The 2025 H.R.1 extended three tax credit programs designed to increase development and investment in underserved places. This post explores these programs and how community lenders use them.

Community Development Finance

We work with community and business leaders to identify opportunities in low- and moderate-income and underserved communities.

Updating Results

Updating Results

Topics include STEM education for the rural workforce, insights form the 2025 CDFI Survey, assessing business conditions for manufacturers, and more.

Erika Bell and Hunter Jones describe the importance of the Federal Reserve Bank of Richmond connecting with small towns and rural communities throughout the Fifth District, including those in western North Carolina recovering from Hurricane Helene. Bell is a community development regional manager and Hunter is a senior business analyst. In addition, Russ Harris of the Southwestern Commission Council of Governments and Nathan Ramsey of the Land of Sky Regional Council reflect on the value of their partnerships with the Richmond Fed and other regional organizations, both before and after the hurricane.

Many rural areas lack sufficient resources to strengthen the STEM pipeline. How is one nonprofit in South Carolina addressing the workforce gap in hopes of reducing rural flight?

Bethany Greene

Regional Economist

This post will examine loan fund responses to the 2025 CDFI Survey: the business lines and top funding sources, as well as how many have leveraged secondary markets as a funding strategy.

Daniel Davis talks about the importance of understanding the economies of small towns and rural areas. He also discusses the work that the Federal Reserve Bank of Richmond has done to examine these economies and connect with community leaders, including the recent launch of the Richmond Fed's Center for Rural Economies and Investing in Rural America webinar series. Davis is group vice president for regional economics at the Richmond Fed and director of the center.

Surekha Carpenter and Taylor Pessin share their initial learnings about community development financial institutions that responded to the 2025 CDFI Survey, which is conducted every other year by the Federal Reserve. Carpenter is a senior research analyst and Pessin is an intermediate research analyst, both on the Regional and Community Analysis team at the Federal Reserve Bank of Richmond.

This post explores the experiences of rural CDFIs using data from the most recent CDFI Survey, including funding challenges and reliance on federal funding.

Emily Wavering Corcoran and James Melton

This post summarizes the 2025 Federal Reserve CDFI Survey and reviews past results to shed light on how the CDFI industry has changed over time.

Key takeaways and supporting data from nearly 450 community development financial institutions across the country.

Mary Donnan and Victor Farmer discuss two projects in the Fifth District that illustrate the challenges of economic development in rural communities and the importance of philanthropic organizations in addressing those challenges. They also reflect on how the Richmond Fed's Community Investment Training program, whose core curriculum is provided by Invest Appalachia, helped move the projects forward. Donnan is executive director of the Alleghany Foundation and Farmer is director of the Boone Memorial Health Community Foundation.

This post provides an early look into some of our findings from the 2025 CDFI Survey before we release a full key findings report on Sept. 19.

The Community Investment Training helps rural leaders jump-start development projects, and based on the 2024 and 2025 cohorts, the Richmond Fed's community development team shares some lessons learned.

Examining the history of Community Development Credit Unions shows the evolving role they played in helping to expand banking access to underserved individuals.

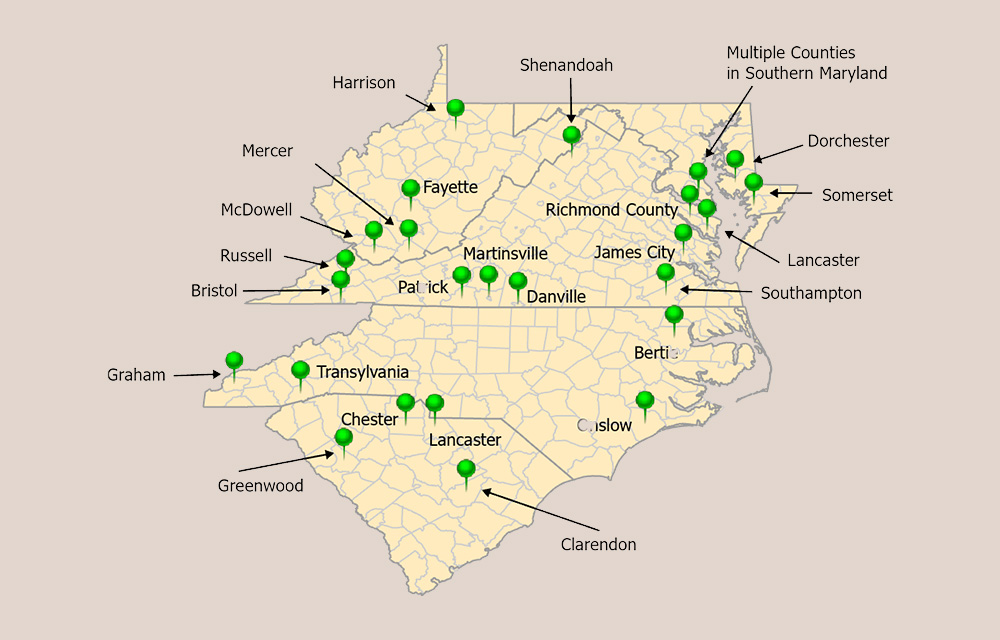

A look at where USDA Rural Development funding goes across the Fifth District. Which programs drive total investments, and which states and counties get the largest shares of funding?

As we gear up for the 2025 Federal Reserve CDFI Survey, this post paints a picture of the current state of CDFIs and seeks to understand what might differ from our 2023 survey results.

Emily Corcoran and Jen Giovannitti discuss the demand and supply factors that influence the financing of community development in rural areas, as well as the issues that impede the flow of capital into the places that need it. Corcoran is a senior manager of regional and community analysis at the Federal Reserve Bank of Richmond and Giovannitti is president of the Claude Worthington Benedum Foundation.

Philanthropic giving can make a big difference in small towns, if both sides can find each other.

Rural communities can face a mismatch between supply of and demand for community development investment dollars. But through partnerships with local government, nonprofits, businesses, and CDFIs, some are developing creative solutions.

Emily Wavering Corcoran and Jen Giovannitti

Alaina Barca and Surekha Carpenter examine the decline in the number of bank branches in certain communities and the economic effects of that trend. They also share data from the Banking Deserts Dashboard developed for the Fed Communities website. Barca is a community development research analyst at the Philadelphia Fed and Carpenter is a research analyst at the Richmond Fed.

The Fed's Small Business Credit Survey monitors small business credit access across the United States. Available data for Virginia, Washington, D.C., and North Carolina show broad similarities to national trends — and a few differences.

Data from Fed Communities' Banking Deserts Dashboard show how in-person banking access changed in the Fifth District from 2019 to 2023.

Surekha Carpenter, Disha Dureja and Avani Pradhan

For millions, food banks fill a crucial gap. How do they do it and just how big is the need they address?

Jason Smith, senior community development advisor at the Richmond Fed, discussed the results of the first round of the Bank's Community Investment Training, which helps rural communities obtain funding for their economic and community development projects. He also shared his interview with one of the program's participants, Craig Sewell of the Southern Maryland Agricultural Development Commission.

Applications are now being accepted for the 2025 Community Investment Training program, a 16-week opportunity offered through the Federal Reserve Bank of Richmond’s Rural Investment Collaborative.

Taylor Bennett and Kim Reed describe how community development organizations in West Virginia use land banks to bring new economic activity to abandoned property. Bennett is executive director of the West Virginia Land Stewardship Corporation and Reed is executive director of the Nitro Land Reuse Authority.

The Richmond Fed’s Community Investment Council convened to share insights centered around our Bank’s community development goals for our region and to discuss some of the issues that impact the work including the labor market and current economic conditions of households and communities. Leaders representing all states within the Fifth District met at the Richmond location.

Some rural and small-town communities see potential for outdoor recreation to reinvigorate their economies.

The Rural Investment Collaborative aims to increase economic investment in small towns and rural communities throughout the Fifth District by providing investment training and improving access to capital.

Uptake in SNAP, which supports low-income households enduring persistent poverty and fights food insecurity, varies over time and geography depending on the U.S. business cycle as well as state-specific factors.

The Richmond Fed's Rural Investment Collaborative will train 20 rural leaders how to create successful proposals for community funding.

CDFIs were created to improve credit access for underserved communities, but little was known about their impact. The Richmond Fed launched the CDFI Survey to fill that data gap.

Proposal submissions are now open for the 2024 Investing in Rural America Conference poster session! In this post, we invite you on a virtual tour of posters from our 2023 conference to learn about the ways rural communities are addressing economic challenges.

Nicholas Haltom and Stephanie Norris

Results from our 2023 CDFI Survey show that a majority of CDFIs nationwide and in the Fifth District would like to offer additional products or services but currently lack the resources to provide them on a sustained basis.

Hailey Phelps

Jarrod Elwell and Jason Smith share what the Federal Reserve Bank of Richmond has learned about the financing needs of rural parts of the Fifth District and how the Bank's Rural Investment Collaborative and other programs help community leaders address those needs.

The Office of the Comptroller of the Currency (OCC), the Federal Reserve Bank of Richmond (FRBR) and the Federal Deposit Insurance Corporation (FDIC) are sponsoring a virtual workshop on the Community Reinvestment Act.

Designed for community-based organizations, this workshop will review the regulation and discuss ways through which community organizations can collaborate more effectively with banks. Topics discussed include an overview of the CRA, understanding the impact of bank performance context, the types of bank activities that qualify for CRA consideration and strategies to develop successful partnerships with banks.

A unique partnership between Compass Point Preschool and Northeastern Technical College in Cheraw, South Carolina, makes affordable, high-quality child care accessible to parents entering the labor force.

Over the past two years, community development financial institutions (CDFIs) received large, targeted investment from three federal programs. How was funding distributed to CDFIs in the Fifth District?

Surekha Carpenter and Hailey Phelps

Surekha Carpenter, Nicholas Haltom, Sierra Stoney, Stephanie Norris, Hailey Phelps and Kai Amado

Richmond Fed Community Development leader Jason Smith co-chairs a national group of Federal Reserve leaders focused on understanding rural communities.

President Tom Barkin shares how small towns in the Fifth District are putting their best foot forward to attract talent.

Tom Barkin

President, Federal Reserve Bank of Richmond

The COVID-19 pandemic dramatically reduced transit ridership across the country. Operators across the Fifth District are still figuring out how to adapt.

$440 million in competitive economic development grants from the 2021 American Rescue Plan Act have arrived in the Fifth District where the funds are expected to have an outsized impact in rural areas.

Results from a recent national Fed survey show that community development financial institutions (CDFIs) and the communities they serve are facing less severe disruptions than last year. Still, staffing and other challenges are preventing CDFIs from fully meeting growing demand for their products and services.

Hailey Phelps

Different people have disparate experiences in accessing credits. Exploring ways to close this credit access gap could provide more economic opportunities for underprivileged areas.

Carrie Cook describes the role of the Federal Reserve System in the community development sector and how the Federal Reserve Bank of Richmond partners with communities to fulfill this role. Cook became the Richmond Fed's community affairs officer and vice president of community development in May 2022.

The Recompete Pilot Program intends to boost economic competitiveness in selected underperforming areas by dispersing grants to fund proposed infrastructure, workforce, and business development activities.

Adam Scavette

Regional Economist

As legal gambling options proliferate, commercial casino expansion is less likely to induce economic growth.

Adam Scavette

Regional Economist

The New River Valley Regional Commission is an example of how a regional development organization can galvanize innovative, sustainable regional and local housing strategies to serve its small towns and rural communities.

Sierra Stoney and Tiffany Hollin-Wright

Small towns have an opportunity to address challenges from health care to transportation, but there are barriers to accessing funding.

Tom Barkin

President and Chief Executive Officer

Kelly Bowers, economic development director for Hertford County, N.C., discusses the challenges and opportunities facing her community. She highlights the importance of collaboration across state lines and the need for infrastructure such as broadband and affordable housing to support growth.

Host Tim Sablik discusses his recent research on the value of entrepreneurs in the economic growth of rural places and small towns, as well as the obstacles that they face compared to more urban communities. Sablik also talks with Erika Bell and Laura Ullrich about what they have learned from their contacts in North Carolina and South Carolina about rural entrepreneurship. Bell is community development regional manager for the Carolinas and Ullrich is a regional economist in the Richmond Fed's Charlotte branch.

Small businesses remained challenged throughout 2021 and those that sought financing to bridge funding gaps experienced a higher rate of denials than before the pandemic.

Surekha Carpenter and Molly O'Quinn

As a regional Fed, it is in our mission to help wherever we can to promote economic vitality in our District. So, starting in early 2018, the Richmond Fed stepped up its efforts to learn about rural and small-town economies and to seek ways in which outcomes could be improved and potential unleashed.

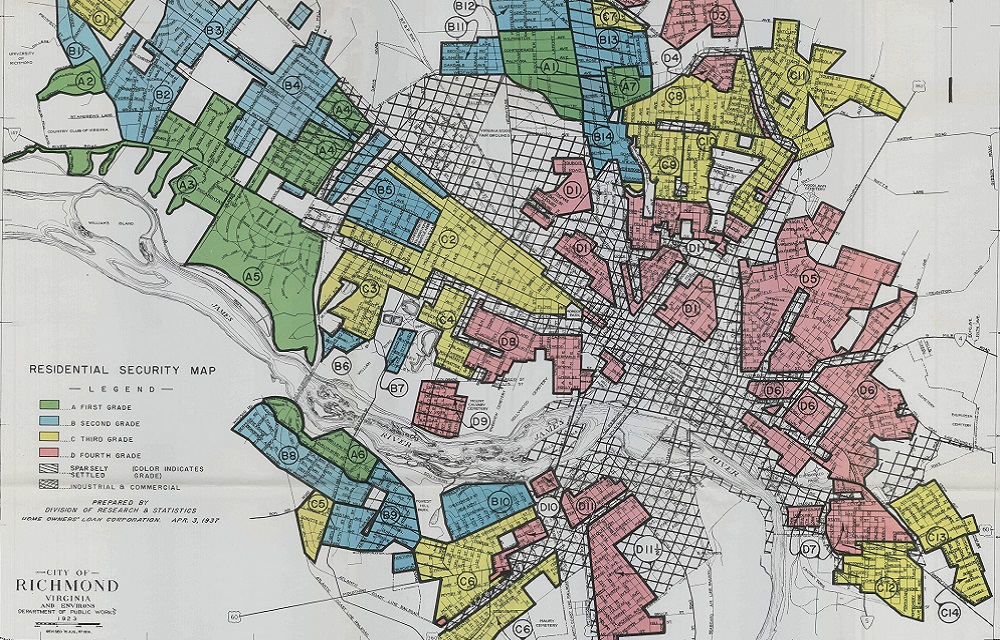

The Community Reinvestment Act (CRA) was enacted in 1977 as part of an attempt to remedy the legacy of redlining and to encourage banks to meet the needs of minority and low- and moderate-income communities.

John Mullin

Tressa Gardner provides an overview of the Southeastern Institute of Manufacturing and Technology (SiMT), the business incubator and other programs that it operates, and its role in supporting economic development in northeastern South Carolina. Gardner is associate vice president of SiMT.

The Fed's Community Impact Survey reveals COVID-19 disruptions to community organizations' operations and the low-income communities they serve.

Surekha Carpenter and Hailey Phelps

Rural America Week brings together community leaders, policymakers, and representatives from financial institutions and foundations.

Daniel Paul Davis and Andrew Dumont discuss an approach to economic development in rural communities that is detailed in a book they have edited, "Investing in Rural Prosperity."

Deborah Markley discusses how community foundations support capacity building and development to improve the well being of rural communities.

Community development financial institutions (CDFIs) like Woodlands Community Lenders are uniquely positioned to help rural towns address unique challenges through place-based revitalization and by attracting investment.

Tiffany Hollin-Wright and Surekha Carpenter

Dave Clark discusses the role of Woodlands Development Group and his organization's community development financial institution in driving economic development in north central West Virginia.

Some observers have recently voiced concern that Fed activities in the areas of climate change and inequality may put the institution at risk.

The Richmond Fed has been working to educate policymakers and workers in the Fifth District about benefits cliffs

Neeraja Deshpande

Investment Connection matches banks and other funders with nonprofits and community groups seeking investment.

Hailey Phelps

Bernie Mazyck and Mark Fessler discuss how the pandemic is contributing to ongoing high volumes of renter evictions in certain parts of our country.

Tiffany Hollin-Wright discusses the work being done by Community Development staff at the Richmond Fed and in the Federal Reserve to respond to current health and economic crises, in particular their disproportionate impact on communities of color.

Reston, Va., and Columbia, Md., were founded in the 1960s with similar visions for inclusive, connected communities.

Emily Wavering Corcoran

Senior Manager

The Richmond Fed's Baltimore Branch hosted this live event where eight organizations in Maryland and the District of Columbia presented their funding proposals.

Investment by community development financial institutions (CDFIs) varies by county and between urban and rural areas.

Emily Wavering Corcoran

Senior Manager

Cities and states are experimenting with a new financing model to support social and environmental programs.