How Persistent Is Inflation?

As inflation has risen during the past year, it is natural to ask: "How long will this period of high inflation last?" This question is important to households and firms forming expectations about the future, as well as policymakers deciding what actions to take against rising prices. In this Economic Brief, we provide a framework for thinking about inflation and conduct an analysis concerning the persistence of contemporaneous shocks that move price levels. In recent decades, the persistence of inflation has been low, especially when compared to the high inflation of the late 1970s and early 1980s.

In characterizing the behavior of inflation, macroeconomists often find it helpful to distinguish two key components:

- Contemporaneous shocks that move prices

- Past inflation

Contemporaneous shocks to inflation can vary in size and originate in different sectors of the economy. Imagine, for example, that the production of cars is temporarily shut down because manufacturers cannot purchase some of the microchips required in their construction. The supply of vehicles would decline, and prices might consequently rise. In addition, the second component suggests these shocks might be persistent and last beyond the current period. In our example, it might take time for car manufacturers to normalize their operations and for the supply of vehicles to recover.

During an episode where inflation is rising, it is natural to ask: "How long will this high level of inflation last?" We can answer this question in part by getting a sense of how much inflation from this period will be inherited by inflation next period. In other words, how persistent is inflation?

Persistence of U.S. Inflation

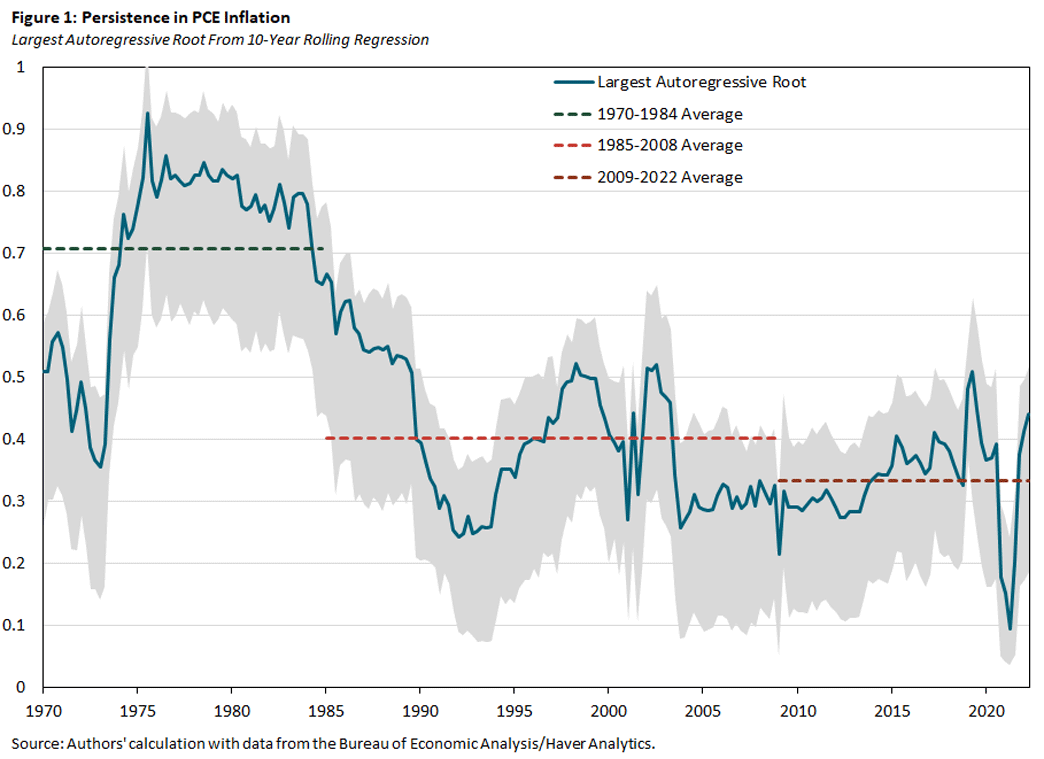

Figure 1 demonstrates inflation persistence (the rough percentage of past inflation carried over to the next period) in the U.S. at quarterly frequencies for PCE price index inflation.1 While other measures of inflation are interesting to consider, the PCE price index is the Federal Reserve's preferred measure of inflation and the basis for its 2 percent inflation target over the longer run.

Figure 1 tells us that inflation persistence was very high in the late 1970s and early 1980s, until the disinflation of the Volcker era, when Paul Volcker was Fed chair. Persistence then stayed relatively low thereafter. In the most recent quarters, inflation persistence has jumped to around the average for the 1985-2008 period, though it is still below pre-COVID levels. The difference being that these observations of increasing persistence are paired with rising levels of inflation as well.

This story of high and declining inflation persistence depicted in Figure 1 over the postwar period generally agrees with more comprehensive and rigorous work on the subject, for example the analysis carried out in the 2007 paper "The Persistence of Inflation in the United States" and the 2010 paper "Inflation-Gap Persistence in the U.S."

We should note that a sudden change from low to high inflation can cause persistence to fall, so low persistence is not necessarily "good." Similarly, the run-up in inflation persistence from 2005-2019 was not necessarily a "bad" development as inflation remained below target.

Expected Inflation and Observed Inflation

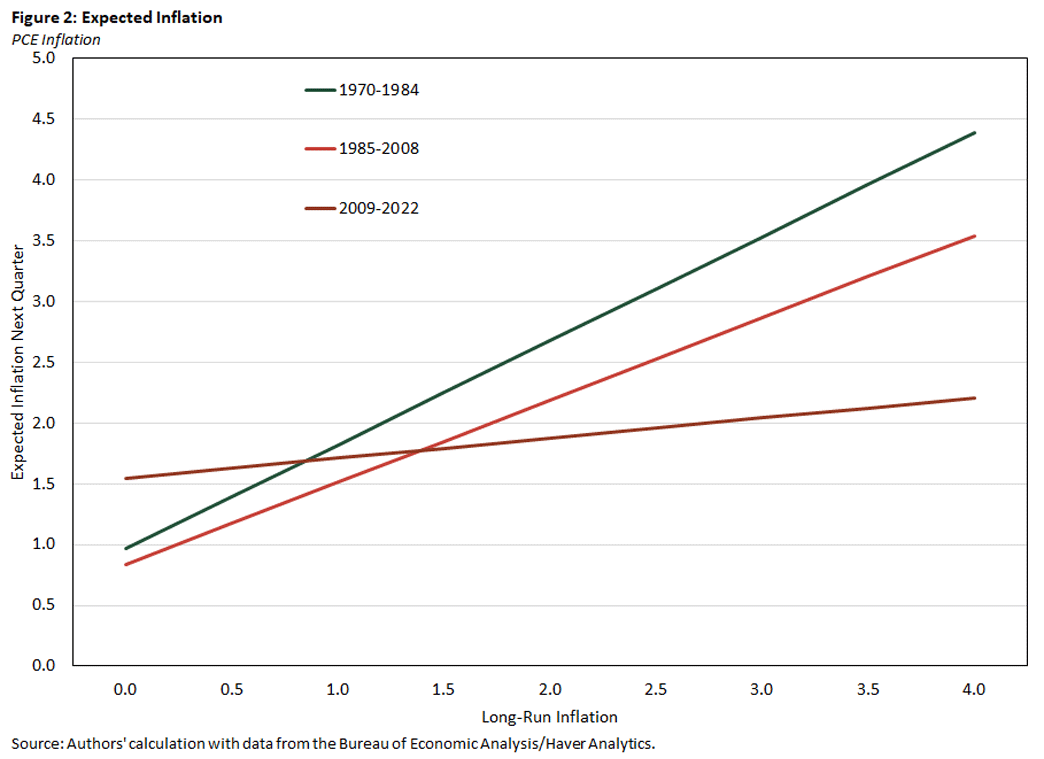

An important implication of inflation persistence is that what we expect inflation to be in the future is not independent of what inflation is today. Thus, Figure 2 illustrates how expected inflation next quarter behaves conditional on observed inflation this quarter.2

Figure 2 provides a few interesting takeaways. First, we see that expected inflation is relatively flat in the most recent era (2009-2022). This reflects the low persistence of inflation observed in Figure 1 over the same period. One might interpret this finding as describing a period in which expected future inflation is "well anchored" irrespective of current inflation, notably just below the Fed's target of 2 percent.

In the era known as "The Great Moderation" (1985-2008), expected inflation tended to increase as current inflation rose. However, when inflation was around 2 percent in the current quarter, expected inflation next quarter was also around 2 percent.

Finally, during the earliest era (1970-1984), expected inflation next quarter rose steeply with current inflation rates. Observe that over this period, current observations of inflation around 2 percent led expected future inflation to exceed 2 percent. As mentioned earlier, the degree of inflation persistence today is roughly the average observed during the Great Moderation, consistent with a regime where inflation persistence rises as measured inflation rises.

Persistence of Inflation Shocks

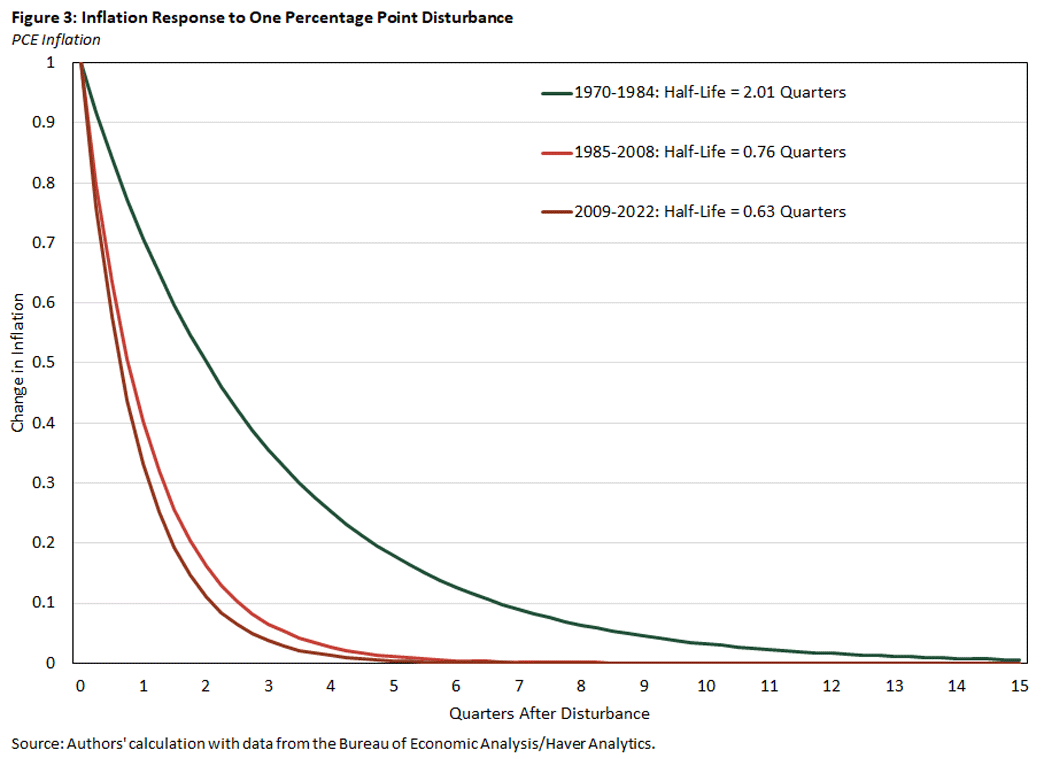

With that context in mind, another useful way to frame inflation persistence is to look at the persistence of individual shocks to inflation independent from the level of inflation. In other words, how long can we expect a one-time disturbance to inflation to continue affecting inflation in future periods? For example, if inflation is low today yet persistence is high, large shocks might have a long-lasting effect if the central bank does not act sufficiently to offset those shocks. Alternatively, if inflation is high today yet persistence is low, the shocks driving high inflation might quickly dissipate, and inflation would fall back to lower levels.

Figure 3 illustrates the typical inflation response to contemporaneous shocks over the same periods we've been examining. Here, we consider a shock to inflation that raises its level by 1 percentage point at the time the shock occurs. Included in Figure 3 is a measure of the half-life of inflation shocks, or how long until half the effects of a given inflation shock dissipates.

In the era 1970-1984, it takes (on average) a little more than two quarters for half the effects of a given inflation shock to dissipate. We see that 10 percent of a shock's effects are still lingering even two years later. In contrast, during the Great Moderation and post-Great Recession periods, it takes a little less than two months for half the effects of an inflation shock to dissipate.

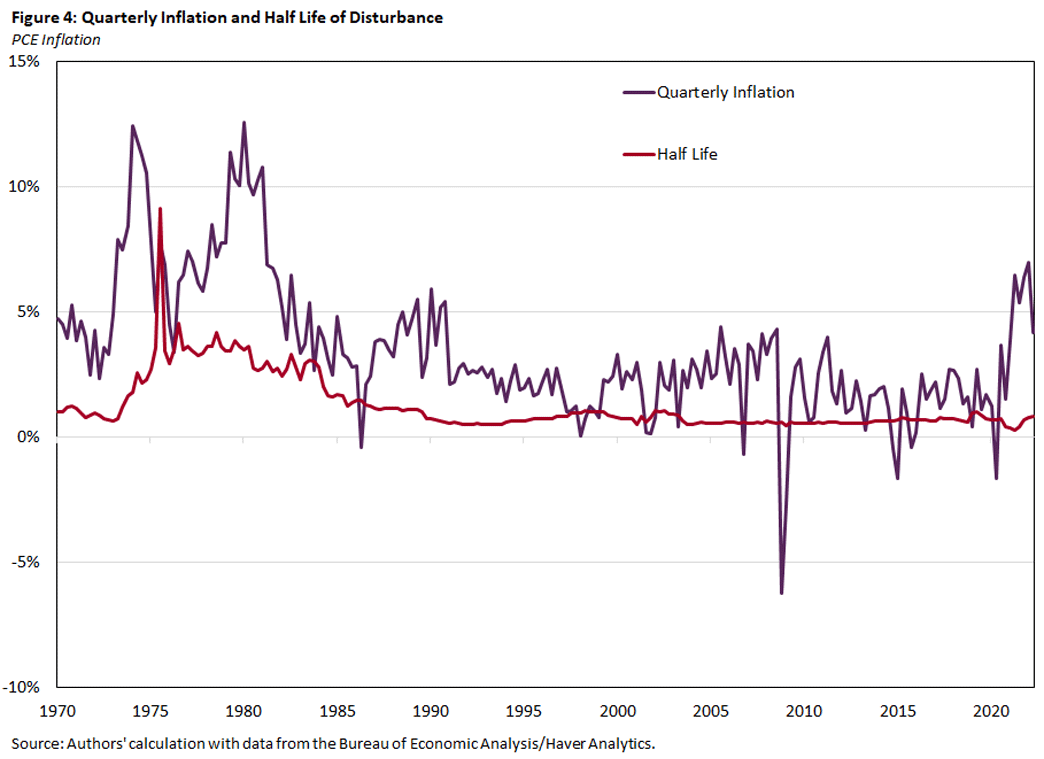

In Figure 4, we compute the half-life of inflation for each of the 10-year rolling windows used in Figure 1. Then, we chart those half-lives along with quarterly PCE inflation to examine the relationship between inflation and half-lives over time.

The half-life of inflation shocks was highest in the late '70s and early '80s before declining and staying low in the following decades. At first glance, it seems odd that quarterly inflation stays elevated for years even after the half-lives bottom out. However, recall that this graph reflects the half-life of current shocks, while quarterly inflation is affected both by current shocks and by the lasting effects of past shocks. Given the extremely high half-life of these inflation shocks in the late '70s (even reaching as high as two years), their effects lasted well into the '80s.

A conventional interpretation underlying the sudden decline in half-lives of inflation shocks in the early '80s relates to the Fed's actions to tame inflation during that period. Just as important, the Fed gained credibility for maintaining low inflation going forward. As a result, the effects of new inflation shocks became noticeably less persistent. The Fed may have been able to affect the persistence of new shocks, but it took a while for inflation to come down because of the persistence of inflation shocks in the years prior.

In the most recent data, the persistence of shocks to PCE appears to be rising, though yet nowhere near the degree experienced in the '70s and '80s. A key difference is that the Fed has been able to establish a high degree of credibility over the past four decades or so for not letting inflation rise too far above its stated target.

This historical perspective provided in this article is a reminder of how difficult it was to earn that credibility and highlights the need to guard it fiercely, as noted in the 2005 paper "The Incredible Volcker Disinflation." As both inflation and inflation persistence rise, it will be important to keep that lesson in mind.

Conner Mulloy is a research associate, John O'Trakoun is a senior policy economist and Pierre-Daniel Sarte is a senior adviser, all in the Research Department at the Federal Reserve Bank of Richmond.

In Figure 1, results reported for different subsamples use averages over those subsamples, which are represented by flat lines.

Expected inflation is calculated using the same simple AR(4) process used to describe inflation persistence in Figure 1 estimated over 10-year windows. Results shown for different sample periods are computed using averages of the estimated coefficients over those periods.

To cite this Economic Brief, please use the following format: Mulloy, Conner; O'Trakoun, John; and Sarte, Pierre-Daniel. (August 2022) "How Persistent Is Inflation?" Federal Reserve Bank of Richmond Economic Brief, No. 22-31.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.