Regional Job Openings and Quits Rates Jolt to New Highs

The Bureau of Labor Statistics (BLS) conducts the Job Openings and Labor Turnover Survey (JOLTS). The survey’s purpose is to provide information on the demand for labor and give insights into the success or challenges firms have filling open positions or retaining workers. These insights come from data on job openings, hires, quits, layoffs, and total separations. The BLS recently started officially releasing monthly state-level data for the first time (previously, the experimental state-level data were quarterly.)

This type of data help create a better understanding of the current condition of the U.S. (and now state) labor market and inform policymakers on business activity and the labor movement in the economy. Typical labor market indicators, such as the unemployment rate and labor force participation rate, help describe labor supply conditions. Meanwhile, the JOLTS data help describe the demand for labor. When used in conjunction, however, we can get a better handle on the match of labor demand and supply, which is currently a topic of significant interest as policymakers and analysts gauge the labor market recovery. This post observes the data available from JOLTS for the jurisdictions in the Fifth Federal Reserve District.

Jobs Openings Rate Across the Fifth District

The BLS defines a job opening as a position that is needed and unfilled, that starts within 30 days, and that includes active recruitment to fill the position. The data are available in the number of openings and the rate of openings. To create a rate, the BLS takes the number of openings divided by total payroll employment (from the establishment survey) plus job openings, and multiply the quotient by 100. In other words, the job openings rate is the share of all positions, filled or unfilled, that are currently vacant. In addition, using the rate of openings, rather than the level, allows us to compare across geographic locations.

Between June and July, the jobs openings rate hit record highs for the data series in the United States and all Fifth District states. West Virginia had the highest job openings rate among states in our district at 9.1 percent, and the District of Columbia had the lowest peak of 5.8 percent. In August, job openings declined slightly in all states except North and South Carolina. Even with some decline across the Fifth District, all states still maintain a job openings rate above their pre-pandemic rates.

Note: The chart below, and subsequent interactive charts, have been initially set to show one jurisdiction along with the United States. Please add and subtract other jurisdictions to the chart by clicking on their name in the legend.

Quits Rate Across the Fifth District

The JOLTS data have several variables for when a position is vacated or terminated. For example, quits is when a person leaves a job voluntarily — generally interpreted as the confidence that people have in the labor market to leave their current job. The chart below clearly shows that the quits rate (calculated by dividing the number of quits by employment and then multiplying that result by 100) tends to rise during an economic expansion and declines in recessionary periods.

In most states, there is also a clear and sharp dip at the start of the pandemic, but the quits rate has generally rebounded and is at or above the pre-pandemic level. Looking at the most recent data (the chart below can be zoomed in by holding down the left mouse button and dragging left or right), after record-high job openings in July, the August quits rate increased slightly in Virginia, Maryland, and North Carolina. South Carolina and West Virginia saw slight decreases, and the District of Columbia remain unchanged.

Earlier this year, in April, Virginia and South Carolina saw the highest quits rates since the series started in 2002. Most states in the district have quits rates greater than or equal to the United States. Maryland and the District of Columbia are the only areas in the district with quits rates lower than the nation. The District of Columbia has the lowest quits rate of 1.7 percent as of August 2021. Read more about the implications of this elevated level of quits here.

Unemployed per Opening Across the Fifth District

We can use additional labor market data to create metrics that offer a slightly different interpretation than the JOLTS variables. One metric is the unemployed per job openings ratio, which is the number of unemployed persons divided by the number of job openings. In other words, it’s the number of people who are currently out of a job but looking for work, per job openings. The larger the number, the more people that are potentially available to fill an opening. A small number means that there are fewer people available, and therefore, it could be more challenging for firms to fill those openings.

In April 2020, during the depth of the economic decline due to the pandemic, the number of unemployed per number of job openings was well above 1 for the nation and states in the Fifth District. For example, in Virginia, the ratio was 3.1: There were about 3 unemployed people per job opening. Therefore, firms might have an easier time filling open positions, at least from the pool of people who are currently unemployed but looking for work. Those positions, of course, could be filled by someone who is already employed.

Since April 2020, this metric has trended down in the United States and across the Fifth District with the ratio below 1 for all geographies, which is near or below the pre-pandemic number. However, this is not to say that the labor market has fully recovered. In fact, the total number of people employed in the United States and in the Fifth District remains below the pre-pandemic level. Additionally, with the exception of West Virginia, the number of people unemployed is still higher than before the pandemic, and many people have left the labor market entirely. These trends are highlighted in the Fifth District Economic Indicators’ charts on unemployment rates and labor force participation rates. Therefore, while the ratio may be close to pre-pandemic levels, the underlying data tell a different story.

State-level Beveridge Curves

The final metric we observe is the Beveridge curve, which shows the inverse relationship between the unemployment rate and the job openings rate. This means when the unemployment rate is low, there tend to be more job openings, and as the unemployment rate increases, the rate of job openings tends to decline. A recent Economic Brief discussed how the Beveridge curve holds across time, countries, and sectors, and gives insight into how well employers search and job seekers find each other.

The economic brief also highlighted how the post-COVID-19 Beveridge curve for the United States has shifted outward and tilted upward. A shift outward means that for any given unemployment rate, the rate of vacant positions is higher than usual, or in other words, it is harder for firms and workers to be matched. An upward tilt, or a steepening of the curve, means that a decline in the unemployment rate would be associated with a larger than usual increase in the job openings rate. With the JOLTS data available by state, we can look to see if the relationship holds at the state-level and see if the state-level curves have shifted or tilted.

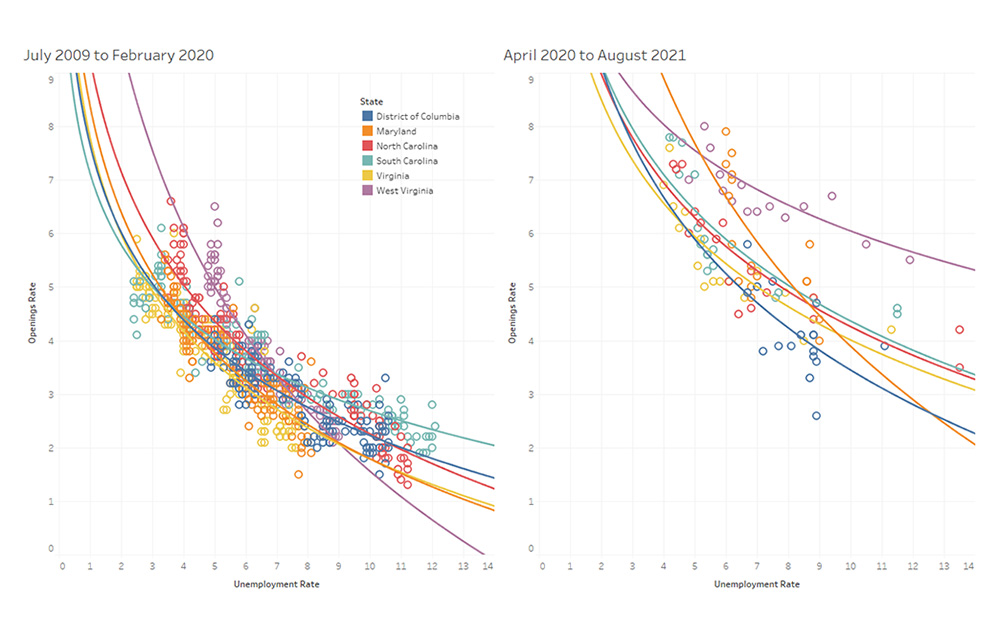

The picture below shows two scatter plots with color-coded trend lines, side by side, for two time periods: after the Great Recession to just prior to the COVID-19 pandemic (July 2009-February 2020) and after the sudden and dramatic spike in unemployment to the most recent data (April 2020-August 2021).

The charts show that the Beveridge curve holds across states, and the post-COVID-19 curve has shifted outward compared to the pre-COVID-19 curve for every jurisdiction in the Fifth District. As previously discussed, this shift outward indicates that firms are posting more job openings now than they would have pre-pandemic given the same unemployment rate, and this is clearly the case for all the states in our district.

The trend lines also show a few notable changes in steepness of the curves: Maryland (the orange line) has steepened, while West Virginia (the purple line) has flattened. For Maryland, this means a reduction in the unemployment rate is associated with a strong rise in job openings compared to pre-COVID-19. In West Virginia, however, a decline in the unemployment rate is currently associated with a smaller increase in the rate of job openings than prior to February 2020.

Conclusion

The newly available JOLTS data by state allow us to look at the labor markets for Fifth District jurisdictions in a way that was previously only available at the national level. Overall, these data show similar and consistent trends with the United States, with a few subtle differences in the timing or intensity at which the data peak. On their own, the JOLTS data show the strong demand for workers across our district and the confidence that workers have to voluntarily quit their jobs. Furthermore, when combined with data on unemployment, we see the limited supply of workers to fill open positions, while the Beveridge curves indicate that firms in our region are finding it harder to match up with workers compared to pre-COVID-19.

For more on this topic: see this recent Macro Minute blog post on mismatches in the labor market.

Have a question or comment about this article? We'd love to hear from you!

Views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Richmond or the Federal Reserve System.