Central bank independence, both legal and operational, delivers both lower inflation and reduced price volatility.

Monetary Policy

Monetary policy refers to the Federal Reserve's actions and communications to promote maximum employment, stable prices and moderate long-term interest rates.

Updating Results

Updating Results

Thomas Lubik reviews how widely used macroeconomic data like GDP is compiled and updated, and how the revision process strikes a balance between decisionmakers' needs for timeliness and accuracy. Lubik is a senior advisor in the Research department of the Federal Reserve Bank of Richmond.

President Tom Barkin shares his views on today’s economy and the path ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

Huberto Ennis provides an updated view of the Federal Reserve's management of its balance sheet and the flow of reserves between banks, which were the focus of a recent conference held at the Federal Reserve Bank of Richmond. Ennis is group vice president for micro, macro and financial economics at the Richmond Fed.

Macroeconomic data revisions appear to be smaller than they were a few decades ago, but they still pose challenges for real-time economic analysis.

President Tom Barkin reflects on 2025 and shares his economic outlook for the year ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

Tom Barkin, president and CEO of the Federal Reserve Bank of Richmond, looks back at 2025 and the resilience of the U.S. economy in the face of uncertainty and changes in the economy, including trade policy, consumer sentiment, and labor market demand and supply. He also discusses how monetary policymakers have navigated the year.

While the government shutdown delayed official data releases, private sector data and outreach efforts helped Fed policymakers keep a pulse on the economy.

Tom Barkin

President and Chief Executive Officer

Alexander Wolman discusses the Federal Reserve's recent unveiling of its revised Statement on Longer-Run Goals and Monetary Policy Strategy, highlighting what has changed and what has remained consistent with past statements. Wolman is vice president for monetary and macroeconomic research at the Federal Reserve Bank of Richmond.

President Tom Barkin shares his perspective on the economy and how the Richmond Fed's outreach efforts inform it.

Tom Barkin

President, Federal Reserve Bank of Richmond

The economic data that monetary policymakers rely on is often noisy and imperfect. Collecting additional signals about economic outcomes can help.

Anna Kovner

Executive Vice President and Director of Research

This post uses a major central bank announcement, the "whatever it takes" speech, to determine how a credible announcement of an unconventional monetary policy intervention affects bank lending standards during crises.

Carlo Alcaraz, Stijn Claessens, Gabriel Cuadra, David Marques-Ibanez and Horacio Sapriza

Tom Barkin

President, Federal Reserve Bank of Richmond

The Fed's "maximum employment" mandate isn't directly measurable, so how can we tell if the economy is close?

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin discusses what he’s seeing in the data, hearing from businesses and expecting in the months to come.

Tom Barkin

President, Federal Reserve Bank of Richmond

Grey Gordon and Felipe Schwartzman discuss the creation and evolution of the Federal Reserve's monetary policy framework and the Fed's current review of the framework. Gordon and Schwartzman are senior economists at the Federal Reserve Bank of Richmond.

Viewing the rise in inflation through a single perspective may mean missing part of the picture.

New challenges have emerged to the production of economic statistics. How are Fed researchers and policymakers adjusting?

President Tom Barkin considers the economic outlook amid elevated uncertainty.

Tom Barkin

President, Federal Reserve Bank of Richmond

Ricardo Reis discusses how swap lines have supported the flow of US currency into global financial markets to meet their liquidity needs and the dollar's prominence in those markets, especially during the 2007-08 financial crisis and the COVID-19 pandemic. Reis is an economics professor at the London School of Economics and a long-term consultant at the Federal Reserve Bank of Richmond.

President Tom Barkin reflects on the past year and shares his outlook for the year ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

The topics presented included unconventional monetary and fiscal policy, global inflation patterns and worker responses to labor shocks.

This paper addresses the heterogeneous effects of monetary policy on households of different races.

Munseob Lee, Claudia Macaluso and Felipe F. Schwartzman

The authors show that there has been a more general relationship between inflation and the distribution of relative price changes during the extended period of inflation stability in the U.S.

Andreas Hornstein, Francisco Ruge-Murcia and Alexander L. Wolman

During the COVID-19 pandemic, the Fed loaned billions of dollars to central banks in desperate need of them.

Felipe Schwartzman explains how he and other economists define the natural rate of interest, what factors have influenced this theoretical estimate of where long-term interest rates will settle, and what it tells us about how the cost of savings and borrowing will respond as monetary policy normalizes after the COVID-19 pandemic.

For our 150th episode, Anna Kovner reviews her career path to becoming the research director at the Federal Reserve Bank of Richmond and reflects on the work of the Bank's Research department. Kovner also offers her views on various topics — including the banking turmoil of 2023, the Fed's "lender of last resort" role, current risks to the financial system, and the "neutral rate" of interest — as well as the current state of the national economy.

A careful comparison of the approaches allows policymakers to discern possible strengths and weaknesses of each approach.

Researchers examine how the post-pandemic trajectory of risk-free rates affects sovereign debt management and default risk in emerging markets (EMs).

Marina Azzimonti and Nirvana Mitra

President Tom Barkin explores where the U.S. economy is today, how it got here and where it may be headed.

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin shares his views on the economy and the recent rate cut, and then looks to what could come next.

Tom Barkin

President, Federal Reserve Bank of Richmond

This paper offers novel insights on modern bank runs using confidential data on wholesale and retail payments to detail the bank runs of March 2023.

The authors show that disruptions in access to corporate bond markets have an economically material, statistically significant impact on the real economy.

The authors find evidence that bank capital matters for the tails of future GDP growth, with a relationship that is particularly strong in reducing the probability of the worst GDP outcomes. The relationship between bank capital and growth, however, is not strong for its central tendency.

Nina Boyarchenko, Domenico Giannone and Anna Kovner

Several factors may have been permanently altered since the onset of the pandemic.

What exactly does it mean for a central bank, created by Congress, to be "independent," and how is the Fed in its current form accountable to elected leaders and the public at large?

The Fed moved quickly to support the financial system during a banking panic last spring. Now, policymakers are evaluating what they learned.

Economist Raghuram Rajan on leading a central bank, creating a digital payment system, and India's future in professional services.

David A. Price

Milton Friedman, the architect of modern monetarism and an advocate for free markets, was an energetic public intellectual who greatly influenced economics.

Julian Kikuchi

President Tom Barkin explores why it has been particularly challenging to predict the path of the economy over the last few years.

Tom Barkin

President, Federal Reserve Bank of Richmond

Economic policy uncertainty rises significantly leading up to an election and stays elevated for a couple months after the election is over.

What are early studies suggesting about how AI may impact labor productivity?

Andreas Hornstein

(Emeritus)

Demographic factors can simultaneously work in opposite directions when it comes to r*.

Alexander Wolman discusses the Federal Reserve's establishment of an inflation target in 2012 and how that has fit within the Fed's evolving monetary policy framework. Wolman is vice president for monetary and macroeconomic research at the Richmond Fed.

President Tom Barkin reflects on recent data and shares his view on where the U.S. economy is headed.

Tom Barkin

President, Federal Reserve Bank of Richmond

Some think such a trap for China is imminent, due to factors such as a surge in deposits, mounting deflationary pressures and high youth unemployment rates.

Taking into account the uncertainty of the state of the world is the hallmark of good policymaking in economics. Moreover, r* and other stars are just one of many inputs in this process.

The FOMC established its explicit inflation target in January 2012 after a decades-long deliberation. It came in part from the Richmond Fed.

It's easy to see why people might differ on the path forward for the economy — each forecaster sees the future through his or her own lens.

Tom Barkin

President and Chief Executive Officer

President Tom Barkin explores different ways to look at recent data, and then gives his own perspective.

Tom Barkin

President, Federal Reserve Bank of Richmond

The pattern of r* paths for other countries seem more alike to each other than they are to the U.S.

Thomas A. Lubik, Brennan Merone and Nathan Robino

Recent data have been remarkable. President Tom Barkin shares why he still sees reasons for caution.

Tom Barkin

President, Federal Reserve Bank of Richmond

How has the economy navigated previous rate cycles, and how do they compare to the current one?

Erin Henry, Pierre-Daniel G. Sarte and Jack Taylor

Thomas Lubik and Christian Matthes discuss how economists wrestle with measuring the natural rate of interest or r-star, why this measure is important for monetary policymakers, and how their model has evolved to better chart the path of interest rates. Lubik is a senior advisor at the Federal Reserve Bank of Richmond and Matthes is a professor of economics at Indiana University.

President Tom Barkin reflects on 2023 and shares his outlook for the year ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

The Reserve Bank boards of directors are a key link between the Federal Reserve System and the communities it serves, working to achieve the dual mandate and formulate monetary policy.

President Tom Barkin shares how communities in the Fifth District are working to move the needle on housing.

Tom Barkin

President, Federal Reserve Bank of Richmond

Paul Ho talks about how countries are connected to each other through international trade and how these connections help spread economic shocks across the globe. Ho is an economist at the Federal Reserve Bank of Richmond.

President Tom Barkin explores potential paths for the U.S. economy and their implications for monetary policy.

Tom Barkin

President, Federal Reserve Bank of Richmond

Richmond Fed president Tom Barkin and Federal Reserve Board Governor Michelle Bowman will lead a discussion about the lingering impact of the pandemic on the economy and the workforce. The general public is invited to listen in, via livestream, as Barkin, Bowman and several special guests explore the challenges and opportunities that exist as the region served by the Richmond Fed continues the transition to a new normal.

President Tom Barkin discusses what he is hearing on the ground from Fifth District contacts, and how it compares to recent data.

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin explores what’s happening in the labor market and how it could impact the path ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

The updates result in a less volatile r* series that more closely reflects our prior belief as to where r* likely is.

Sonya Waddell and Chen Yeh provide an update on credit market conditions, based on recent results of the CFO Survey and other surveys of borrowers and lenders. They also discuss the macroeconomic forces that shape the supply and demand sides of the market, including the current round of monetary policy tightening. Waddell is a vice president and economist and Yeh is an economist at the Federal Reserve Bank of Richmond.

What is the typical lag between market interest rate increases and increases in CD and MMMF balances? Is the recent increase unusually large, or is more in store?

Paul Ho talks about how economists model the interactions between monetary policy and the economy and the challenges of determining the economic effects of policy with precision. Ho is an economist at the Federal Reserve Bank of Richmond.

President Tom Barkin discusses what’s driving the resilient U.S. economy and where it may be headed next.

Tom Barkin

President, Federal Reserve Bank of Richmond

How do the Fed's interest rate hikes affect bank lending standards? One way to find out is to directly ask banks whether they've tightened lending standards to borrowers.

John O'Trakoun

Senior Policy Economist

President Tom Barkin explores a plausible story for how inflation returns to target.

Tom Barkin

President, Federal Reserve Bank of Richmond

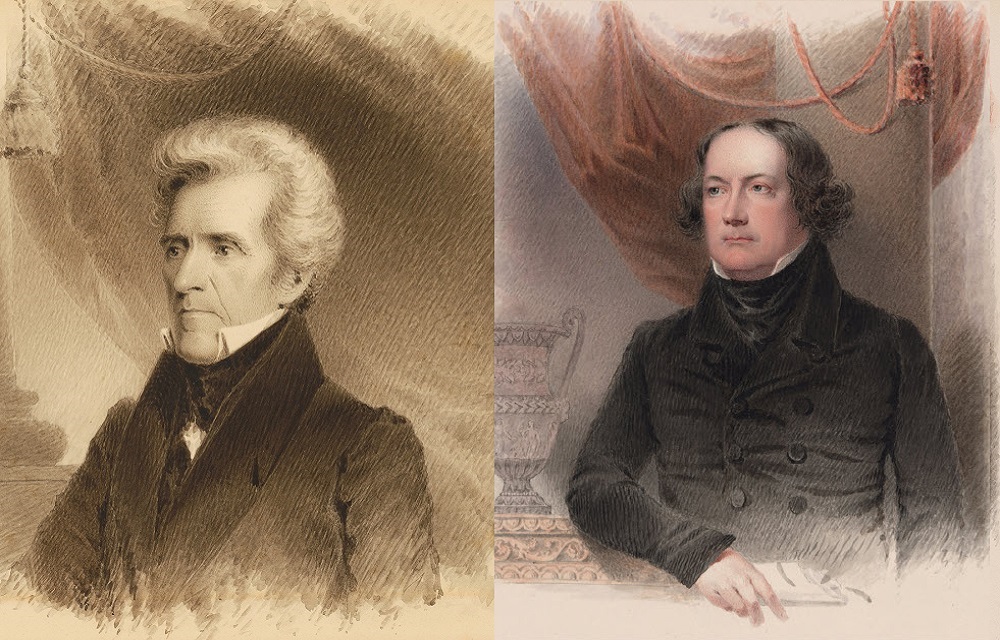

In his July 1832 veto message of the bill rechartering the Second Bank of the United States, President Andrew Jackson triggered the demise of America's second central bank with a stroke of his veto pen.

Even though economists have made huge leaps in understanding how monetary policy impacts the economy, there remains substantial disagreement and imprecision in the estimates.

This paper analyzes the welfare effects of unemployment insurance in a life-cycle model, focusing on partial vs. general equilibrium effects.

Do relative price changes account for the behavior of inflation in the pandemic and post-pandemic eras?

President Tom Barkin discusses recent data and events and explores potential implications for monetary policy.

Tom Barkin

President, Federal Reserve Bank of Richmond

In part two of this two-part conversation, Robert Hetzel focuses on the Fed's policies during the Great Inflation and the Great Moderation and after the Great Recession, as well as the role of the Federal Reserve Bank of Richmond during these periods.

In part one of this two-part conversation, Robert Hetzel discusses the Fed's policy shifts in the two decades following the Treasury-Fed Accord of 1951 and the role of the Federal Reserve Bank of Richmond during that period.

Market commentors noticed a pattern during Alan Greenspan's tenure as Fed chair from 1987 to 2006. The Fed, it appeared to some, had developed a policy of bailing out stock investors by injecting liquidity into the economy amid large stock market declines. This perceived tendency came to be called the "Greenspan put."

John Mullin

President Tom Barkin discusses how he sees the economy, and the implications for inflation and for policy.

Tom Barkin

President, Federal Reserve Bank of Richmond

Moves toward stable inflation and maximum employment can be in conflict in the short term.

Just by allowing the securities in its portfolio to mature, the Fed could reach a normalized size of its balance sheet in two to three years.

Huberto M. Ennis and Tre' McMillan

Tom Barkin discusses the state of inflation and the monetary policy response of the Federal Reserve, as well as his outlook on the national economy. Barkin is president and CEO of the Federal Reserve Bank of Richmond.

President Tom Barkin reflects on monetary policy and the economy in 2022 and shares his thoughts on what’s ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

Huberto Ennis explores how the Federal Reserve used its asset purchases to deal with market disruptions and the unprecedented economic issues related to the COVID-19 pandemic. He also discusses why and how the Fed is unwinding these purchases. Ennis is group vice president for macro and financial economics at the Federal Reserve Bank of Richmond.

The past few years have seen unprecedented real economy shocks, which are particularly hard to deal with for any central bank, and so drove a lot of the inflation in the wake of the pandemic's arrival.

Kartik Athreya

Executive Vice President and Director of Research

For the first time in more than a generation, we are grappling with high, broad-based, and persistent inflation. Is there an end in sight?

Tom Barkin

President and Chief Executive Officer

While the Fed has never been a stranger to criticism, the criticism has been notable and specific during the past year. The subject: inflation.

Talking about the future has become a valuable tool of monetary policy, but recent events have prompted a reevaluation.

John O'Trakoun and Pierre-Daniel Sarte discuss the persistence of inflation over the years and what may set apart the current period of elevated prices compared to historical patterns. O'Trakoun is a senior policy economist and Sarte is a senior advisor at the Federal Reserve Bank of Richmond.

Techniques at the frontiers of econometrics were addressed by economists during a recent research conference.

John Mullin

Kartik Athreya responds to recent critiques of the Federal Reserve and its efforts to combat inflation. Athreya is executive vice president and director of research at the Federal Reserve Bank of Richmond.

The newer a product is, the more likely its price will change and the larger the price change will likely be.

Declining gasoline prices have contributed to an easing of inflation and lower inflation expectations, working in tandem with the FOMC's efforts to bring price levels down. But how hard is monetary policy tapping on the brakes of the economy?

John O'Trakoun

Senior Policy Economist

President Tom Barkin considers the forces behind today’s high inflation and offers his outlook for the economy.

Tom Barkin

President, Federal Reserve Bank of Richmond

This theory may be obscure, even to economists, but it can have quite an impact on inflation.

One can argue whether the FOMC's response to inflation has been strong enough, but financial markets and surveys suggest that the Fed retains credibility for low inflation in the long run.

While the Fed has experience buying assets to respond to crises, questions remain around unwinding those actions

Today's inflationary snarls reflect both supply shocks and policy stimulus.

John Mullin

Fed Chair Jerome Powell has stressed that monetary policy is a blunt instrument and using it to bring down inflation could entail some short-term pain. This risk, though, must be compared with outcomes that would confront the Fed and the economy were clear action not forthcoming.

Columbia University economist on inflation, capital controls, and finding research topics.

David A. Price

Given the critical role that Reserve Bank presidents play in formulating monetary policy, the Federal Reserve has taken steps to ensure that the presidential selection process is transparent, fair, and inclusive.

Chris Murphy

How might a CBDC alter the banking system? How does credit easing affect bank runs? These and other questions were addressed during a recent Richmond Fed conference.

John Mullin and Matthew Wells

Inflation has hit most other advanced economies in addition to the United States. What can we learn from their experiences?

Persistence in inflation depends on the time period studied.

Conner Mulloy, John O'Trakoun and Pierre-Daniel G. Sarte

President Tom Barkin outlines how he expects inflation to come down.

Tom Barkin

President, Federal Reserve Bank of Richmond

John O'Trakoun offers an update on where inflation stands, how it is affecting the economy, and what steps the Federal Reserve is taking to bring it down. O'Trakoun is a senior policy economist at the Richmond Fed and primary author of the Bank's Macro Minute blog.

Decomposing the 2012-2019 inflation shortfall, and its surge starting in 2021, we find that sectoral shocks were major contributors to the inflation deviations from target.

Francisco Ruge-Murcia and Alexander L. Wolman

As the Fed works to contain inflation, many ask whether we are headed into a recession. President Barkin shares his perspective.

Tom Barkin

President, Federal Reserve Bank of Richmond

Perhaps history can be a guide on whether central banks should issue digital currencies.

When COVID-19 hit, it put consumers and businesses in unprecedented difficulty. Given the magnitude of the unique shock hitting the economy, the Fed acted to ensure that broader financial conditions did not further hurt consumers and businesses.

Among the topics covered at the Marvin Goodfriend conference were Fed bond facilities' impact on corporate credit risk and how trade leads to a global Phillips curve.

John Mullin

Alex Wolman and Robert King reflect on the life and legacy of Marvin Goodfriend. Throughout his career, Goodfriend wrote a number of influential papers on monetary policy and played a key role in the development of the Richmond Fed's Research Department.

Inflation hasn’t been a hot topic for decades. Now that it’s back, it’s clear consumers and businesses dislike it. Richmond Fed President Tom Barkin discusses why and how the Fed is working to contain it.

Tom Barkin

President, Federal Reserve Bank of Richmond

The concept of interest rate smoothing behavior by central banks is now standard, but it was not in the early 1980s when Marvin Goodfriend made the concept into a distinct phenomenon to be explained.

This paper builds on the analysis of Marvin Goodfriend and examines how the Fed can better engage in a rules-based monetary policy going forward.

This essay reviews the Volcker and Greenspan policy accomplishments at the Fed, as well as Marvin Goodfriend's contributions during this timespan.

Like many economists who came of age in the late 1970s and early 1980s, Marvin Goodfriend learned how models were affected by the assumption of rational expectations.

This essay discusses the ideas and contributions in Marvin Goodfriend and Robert G. King's 1988 paper and relates it to some of Goodfriend's other research on banking and monetary policy.

Marvin Goodfriend drew a number of conceptual and policy implications from his analysis of inflation scares, which have become part of the central banks' approaches to monetary policy.

This essay details Marvin Goodfriend's work around central bank secrecy and the evolution of transparency over the years.

This essay explains why central banks have targeted a 2 percent target inflation rate instead of literal price stability.

An examination of Marvin Goodfriend and Robert G. King's "The Incredible Volcker Disinflation" paper.

An examination of Marvin Goodfriend's research on the relationship between the zero lower bound and interest rate policy.

Marvin Goodfriend's views on the proper role of a central bank and his defense of the federal structure of the Federal Reserve System.

This essay recounts the history of interest on reserves at the Fed, showcasing the influence of Marvin Goodfriend's ideas and how those ideas were adapted as policymakers learned from the implementation of policy.

An analysis of the roles of central bank lending and central bank credit policy, what can go wrong with central bank lending, and how to fix these problems.

In 1997, Marvin Goodfriend published two papers that advocated a new approach to monetary policy analysis.

This essay considers whether the 1951 Treasury-Fed Accord should be amended in order to address new challenges to Fed independence.

This essay reviews Marvin Goodfriend's path to making the case that the U.S. should adopt an explicit inflation targeting system.

The development of a symbiotic relationship between academic research and central bank policymaking led to a consensus on a new framework for monetary policymaking, which remains with us today.

Based on different sets of reasonable assumptions, we analyze several different scenarios for the future of this critical policy-relevant lever.

President Tom Barkin explores the conditions we may face once we navigate through the current inflation storm.

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin discusses how the Federal Reserve is working to contain inflation and reflects on the post-pandemic era economy.

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin reflects on lessons learned last year and looks forward at what this year could look like for the U.S. economy.

Tom Barkin

President, Federal Reserve Bank of Richmond

The Fed's Overnight Reverse Repo facility has seen significant activity since the onset of the COVID-19 pandemic.

For the Fed, good communication is an important tool

Tom Barkin

President and Chief Executive Officer

For policymakers and market participants, inflation can be challenging to predict.

President Tom Barkin talks about the merits of outcome-based, rather than date-based, forward guidance.

Tom Barkin

President, Federal Reserve Bank of Richmond

The annualized PCE inflation rate over the period March through July is 6.5 percent, the highest five-month rate since November 1981.

Not everyone experiences the same inflation. What does that mean for monetary policy?

Sometimes money gets used when it should not, and we investigate why using surveys plus measures.

Janet Hua Jiang, Peter Norman, Daniela Puzzello, Bruno Sultanum and Randall Wright

The new language — which has been in each FOMC statement since September — represents a significant shift in the committee's thinking.

With a revised strategy, the Fed responds to challenges facing central banks today

The "modern monetary theory" tenet that governments can continuously print money to fund deficits ignores the fact that governments ultimately must satisfy creditors.

Michael U. Krause, Thomas A. Lubik and Karl Rhodes

President Tom Barkin spoke about the potential for COVID-19 to leave long-lasting scars on the economy—and how policy can help.

Tom Barkin

President, Federal Reserve Bank of Richmond

Richmond Fed Research Director Kartik Athreya reflected on how — or if — monetary policy choices influence financial stability.

Kartik Athreya

Executive Vice President and Director of Research

Conducting a statistical analysis of U.S. economic data, economists from the Richmond Fed and the University of Bern find no evidence of hysteresis, the idea that seemingly temporary economic shocks can have permanent effects.

Luca Benati and Thomas A. Lubik

We study new transaction-level data of discount window borrowing in the U.S. from 2010–17, merged with quarterly data on bank financial conditions (balance sheet and revenue).

Huberto M. Ennis and Elizabeth Klee

Economists at the Richmond Fed, the University of Virginia, UC Irvine, and Purdue analyze how monetary policy affects lending relationships for small businesses and vice versa.

Hailey Phelps and Russell Wong

We construct and calibrate a monetary model of corporate finance with endogenous formation of lending relationships. The equilibrium features money demands by firms that depend on their access to credit and a pecking order of financing means.

Zachary Bethune, Guillaume Rocheteau, Russell Wong and Cathy Zhang

Richmond Fed president Tom Barkin spoke about the outlook for inflation at a webinar hosted by the Money Marketeers of New York University.

Tom Barkin

President, Federal Reserve Bank of Richmond

The Fed is using emergency lending powers it invoked during the Great Recession to respond to COVID-19 — but it cast a wider net this time.

The Federal Reserve's purchases of agency mortgage-backed securities — launched in response to financial disruptions caused by COVID-19 — appear to have restored smooth market function supporting the continued flow of credit to mortgage borrowers.

The market for repurchase agreements has repeatedly adapted to changing circumstances.

John Mullin

The process of guiding inflation expectations higher is not likely to be easy. Indeed, the historical record suggests that making up for periods of below-target inflation will be challenging.

John A. Weinberg

(Emeritus)

This gallery offers a record of some of the unprecedented economic changes that Americans experienced at the beginning of the COVID-19 pandemic.

Jacob Crouse, David A. Price, Rachel Rodgers, Jessie Romero and Luna Shen

As a result of the COVID-19 pandemic, public debt has increased dramatically and private debt seems likely to increase as well.

The U.S. presidential election of 1896 provides an excellent natural experiment to measure the impact of exchange-rate uncertainty on bank balance sheets and the broader economy.

Scott Fulford, Karl Rhodes and Felipe F. Schwartzman

On Sept. 17, 2019, the repo rate spiked as high as 9 percent at one point during the trading day and ended up averaging 5.25 percent over the entire day. The size of the spike was extremely unusual.

Richmond Fed President Tom Barkin spoke November 13, 2019 at the Greensboro Chamber of Commerce’s Economic Forecast Luncheon in Greensboro, N.C.

Tom Barkin

President, Federal Reserve Bank of Richmond

Richmond Fed President Tom Barkin spoke November 5, 2019 at the Greater Baltimore Committee Economic Outlook conference in Baltimore, Md.

Tom Barkin

President, Federal Reserve Bank of Richmond

Over the last few years, the FOMC has embarked on a process of monetary policy "normalization," which includes raising interest rates above zero and reducing the size of the Fed's balance sheet.

John A. Weinberg

(Emeritus)

Policymakers and commentators argue that the pursuit of attractive quarterly results often takes precedence over building long-term value. Monetary policymakers need to understand this part of the economic environment.

Tom Barkin

President and Chief Executive Officer

Richmond Fed President Tom Barkin spoke September 26, 2019 to the Richmond chapter of the Risk Management Association.

Tom Barkin

President, Federal Reserve Bank of Richmond

Knowing about the components of the nation's money supply and its evolving role in the economy is important for monetary policy.

Mike Finnegan

Richmond Fed President Tom Barkin spoke July 11, 2019, at the Global Interdependence Center’s Rocky Mountain Economic Summit.

Tom Barkin

President, Federal Reserve Bank of Richmond

National markets in many U.S. industries seem to be increasingly dominated by large companies. Some policymakers have argued that this growing market concentration is a sign of weakening competition, but concentration by itself does not necessarily translate into market power.

This brief makes the case that research and policy should focus on four aspects of economic fluctuations: a short-term component (cycles of less than two years), a business cycle component (cycles between two and eight years), a medium-term component (cycles up to thirty-two years), and a long-term component (the trend).

Modeling the U.S. economy on computers has come a long way since the 1950s. It's still a work in progress

David A. Price

Richmond Fed President Tom Barkin spoke to community and business leaders in Roanoke, Virginia, about strategies to boost economic growth.

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin spoke at George Mason University in Fairfax, Va. on May 7, 2018.

Tom Barkin

President, Federal Reserve Bank of Richmond

Although very uncommon now, the Fed used to intervene regularly in foreign exchange markets

The storied showdown between Fed Chairman Bill Martin and President Lyndon Johnson wasn't just about personalities. It was a fundamental dispute over the Fed's policymaking role

Helen Fessenden

As a way to understand the origins of this expectation, in this Economic Brief we look at the relationship between the federal funds rate and the average net interest margin for U.S. banks since the mid-1980s. We find that the relationship is not as clear-cut as one might suspect.

Huberto M. Ennis, Helen Fessenden and John R. Walter

Real interest rates — nominal rates adjusted for inflation — are what matter for saving, borrowing, and investing.

Helen Fessenden

FOMC meetings are set up to bring a wide range of perspectives to bear

Richmond Fed President Jeffrey M. Lacker addressed the Global Interdependence Center in Sarasota, Florida.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey Lacker addressed the Greater Richmond Chamber of Commerce.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

The Richmond Fed has a long tradition of concern for price stability

Does the hawk-dove distinction still matter in the modern Fed?

Disinflation is when inflation is falling. The Fed sometimes deliberately brings about disinflation, but there is a risk of it becoming outright deflation.

Renee Haltom

Vice President and Regional Executive

Stanford University economist on the effects of economic uncertainty, the role of management practices in economic performance, and fostering good management

Renee Haltom

Vice President and Regional Executive

Economists ponder whether demographic change will reduce the potency of the Fed's interest rate moves

David A. Price

Richmond Fed President Jeffrey M. Lacker addressed business leaders during a luncheon hosted by the Rotary Club of Charlotte in Charlotte, N.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke on May 30, 2014 during the Hoover Institution’s Central Banking Conference at Stanford University.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

This paper studies equilibrium pricing in a product market for an indivisible good where buyers search for sellers.

Guido Menzio and Nicholas Trachter

Richmond Fed President Jeffrey M. Lacker spoke about the economic outlook Jan. 17, 2014, in remarks to the Richmond chapter of the Risk Management Association.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke about the economic outlook in remarks to business and community leaders in Asheboro, N.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker discussed U.S. monetary policy at the Swedbank Economic Outlook Seminar on Sept. 26 in Stockholm.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker discussed Federal Reserve history at Christopher Newport University on Aug. 29 in Newport News, Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Lacker speaks at the Charlotte Chamber of Commerce's Annual Economic Outlook Conference.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Lacker Speaks at Shadow Open Market Committee Symposium in New York

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Speech before the West Virginia Economic Outlook Conference Nov. 15, 2012

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Lacker Addresses Business and Government Leaders in Roanoke, Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Speech before the Frank Batten School of Leadership and Public Policy Oct. 12, 2012

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Speech before Money Marketeers Sept. 18, 2012

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

This Economic Brief argues that the current fiscal position is not sustainable. Though financial markets seem unconcerned, for the time being, about U.S. fiscal health, as evidenced by low rates on Treasury securities, lawmakers should not be complacent.

Lacker Addresses Richmond Risk Management Association.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Aaron Steelman

Publications Director

Lacker on Understanding the Interventionist Impulse of the Modern Central Bank,CATO Institute Monetary Conference

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Several recent research efforts have found that stimulative fiscal policy — government spending or tax cuts — can have unusual effects when nominal interest rates are as low as they are today. In particular, some studies have found that the government spending "multiplier" can be much larger at the zero lower bound.

Lacker Addresses Dulles Regional Chamber of Commerce, Chantilly, Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Reviews the Bank's operations and includes the article entitled "The Financial Crisis: Toward an Explanation and Policy Response"

Richmond Fed President Jeffrey M. Lacker spoke March 9, 2007 at the U.S. Monetary Policy Forum 2007 in Washington, D.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke December 1, 2006 at The Philadelphia Fed Policy Forum in Philadelphia, Pa.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke October 30, 2006 at the Baltimore Convention Center in Baltimore, Md.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke February 14, 2006 at the West Virginia University's Acordia/Royal & SunAlliance Distinguished Lecture Series in Morgantown, Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Reviews the Bank's operations and includes the article entitled "Inflation and Unemployment: A Layperson's Guide to the Phillips Curve"

Richmond Fed President Jeffrey M. Lacker spoke October 20, 2005 at the Winthrop University in Rock Hill, S.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Cover Story: Homeward Bound

Housing markets work just fine for most people. But certain markets in the Fifth District aren't producing homes and apartments that working families can afford.

As usual I’ll begin with a recap of recent developments in the economy to put the outlook in perspective. Then I’ll comment on the outlook — as others see it and I see it — and finally I’ll conclude with a few remarks about monetary policy.

J. Alfred Broaddus

President

It is a pleasure to be with you this morning. The theme of this session is “How Banks Compete.” I want to develop a variation on this theme and consider how the intensity of competition in banking has increased over the years, and some of the challenges this change presents.

J. Alfred Broaddus

President

It's a pleasure to be back with you once again. I don't know exactly how many years you've honored me by inviting me back, but it's an appreciable number, and I always enjoy being with you. I guess I should say most of the time.

J. Alfred Broaddus

President

It's a pleasure to be here today and to have this opportunity to comment on conducting monetary policy in a low inflation environment.

J. Alfred Broaddus

President

This has been a very useful conference in my view, and I am honored by this opportunity to be a part of it.1 As some of you may know, I was the second choice for this slot, but that doesn't bother me at all because the first choice was Don Brash, the Governor of the Reserve Bank of New Zealand and a pathbreaker in bringing both transparency and accountability to central banking in practice.

J. Alfred Broaddus

President

The paper explores the relationship between financial stability, deflation, and monetary policy. A discussion of narrow liquidity, broad liquidity, market liquidity, and financial distress provides the foundation for the analysis.

Reviews the Bank's operations and includes the article entitled "What Assets Should the Federal Reserve Buy?"

Reviews the Bank's operations and includes the article entitled "The Role of a Regional Bank in a System of Central Banks"

Needless to say, it's a great pleasure for both Margaret and me to have this opportunity to return to IU, where we spent four very happy years between mid-1966 and mid-1970.

J. Alfred Broaddus

President

Reviews the Bank's operations and includes the article entitled "Monetary Policy Comes of Age: A 20th Century Odyssey"

Mr. Broaddus wishes to thank his long-time colleague, Timothy Cook, for substantial assistance in preparing the address.

J. Alfred Broaddus

President

Reviews the Bank's operations and includes the article entitled "Foreign Exchange Operations and the Federal Reserve"

Thank you very much for that kind introduction. It is very nice indeed to be here in the Shenandoah Valley.

J. Alfred Broaddus

President