2025 Federal Reserve CDFI Survey Key Findings Report

Key takeaways and supporting data from nearly 450 community development financial institutions across the country

Highlights

From April 10 through June 13, 2025, the Federal Reserve fielded the 2025 Community Development Financial Institutions (CDFI) Survey. Four hundred forty-eight mission-driven lenders answered questions about demand for their products and services, future organizational goals, operational challenges, what they see as their most valuable contribution in the financial industry, and the policies and programs that enable them to offer their services.

- One-pager

- Survey questionnaire

- Anonymized survey data will be available by request in early 2026.

Introduction

Community development financial institutions (CDFIs) play a role in providing financial products and services to financially underserved consumers, businesses and communities. These mission-driven organizations can take many forms, including depository banks, thrifts, and credit unions or non-depository venture capital or loan funds.

Regardless of their institutional structure, CDFIs are conduits of public and private funds, including federal awards, donations, and philanthropic dollars, and are often important funding partners for community and economic development.

The Federal Reserve has a public service mission to promote a healthy economy and provide financial stability. As part of this work, we research and engage with CDFIs because of their role in expanding credit access and banking services. Every two years, we survey executive leaders of CDFIs across the country to keep a pulse on industry conditions and institutional dynamics. The data collected through the Fed's CDFI Survey help us understand economic conditions from the perspectives of CDFI leaders to inform research and policymaking and to advance access to credit and economic opportunity in communities nationwide.

The 2025 CDFI Survey was fielded from April 10 to June 13 and received 448 responses, representing about one-third of all certified CDFIs. This year, our respondent CDFIs reported the following:

- Strong Demand Persisted for CDFIs. Most CDFIs saw rising demand for their products across all business lines in 2024. Increased demand was largely driven by new customers seeking consumer, small business, and residential real estate development loans through CDFIs.

- Federal Funds Enabled CDFIs to Reach More Borrowers. CDFIs identified the ability to reach otherwise financially underserved borrowers with flexible underwriting and loan terms as their unique value add. Three-quarters of survey respondents also said that federal funding streams were critical to providing the underwriting and loan terms needed to reach underserved borrowers.

- Staffing, Technology, and Capital Cited as Top Challenges. Staffing and technology were the most widely experienced challenges across all respondents. Lending and operational capital remain acute challenges for loan funds. CDFIs were specifically challenged by a lack of qualified candidates to fill open positions, limited ability to bridge skills gaps through training, and the high costs associated with technology and new debt capital.

- Respondents Split on Economic Outlook — Ability to Meet Growing Demand Hinges on Sustaining Funding Levels. Historically, CDFIs have been critical lenders in weaker economic environments. Therefore, while more than half were pessimistic about the overall economy, many expected demand for their products and services to grow through 2025. Almost all respondents expect to grow their customer base and their level of financing through 2030. Demand growth could outpace funding if capital sources dry up, especially for loan funds.

Stay connected with the Richmond Fed for more insights from the 2025 CDFI Survey. Forthcoming publications will dive deeper into data trends over time, findings on rural-serving CDFIs and more. If you would like to receive notifications about CDFI Survey data and analysis, you can fill out this interest form.

Respondent Overview

- This section provides a brief snapshot of 2025 CDFI Survey respondents. For more information about the characteristics of respondent organizations, see the Appendix: Survey Respondents and Methodology.

Of the 448 organizations that responded to the 2025 survey, most were loan funds (49 percent) and credit unions (36 percent). Respondent loan funds primarily offered small business finance, while credit unions primarily offered consumer finance products. CDFI banks (11 percent of respondents) typically offered commercial real estate finance and small business finance.

At the time of the survey, almost all respondents (95 percent) were certified by the U.S. Department of the Treasury's CDFI Fund. Eighty-seven percent said that they had either already submitted an application through the CDFI Fund's revised certification process or were planning to.

More than two-thirds of our sample operate within a single state. Eighty-one percent reported having assets of $375 million or less. Loan funds in our sample were smaller in either assets or employee size than depository institutions. Depository credit unions and banks tended to hold more assets, have larger staff, and have longer histories of mission-driven financing.

Strong Demand for CDFI Products Persists

- Seventy-one percent of CDFIs reported increased demand over 2024.

- New customers drove demand increases for 88 percent of the sample.

- Seventy-eight percent of respondents were able to fully or mostly meet demand for their products in 2024.

Nearly three-quarters of respondents saw demand increase in 2024 and expected continued increase throughout 2025. This is not a new finding: Most CDFIs have consistently reported increasing demand since the CDFI Survey began national data collection in 2019.

Among the most frequently cited business lines, higher shares of respondent small business and mortgage lenders saw demand grow over 2024 compared to consumer lenders (69 percent and 72 percent, respectively). Still, more than half of respondent consumer lenders saw demand grow over 2024.

What drove the reported increase in demand for CDFIs' products and services? Almost all CDFIs said their increased demand was driven by new customers (88 percent), and most also reported expanded needs from existing customers (68 percent).

Part of the value offered by CDFIs is in development services — such as business support, technical assistance, or financial education — to help borrowers make the most of their loan. In this survey, demand for CDFIs' financial products outpaced demand for their development services. Part of this might be driven by the demand growth coming from existing customers who may not have needed the same level of assistance or intervention.

For the most part, CDFIs were able to meet increased loan demand. Seventy-eight percent of respondents were able to fully or mostly meet overall demand for their products (33 percent and 45 percent, respectively).

Of course, while most respondents observed growing demand, this was not the experience of every respondent. Twenty-nine respondents reported decreased demand for loans in 2024. Some of these respondents said that high interest rates negatively impacted loan demand. In addition, about one-fifth of respondents reported being only "somewhat" able to meet overall demand for their products. Among this group, most were loan funds.

Federal Funds Enable CDFIs to Reach More Borrowers

- More than half (56 percent) of CDFI respondents identified their ability to expand access to financial products, use flexible underwriting, or offer tailored loan terms as their unique value add in the lending industry.

- Nearly three-quarters (74 percent) of respondents said that federal programs enable them to provide the underwriting and loan terms needed to reach underserved borrowers.

- Fifty-four percent of respondents said that the benefits of CDFI certification greatly outweighed the costs.

Given the challenges CDFIs face and the unique contributions they make within the larger financial ecosystem, it is important to understand how CDFIs are leveraging public programs to deliver their products and services.

Respondents indicated that their value add, compared to non-CDFI financial institutions, was their ability to reach more customers through flexible underwriting (21 percent) or loan terms (17 percent). Eighteen percent simply said their most important contribution was expanding financial access to more customers and borrowers.

Responses differed by institution type. Loan funds were most likely to report their value add as their flexible underwriting standards (25 percent). Credit unions were most likely to respond that it was their ability to expand access to financing (23 percent), while banks indicated it was their local knowledge (24 percent).

Seventy-four percent of respondents indicated that federal programs enabled their CDFI to better reach customers, compared to traditional financial institutions. Over half of all programs named were administered by the CDFI Fund, including financial and technical assistance programs. Some respondents submitted text responses that indicated CDFI Fund programs helped their organization overcome barriers to scaling up. For example, one respondent remarked that CDFI grants enabled their small credit union to afford technology it otherwise could not have purchased.

Respondents indicated that CDFI Fund programs are critical for reaching borrowers and customers, but mission-driven lenders must be certified by the CDFI Fund to access these programs. How do CDFIs see the trade-offs of the certification process? Seventy-eight percent of respondents indicated that the benefits of CDFI Fund certification either greatly (54 percent) or somewhat (24 percent) outweigh costs, where costs are defined as staff resources and time dedicated to certification application and maintenance. For organizations that rely on federal programs as a top funding source, 85 percent indicated that certification benefits outweigh costs.

Nine percent indicated that the costs of certification outweigh the benefits. Interestingly, three-quarters of these organizations had still applied for certification or were planning to. The cost-benefit ratio of certification did not vary much by size: Twelve percent of large CDFIs and 10 percent of small CDFIs said that costs outweighed the benefits of certification. (Read details about CDFI size in the Appendix.)

Aside from the CDFI Fund, other respondents frequently mentioned funding programs designed for small business lending. That included programs administered by the Small Business Administration (SBA), like the SBA 7(a) or microloan program as well as the U.S. Department of the Treasury's State Small Business Credit Initiative program.

Staffing, Technology, and Capital Cited Among Top Challenges for CDFIs

- Most respondents reported inadequate staffing and technology challenges, including a lack of qualified candidates to fill open positions, limited ability to bridge skills gaps through training, and the high costs associated with procuring and integrating new technology.

- Loan funds reported challenges with lending capital (40 percent) and operational funding (28 percent) as severely limiting — specifically the cost of capital.

- The most cited borrower qualification challenge of 2024 was an inability to afford loan terms (65 percent).

What factors constrain CDFIs' business operations and lending? Inadequate staffing (72 percent) and technology challenges (69 percent) were most likely to impede respondent CDFIs' ability to meet demand. Operational and lending funding were not far behind.

Sixty-five percent of respondents who faced staffing shortages said it was challenging to find qualified candidates; forty-three percent of respondents said they lack time or resources to properly train new hires; and half of respondents shared that existing staff lack necessary skills.

As for technology, respondents expressed that the high costs associated with back-office and customer-facing technology limited their capacity to meet demand. Many also cited challenges integrating new technology with their existing systems, finding the right technology or vendors, and maintaining cybersecurity.

There were clear differences in the top challenges by type of institution. Funding presents the greatest barrier for loan funds. Since they do not take deposits, loan funds are more reliant on external funding sources. Lending capital was ranked as the most significant issue for 40 percent of respondent loan funds, particularly the cost of capital. Operational funding was frequently cited by loan funds but was reported as having a less severe disruption compared to lending capital (28 percent reported it as a significant challenge).

Credit unions and banks largely indicated that technology was the top factor limiting their ability to meet demand (76 percent). Most cited the cost of back-office and customer-facing technologies (around 80 percent), integration with existing systems (72 percent), and cybersecurity (around 60 percent) as the specific limiting factors.

Inability to afford loan terms (65 percent of respondents) was the most cited borrower qualification challenge of 2024. More than half of respondent CDFIs also indicated that their ability to serve their customers was hindered by credit report challenges or their lack of collateral. While development services could help CDFI customers overcome some borrower qualification issues, nearly half of respondents indicated that they lacked the staff capacity to offer the development services that their clients needed. Several CDFIs grappled with customers thinking they did not need assistance (36 percent of respondents) — which may have contributed to the lower demand for development services mentioned in the previous section.

Amid Economic and Funding Uncertainty, CDFIs Expect Demand to Rise

- Seventy-seven percent of respondents anticipated that overall demand for their products and services would rise through the remainder of 2025.

- Sixty-four percent of respondents were optimistic about their own organization's financial health, while 56 percent reported being pessimistic about the overall economy.

In addition to asking about their own institution, we asked CDFIs to share their expectations of market and business conditions through the remainder of 2025. More than three-quarters of CDFIs anticipated that overall demand for their products and services would rise through 2025, including more than half of the CDFIs that experienced decreased or steady demand in 2024.

More specifically, 79 percent of CDFIs in the small business lending space expected loan demand to increase over the remainder of the year. Comparatively, residential real estate lenders were slightly less anticipatory of demand increases, but most (66 percent) still expected demand growth over 2025.

Large shares of respondents said that they expected to be able to meet more demand over 2025 due to anticipated increases in staff capacity (73 percent) and additional technological resources (66 percent). Conversely, of the respondents who reported that they would not be able to meet demand through 2025, 81 percent cited decreased lending capital as a driving factor.

When asked about their outlook on the overall economy, most respondents were pessimistic. Since CDFIs act as "financial first responders," especially for lower-income borrowers, a weakening economy may translate to demand growth. CDFIs' expectations for the economy, combined with strong demand in 2024, led nearly two-thirds of respondents to be optimistic about the financial health of their own organization. Unsurprisingly, CDFIs that did not anticipate being able to meet demand through 2025 were more likely to be pessimistic about their organization's financial prospects.

Optimism varied by the survey respondent's top funding sources. Respondents who rely heavily on deposits were most likely to feel optimistic about their organization's finances (79 percent). In contrast, respondents with philanthropic dollars as a top funding source were far less optimistic (45 percent). See the Appendix for more information on funding sources.

CDFIs Are Planning for Future Expansion

- Over the next 5 years, over 9 in 10 respondent CDFIs want to expand their client base, and over 8 in 10 want to increase the level of financing they offer.

The CDFI industry is organizationally diverse, which can make it challenging to grasp how the industry as a whole thinks about growing and scaling. To shine some light on this question, we asked respondents about their organizational goals over the next five years.

Most CDFIs are looking to grow in the near future. Almost all CDFI Survey respondents (95 percent) said they aimed to increase their customer base over the next five years, and 83 percent of respondents wanted to increase their level of financing over the same period. Around half of respondents reported that they seek to expand their geographic scope or number of business lines.

Compared to the rest of the sample, a smaller percentage of loan funds reported wanting to increase their number of business lines, development services, or geographic scope. This could be because they are — or feel like they are — more constrained by their lending sources and mission scope.

Older CDFIs aimed to scale up operations at a higher rate than younger CDFIs. CDFIs older than 15 years tended to report that they aim to expand their development services, the level of financing they offer and, to a smaller extent, the geography which they cover.

Summary

Overall, CDFIs reported sustained demand for their products throughout 2024. CDFI Survey respondents anticipate their demand will continue to grow in 2025, though more than half were feeling pessimistic about the overall economy. CDFIs' lending terms and specialized products may have allowed them to serve individuals, businesses, and communities that would have otherwise not had access to new credit in 2024.

CDFIs hope to be able to hire qualified applicants — or find more resources to train existing staff — and incorporate new technology to meet rising demand in 2025. At the time of this survey, almost all aim to expand their organizations in the next 5 years through new customer acquisition and expanded product offerings.

Appendix: Survey Sample and Methodology

This Appendix provides greater detail about 2025 survey respondents, including:

-

CDFI Type

The 2025 survey yielded responses from 448 CDFIs, including loan funds (49 percent), credit unions (36 percent), banks and thrifts (11 percent). The remaining 4 percent of responses were from CDFIs that identified as venture capital funds, holding companies or other.

Seventy-two percent of CDFIs also carried special designations or community identifiers. Survey respondents included cooperativas (Puerto Rican cooperative credit unions that offer services both inside and outside of the community development finance space), Native CDFIs (which specifically serve Native American communities across the nation), minority depository institutions, community development corporations, and microenterprise development loan funds.

-

Certified CDFIs

Almost all CDFI Survey respondents reported that they were currently certified by the CDFI Fund (95 percent). Over three-quarters of CDFIs that were not certified had already submitted a revised CDFI certification application or were planning to do so. (As a note, mission-driven lenders and financial institutions that are not CDFI certified can take the CDFI Survey.)

Compared to the CDFI Fund's list of certified CDFIs from June 2025, loan funds were overrepresented in the survey sample (49 percent compared to 41 percent), as were credit unions (36 percent compared to 32 percent). Banks were slightly underrepresented in the sample (11 percent compared to 14 percent).

Compared to the CDFI Fund's most recent Annual Certification and Data Collection Report (ACR), the 2025 CDFI Survey slightly undersampled CDFIs primarily offering consumer finance (37 percent versus the ACR's 41 percent) and slightly oversampled business lenders (29 percent versus 21 percent). The ACR does not report on home purchase and improvement lending and residential real estate lending separately; however, when combining these business lines for CDFI Survey responses, the sample is comparable (18 percent versus the ACR's 19 percent).

-

Primary Business Lines

The top primary business lines reported by respondents this year were consumer finance (37 percent), small business finance (29 percent), and residential real estate finance (12 percent).

The primary business line differed by institution type. Most respondent credit unions (91 percent) primarily offered consumer finance products. CDFI banks primarily offered commercial real estate finance (44 percent) and small business finance (26 percent). Exactly half of loan fund respondents reported small business finance as their primary line of business, followed by residential real estate finance (18 percent) and home purchase/improvement finance (10 percent).

-

Geographic Scope and Service Area

More than half of respondents indicated that they served multiple counties (or county equivalents) or one state, American Indian reservation or territory. The remainder were either hyper-local (serving just one county), multistate or national.

Most CDFIs dedicate most of their resources and time to serving urban areas (36 percent) or split their resources and time equally among urban, rural, and suburban areas (36 percent). Twenty-six percent of respondents primarily serve rural places.

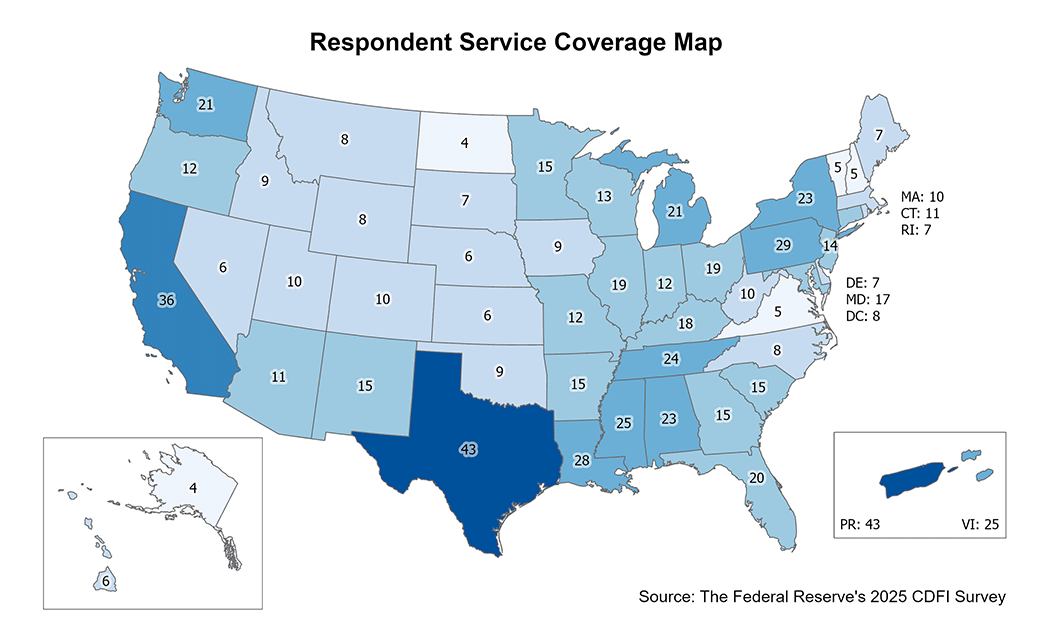

This year, the CDFI Survey received responses from 48 states, the District of Columbia, and Puerto Rico. Puerto Rico had the largest representation in the survey, followed by Texas and California.

Top 10 States with Highest 2025 CDFI Survey Response State Number of Respondents Number of Total Certified CDFIs (per CDFI Fund) Puerto Rico 51 85 Texas 36 54 California 34 112 New York 23 81 Mississippi 18 100 Louisiana 16 101 Pennsylvania 16 33 Michigan 14 44 Minnesota 14 32 Ohio 14 39 Source: Federal Reserve's 2025 CDFI Survey Puerto Rico and Texas were served by the most local or statewide (rather than national) CDFIs, followed by California, Pennsylvania and Louisiana. The only states or territories that did not have coverage outside of national CDFIs were Guam and the Northern Mariana Islands.

-

Number of Years Offering Mission-Driven Finance

Though the CDFI Fund did not exist prior to 1994, around 38 percent of survey respondents reported that they offered mission-driven financing before that. The majority of respondents started offering mission-driven financing after 1994, with several starting in the years immediately after the Great Recession.

Among respondents, loan funds had been offering mission-driven lending for fewer years than depositories. The average bank reported providing mission driven lending for about 32 years, with some delivering their products for more than 100 years. The average credit union had been in the business for 43 years, although there were several respondent credit unions that began their mission-based lending within the last 10 years. The average loan fund respondent had been in the CDFI business for 25 years.

-

CDFI Size

As reported by the New York Fed, although the industry as a whole holds an estimated $450 billion in assets, CDFIs tend to be smaller than traditional financial institutions by asset size. For comparison, the largest mainstream financial institution in the United States holds over $3.6 trillion in assets.

In this report, small, medium, and large designations were defined by asset size. Size classification thresholds for banks are taken from the Federal Financial Institution Examination Council. Thresholds from 2023 were used in the 2025 questionnaire and text of this report for comparability to the 2023 CDFI Survey.

These size classifications were defined by the authors:

Small Medium Large Loan Funds <$20M >$20M and <$375M >$375M Credit Unions <$100M >$100M and <$875M >$875M Banks <$375M >$375M and <$1.5B >$1.5B Note: CDFI asset size classifications are defined by the authors Using these definitions, the survey sample was comprised mostly of small or medium-sized CDFIs (91 percent). Loan funds are smaller than depository CDFIs: Forty-three percent of respondent loan funds had less than $50 million in assets; nineteen percent held $5 million or less.

Loan funds also tend to have leaner staff than credit unions or banks. Most loan funds had fewer than 50 full-time employees (87 percent), whereas 40 percent of banks had 100 employees or more.

-

Funding Sources

CDFIs were asked to indicate and rank their top three funding sources. The most selected funding sources were earned income (68 percent of respondents) and federal funding (63 percent).

CDFIs focused on different primary business lines tend to rely on different funding sources. Sixty-seven percent of CDFIs that primarily offer consumer lending reported earned income as one of their top three funding sources, followed by deposits (65 percent) and federal funding (58 percent).

Meanwhile, CDFIs that focused on small business lending were most likely to report top funding sources as federal funding (69 percent), earned income (65 percent) and philanthropy (41 percent). Residential real estate lenders' top three sources tended to be: Earned income (59 percent), federal funding (46 percent), and other financial institutions (44 percent).

Tune in to our upcoming Connecting Communities webinar on Sept. 25, 2025, where we will discuss 2025 CDFI Survey findings and hear about other ways Federal Reserve Banks learn from — and about — CDFIs.