There's a scene from It's a Wonderful Life in which George Bailey is en route to his honeymoon when he sees a crowd gathered outside his family business, the Bailey Brothers' Building and Loan. He finds that the people are depositors looking to pull their money out because they fear that the Building and Loan might fail before they get the chance. His bank is in the midst of a run.

Bailey tries, unsuccessfully, to explain to the members of the crowd that their deposits aren't all sitting in a vault at the bank — they have been loaned out to other individuals and businesses in town. If they are just patient, they will get their money back in time. In financial terms, he's telling them that the Building and Loan is solvent but temporarily illiquid. The crowd is not convinced, however, and Bailey ends up using the money he had saved for his honeymoon to supplement the Building and Loan's cash holdings and meet depositor demand.

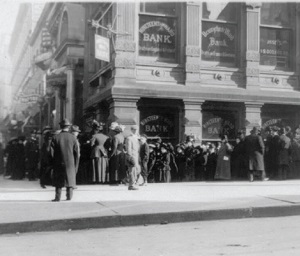

It's a scene that would have been familiar to many moviegoers when the film debuted in 1946. Bank runs were a regular occurrence in the United States during the 19th and early 20th centuries. But the scene is also reminiscent of what happened during the financial crisis of 2007-2008. In that crisis, though, it wasn't ordinary depositors who were in line. Creditors that had supplied banks and other institutions with short-term funding suddenly questioned the health of the institutions they were lending to. Just as depositors sought to pull their money out of banks during the panics of previous centuries, creditors pulled their funding out of the market, leaving banks and institutions suddenly short on the cash needed to fund their operations.

As the movie hints at, the liquidity risk that banks face arises, at least to some extent, from the services they provide. At their core, banks serve as intermediaries between savers and borrowers. Banks take on short-maturity, liquid liabilities like deposits to make loans, which have a longer maturity and are less liquid. This maturity and liquidity transformation allows banks to take advantage of the interest rate spread between their short-term liabilities and their long-term assets to earn a profit. But it means banks cannot quickly convert their assets into something liquid like cash to meet a sudden increase in demand on their liability side. Banks typically hold some cash in reserve in order to meet small fluctuations in demand, but not enough to fulfill all obligations at once.

Should banks hold more liquid assets in reserve? If policymakers were willing to do away with fractional reserve banking entirely, banks could be required to hold enough cash to fully back all their deposits and other liabilities. But while the Swiss government recently proposed a referendum on implementing such full-reserve banking for its institutions, most banking scholars think that it would do more harm than good. "Doing so would be both unprofitable and socially undesirable," former Fed Chairman Ben Bernanke said in a 2008 speech. "It would be unprofitable because cash pays a lower return than other investments. And it would be socially undesirable, because an excessive preference for liquid assets reduces society's ability to fund longer-term investments that carry a high return but cannot be liquidated quickly."

But if it is not desirable to entirely eliminate liquidity risk, is there an effective way to manage it? It's a question that policymakers and economists have wrestled with for decades.

Managing Liquidity Risk

Why would banks not voluntarily hold enough liquidity to protect themselves against the risk of runs? As Bernanke and others have noted, holding liquid assets is less profitable, so banks have an incentive to hold only as many as they think they may need. But some economists have also suggested that the financial system as a whole may be too illiquid as a result of externalities. Negative externalities occur when the economic costs of a decision are not entirely borne by the decision-maker. Some banks may opt to maintain inadequate liquidity, gambling that liquidity will be available from other institutions when needed — a gamble that creates risks for the system.

This practice might function perfectly well in normal times, but during a crisis, illiquid firms place additional pressure on the more liquid firms. Those firms, which also must meet their own demands, may be unable or unwilling to lend their reserves to other firms. As the market for liquidity breaks down, the financial system as a whole suddenly becomes much less liquid than it initially appeared under noncrisis conditions.

One solution to this problem is to have a central bank that acts as a "lender of last resort" (a phrase associated with 19th century British banking theorists Henry Thornton and Walter Bagehot, though neither used those exact words) when the private market for liquidity fails. During the crisis of 2007-2008, the Federal Reserve did just that. Through a variety of lending programs, the Fed and some other central banks supplied liquidity to firms that were unable to obtain it from the market.

In the aftermath of the crisis, however, some questioned whether central banks had lent too freely. If a central bank like the Fed were to lend to firms that were insolvent due to imprudent business practices, it would create an incentive for firms to engage in more risky activity like maturity transformation and offload that risk onto the central bank (and ultimately, the taxpayers). It also removes much of the incentive for firms to hold highly liquid assets of their own, contributing to the illiquidity of the financial system.

One way to potentially avoid this moral hazard problem is to require financial firms to hold more liquid assets, allowing them to get through a crisis without the help of a central bank. After the financial crisis of 2007-2008, the group of international banking officials and financial regulators that make up the Basel Committee on Banking Supervision recommended such requirements. The Basel III Accord included two new liquidity requirements for banks. The first, the Liquidity Coverage Ratio (LCR), requires banking institutions to maintain a buffer of highly liquid assets equal to some portion of their total assets. The second, the Net Stable Funding Ratio (NSFR), requires that institutions hold some amount of liabilities that can reliably be converted into liquidity during a crisis, reducing their exposure to liquidity risk.

Requiring banks to hold certain liquid assets is not a new idea. In fact, the LCR closely resembles bank reserve requirements, a tool that was used — unsuccessfully — to try to prevent banking panics before the creation of the Fed.

Lessons from the Past

After the Panic of 1837, three states — Virginia, Georgia, and New York — experimented with using reserve requirements to prevent liquidity crises. At the time, bank notes were typically redeemed for gold or silver (specie), so these laws required banks to hold specie equal to some proportion of the currency they had in circulation.

According to a 2013 working paper by Mark Carlson of the Federal Reserve Board of Governors, reserve requirements were slow to catch on: Only 10 states had adopted such laws by 1860. Reserve requirements became more prevalent following the National Bank Act of 1863. All national banks were required to hold reserves equal to a percentage of their deposits, which varied based on their location. "Country banks" — those outside of major cities — had the lowest requirements and could keep a portion of their reserves as deposits at banks in larger reserve cities. Those reserve city banks in turn were allowed to hold a portion of their reserves at banks in so-called "central reserve" cities, initially just New York and later Chicago and St. Louis.

Banks in reserve cities had higher reserve requirements than country banks, to account for the fact that they would face withdrawal demands from country banks during a widespread crisis. In practice, however, allowing interbank deposits to count as reserves created an unstable pyramid structure of liquidity that collapsed in times of crisis.

"A bank could deposit cash in another bank and count that deposit in its reserve while the second bank counted the cash in its reserve," Carlson wrote. "The second bank could then deposit the cash in a third bank and compound the process. A withdrawal of reserves by the bottom of the pyramid during a panic could thus result in a rapid depletion of reserves within the banking system."

Because banks couldn't be sure that they could obtain liquidity from the system during a crisis, they tended to hoard liquid assets during a crisis rather than lending them out, making the problem worse. Clearinghouses in some cities like New York attempted to address this problem. They were groups of banks that banded together to fill the role of a lender of last resort for each other. But their tools were limited and, as Ellis Tallman of the Cleveland Fed and Jon Moen of the University of Mississippi found in a 2013 paper, they were not always successful at preventing a crisis.

Perversely, reserve requirements may have also contributed to externality problems because they did not apply to every bank in the system. "The national banks were required to hold all this cash, but many state banks were not," says Carlson. "So when a crisis hit, newspaper reports claim that the state banks would turn to the national banks for help." This additional pressure that would emerge once a crisis hit meant that the system was even less liquid than it appeared.

Another problem regulators faced was persuading banks to actually use their required reserves to meet depositor demand during a crisis. In order to ensure that banks complied with the reserve requirements, the National Bank Act allowed the comptroller of the currency to punish delinquent banks by prohibiting them from making loans and paying dividends until they corrected their deficiency. In cases of extended delinquency, the comptroller could place banks into receivership. But would a comptroller punish banks for falling below their reserve requirements if they were using those reserves for their intended purpose to stave off a crisis?

Carlson found that the answer to this question was not entirely clear. The comptroller had flexibility to decide when to enforce punishments for violating reserve requirements, allowing him to suspend penalties during a crisis. But in practice, banks were reluctant to test that possibility — to the point that banks suspended operations even in instances where they had sufficient reserves to continue operating.

Rather than ensure sufficient liquidity was available during a panic, reserve requirements in the national banking era seem to have largely contributed to its scarcity.

Toward a Lender of Last Resort

The Panic of 1907 was the final nail in the coffin for relying solely on reserve requirements. By themselves, they had failed to stop liquidity crises from happening, and Congress created the National Monetary Commission to study the defects of the U.S. financial system and recommend reforms. In its 1912 report, the Commission identified 17 flaws. First on the list was the lack of a central entity that could provide liquidity to the whole system. "We have no provision for the concentration of the cash reserves of the banks and for their mobilization and use whenever needed in times of trouble," the Commission wrote. "Experience has shown that the scattered cash reserves of our banks are inadequate for purposes of assistance or defense at such times."

Congress created such a lender of last resort in 1913 with the Federal Reserve Act. With the Fed providing a central reservoir of liquidity for the entire system, it seemed duplicative for banks to maintain large buffers of their own liquid assets. Reserve requirements were gradually lowered for banks that were part of the Federal Reserve System. By the 1930s the Fed no longer viewed reserve requirements as an important liquidity tool, according to a 1993 article by Joshua Feinman of the Federal Reserve Board of Governors. Rather, they became a means of influencing the supply of bank credit in the system — an early tool of monetary policy.

The adoption of deposit insurance during the Great Depression also reduced the likelihood of bank runs by depositors, further reducing the need for banks to hold as much liquidity. By the 1940s and 1950s, liquidity crises seemed to have become a thing of the past. The international community also moved away from reliance on liquidity requirements. In the first Basel Committee meeting in 1975, then-Chairman George Blunden argued that developing rules to ensure bank liquidity should be one of the group's primary objectives — but that goal ultimately took a back seat to that of ensuring bank solvency. The first two Basel Accords introduced international standards for capital requirements but included no liquidity requirements. Capital is the difference between a firm's assets and liabilities, so requiring a firm to hold more capital would make them more likely to remain solvent in times of stress.

"There was a view that if you had strong enough capital requirements, so that bank solvency was reasonably well assured, then there would be no liquidity problems at all," says Charles Goodhart, an economist and banking scholar at the London School of Economics who wrote a 2011 book on the history of the Basel Committee. "A bank that was solvent could presumably always raise funds in wholesale markets. So the members of the Basel Committee thought that the capital requirements were in some ways a substitute for the need for liquidity."

This thinking seemed sound for a time. Over the next several decades, banks and other financial firms came to rely almost entirely on liquidity obtained from the market rather than on their own holdings of liquid assets, says Goodhart, and there were no major liquidity crises — until 2007-2008.

That crisis revealed the danger of relying too heavily on outside funding sources to provide liquidity. Just as the pyramid of bank reserves collapsed during panics in the 19th century, short-term funding markets dried up in 2007-2008 as soon as creditors began questioning the solvency of the firms they were lending to. The Basel capital requirements were intended to prevent those questions from arising in the first place, but during the financial crisis, they turned out not to be the ironclad guarantee that regulators had envisioned.

"Many of the banks, indeed perhaps most of the banks, that failed were more than Basel II compliant," says Goodhart. "When there was a sufficient concern about the solvency of banks, the wholesale money market simply dried up. So funding liquidity collapsed just at the time that people were desperate to get liquidity."

With few liquid assets of their own, financial firms turned en masse to the lender of last resort — the Fed — inviting the risk of moral hazard that regulators had hoped to avoid.

Everything Old is New Again

If the banking panics of the 19th and early 20th centuries revealed the pitfalls of relying solely on liquidity requirements to prevent crises, and if the financial crisis of 2007-2008 raised concerns about relying too heavily on a lender of last resort, could the two tools be combined into something greater than either alone?

That was what policymakers hoped. Stephen Cecchetti of the Brandeis International Business School was the chief economist at the Bank for International Settlements in Basel, Switzerland, and worked on numerous aspects of the financial regulatory reform, including Basel III. He says that "there was a lot of conversation about what the role of the central bank should be with the LCR. Could we construct the LCR in such a way that the central bank is really a lender of last resort and not a lender of first resort?"

The challenge is finding the right balance. Having liquidity requirement that are too high comes with a cost. "If you make banks hold all cash, then they can't actually make loans," says Carlson. "Moreover, you don't really want banks to be self-insuring against the really big systemic shocks. At some point, the lender of last resort needs to step in and expand the pool of liquid assets."

Unfortunately, economic theory does not provide a lot of guidance for how to balance these two tensions. With liquidity requirements largely absent from regulatory discussions for decades, few economists had put much thought into what their optimal form might be. Since the release of the LCR, however, a few banking economists have proposed theoretical frameworks for thinking about the issue. A 2016 working paper by Douglas Diamond and Anil Kashyap of the University of Chicago found that the optimal solution is a rule that "induces a bank to hold excess liquidity but allows access to it during a run." Under their framework, a lender of last resort would lend against liquid assets in a crisis and ensure that banks complied with their liquidity requirements by imposing a penalty for noncompliance on bank management.

Diamond and Kashyap note that there is actually a precedent for this type of arrangement: the original Federal Reserve Act. Banks had reserve requirements, and those that violated the requirements were prohibited from paying dividends. The penalty ensured that bank managers would comply with the rules during normal times, but it was not so severe that it would deter banks from using their reserves during a crisis.

Liquidity requirements like the LCR can also aid a central bank by giving it "time to consider the best and most appropriate line of response during a crisis," says Goodhart. This may help minimize the moral hazard attached to the lender of last resort by providing more time to assess the solvency of individual firms. "I think of it as the 'Be Kind to Central Banks Ratio,'" says Goodhart.

At the same time, it's unclear whether these new liquidity requirements will exhibit some of the same shortcomings as the old ones. Will banks actually use their liquid assets during a crisis if it means violating their LCR? Will financial firms that are not subject to the new rules attempt to free ride on those that are, introducing hidden liquidity strains into the financial system? It will likely take another crisis to know for sure.

![]() " Basel Committee on Banking Supervision, January 2013.

" Basel Committee on Banking Supervision, January 2013.![]() " Speech at the Federal Reserve Bank of Atlanta Financial Markets Conference, Sea Island, Ga., May 13, 2008.

" Speech at the Federal Reserve Bank of Atlanta Financial Markets Conference, Sea Island, Ga., May 13, 2008. ![]() " International Journal of Central Banking, January 2015, vol. 11, no. 1, pp. 191-224.

" International Journal of Central Banking, January 2015, vol. 11, no. 1, pp. 191-224. ![]() " Board of Governors of the Federal Reserve System Finance and Economics Discussion Series No. 2015-011, Feb. 10, 2015.

" Board of Governors of the Federal Reserve System Finance and Economics Discussion Series No. 2015-011, Feb. 10, 2015. ![]() " International Journal of Central Banking, June 2015, vol. 11, no. 3, pp. 127-139.

" International Journal of Central Banking, June 2015, vol. 11, no. 3, pp. 127-139. ![]() " National Bureau of Economic Research Working Paper No. 22053, March 2016.

" National Bureau of Economic Research Working Paper No. 22053, March 2016. ![]() " Federal Reserve Bulletin, June 1993, pp. 569-589.

" Federal Reserve Bulletin, June 1993, pp. 569-589. ![]() " Federal Reserve Bank of New York Staff Report No. 458, February 2012.

" Federal Reserve Bank of New York Staff Report No. 458, February 2012.