The Burns Disinflation of 1974

Economists often describe the Great Inflation of the 1970s as a failure of the monetary policy actions of the Federal Reserve under Chairman Arthur Burns. According to conventional wisdom, when Paul Volcker became chairman of the Fed in 1979, he implemented changes that ushered in a period of disinflation. This Economic Brief challenges this standard narrative in two ways. First, it argues that the “Volcker disinflation” had its roots in 1974. And second, Volcker’s actions were the culmination of a gradual shift in policy that began under Burns rather than an abrupt shift.

The Great Inflation was one of the most turbulent economic periods of the twentieth century. Inflation and economic output were highly volatile throughout the 1970s. Annual growth in real gross domestic product (GDP) climbed as high as 6.9 percent in 1972 and 1978 and fell as low as -1.9 percent in 1974, while inflation dipped to less than 3 percent in 1972 and spiked to more than 10 percent in 1974 and 1979. But after peaking in 1980, inflation started to fall dramatically following interest rate increases by the Federal Reserve. By the early 1990s, inflation had become much less volatile, stabilizing around 2 percent to 3 percent. The United States entered a period of relatively uninterrupted economic growth, later dubbed the Great Moderation, which lasted until the late 2000s.

Milton Friedman famously said that “inflation is always and everywhere a monetary phenomenon.” It is hardly surprising, then, that economists have long viewed the Fed as central to understanding what caused the Great Inflation and what prompted the shift to the Great Moderation. Indeed, the conventional narrative is that the Fed, under Chairman Arthur Burns, pursued what has often been called “stop-go” monetary policy, meaning it targeted lower inflation but reversed course whenever employment looked weak and vice versa. This approach contributed to inflation’s volatility and encouraged expectations of higher future inflation because the Fed was seen as opportunistically pursuing short-term goals at the expense of longer-term stability. The conventional explanation is that this process ended only after Paul Volcker became Fed chairman and adopted more consistent anti-inflationary policies.

While this narrative appears to cleanly explain the time line of events, it raises a puzzle. Why would the Fed have waited until the 1980s to adopt anti-inflationary policies? Economists and policymakers at the Fed long understood the dangers of inflation and were well aware of rising inflation in the 1970s. Why would they have chosen to pursue “bad” policies?

One explanation is that the Fed was very unlucky in the 1970s. The U.S. economy was buffeted by a series of unique, large, and persistent macroeconomic shocks, including the collapse of the Bretton Woods international monetary system, the end of the dollar’s convertibility to gold in 1971, and two oil price shocks in 1973–74 and 1978–79. Even the best-intended monetary policymakers would have been overwhelmed by these forces, some economists argue.1

Others have blamed real-time data errors for poor monetary policy decisions in the 1970s. Under this view, the Fed believed it was pursuing suitable policies based on its understanding of the economy and the data it had available at the time, and its policies only seem incorrect with the benefit of hindsight and revised data. In the 1980s, the Fed’s real-time understanding of the economy improved, and the incidence of shocks declined, allowing Volcker to make better policy decisions that led to disinflation.2

This Economic Brief draws on both of these interpretations to explain the policies pursued by the Burns and Volcker Feds. Contrary to the conventional wisdom, this Economic Brief argues that what is now known as the Volcker disinflation of the 1980s was set in motion in 1974, five years before Volcker actually became chairman. Monetary policy decisions under then-chair Burns provided the foundation for economic developments that culminated in the Great Moderation.

Monetary Policy under Uncertainty

In order to better understand why the transition from the Great Inflation to the Great Moderation occurred when it did, two of the authors of this article (Lubik and Matthes) developed a model for analyzing how the Fed sets monetary policy and how these monetary policy decisions relate to economic outcomes.3

In this model, the Fed faces two important limitations. First, policymakers at the Fed are unable to directly observe the true structure of the economy. Instead, they learn about the economy by observing economic outcomes over time and updating their beliefs. Economic volatility, caused by shocks like those that occurred in the 1970s, can actually make it easier for the Fed to learn because it provides a greater number of different data points that the Fed can use to infer the true structure of the economy.4 This learning process is complicated by the Fed’s second limitation, however. Its observations and decisions are based on initial data releases, which are subject to measurement errors. When real-time data contain large errors, the Fed is more likely to misinterpret the state of the economy and choose the wrong policy response.5

Applying real-time data to their model, Lubik and Matthes confirm that the shift toward appropriate, more anti-inflationary monetary policy occurred in the early 1980s, which coincides with the start of the Great Moderation. But their model also identifies an earlier period of appropriate policy starting in late 1974. They argue that this earlier policy shift laid the foundation for the Volcker disinflation.

1974

Inflationary pressures mounted in 1974 as wage and price controls implemented by President Richard Nixon to contain inflation came to an end in April of that year. These pressures were further exacerbated by the first major oil embargo, which began in October 1973 and lasted until early 1974. Moreover, the country was in the midst of a recession that had begun in November 1973. The recession hit bottom in the winter of 1974–75 with the worst period of stagflation up to that point. Annual inflation rose to more than 10 percent, and unemployment increased to nearly 9 percent by the time the recession ended in March 1975.

The Fed responded to rising inflation by tightening monetary policy.6 Lubik and Matthes’ model shows that the Fed’s response was enough to put the economy on a stable path toward lower inflation, which lasted for roughly a year. But in part because of the Fed’s tightening, the economy dipped deeper into recession. The initial data from the first quarter of 1975 suggested a 10 percent loss (annualized) in GDP. At the same time, initial data suggested that inflationary pressures were contained. These early reports turned out to be false. The GDP numbers were later revised to a loss of about 5 percent, and inflation would rise again throughout the decade. But the initial data, coupled with political pressure to stimulate the economy, shook the Fed’s resolve as seen through the lens of Lubik and Matthes’ model.

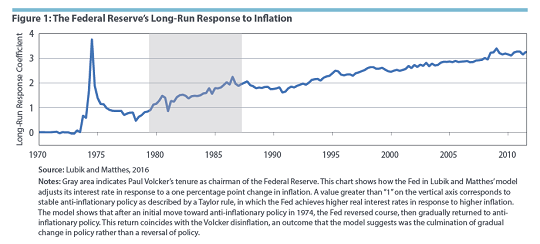

In 1975, the Fed pulled back on its disinflationary stance, but not completely. Lubik and Matthes’ model shows that while the Fed’s responsiveness to inflation declined, it gradually moved toward a more predictable and disinflationary policy throughout the rest of the 1970s. Looking at the Fed’s long-run responses to inflation and changes in output — as modeled by Lubik and Matthes — the Volcker disinflation doesn’t appear to have been a dramatic shift in policy. Rather, it was the consistent follow-through of a gradual shift in the Fed’s inflation response that began in 1974. (See Figure 1.)

Luck and Measurement Error

While Lubik and Matthes’ model indicates that Volcker’s policies were less of a break from Burns’ policies than the conventional wisdom suggests, Volcker still deserves credit for resisting political pressure to ease during the 1981–82 recession, which might have led to a continuation of the stop-go approach the Fed was seen as pursuing under Burns. What distinguishes Volcker from Burns in the minds of many is the fact that he followed through after initial disinflationary policy moves, a consistent approach that helped build and maintain the Fed’s credibility for keeping inflation in check. At the same time, Lubik and Matthes find that data measurement errors may have played a role in strengthening the Volcker Fed’s resolve. Real-time inflation data in the early 1980s indicated that inflation was much higher and more persistent than it actually was. This prompted the Volcker Fed to adopt stronger anti-inflationary policies than might have been warranted, which helped put inflation on a stable long-run path.

To illustrate this point, Lubik and Matthes estimate the results of their model using revised data. This exercise assumes (unrealistically) that the Fed had access to “perfect” information in real time. Under these assumptions, the model predicts a much more muted response to inflation, which may have delayed the Volcker disinflation.

These results suggest that there is some truth to both the “bad luck” and “bad data” explanations for the Great Inflation. Burns had the bad luck of working with inflation data that looked better than they were and economic data that looked worse than they were, prompting less aggressive anti-inflationary policies. Data errors for Volcker, in contrast, were biased toward higher inflation, supporting the more successful disinflationary policies for which he is known. At the same time, through the lens of Lubik and Matthes’ model, the Fed’s policies under Volcker appear to be more of a continuation of changes that began under Burns in 1974 rather than a dramatic shift. Therefore, Burns may deserve more credit for laying the groundwork for the Volcker disinflation.

Thomas A. Lubik is the group vice president for microeconomics and research communications, Christian Matthes is a senior economist, and Tim Sablik is an economics writer in the Research Department of the Federal Reserve Bank of Richmond.

See, for example, Christopher A. Sims and Tao Zha, “Were There Regime Switches in U.S. Monetary Policy?” American Economic Review, March 2006, vol. 96, no. 1, pp. 54–81. A working paper version is available online.

See, for example, Athanasios Orphanides, “Monetary Policy Rules Based on Real-Time Data,” American Economic Review, September 2001, vol. 91, no. 4, pp. 964–985. A working paper version is available online.

Thomas A. Lubik and Christian Matthes, “Indeterminacy and Learning: An Analysis of Monetary Policy in the Great Inflation,” Journal of Monetary Economics, September 2016, vol. 82, pp. 85–106. A working paper version is available online.

Many papers have used learning models to explain the Fed’s actions during the Great Inflation. See for example, Timothy Cogley and Thomas J. Sargent, “The Conquest of US Inflation: Learning and Robustness to Model Uncertainty,” Review of Economic Dynamics, April 2005, vol. 8, no. 2, pp. 528–563. A working paper version is available online.

Some economists have noted that real-time measurements of the output gap (the difference between the economy’s potential and actual growth) worsened in the 1970s, leading to large data adjustments after the fact. See Athanasios Orphanides, “The Quest for Prosperity Without Inflation,” Journal of Monetary Economics, April 2003, vol. 50, no. 3, pp. 633–663. A working paper version is available online.

See Robert L. Hetzel, The Monetary Policy of the Federal Reserve: A History, New York: Cambridge University Press, 2008, p. 113.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.