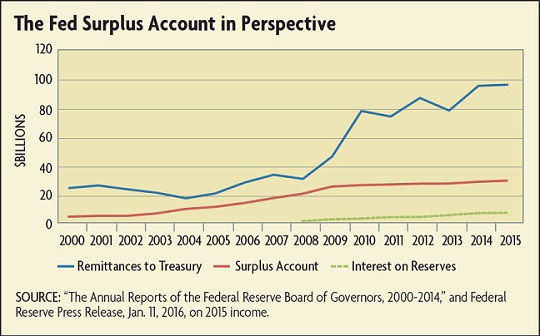

Most of the Fed's gross earnings come from the interest the Fed earns from the Treasuries and other securities on its $4.4 trillion balance sheet. Out of that income, the Fed must pay out its operational expenses, the interest it pays banks on the reserves they hold, and dividend payments to member banks. Once those costs are covered, the Fed sends to the Treasury any excess earnings. Those remittances have amounted to almost $600 billion since the financial crisis, when the Fed vastly expanded its holdings of securities and took in a dramatic increase in interest income; in 2015, that amount was a record $98 billion. As for the surplus account, the standard practice until the highway law was to compare it to the amount of member banks' paid-in capital at the end of each year; if the former exceeded the latter, the excess in the account was also sent to the Treasury.

Overall, the Federal Reserve System has not suffered any net losses since 1915, and the surplus account has usually been untouched by Fed operations. But on rare occasions, Reserve Banks, such as the Richmond Fed, have dipped into the surplus account to cover unexpected losses, usually in cases when they had to recover from a revaluation of their foreign currency holdings, which total around $20 billion for the System. But in general, such shortfalls are unusual. According to a 2002 Government Accountability Office report that analyzed the surplus account, there were only 158 weekly losses out of 7,337 possible cases from 1989 to 2001. In these cases, the Banks used money from the surplus account to temporarily cover those losses, while the surplus account was quickly replenished.

Early Warnings

If the Reserve Banks tap into the surplus account only on rare occasions, and if the account hasn't played a meaningful role in Fed operations or in emergencies, why did senior Fed officials oppose its funding the highway bill? One underlying concern, raised by Fed Chair Janet Yellen and others, is that such a transfer represents an infringement of Fed independence by breaking down the wall between fiscal policy — the exclusive domain of Congress — and monetary policy — the exclusive domain of the Fed since the 1951 Fed-Treasury Accord. Generally speaking, if central banks are forced to subordinate monetary policy to fiscal or political needs, politicians could compel them to print money, which in turn could spur inflation. In this particular case, warnings from Fed officials focused on the concern that Congress could turn to the Fed in future budget battles rather than making fiscal trade-offs (cutting spending or raising taxes) on its own. This was the gist of the warning issued by Fed Vice Chairman Stanley Fischer last November, when he said that the legislation has "manifold implications for central bank independence as well as for the quality of fiscal policy decisions."

"Financing federal fiscal spending by tapping the resources of the Federal Reserve sets a bad precedent and impinges on the independence of the central bank," agreed Yellen in congressional testimony in December. In addition, she said, "it weakens fiscal discipline."

Former Fed Chairman Ben Bernanke, writing on his blog last December, detailed another critique on the budget side, one that other senior Fed officials have also noted. Because the surplus account holds U.S. government bonds, he wrote, the Treasury would see a drop in remittances if the Fed sold those securities to the public so that the proceeds could be transferred as cash to the Treasury. In effect, the outcome would be the same if the Treasury issued new debt to sell to the public and then paid interest on that debt to bondholders: There would be no net infusion of revenue to the government. So while its congressional backers may have presented the highway bill as fully funded, what actually occurred was, in Bernanke's words, "budgetary sleight of hand."

The Century-Old Framework

The debate over the Fed's role in funding the highway legislation is unlikely to end soon, but one thing is clear: The move represents a change from organizational principles dating from the Fed's early days that relate to both the surplus account and the relationship between the Fed and member banks.

When the 1913 Federal Reserve Act chartered the Reserve Banks, it required that they be financed by member banks rather than congressional appropriations, in an attempt to make the Fed seem less risky to taxpayers and therefore politically more popular. Under these guidelines, if a bank wanted to join the Fed system, it had to purchase Fed stock in an amount equal to 3 percent of the capital and surplus listed on the bank's most recent Call Report (namely, the accounting categories that represent the sum of owners' permanent equity). The member bank had the obligation to purchase additional stock, up to the same amount, "on call," that is, available if the Federal Reserve Board demanded it. (Because these two provisions add up to 6 percent, the subscription is often referred to as 6 percent of a bank's surplus and capital, but it is important to remember that the 3 percent "on call" is not held at Reserve Banks unless the Board asks for it.)

Since member banks couldn't sell or use this capital for other investments, the Fed agreed to pay dividends on the paid-in capital to member banks (see "The Cost of Fed Membership," Economic Brief, February 2016). The Fed set the dividend payment at 6 percent, a return that stayed unchanged until the highway legislation. (The new law pegs it to the yield on the 10-year Treasury, now slightly below 2 percent. Only banks with assets greater than $10 billion will be affected; smaller banks will still receive the full 6 percent.)

The size of the surplus, as well as its ratio to the capital account, has evolved over the decades, and at times it has been a target of congressional intervention. Originally, the Federal Reserve Act allowed the Fed to build up a surplus account equal to 40 percent of member banks' paid-in capital; that ratio rose to 100 percent of paid-in and on-call capital in 1919. The Banking Act of 1933 required that half of the surplus account — $139 million at the time — be used to capitalize the Federal Deposit Insurance Corporation; in return, the Fed was allowed to retain future net earnings to replenish the surplus. Then, as the economy emerged from the Great Depression, the surplus account grew over the years as the banking sector recovered.

In 1959, the Fed's Board of Governors decided to update its policy, announcing the surplus account would equal the full legislated allowance equal to the combined value of member banks' paid-in and on-call capital. Still, as the budget deficit grew in the early 1960s, there was fresh congressional pressure to apply more of the surplus account toward deficit reduction. In response, in 1964 the Board issued another ruling that halved the size of the surplus account, declaring it had to equal only paid-in capital; the other half, which came to $524 million, was sent to the Treasury as remittances. Several more such transfers occurred in the 1990s. President Clinton's 1993 budget deal mandated that a portion of the surplus account be sent to the Treasury in the 1997 and 1998 fiscal years, totaling $213 million. In 2000, Congress passed a spending bill that transferred a far larger sum, $3.75 billion, and prohibited Reserve Banks from replenishing their surplus accounts until the start of the 2001 fiscal year. Between the Fed's early years and the 2015 highway bill, however, Congress never passed legislation that specifically addressed the size or function of the surplus account, leaving this matter to the Board instead.

Revisiting the 'Carry Trade'

As noted, one common argument that senior Fed officials have made focuses on the issues of Fed independence and fiscal precedent. Some economists point to another risk – one that is tied to the massive amount of liquidity that the Fed put into the banking system through its unconventional monetary policy. This infusion dates back to late 2008, after the Fed had lowered the federal funds rate to a range of zero to 0.25 percent — effectively to the "zero lower bound" — and sought new tools for stimulus. It turned to making unprecedented amounts of bond purchases as a way to inject more reserves into the banking system and pressure longer-term interest rates (including mortgage rates) lower. Cumulatively, those bond purchases expanded the Fed's balance sheet from $800 billion in summer 2008 to $4.4 trillion today, more than a fivefold increase, while reserves held by banks ballooned from $25 billion to $3 trillion. (When the Fed acquires assets, it buys them with newly issued money, namely, bank reserves. So the bigger the Fed's balance sheet, the greater the amount of reserves.)

Now that there are substantial excess reserves in the banking system, rather than changing the federal funds rate through buying or selling bonds on the open market — as was traditionally done — the Fed is using adjustments to its interest payments on reserves to implement policy changes. In a July 2009 report to Congress, the Fed called this particular authority the most important tool the Fed can use in raising interest rates without shrinking its balance sheet — that is, selling the bonds it currently holds.

By extension, a diminished surplus account could complicate the Fed's plans to continue lifting rates by giving it less room for adjustment: If interest rates rise in coming years, as the Fed projects, it may choose to pay out more in interest payments on reserves held by banks to prevent the banking system from using excess reserves to rapidly expand lending, which could create inflationary pressures. Accordingly, if interest rates go up quickly or suddenly — say, if inflation spikes — the spread could narrow more than expected between what the Fed takes in as interest earnings (on the securities it bought when yields were low) and the amount it has to pay out as interest on reserves (which will increase as rates rise).

The Fed's expected path toward "normalization" also implies that the Fed's interest earnings will diminish in the years to come, assuming it will start shrinking its balance sheet as it has pledged to eventually do. To do this, rather than re-invest the securities it holds, as it has done since 2008, the Fed has stated that it plans to start letting bonds "roll off" the balance sheet upon reaching maturity. This means the Fed's interest income will decline.

A note of general caution came from Bernanke himself in September 2009, when the FOMC gathered for its policy meeting, as members discussed how the Fed would absorb possible losses during a period of rising interest rates. "We'll be returning to the Treasury very high levels of seigniorage over the next few years," he said, noting he had been in talks with Treasury officials. "I think there would be some basis for withholding some of those earnings to augment our capital, so that if we do have losses, we'd be able to absorb them."

For now, the Fed still plans to re-invest its securities. But taking these factors together, some economists conclude that the Fed may need an extra cushion in the years ahead, especially if rates rise quickly or suddenly, and that the surplus account should be part of this buffer. In a 2014 paper, "Monetary Policy as a Carry Trade," economist Marvin Goodfriend of Carnegie Mellon University highlighted this risk and argued that the Fed should watch its own exposure as much as it expects banks to monitor theirs. He described the analogy of the market term "carry trade" — the practice of borrowing cheaper short-term debt to finance longer-term higher-yielding investments — as useful in understanding the Fed balance sheet. A central bank should make sure it has enough net interest income up front so that it can pay for interest costs and risks later on, he concluded.

"The presumption should be that the central bank must be prepared to raise market interest rates against inflation, if need be, by raising interest paid on reserves well before unwinding its carry trade," Goodfriend wrote. To that end, he argued, the Fed should avoid facing a scenario where it has to create more reserves just to pay interest on its liabilities, which would worsen the cash-flow crunch and possibly even "unhinge" inflation expectations.

Other economists see this scenario as unlikely: They argue that the difference between the Fed's remittances to the Treasury and its interest payments on reserves is so great that the Fed is unlikely to face a net loss even if interest earnings fall and interest payments increase. For example, the Fed paid banks $6.9 billion in interest on reserves in 2015, while its total interest income was $113.6 billion. Moreover, the interest rate on reserves has thus far been well below the average yield paid on Treasuries held by the Fed, many of which have longer-term maturities. For securities averaging 10 or more years in maturity on the Fed's balance sheet, the average yield is 2.5 percent.

To see what the near and mid-term risks could look like, three economists at the San Francisco Fed, Jens Christensen, Jose Lopez, and Glenn Rudebusch, have modeled alternative interest rate scenarios against baseline forecasts, and in a 2013 working paper they concluded that "the risk of a long or substantial cessation of remittances to the Treasury is remote." In fact, in almost 90 percent of their simulations, they projected no shortfalls at all through 2020.

Even under scenarios of continuing remittances, however, many economists expect they will drop. A recent analysis by five researchers at the Fed's Board of Governors estimating the Fed's projected remittances to the Treasury through 2020 (under baseline assumptions) forecast a drop in net remittances to $18 billion in 2018, $23 billion in 2019, and $31 billion in 2020. But if interest rates were to rise by 200 basis points (2 percentage points) higher than expected, remittances to the Treasury could fall to zero, according to this model. Noting that 2 percentage points are beyond the historical standard deviation of the 10-year Treasury yield (around 1.6 percent), the authors concluded that "this higher interest rate scenario should be seen as a somewhat unlikely scenario, but not an implausible one."

For now, there remain two implications that go beyond technical questions of balance-sheet operations. First, it remains to be seen what the political fallout will be if the Fed's remittances to the Treasury do decline sharply in coming years. The other question is psychological: namely, whether the Fed's credibility will be weakened as a result of Congress having tapped into the surplus account. This risk to credibility could either take the form of Congress opting for future interventions that could directly affect the Fed's conduct of monetary policy, or a scenario in which the Fed has to resort to printing money to cover losses that result from such an intervention. In both cases, the Fed's ability to control inflation would come into question.

Speaking at the time of the last (and far less controversial) surplus-account transfer in 2000, then-Fed Gov. Lawrence Meyer raised the issues of perceptions and credibility. He noted that while the risks to the Fed's balance sheet had receded over the years, there was still value in maintaining the surplus account, on grounds that it "may help support the perception of the central bank as a stable and independent institution by ensuring that its assets remain comfortably in excess of its liabilities."

Yellen chose to emphasize this last point, as well, as she testified to Congress in December. "Almost all central banks do hold some capital in operating surplus," said Yellen. "And holding such a surplus or capital is something that I believe enhances the credibility and confidence in the central bank. … [W]e don't have a lot of capital, but we have long had capital in surplus that, I think, creates confidence in our ability to manage monetary policy."

![]() " International Journal of Central Banking, March 2015, vol. 11, no. 2, pp. 237-283.

" International Journal of Central Banking, March 2015, vol. 11, no. 2, pp. 237-283.![]() " Monetary and Economic Studies, Bank of Japan, November 2014, pp. 29-44.

" Monetary and Economic Studies, Bank of Japan, November 2014, pp. 29-44. ![]() " General Accounting Office, September 2002.

" General Accounting Office, September 2002.![]() " Federal Reserve Bank of San Francisco Working Paper No. 2013-38, December 2013.

" Federal Reserve Bank of San Francisco Working Paper No. 2013-38, December 2013.