with loans from a bank. For external financing, many small businesses access credit through longstanding relationships with banks. These relationships often provide firms with adequate liquidity: according to the 2003 Survey of Small Business Finances (SSBF), firms with access to bank credit typically hold 20 percent less cash than firms that are not in a lending relationship.2 Still, the SSBF reports that 32 percent of small businesses do not have access to a credit line or a revolving-credit arrangement with banks. This difference between banked and unbanked small businesses creates the potential for asymmetric transmission of monetary policy, depending on firms' access to credit and their cost of internal finance.

The traditional model for explaining monetary policy focuses on the aggregate demand channel. This approach asserts that when the central bank reduces interest rates, it decreases the cost of borrowing and increases the demand for credit. Lowering interest rates, therefore, encourages investment and consumption spending. However, an alternative model considers how monetary policy affects the supply of credit through the bank-relationship channel. This approach asserts that when the central bank raises interest rates, it encourages banks to create relationships with firms to increase the revenue of the banks via higher interest payments and fees. Additionally, firms may find it more profitable to be in banking relationships when the interest rate is higher. In the long run, these new relationships lead to an increased number of loans to firms, which provides more funds with which firms can invest. However, relationships between banks and small businesses take time to develop. As a result, this match-making friction affects the transmission of monetary policy in this alternative model.

In a recent working paper, Russell Wong of the Richmond Fed, Zachary Bethune of the University of Virginia, Guillaume Rocheteau of the University of California, Irvine, and Cathy Zhang of Purdue University analyze the channel through which monetary policy affects the creation of new lending relationships, the financing of firms' investments, and the trade-offs of the central bank.3 Their model predicts the economy's response to an unanticipated banking crisis that destroys lending relationships. From there, they analyze the optimal monetary policy responses under different levels of central bank commitment. Lastly, they adapt their model to characterize the optimal response to a partial lockdown of the economy caused by a crisis like the COVID-19 pandemic.

The Model

The researchers develop a search model in which banks and firms search for and develop relationships with one another to maximize lifetime utility. In their model, each period of time is composed of three stages. During the first stage, investment opportunities arise that are financed by cash or bank loans. During the second stage, unbanked firms search for lending relationships with banks. During the third stage, firms settle bank loans, trade assets, and raise more cash internally if needed. While the researchers consider a general case in their working paper, for the sake of brevity, this Economic Brief considers a simpler case in which a nominal bond (one whose return is not adjusted for inflation) is the only asset, and the central bank can directly control its interest rate by trading nominal bonds and cash in the open market. Since cash and nominal bonds are imperfect substitutes, the interest rate is essentially the opportunity cost of holding cash, regardless of whether a firm is banked or not. Having cash benefits unbanked firms more because they do not have access to bank loans to finance their investments. Banked firms can finance their investments by drawing on bank lines of credit line in addition to their cash holdings. The loan rate and credit line are determined by bargaining between firms and banks.

Consistent with the data, the model predicts the following. First, banked firms hold less cash than unbanked firms, but their level of investment is higher. Second, banks are able to pass on the higher interest rate to borrowers in the form of higher loan rates. Third, while a higher interest rate reduces cash holdings in general, unbanked firms retain more cash than banked firms because unbanked firms cannot rely on bank credit, and therefore, need to retain some cash. Taken together, these outcomes imply that the cash demand of unbanked firms is less sensitive to interest rate movements than that of banked firms.

To see the effect of monetary policy on this bank-relationship channel, consider what would happen if the central bank increases the interest rate. A direct effect is that holding nominal bonds would have a higher return. Since banked firms can rely more on bank loans than cash to finance investment, they can afford to hold less cash in exchange for more nominal bonds. For this reason, banked firms find their existing banking relationships more beneficial, and unbanked firms become more likely to seek out relationships with banks. Additionally, increasing the interest rate allows banks to increase their income — via higher loan rates — and encourages them to create new relationships with firms to expand their credit lines. Finally, because there are now more banked firms and because banked firms have higher levels of investment, total aggregate investment can increase.

The Central Bank's Dilemma after a Crisis

Following a negative credit-supply shock, such as the 2008 financial crisis, a fraction of banks and businesses shut down, and some lending relationships are destroyed. After the shock, the central bank must choose either to support firms by providing greater access to cash or to encourage banks to form new lending relationships. This choice represents two basic monetary policies: interest rate targeting and aggregate liquidity targeting. Interest rate targeting holds the interest rate constant and supports firms by allowing them access to cash at the same opportunity cost. Following the shock, investment by individual firms under interest rate targeting remains unaffected, but aggregate investment decreases because of an increased number of unbanked firms, which have lower levels of investment than the banked firms. In contrast, aggregate liquidity targeting holds the cash supply constant. Firms' demand for cash is higher, and their demand for nominal bonds lower, after they lose access to lending relationships, so this approach pushes up the interest rate if the central bank does not increase the supply of cash. Thus, if the central bank wants to encourage banks to form new lending relationships, it can hold the cash supply constant and allow the interest rate to rise. Aggregate investment, especially of the unbanked firms, decreases under aggregate liquidity targeting due to the higher interest rate and insufficient cash. In the longer run, however, the economy performs better under liquidity targeting because the higher interest rate encourages the creation of new lending relationships.

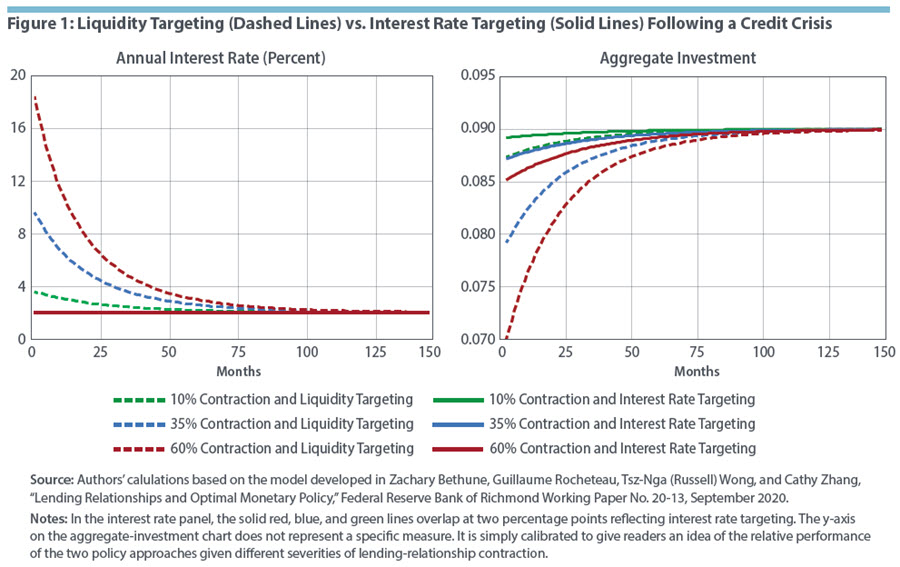

Using data from the SSBF and Compustat, the researchers calibrate their model to simulate how the economy would respond to a negative credit shock under the policies described above. They simulate 10 percent, 35 percent, and 60 percent contractions in banking relationships, corresponding to different interpretations of small business lending contractions during the 2008 financial crisis. In Figure 1, the solid lines represent the interest rate targeting policy, and the dashed lines represent the liquidity-targeting policy. If the central bank decides to hold the cash supply constant, then the rise of the interest rate corresponds to the size of the contraction: the greater the shock, the greater the initial jump in interest rate. If the central bank decides to hold the interest rate constant, then the rate remains fixed at two percent. (See the left panel of Figure 1.) Additionally, the decline in aggregate investment under the liquidity-targeting policy is nearly double the decline in investment under the interest rate targeting policy. (See the right panel of Figure 1.)

Optimal Monetary Policy after a Crisis

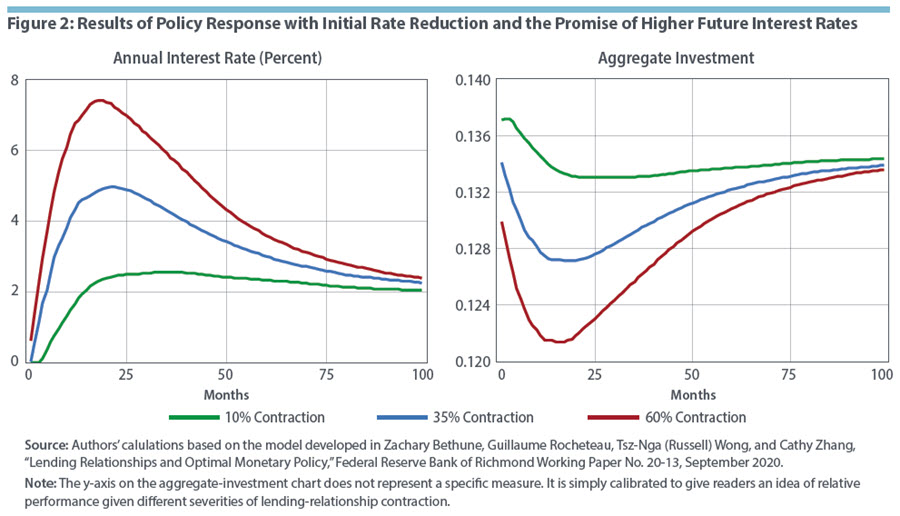

Alternatively, the central bank can achieve both objectives by reducing the interest rate at the onset of a crisis, to allow unbanked firms to access cash at a low cost, and then using "forward guidance" to commit to increasing the interest rate in the future, a policy that would encourage banks to create new lending relationships with firms. This policy response maximizes the welfare of both the banks and the firms. Under this forward-guidance approach, the central bank reduces the interest rate in the short run, increases it above its long-run value in the medium run, and gradually decreases it to its steady-state value in the long run. This policy creates a hump-shaped path for the interest rate that becomes more pronounced depending on the size of the shock. (See the left panel of Figure 2). Under the forward-guidance policy, aggregate investment declines sharply immediately following the shock but gradually recovers. (See the right panel of Figure 2). Compared with liquidity targeting, aggregate investment does not decline sharply immediately following the shock. Compared with interest rate targeting, aggregate investment recovers faster.

If the central bank cannot commit to future interest rates, then the optimal policy solution becomes very different because banks would not believe the forward guidance. Therefore, if the shock were small, then it would be optimal to keep the rate low, but if the shock were large, then it would be optimal to initially increase the rate to encourage the creation of new lending relationships before gradually decreasing it over time. (See the left panel of Figure 3.) Compared with the forward-guidance approach, the interest rate path is lower without commitment. The inability to commit leads to aggregate investment decreasing initially and then recovering gradually. (See the right panel of Figure 3.) The researchers' model predicts the half-life of a recovery following a 60 percent contraction to be twenty months when the central bank can commit and twenty-seven months when the central bank cannot commit. The inability to commit causes firms to become stuck in a liquidity trap and decreases banks’ desire to enter the credit-supply market due to a lack of central bank credibility. The combination of these two effects prolongs economic recovery and generates a welfare loss between 0.90 percent and 0.98 percent of consumption, depending on the size of the shock.

Implications for the COVID-19 Pandemic

The researchers adapt their model to determine the optimal policy response following a temporary business lockdown, such as the one caused by the COVID-19 pandemic. Assuming an unexpected 40 percent decrease in investment opportunities for all firms,4 and that between 25 percent and 55 percent of small businesses would close or likely would close, the researchers analyze the impact of a lockdown lasting three, six, and nine months before returning to prepandemic levels. If the central bank can commit to future interest rates and the lockdown lasts three months, then the optimal response consists of reducing the interest rate close to zero, keeping it low following the lockdown, then gradually returning it to normal after approximately twenty months. If the lockdown lasts only three months, banks have incentives to create relationships with firms because they expect production will return to normal quickly. If the lockdown lasts six or twelve months, then the optimal policy consists of reducing the rate at the onset of the lockdown but then increasing it before the lockdown ends to prevent banks from becoming discouraged about creating relationships with firms.

Conclusion

Wong, Bethune, Rocheteau, and Zhang demonstrate that the formation of lending relationships is critical for small businesses to finance their investment opportunities. The researchers' model shows the central bank's optimal responses following a banking crisis under different levels of commitment. If the central bank can commit to setting future interest rates, then the optimal response is to employ forward guidance by setting the rate close to zero at the onset of the crisis and increasing it over time as the economy recovers. If the central bank cannot commit to setting future rates, then the interest rate remains low, and the recession lasts longer.

Russell Wong is a senior economist and Hailey Phelps is an economics writer in the Research Department at the Federal Reserve Bank of Richmond.

U.S. Census Bureau, "2017 County Business Patterns," released on March 6, 2020.

Board of Governors of the Federal Reserve System, Occasional Staff Studies, "2003 Survey of Small Business Finances."

Zachary Bethune, Guillaume Rocheteau, Tsz-Nga (Russell)Wong, and Cathy Zhang, "Lending Relationships and Optimal Monetary Policy," Federal Reserve Bank of Richmond Working Paper No. 20-13, September 2020.

MetLife and U.S. Chamber of Commerce, "Special Report on Coronavirus and Small Businesses," April 3, 2020.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.