Will Interest Rates Remain Elevated Even as Monetary Policy Normalizes?

Long-term bond yields indicate an increase in long-run r* of between 1.2 and 1.4 percentage points relative to its pre-pandemic level. This increase in r* is compatible with underlying economic shifts following the pandemic, including a reduction in personal savings by U.S. households. Evidence suggests that, even as inflation returns to trend and monetary policy normalizes, policy rates may remain above their prepandemic level.

Following the pandemic, inflation spiked and only partially receded. Accordingly, the Federal Open Market Committee (FOMC) has chosen to raise policy interest rates and keep them in restrictive territory until it is confident that inflation will return to its 2 percent target. Being in restrictive territory means that the policy rate is above r*, defined as the real rate that is neither stimulating or restrictive and that keeps inflation at its target level.1

How restrictive are interest rates right now? This article argues that current policy is likely to be restrictive, but it may be less restrictive than previously thought. In particular, median projections from the FOMC's December 2023 Summary of Economic Projections placed r* in the 0.5 percent to 1 percent range, so the neutral nominal policy rate consistent with 2 percent expected inflation would be between 2.5 percent to 3 percent. However, long-term bond prices indicate that r* may be closer to 2 percent, putting the neutral nominal policy rate at 4 percent. Such a rise in r* is also consistent with various recent economic and social trends.

Estimating r*: First Principles

How would one go about estimating r*? Before settling on measurement, it is worth returning to first principles. The r* discussed by policymakers is closely related to the natural rate of interest as defined by Michael Woodford in his 2003 book Interest and Prices. That is, it is the interest rate that would prevail in an economy where the central bank cannot use monetary policy to influence its value.

More specifically, in a workhorse New Keynesian model of the type commonly used by central banks, monetary policy can influence the rate of interest because prices are sticky. If prices were to suddenly become flexible, interest rates would then be pinned down by the return on capital, intertemporal preferences and expectations about future economic growth.

In other words, at the natural rate, policy replicates the equilibrium that would be obtained in the absence of price rigidities. If policy keeps interest rates above that level, consumption and investment fall below potential. The economy then becomes "slack," and firms reduce the prices they charge for goods and services, leading to receding inflation.

This definition of r*, while precise, requires committing to a complete model of the U.S. economy that accurately describes all the trade-offs made by households and firms. While such models are certainly useful and have been used to estimate r*, one might be excused for preferring an option that is less heavily dependent on a particular economic model.

Long-Run Value of r*

One strategy for a more model-light measurement of r* is to focus on its long-run value. In most macroeconomic models, deviations between the policy rates and their flexible price equilibria are expected to be temporary. If interest rates were instead expected to remain above their natural rate over a prolonged period, then one should also expect inflation to stay below its target, and vice versa.

This implies that a best guess of r* over the long run is also the best long-run forecast for the real interest rate. While imperfect, this best guess provides a useful gauge of the restrictiveness of monetary policy, consistent with the definition quoted at first. It may also be more operationally useful given lags in transmission between monetary policy decisions and economic outcomes.

How would one do such forecasts? One strategy is to rely on an econometric model. This is the tack taken, for example, by Thomas Lubik and Christian Matthes' r* model. Another method, which is the focus of this article, is to rely on the forecasts made by financial institutions trading bonds. An average of those prices should be reflected in long-run bond prices and, under the efficient market hypothesis, would provide as good a measure as one could obtain of future interest rates. One important wrinkle (which we will discuss here) is that bond prices also reflect market risk, so a forecast for r* cannot be directly read from them.

In the Dec. 4, 2024 episode of the Speaking of the Economy podcast, Felipe Schwartzman explains how he and other economists define the natural rate of interest, what factors have influenced this theoretical estimate of where long-term interest rates will settle, and more.

Long-Run Treasury Rates Indicate r* Higher Than Prepandemic Trends

A convenient first step for obtaining a market-based measure of r* is to focus on 10-year Treasury bonds. This is because 10 years is beyond the horizon within which one would expect current monetary policy to matter for rates. Also, 10-year Treasury bonds are traded in very liquid markets, so large movements in their yields are likely to reflect expectations and risk attitudes of traders rather than liquidity considerations. Here and below, the focus is on the rough movements between late 2019 and now, rather than the month-to-month bond market ups and downs.

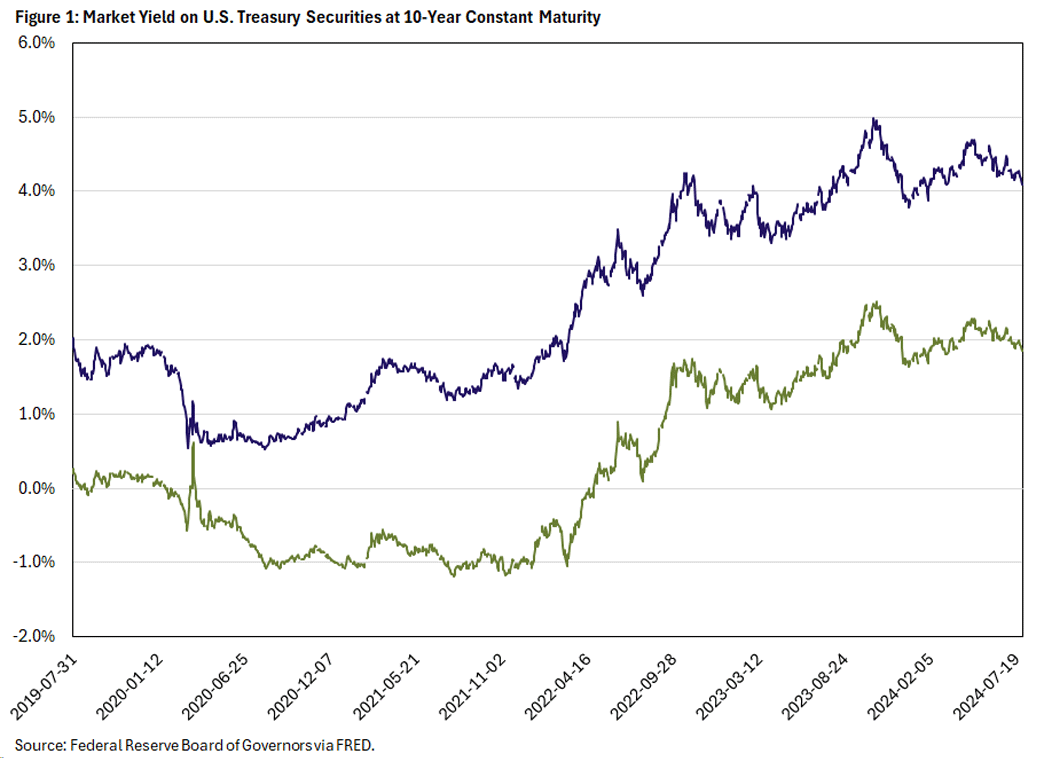

Ten-year yields have been on an upward trend since the pandemic bottomed out and fairly consistently since the spring of 2023. Ten-year yields were close to 2 percent before the pandemic and are now close to 4 percent. The rise in Treasury yields could be due either to a rise in the real rate of return sought by investors or to investors' expected rate of inflation.

Treasury-Inflation Protected Securities

One way to control for that is to look at the yields on inflation-adjusted Treasury bonds (specifically, Treasury inflation-protected securities, or TIPS). As seen in Figure 1, those have moved in parallel with 10-year Treasuries, from close to 0 percent to close to 2 percent, excluding unanchoring inflation expectations as a driving force for the increase in Treasury yields. Furthermore, because TIPS are inflation protected, the increase in TIPS yields also excludes inflation risk as a motivator for investors to ask for higher Treasury yields.

Five-Year/Five-Year Forward Treasury Rates

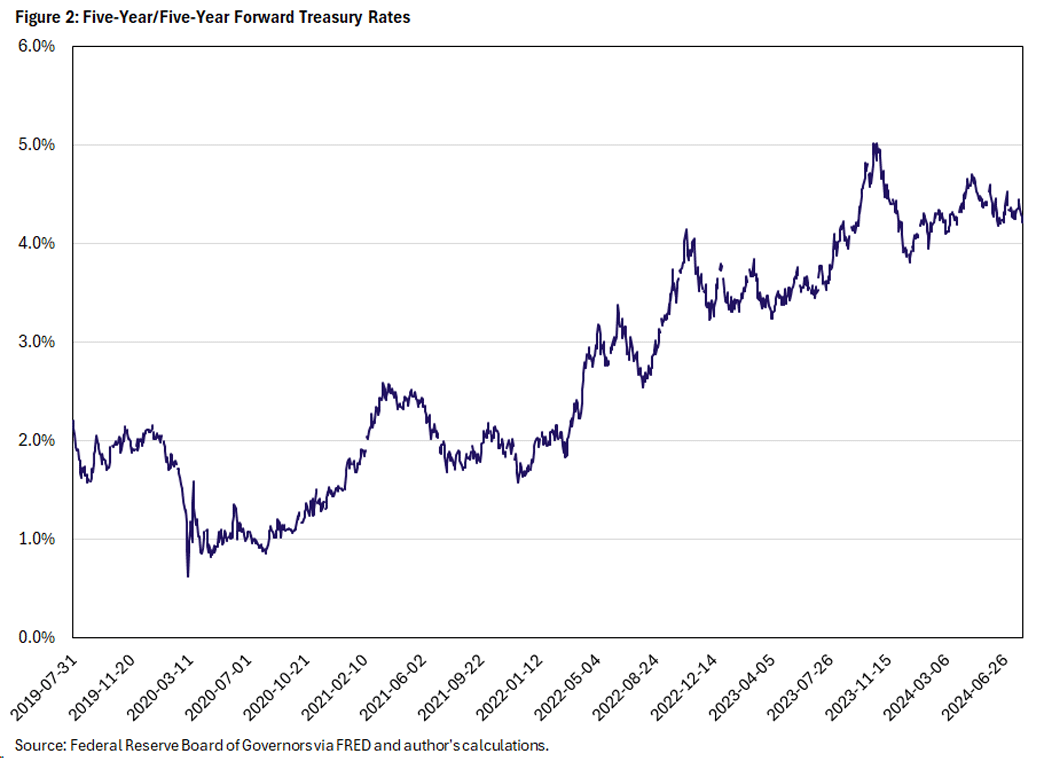

One may wonder whether long-term Treasury yields reflect current monetary policy. If the Fed raises the federal funds rate, shouldn't this also lead to an increase in 10-year Treasuries? To sidestep this possibility, we can difference out yields on five-year bonds, building the five-year/five-year forward Treasury rate. This captures the annual rate of return that investors expect to gain by holding 10-year Treasury bonds between five and 10 years in the future.

The five-year/five-year forward rate is informative because after five years the monetary policy stance should be little affected by present day interest rates. Therefore, expectations about the monetary policy stance in the coming years should reflect equally in five-year and 10-year yields. Again, there is a clear increase of about 2 percentage points in the yields relative to their prepandemic level. This indicates that financial markets may expect rates to remain high for a long time.

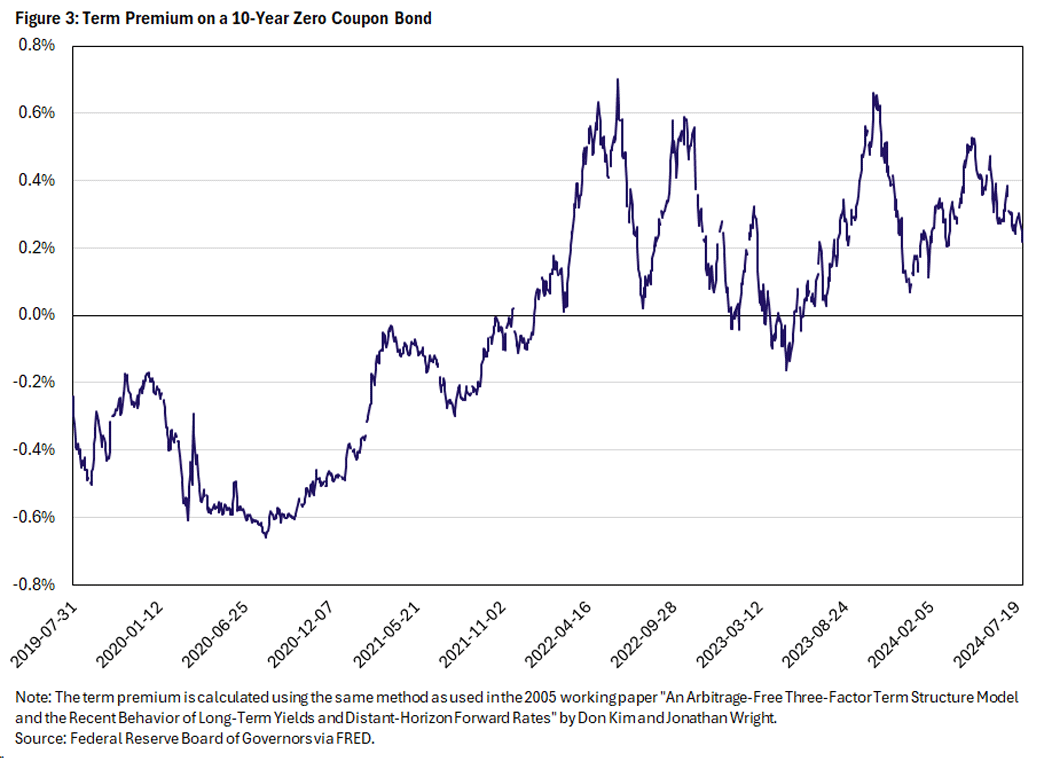

Term Premia

Lastly, long-run Treasuries may increase not because investors expect the policy rate to rise over time, but because they perceive those securities as riskier than before. Treasury bonds are risky because their interest rates are set in advance. If policy rates turn out to be higher than expected, investors stand to lose money. Conversely, if rates are lower than expected, investors stand to gain.

Investors care about how those gains or losses co-vary with the state of the economy. If bond prices lose value when the economy is in a recession, risk-averse investors may hold fewer Treasury securities and/or demand higher premia for longer terms. In the opposite situation, they may be happy holding more Treasuries and/or demanding lower premia as a useful hedge or insurance against macroeconomic risk. More generally, to the extent that investors have preferences for bonds of certain maturities, long-run Treasury yields may move as the supply of Treasuries shifts.

Term premia are hard to measure, but there are good reasons to believe they have increased. This is what one finds by examining the two most widely models for measuring term premia:

- The three-factor nominal term structure model by Don Kim and Jonathan Wright

- The Adrian, Crump and Moench (ACE) model for extracting term premia from Treasury yields by Tobias Adrian, Richard Crump and Emanuel Moench.

In particular, the model from Kim and Wright (shown in Figure 3) finds that the term premium on a 10-year zero-coupon bond has risen from close to -0.6 percentage points before the pandemic to hovering around 0.3 percentage points in recent months. Similarly, the ACE model finds an increase in term premia of close to 0.8 percentage points. These measures, however, fall short of explaining the full 2 percent increase in bond yields that occurred after the onset of the pandemic. Factoring them in, long-term bond prices suggest that r* has risen by 1.1 percent to 1.2 percent since 2019.

What Drives Long-Run Yields?

What does the rise in Treasury yields imply for monetary policy? As made clear in the previous section, this depends on how much one trusts current measures of term premia. In the end, it is useful to apply a plausibility test: Are there enough plausible fundamental trends that could be leading to higher r* (rather than, say, higher term premia)?

More generally, a cardinal rule of macroeconomic analysis is to never reason from a price change. Price changes are endogenous responses to fundamental changes in the economy that may have multiple implications. It is helpful to think through what the underlying causes may be.

There are currently many trends in place that may point towards a rising r*. In a nutshell, the post-pandemic world is one where private and public spending pressures have increased. The following discusses a few of these pressures.

Private Consumption

In spite of higher real interest rates, the personal savings rate has fallen from close to 7 percent in late 2019 to 3.5 percent in 2024.2 A few factors that could lead to a persistent reduction in the savings rate include:3

- Historically low unemployment rates and job prospects may have led households to forecast higher income growth and less risk, leading them to borrow more.

- The pandemic may have increased individual assessment of mortality risk, leading to a "seize the day" type of attitude and increased spending at the expense of saving.

- Migration trends may affect personal savings rates, as immigrants are relatively less wealthy than natives.

Private Investment

While private investment has not risen noticeably as a share of GDP relative to prepandemic levels, it has also not declined despite the increase in borrowing rates. The return on investment may have increased as new technologies and remote work open new opportunities.

Also, changes in the world economy — such as shifts from services to goods, nearshoring and friendshoring, energy transition, and location of workforce — demand new investments, since old "misallocated" capital cannot be seamlessly transformed into new capital.

Finally, the emergence of new technologies (such as chat-based AI) require investment in energy capacity and may provide new and increasing opportunities for renewed investment if it has a significant productivity-enhancing impact.

Government Spending

Geopolitical risk has increased notably following the pandemic, with wars breaking out in Ukraine and the Middle East. As the geopolitical conditions shift and become more unstable, one might expect the U.S. and other countries to increase military spending, reducing the amount of real resources available for consumption and investment. This may itself lead to higher real rates, as more marginal projects are left unfunded.

Higher Term Premia

At the same time, there are also trends towards higher term premia. Before the pandemic, long-term Treasury bonds could be regarded as good hedges. In recessions, the Fed lowered interest rates, leading to an increase in the price of long-term Treasuries.

However, the recent inflation surge and the gradual realization that the Fed will not tolerate high inflation suggested that a different dynamic may become more common. If large geopolitical shocks lead to surges in supply chain problems and inflation, we may see more instances where the Fed needs to raise interest rates to keep inflation under control even as economic conditions worsen. This can explain part of the increase in long-term rates.4

Conclusion

As the pandemic receded, personal savings have declined, and long-run real rates have gone up. While some of the increase in long-run rates may be due to increased term premia, it makes sense to believe that part of it is also driven by real factors influencing the long-run neutral interest rate for the U.S. economy. This suggests that, even as monetary policy normalizes, policy rates may converge to a higher level than was usual before the pandemic.

Felipe Schwartzman is a senior economist in the Research Department at the Federal Reserve Bank of Richmond.

For additional information, see Christopher Waller's 2024 speech "Some Thoughts on r*: Why Did It Fall and Will It Rise?"

The argument here relies on the assumption that, all else equal, the personal savings rate increases with the interest rate faced by households. This may not be the case if, for example, households have a savings target that they can more easily reach with higher rates.

Personal savings rates are also a function of demographic trends, such as aging populations and rising life expectancies. Much of the literature focused on explaining the prepandemic secular decline in rates have focused on those. In a recent article, my Richmond Fed colleague Paul Ho examines what role (if any) those forces may have played in recent natural rate movements and finds that cross-currents are pushing r* in different directions.

This has been recently discussed in the 2019 article "A Simple Macro-Finance Measure of Risk Premia in Fed Funds Futures" by Anthony Diercks and Uri Carl and the 2020 paper "Macroeconomic Drivers of Bond and Equity Premia" by John Campbell, Carolin Pflueger and Luis Viceira. I have also heard this point made repeatedly by my Richmond Fed colleague Alex Wolman in personal communication over the years.

To cite this Economic Brief, please use the following format: Schwartzman, Felipe. (August 2024) "Will Interest Rates Remain Elevated Even as Monetary Policy Normalizes?" Federal Reserve Bank of Richmond Economic Brief, No. 24-28.

This article may be photocopied or reprinted in its entirety. Please credit the author, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.