The Sharing Economy

Are new online markets creating economic value or threatening consumer safety?

The first time she rented out her bedroom to strangers on the Internet, Shela Dean admits, it was "a little weird." After she retired from practicing law at the end of 2013, she and her husband Dale realized they had more space than they needed in their four-bedroom home in Richmond, Va. They decided to move into their guest bedroom and put the master suite up for rent on Airbnb, a website that allows users to book nights in other people's homes, much like a hotel.

"I'm sort of an old hippie from the San Francisco Bay Area and I liked the idea of sharing your home," Dean says. "Plus, it would give us an opportunity to meet new and interesting people." Still, she wasn't completely at ease as they awaited their first guests. "I told my husband, either they're serial killers or they're lovely people," she says. Fortunately, they were lovely.

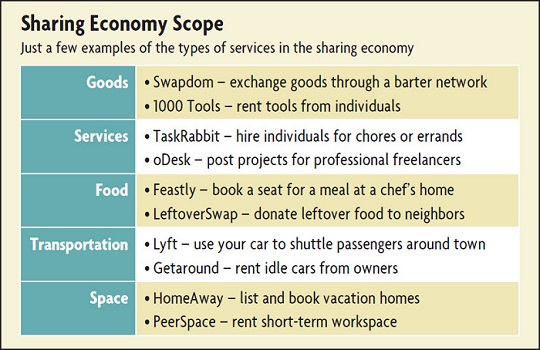

As members of Airbnb, the Deans are participants in a growing phenomenon that has been called the "sharing economy." A common thread that unites Airbnb and a number of similar businesses is that they create online platforms where individuals can share their possessions (such as a car or home) or market their skills.

While some of these services allow participants to make a profit, others focus on free sharing. For example, one can earn rent from travelers through Airbnb or advertise free sofa space on Couchsurfing for guests needing minimal accommodations. 1000 Tools lets owners of seldom-used tools like power drills or hacksaws rent them to someone looking to do a quick home improvement project; Freecycle, on the other hand, lets users give away those same items for free. Services like Lyft and Uber allow car owners to turn their vehicles into taxis and charge fares to shuttle travelers around; Ridejoy matches drivers with passengers traveling in the same direction, leaving them to work out the details of any compensation.

New sites are springing up seemingly every day, and some are enjoying meteoric success. Uber, which launched in San Francisco in 2009, today operates in over 200 cities and was recently valued at more than $41 billion, making it one of the most lucrative tech startups in history. This suggests that investors see potential for these companies to generate huge economic benefits, but where will those benefits come from? Supporters say the sharing economy is already increasing consumer welfare by opening up markets and providing more options to consumers. But detractors argue that many of these companies have ignored laws designed to protect consumers, giving them an unfair advantage over traditional services and making them a public safety disaster waiting to happen.

Market Power

As a group, economists have tended to view the sharing economy favorably. In a September 2014 poll by the University of Chicago's IGM Forum, a diverse panel of 40 economists unanimously agreed that allowing new car services like Uber and Lyft to compete with traditional taxis would raise consumer welfare. They have good reason for being optimistic. Economic theory states that increasing the supply of goods or services in a market improves welfare by enabling more gains from trade, particularly when the increased supply comes from the use of previously idle resources.

Evidence suggests that sharing economy firms have greatly increased supply in sectors like transportation and lodging. The Bureau of Labor Statistics reports that there were 233,000 taxi drivers and chauffeurs in the United States as of 2012, but new services are substantially adding to that number. According to a recent study by Uber's head of policy research Jonathan Hall and Princeton University economist Alan Krueger, the company had more than 160,000 active U.S. drivers in 2014. That alone nearly doubles the supply of short-term transportation, not counting Uber's competitors like Lyft and Sidecar. Similarly for the hotel industry, Airbnb boasts over a million properties in nearly 200 countries, surpassing the capacity of major hoteliers like Hilton Worldwide, which had 215,000 rooms in 74 countries in 2014.

Initial research suggests that consumers are benefiting from the wider range of options. In a March working paper, Samuel Fraiberger and Arun Sundararajan of New York University modeled the economic effect of ride-sharing services using data from Getaround, a company that allows individuals to rent cars from other users. They estimated that such services lower used vehicle prices and improve consumer welfare by allowing individuals (particularly those with below-median income) to rent transportation instead of owning it. For hotels, Georgios Zervas, Davide Proserpio, and John Byers of Boston University reported in a February working paper that an increase in Airbnb listings in Texas had a similar effect on hotel room revenue as an increase in the supply of hotel rooms, suggesting that travellers viewed Airbnb as an "alternative for certain traditional types of overnight accommodation."

Another benefit of the sharing economy may be the flexibility of supply. "The hotel business is a very efficient way to have short-term housing for a stable number of people, but it's not so great for variable demand," says Jonathan Levin, a professor of economics at Stanford University who studies Internet markets. "Either you've got a lot of empty rooms, or you've got super expensive rooms and a lot of people who can't find a place to stay." In contrast, firms like Airbnb allow for a more fluid supply of short-term accommodations. During events like the Super Bowl that draw many tourists, more property owners may choose to rent out space to take advantage of the increased demand and higher prices. But during lulls, those properties remain occupied by their owners rather than sitting idle.

In addition to expanding supply for existing markets, the sharing economy is also creating entirely new markets for goods and services. While it is theoretically possible for markets to exist for anything, transactions aren't free. It takes time and effort for buyers to find the best price, to locate sellers, to ascertain the true quality of the good being sold, and to make sure a seller will follow through on the commitment once the transaction is complete. Economists refer to these as "transaction costs." While pre-Internet institutions like classified ads and dedicated intermediaries such as real estate agents helped reduce the costs of many transactions, new technology has greatly expanded the range of viable exchanges.

"Before, if you wanted to borrow someone's hacksaw or couch, you'd first have to determine who in your area has those things available for rent," says Matthew Mitchell, a senior research fellow at George Mason University's Mercatus Center. "The beauty of these websites is that they dramatically lower transaction costs and allow people to interact and exchange in new ways."

This creates more opportunities for entrepreneurs as well as consumers. Many sharing economy participants, like the Deans, see these platforms as a way to earn some extra spending money in their spare time. According to Hall and Krueger's study of Uber drivers, more than half drove 15 hours or less each week. But for some, the sharing economy offers an alternative to traditional full-time work. Nearly 20 percent of drivers in Hall and Krueger's study drove 35 hours or more each week, and on average they made about $19 an hour — $6 more than traditional taxi drivers and chauffeurs. The authors note that Uber drivers must pay for expenses like gas and car maintenance that some taxi companies may cover, but many professional drivers still view the new services as viable alternatives to traditional options. The San Francisco Cab Drivers Association reported in 2014 that nearly a third of the city's taxi drivers had switched to driving for services like Uber, Lyft, or Sidecar.

Economic benefits from improved selection and greater market efficiency are only some of the potential gains from the sharing economy. Many supporters have touted the environmental benefits of reducing consumption by using underutilized resources more efficiently. While it is still too early to tell what the final environmental impact will be, one study of vehicle-sharing services found that about a quarter of users in North America sold their vehicles after joining and their carbon dioxide emissions from transportation fell by as much as 56 percent due to the reduction in vehicle ownership and vehicle miles traveled.

Critics, however, contend that many of these benefits come at a huge risk. They say that companies like Airbnb, Uber, and others have enjoyed success largely by ignoring laws designed to protect consumers — laws that their traditional competitors must still adhere to.

Whom Do You Trust?

Many, if not all, of the markets that the sharing economy touches are regulated in some fashion. Zoning laws partition cities into commercial and residential areas; hotels are allowed in some areas and not in others. Professional drivers carry special licenses requiring additional training and more comprehensive background checks than personal driver's licenses. Restaurants must comply with health codes that don't apply to personal kitchens. A common goal of regulations is to prevent harm to consumers by providing them with information and certifying goods and services as trustworthy.

Establishing trust is particularly important when markets are prone to what economists call "asymmetric information" — meaning one party in a transaction, often the seller, has more information about the quality of the good or service in question than the other party. If these asymmetries are severe and there is no way for buyers to learn the true quality of the good or service, market efficiency suffers — even, or especially, when the numbers of buyers and sellers might seem plentiful enough to eliminate any monopoly power. This was the insight of Nobel Prize winner and University of California, Berkeley economist George Akerlof. In a famous 1970 paper, Akerlof looked at the market for used cars and reasoned that each car could either be of good quality or be a "lemon." When buyers don't know whether a given car is a lemon, good and bad cars will sell for the same price. This price will be lower for sellers of good cars than they would get in a market with full information, and this will tend to drive good cars out of the market, leaving more lemons.

Government regulations are one way to counteract such asymmetric information. For example, taxi drivers typically must display licenses in their car to signal they have undergone proper training to operate a commercial vehicle. Hoteliers are also required to follow state safety regulations, so guests can assume they are reasonably well protected when renting accommodations.

Critics argue that sharing economy firms have willfully ignored regulations like these to gain an unfair advantage against traditional businesses, and they say such actions put consumers at risk. In October 2014, New York Attorney General Eric Schneiderman issued a report stating that roughly three-quarters of Airbnb listings in New York City were illegal because they broke zoning laws and other rules related to safety such as maximum occupancy limits. Legislators in the state have cited complaints from constituents in residential apartment buildings that have seen increased commercial traffic thanks to sites like Airbnb. Uber has also been in the news for safety issues. In December, a woman in New Delhi, India, reported being raped by an Uber driver. Similar incidents have been reported in other cities, including Chicago and Boston. The company has been accused of failing to perform sufficient background checks on its drivers, and several countries, including India, have banned the service.

But it is not clear that top-down regulations perform better than markets at establishing trust and policing bad behavior. For one thing, economists note that regulations often have hidden costs. Licensing requirements can help ensure minimum quality, but they can also be used to reduce competition by making it harder for new firms to enter the marketplace. (See "May I See Your License, Please?" Region Focus, Summer 2003.) For example, the cost of a taxicab medallion in New York surpassed $1 million in 2011 — creating a substantial barrier for new entrants that might provide better service.

Firms have their own incentives to establish trustworthiness and quality in order to maintain and expand their market share. This can lead to novel market solutions designed to solve Akerlof's "lemons problem." For example, in the 1990s, it was not obvious that online retailers like eBay and Amazon would succeed. After all, they faced the challenge of courting customers who couldn't inspect their products before they bought them and had no guarantee of receiving a good in the mail after they ordered it. Those initial online firms developed rating and review systems to allow market participants to provide measures of quality.

Today, sharing economy businesses rely on the same underlying framework, and technological developments in the last decade have improved the reach and effectiveness of these systems. Widespread adoption of Internet-enabled smartphones gives consumers instant access to prices and reviews.

Readings

Akerlof, George A. "The Market for 'Lemons': Quality Uncertainty and the Market Mechanism." Quarterly Journal of Economics, August 1970, vol. 84, no. 3, pp. 488-500.

Fraiberger, Samuel, and Arun Sundararajan. "Peer-to-Peer Rental Markets in the Sharing Economy." NYU Stern School of Business Research Paper, March 6, 2015. (Paper available online by subscription.)

Hall, Jonathan, and Alan Krueger. "An Analysis of the Labor Market for Uber’s Driver-Partners in the United States." Report from Uber Technologies, January 22, 2015.

Koopman, Christopher, Matthew Mitchell, and Adam Thierer. "The Sharing Economy and Consumer Protection Regulation: The Case for Policy Change." Mercatus Working Paper, December 2014.

Levin, Jonathan, "The Economics of Internet Markets." In Daron Acemoglu, Manuel Arellano, and Eddie Dekel (eds.), Advances in Economics and Econometrics, Tenth World Congress, vol. 1, Cambridge University Press: May 2013. (Previous version available online.)

Zervas, Georgios, Davide Proserpio, and John W. Byers. "The Rise of the Sharing Economy: Estimating the Impact of Airbnb on the Hotel Industry." Boston University School of Management Research Paper Series No. 2013-16, Feb. 11, 2015. (Latest version available online by subscription.)

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.