Virginia's Labor Market Recovery Resumes

As we pass the halfway mark in the year, it appears that Virginia's employers have resumed hiring after a slow spring. During calendar year 2015, employers added about 8,700 net new jobs per month, on average. In contrast, employment growth slowed to 5,700 per month during the first quarter of the year, followed by an average monthly loss of 2,500 in the second quarter, with the most recent increase of 2,600 jobs in July 2016 (see chart below). It is certainly possible that job growth has returned with two consecutive months of gain in June and July, but unless the pace of job growth accelerates further, 2016 is shaping up to be softer than 2015.

Virginia's unemployment rate stood at a seasonally adjusted 3.7 percent in July 2016 for the third consecutive month. The unemployment rate has not been this low since April 2008, but the good news comes with some qualification. The labor force — defined as the number of people who are employed or are unemployed but actively searching for work — has now declined for six straight months, following a sustained increase from August 2015 through January 2016. A decline in the labor force can reflect demographic trends, such as an increase in the number of retirees. But it can also result from people leaving the labor force for other reasons, such as seeking additional schooling.

Industry Growth

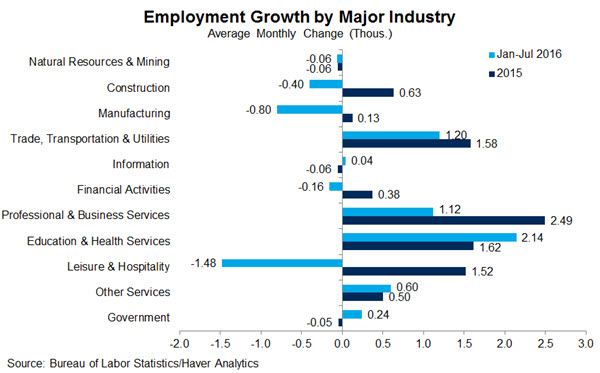

For the most part, employment growth in Virginia's major industry sectors was better in 2015 than it was in the first seven months of 2016. Employment in most of the major industries in Virginia grew during 2015. The greatest contributor to job growth in 2015, by virtue of its sizable share of employment (18 percent), was the professional and business services sector, which added nearly 2,500 jobs per month, on average.Other large sectors – education and health services; trade, transportation, and utilities; and leisure and hospitality – also contributed significant job gains during 2015.

So far during 2016, however, only a few industry sectors have outpaced their contributions in 2015 – education and health services, other services, government, and information. Most importantly, two of the larger industry sectors for Virginia – professional and business services, and trade, transportation, and utilities – saw the pace of job growth decline in 2016 (see chart below). Several industry sectors have registered an average monthly loss in 2016 following growth in 2015, including construction, manufacturing, and financial activities, as well as the much larger leisure and hospitality sector.

Regional Growth

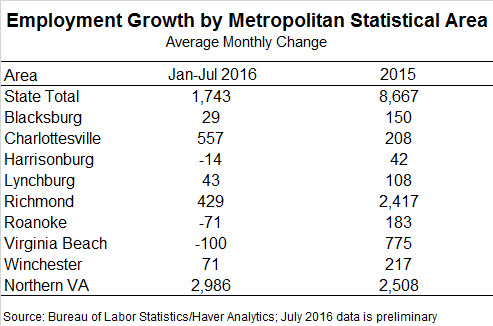

Every major metropolitan statistical area (MSA) in the state gained jobs during 2015. However, during the first seven months of 2016, the slowdown in job growth has been felt in nearly every major metropolitan area, with little exception, while a few metro areas have even lost jobs so far this year. The most notable exception to this trend is Northern Virginia, where the average monthly job gain this year has exceeded its 2015 average (see chart below). Northern Virginia is a major contributor to the state's job growth since it accounts for just over a third of total employment – the largest metropolitan area, by far, in terms of its share of statewide employment.

In contrast, the next largest metropolitan area — the Virginia Beach-Norfolk MSA, which accounted for nearly 20 percent of the state's total employment in 2015 — pivoted from a net contributor of jobs during 2015 to a net drain on jobs during 2016. Based on the statewide average monthly gain of only 1,743 jobs, the smaller metro areas (not listed) and the non-metro areas of the state have lost jobs, on balance, during 2016.

Summary

Labor market data, which is released every month, provides the timeliest indicators of economic performance in the various industries and regions of the state and is therefore watched with great interest. As we have seen in years past, trends can shift throughout the year, as was the case in 2015 when growth picked up in the second half of the year relative to the first half.

With several months left in the year, the focus will be on key economic drivers in the state – professional and business services, and education and health services – as well as the contribution to growth from the so-called "golden crescent" that includes the Northern Virginia, Richmond, and Virginia Beach-Norfolk metro areas.

Have a question or comment about this article? We'd love to hear from you!

Views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Richmond or the Federal Reserve System.