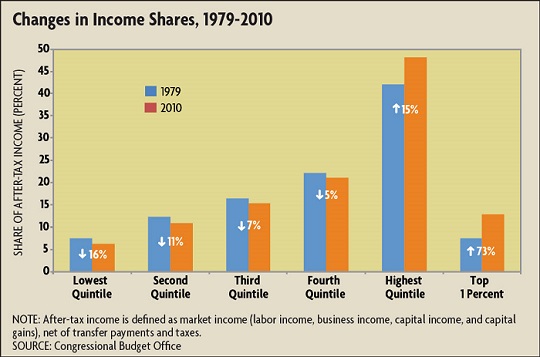

Other research depicts a similar trend. According to Thomas Piketty of the Paris School of Economics and Emmanuel Saez of the University of California, Berkeley, the share of pretax income earned by the top 10 percent of households in the United States increased from 32 percent in 1970 to 48 percent in 2012. (Piketty’s 2013 bestseller, Capital in the Twenty-First Century, has helped draw attention to the inequality issue.) This increase was largely driven by those at the very top of the distribution. While the income share for those in the 90th through 99th percentiles increased slightly from 24 percent to 29 percent, the share for those in the top 1 percent more than doubled, from 8 percent to 19 percent. The share for the top .1 percent nearly quadrupled from 2 percent to 9 percent. Piketty and Saez also found that although people in the top percentiles saw their incomes decline by a greater percentage during the recession, they’ve captured a disproportionate share of the gains during the recovery.

Income inequality is a tricky thing to measure, however, and not everyone agrees that the increase in inequality has been so pronounced. For example, the Census Bureau’s primary measure of the Gini coefficient doesn’t take into account deductions from income such as taxes or noncash additions to income such as food stamps or Medicare, which could exaggerate the difference between the top and the bottom. In addition, studies that look at the changes in income shares over time might be understating income growth in the lower percentiles. This is because they generally adjust incomes for inflation using the Consumer Price Index (CPI), which many economists believe overstates the actual rate of increase in the price level. Lee Ohanian of the University of California, Los Angeles and Los Angeles venture capitalist Kip Hagopian redid the CBO’s study using Personal Consumption Expenditures (PCE) as the measure of inflation and found that income growth in the first quintile was 40 percent higher, growth in the middle quintile 24 percent higher, and growth in the top quintile 9 percent higher than reported by the CBO. Income inequality still increased over time in their analysis, but by a lot less.

More generally, accurate income data is hard to come by, particularly for households at the extremes of the distribution, says James Sullivan, an economist at the University of Notre Dame. “You have to be really careful about what you glean from income at the top and bottom.”

At the top of the distribution, the problem is largely “top coding”: Publicly available datasets cap incomes at a certain level to protect the anonymity of very high earners. (It wouldn’t take many guesses to figure out who earned $12 billion, for example.) At the bottom of the distribution, the problem is underreporting, because income tends to be more sporadic and inconsistent. “You and I get a W-2 form at the beginning of the year, so if the Census Bureau calls us, we can give them our income by looking at one piece of paper,” Sullivan says. “But for people near the bottom, their income comes from a lot of different sources and is therefore harder to report.” Research suggests that the degree of underreporting has increased over time, which could help account for the relatively slow growth of income at the bottom of the distribution.

Is Income the Right Measure?

A broader concern about studies of income inequality is that income might not be the best way to measure people’s actual welfare. That’s because income varies from year to year; a college senior with a very low income this year might be working on Wall Street next year. But consumption tends to be less volatile because people can borrow and save according to their expectations about the future. Many economists thus believe that looking at what people actually buy, rather than how much they earn, is a better gauge of lifetime welfare.

Many researchers have found that consumption inequality is both lower than income inequality and growing less quickly. In a 2010 paper, Jonathan Heathcote and Fabrizio Perri of the Minneapolis Fed and Giovanni Violante of New York University concluded that the increase in consumption inequality between 1967 and 2005 was less than half the increase in income inequality. Sullivan and his co-author Bruce Meyer of the University of Chicago showed that income inequality increased 45 percent between 1980 and 2011, compared with a 19 percent increase in consumption inequality. These results suggest that a large divergence in income doesn’t necessarily translate into the same divergence in living standards. Other research has found, however, that consumption inequality has increased at roughly the same rate as income inequality over the past few decades.

Economists also study wealth inequality, or how the value of households’ assets varies across socioeconomic groups. The variation is quite large: In 2009, for example, the median net worth of white households was 19 times the net worth of black households and 15 times the net worth of Hispanic households. The ratios were around 10-to-1 between 1984 and 2004, but black and Hispanic households were disproportionately affected by the decline in household wealth caused by the financial crisis. Not surprisingly, net worth also varies significantly according to income; the median net worth of households in the top income quintile is $293,000, more than double the net worth of households in the fourth quintile, $113,000. The net worth of households in the lowest income quintile is just $5,000.

Wealth has always been quite concentrated in the United States. During the 1920s, the top 10 percent of households owned between 75 percent and 85 percent of the country’s wealth. The share declined to around 65 percent during the 1980s but has climbed back to 75 percent as of 2012, according to research by Saez and Gabriel Zucman of the University of California, Berkeley and the London School of Economics. As with income, the increase is primarily at the very top of the distribution: The share of wealth owned by the top .01 percent has increased from about 8 percent in 1980 to 22 percent in 2012. This increase has recently received less attention among members of the general public than the rise in income inequality. But many economists say wealth inequality is most troubling since wealth builds on itself, passes to the next generation through inheritances, and in principle has no effect on one’s incentive to work harder. Many economists have even advocated hefty death taxes to reduce wealth inequality. Wealth also provides a safety net to households during economic downturns and can be a source of political power. Its social and mathematical self-perpetuating properties have some economists and policymakers concerned that the concentration will only increase.

Is Inequality Harmful?

What if relatively high consumption levels actually are a sign of serious problems in the economy — problems caused by income inequality? That was the hypothesis put forth by Marriner Eccles, former chairman of the Federal Reserve, to help explain the Great Depression. Writing in 1951, he compared the 1920s to a “poker game where the chips were concentrated in fewer and fewer hands, [and] the other fellows could stay in the game only by borrowing. When their credit ran out, the game stopped.”

Similar theories have been proposed to explain the recent financial crisis and Great Recession. In his 2010 book Fault Lines, Raghuram Rajan, who is currently on leave from the University of Chicago to head the Central Bank of India, argued that the consumption levels of people below the 90th percentile of the income distribution prior to the financial crisis were achieved only through a significant expansion of credit. That expansion was engineered by politicians, who, unable to tackle the primary problem of growing income inequality, propped up consumption by increasing the availability of housing credit. In Rajan’s view, income inequality was a direct cause of the housing boom and subsequent bust, which precipitated the financial crisis.

Barry Cynamon, a visiting scholar at the St. Louis Fed, and Steven Fazzari, an economist at Washington University in St. Louis, tell a similar story about the role of income inequality in the Great Recession and subsequent slow recovery. In a recent paper, they observed a seeming paradox: Economic theory predicts that greater income inequality should lead to lower aggregate consumption because people who earn more tend to save a greater portion of their income. But rising income inequality after 1980, the result of a sharp drop in income growth for the bottom 95 percent of the distribution, actually coincided with a large increase in aggregate consumption. The reason, Cynamon and Fazzari concluded, is that households in the bottom of the distribution responded to their slower income growth by decreasing savings and increasing debt. When the financial crisis cut off the supply of credit, however, consumption fell and has not yet recovered, explaining the recession and slow recovery. “Borrowing postponed demand drag from rising inequality and helped the economy grow in the years prior to the Great Recession. But with this borrowing cut off, the bottom 95 percent can no longer grow their spending fast enough to maintain something close to full employment,” Fazzari says.

Cynamon and Fazzari view the rise in debt as a result of increases in both supply and demand. Regulatory and technological changes made credit more available, and consumers with stagnating incomes turned to credit to maintain their lifestyles, not only for discretionary items but also for services such as child care. “You need the weapon and the motive,” Cynamon says. “The weapon was the supply of credit, and the motive was keeping up with the Joneses.”

Other research attributes the increase in debt almost entirely to the supply side factors. In a recent working paper, Olivier Coibion of the University of Texas at Austin, Yuriy Gorodnichenko and John Mondragon of the University of California, Berkeley, and Marianna Kudlyak of the Richmond Fed found that low-income households in areas with high inequality actually borrowed less than low-income households in areas with low inequality, which suggests that upward comparisons were not a factor in the rise in household debt before 2008. Instead, they concluded that the increase in debt was due to banks channeling more credit to low-income households in certain regions.

It’s also possible that the financial crisis had nothing to do with inequality. In a 2012 working paper, Michael Bordo of Rutgers University and Christopher Meissner of the University of California, Davis studied financial crises in 14 developed countries between 1920 and 2008. They found that while credit booms were strongly associated with the probability of a crisis, those booms were caused by low interest rates and strong economic growth; this finding “resoundingly rejects any role for income concentration” in fueling credit growth and subsequent crises.

Whether or not income inequality caused the financial crisis, research has linked it to a variety of social ills, including higher rates of divorce, obesity, bankruptcy, and crime, among others. Particularly in developing countries, inequality might contribute to social unrest and ethnic violence. But this research relies on cross-country comparisons, and it’s hard to disentangle the effects of income inequality from other factors, such as universal health care, government spending on education, or other economic and government institutions. Overall, the jury is still out on the effects of income inequality. As Harvard University professor of social policy Christopher Jencks recently told the New York Times, “Can I prove that anything is terrible because of rising inequality? Not by the kind of standards I would require. But can they prove I shouldn’t worry? They can’t do that either.”

Readings

Bordo, Michael D., and Christopher M. Meissner. "Does Inequality Lead to a Financial Crisis?" National Bureau of Economic Research Working Paper No. 17896, March 2012. (Earlier version available online.)

Cynamon, Barry Z., and Steven M. Fazzari. "Inequality, The Great Recession, and Slow Recovery." Working Paper, March 2014.

Meyer, Bruce D., and James X. Sullivan. “Consumption and Income Inequality and the Great Recession.” American Economic Review, May 2013, vol. 103, no. 3, pp. 178-183. (Working paper version available online.)

Piketty, Thomas, and Saez, Emmanuel. "Income Inequality in the United States, 1913-1998." Quarterly Journal of Economics, February 2003, vol. 118, no. 1, pp. 1-39. (Updated data available online in Excel format.)