Will America Get a Raise?

Economists debate why wage growth has been so sluggish during the recovery from the Great Recession

The persistence of slow wage growth since the Great Recession — amid a steady economic recovery and a sharp drop in unemployment — has become one of the biggest puzzles for economists in recent years. It’s not just an issue for economists; in this election cycle, weak wage growth has been used to support proposals ranging from strengthening unions to boosting the federal minimum wage. More broadly, stagnating incomes have likely fed into the broader ongoing economic pessimism among Americans. One recent Pew Research survey, for example, found that 73 percent of those polled described economic conditions as fair or poor, while only 27 percent considered them excellent or good.

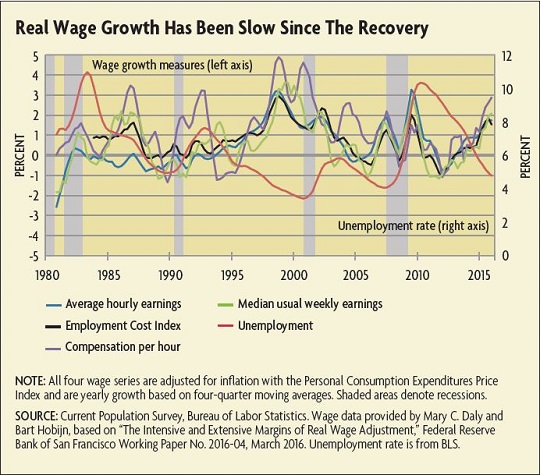

Numerous measures indicate that wage growth has indeed been sluggish since the Great Recession compared to the decade before. For example, in a working paper released earlier this year, economists Mary Daly of the Federal Reserve Bank of San Francisco and Bart Hobijn of Arizona State University found a general deceleration in wages across four different measures of labor compensation compared to the 2000s. These measures include average hourly earnings of private sector production and nonsupervisory workers, as well as compensation per hour in the nonfarm business sector; they also include the quarterly median usual weekly earnings of full-time wage and salary workers, which captures overtime pay and trends in the average workweek, and the broader quarterly Employment Compensation Index, which tracks both wages and benefits. Even though these series cover disparate forms of labor compensation, they are quite closely correlated. (See chart below.)

So how much have wages decelerated? According to one common benchmark — median usual weekly earnings — real wage growth averaged 0.57 percent from 1980 through the first quarter of 2016. That average has been lowered by particularly slow real wage growth since the end of the Great Recession: It has averaged just over half that despite the steady drop in joblessness to pre-recession levels. Across most of the other measures as well, real wage growth was notably soft during the recovery.

But does this slowdown suggest something unusual, or is it typical during recoveries? Based on the most recent research, economists suggest that the answer lies somewhere in between. One challenge, however, is the nature of aggregate statistics, which could have been distorted by the fact that the Great Recession was severe in so many respects beyond the labor market. Moreover, many aggregate measures can be skewed by composition effects, that is, by changes over time in terms of who's working, and the types of jobs they hold. This leads to another question for economists: Does slower wage growth indicate hidden residual labor market weakness — which the Fed could potentially help address through a more accommodative monetary policy? And are lower wages, and their implications for the well-being of workers, here to stay?

In the case of the recent recovery, economists have given special scrutiny to factors such as the changing makeup of the labor force as well as the effects of the baby boomer retirement wave. If researchers can accurately adjust for these factors, they may get a better picture of whether slow wage growth is a sign that workers have lost their bargaining power due to continuing, if unseen, labor market "slack," or underutilization.

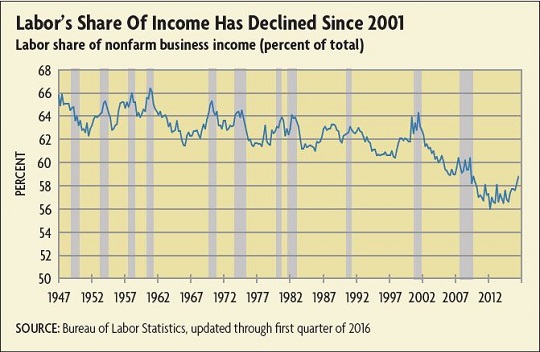

Another question is whether the recent trend of slow wage growth is related to longer-term shifts that predate the recent recovery. For example, productivity has been slumping since around 2000, and economic theory suggests wages and productivity should be closely tied. Moreover, the share of national income that goes to labor, compared to capital, has been dropping since then as well. Economists have been paying closer attention to these particular changes to unearth longer-term forces, separate from the business cycle, that could explain what is happening to the U.S. labor market — and perhaps labor markets globally.

Wages and the Business Cycle

The question of how wages respond to the business cycle is an age-old debate in economics. Standard economic theory tells us that wage growth and unemployment should be closely linked: Aggregate wages rise when the unemployment rate falls and slow when the unemployment rate rises. Then, in the 1930s, John Maynard Keynes advanced the theory that wages were actually "sticky," or imperfectly responsive, and didn't fall during downturns as much as fundamentals would suggest. In the following decades, more debate ensued over such questions as how to best measure wages and compensation, and whether they were closely tied to the business cycle at all.

In an influential 1995 essay that reviewed the research on real wages and cyclicality since World War II, economists Katharine Abraham of the Bureau of Labor Statistics and John Haltiwanger of the University of Maryland noted the array of methodological challenges at stake. For example, the relationship between real wages and the business cycle can be affected by which measurement of inflation — consumption-based or production-based — that an economist uses to define the real wage. The relationship also varies depending on the composition of the workforce and the industry in question, as well as on the time period. Abraham and Haltiwanger found some cases in which wages moved closely with the business cycle, such as the early 1980s, when the real wages of workers in steel manufacturing were especially hard hit during the recession. There were other cases, especially before 1970, when a cyclical effect was less discernable.

But they did note one important phenomenon over the decades, one that economists such as Daly and Hobijn have expanded on more recently: The ranks of the employed tend to develop a larger concentration of high-skilled workers during recessions (as more of the lower-skilled are laid off), while the opposite happens during recoveries (as the lower paid, lower-skilled get jobs). In short, the demand for lower-skilled workers seems to be more sensitive to the business cycle than that of higher-skilled workers. This may explain why aggregate wages don't drop as much as expected during recessions but then can soften considerably as the economy improves.

Taking a longer view, however, the authors found that once measurement and composition issues are accounted for, real wages are neither systemically procyclical nor counter-cyclical over time. What the research did show, they concluded, was the importance of using consistent methodology when looking at real wage growth over time.

Who's In, Who's Out?

So was there anything unusual in the way wages responded to the Great Recession and its recovery? And was this a case of "counter-cyclical bias" on wages? Daly and Hobijn are among the economists who have tried to answer this. They have been exploiting econometric tools to explain, among other things, why aggregate wages are generally less variable than other indicators such as the unemployment rate, and why there is such a weak correlation between unemployment and wage growth.

In their recent paper, Daly and Hobijn provided one way to eliminate the composition effects that have long complicated these studies by devising a way to look at median wage growth for the same people year after year. Their innovation was the way they used "micro data" — information on individuals, rather than composite measures or a mean wage of a given job — to track wages of workers throughout the recession and recovery. That way, they could see whether these people stayed continuously employed, retired, lost their job, were forced to work part-time, or dropped out of the labor force and later re-entered. With that information, they could determine how the wages of any given individual in these groups fared relative to the macro trend as seen in aggregate wages.

What actually happened during the Great Recession? It turns out that workers who stayed on at their jobs were indeed among the higher skilled and better paid, whereas those who were let go were lower skilled and tended to have wages below the median. The growing concentration of higher-paid workers meant the aggregate wage stayed surprisingly high even as gross domestic product plunged and unemployment spiked. Then, as the economy picked up, the wages of the continuously employed rose as well, just as economic theory would predict. At the same time, however, the new hires coming back into the full-time workforce — whether they had been unemployed, forced to work part-time, or had dropped out of the labor force altogether — re-entered at substantially lower wages compared to their continuously employed peers. Daly and Hobijn found that about 80 percent of these "re-entries" started their new jobs below the median wage.

So even as the economy was improving and unemployment was falling, the effect of this pro-cyclical hiring was to pull the aggregate wage down, producing the usual counter-cyclical bias in wages. In relationship to the business cycle, then, the effect following the Great Recession was typical, but the degree was unusual — because so many "re-entries" were coming back into the workforce at the same time, at extremely discounted wages.

At the same time, a secular trend was unfolding that re-enforced the post-recession slowdown in wage growth: The mass retirement of baby boomers, a cohort of 76 million people. Older Americans who were exiting the labor force tended to be among the higher earners due to age and experience. So the slowdown in wage growth stemmed from both cyclical composition factors — the re-entry of lower-paid, formerly unemployed workers as hiring picked up — and secular ones — namely, the changes in the demographics of the U.S. labor force, as lower-paid younger workers became a larger share of the workforce. The severity of the downturn and number of layoffs, as well as the outsized effect of mass retirements due to their relatively large share of the population, had an especially pronounced effect on the aggregate wage.

Other researchers have found similar results that show a substantial wage penalty for those who re-entered the workforce after the Great Recession. A group at the New York Fed, led by Ayşegül Şahin and Giorgio Topa, used data from the 2013 New York Fed Survey of Consumer Expectations to see how workers who stayed continuously employed fared versus those who had a break in full employment. The researchers found a similar pattern: No matter what the last wage was of those workers who had left full-time work, they re-entered the workforce at significantly lower wages. For example, among workers who switched from one job to another without a break, the average starting wage was around $20 an hour, slightly more than a dollar above their prior hourly wage. For people who re-entered full-time employment after a stretch of part-time work, unemployment, or disengagement from the labor force altogether, they started their new job at significantly discounted pay, below $15 an hour, even though their average wage at the last job was close to that of their employed counterparts, at almost $18 an hour.

In a blog post summarizing these findings, the researchers used the analogy of a "job ladder," in which typical workers make their way up each rung over time, with each step leading to better jobs and higher pay. But if this trajectory is interrupted — as it was for so many workers during the Great Recession — with spells of either unemployment or involuntary part-time employment, aggregate wage growth is weighed down by the discounted pay of "re-entries." If wage growth is typically explained by job-to-job transitions in which workers move on to better matches, the authors wrote, "perhaps we should explore the importance of job-to-job transitions — rather than movements in the unemployment rate alone — when thinking about the recent dynamics of wage growth."

Hobijn also finds the "ladder" to be a good analogy. "In the Great Recession, people didn't just fall down the ladder — they fell much further than what used to be the case," he says. "And this happened to a much larger share of workers than in previous downturns."

A Shrinking Slice of the Pie

Another possible driver of slower wage growth is the long-term drop in productivity growth. Productivity growth surged in the late 1990s but then slid in the 2000s. After a brief spike during the recession, it has barely crept along in recent years. This slide has prompted debate over the drivers of lower productivity, in part because productivity can be difficult to measure outside of manufacturing, and in part because this appears to be a global trend. What is clear, however, is that U.S. productivity growth has declined in recent years.

A slowdown in productivity growth, according to theory, would lead to a corresponding decline in wage growth because paychecks reflect the fact that workers are producing less. And historically, the two measures have seen a close correlation. In recent years, however, the most commonly cited measures of wage growth have not kept pace with productivity growth to the extent they once did once they are adjusted for inflation based on output to be comparable with productivity statistics. (This trend also applies to compensation including benefits, which have become a larger part of most workers' total pay packages.)

When real wage growth lags productivity growth, the result is a phenomenon known as a decline in the labor share of income: the amount of national income that goes to wages and other forms of compensation versus the amount that goes to capital (such as rents, dividends, and capital gains). And indeed, that is what has been happening since about 2000. (See chart below.) As with productivity, there is a lively debate over the drivers of this drop in the labor share, but the decline is real. In the decades after World War II, the labor share steadily averaged around 62 percent; then, in 2000, it began dropping and is now around 56 percent. Most economists say this trend is due to a decline in wage growth rather than an increase in productivity.

One especially curious feature of the drop in labor share is that it appears to be global. To be sure, there is international variation in how much of each economy's output is split between labor and capital, and how income is measured. That said, economists do think a variety of common structural changes in the global economy may be at play. Some of the more popular explanations include "capital deepening" (a substitution of capital for labor in the production process), globalization, and rising inequality. But economists are divided over the power of any one explanation.

Hobijn, joined by Şahin and University of Edinburgh economist Michael Elsby, analyzed some potential explanations in a 2013 article from the Brookings Papers on Economic Activity. Technology and equipment have become relatively cheaper, and far more sophisticated, over the decades, so to the extent that capital has replaced labor, it could be redistributing income from labor to capital. The problem with this theory is that the rate of growth in capital intensity has actually slowed down since the decline in labor share began. The authors also address the argument that the drop in labor share has occurred because the wealthy may be accruing more of their income through capital. Recent increases in income inequality, they point out, have been largely driven by wage divergence, not investment income. Higher wages at the top would, in fact, help to keep the labor share high, which means the decline in labor share has occurred despite rising inequality, not because of it. In short, these two explanations — capital deepening and inequality — don't quite succeed in getting to the heart of this puzzle.

What about globalization-based explanations? U.S. firms, like firms across the world, typically offshore the more labor-intensive functions of their production chain to countries where wages are cheaper, while leaving the capital-intensive functions at home — in turn, lifting the capital side of the income share. But here, too, the problem is timing, because this shift began well before the decline in labor share. Elsby, Hobijn, and Şahin did point to an interesting correlation, however: They found that industries with the most exposure to imports (predominantly manufacturing) also saw the largest declines in their labor share, possibly through the offshoring of the more labor-intensive components of the U.S. supply chain. While noting this is only a correlation, not causation, they calculated that this effect accounts for much of the drop in the labor share. The effect of import exposure on wages suggests that the workers are increasingly competing with global counterparts for jobs — through offshored production lines and trade — thus driving down wages of workers in those sectors. But the authors cautioned against reaching any firm conclusions without more evidence.

Whatever the cause, the long-term trend of the labor share is one important part of understanding weak wage growth over the long run. As Hobijn put it, "Wage growth can be explained by three things: if what you produce is valued more, if you become more productive, or, if the labor share of income increases. The fact that productivity growth is slowing and the labor share is declining suggests that we'll see more sluggish wage growth going forward."

Wages and Normalization

The new research on recent wage behavior may provide economists with a better understanding of the dynamics that have been at play in the recovery. For the workers affected, and for policymakers seeking solutions, the ever-shifting dynamics of the labor market may offer clues on what tools can help people stay productive and steadily employed — for example, through investment in education, job training measures, or job-sharing schemes. However, economists are far from having the ideal measure of wage growth that Abraham and Haltiwanger envisioned. Or, furthermore, one that provides a reliable indicator of labor market slack for the Fed.

What does slack mean, exactly, for Fed policy? Some observers argue that stagnant wages signal that the economy still has significant room to expand without generating inflation, because there are still many part-time workers and workers who have dropped out of the labor force, who would like to work full time but cannot. These workers may be willing to take new jobs at wages well below what they used to earn if such jobs were available. This has led some to argue that the Fed should delay raising rates on the grounds that it has yet to fulfill its mandate on reaching maximum employment.

Some groups have gone a step further and argued that the Fed should formally consider a wage growth target when it makes policy. For example, the Economic Policy Institute, a liberal think tank, has argued that nominal wages need to rise an annualized 3.5 percent to 4 percent (in other words, pre-recession rates), rather than the current 2.5 percent, before the Fed should consider raising rates. The EPI reasons that this growth rate accounts for both the current trend in productivity growth and the Fed's 2 percent inflation target.

A more widespread (if not universal) interpretation on the Federal Open Market Committee, however, is that slack is diminishing, as noted recently in the committee's statement following its July meeting. Fed Chair Janet Yellen noted in June that the Fed is "beginning to see slightly faster wage growth based on [nominal] average hourly earnings … about 2.5 percent and that's up from the very low level it was." She also cited the data provided by the Atlanta Fed wage tracker, a widely used nominal-wage aggregate series based, in part, on Daly and Hobijn's methodology, showing that wage growth has modestly accelerated in the last two years. And a broader gauge, the Board of Governors' Labor Market Conditions Index, shows that most labor-market indicators are back to pre-recession levels.

Finally, even if there is a smaller amount of slack left, it means that people returning to full-time work may face a lower starting wage because there is still relatively more labor supply than labor demand, compared to the pre-recession economy. Also, workers coming back to full-time employment may well be earning discounted wages that are lagging trend productivity growth — and that may not change rapidly even as the labor market improves.

"Wage growth is really more of a lagging indicator of slack," says Daly. "Once unemployment drops down to its natural rate, it will take time to pressure wages upwards because you have more people outside the workforce waiting to get back in. In other words, labor markets adjust first through quantity — employment — and then through price — or wages."

This adjustment is part of what Yellen and other Fed officials will continue to look for as they decide how quickly to normalize monetary policy, as well as the sustainability of progress in other gauges of labor market health. But for economists more generally, the tougher challenge is in understanding the longer view — both the historical trend, and the outlook in the decades ahead — of what kind of fundamental changes might keep a lid on robust wage growth over time.

Readings

Abraham, Katharine G., and John C. Haltiwanger. "Real Wages and the Business Cycle." Journal of Economic Literature, September 1995, vol. 33, no. 3, pp. 1215-1264. (Article![]() available online with subscription.)

available online with subscription.)

Armenter, Roc. "A Bit of a Miracle No More: The Decline of the Labor Share.![]() " Federal Reserve Bank of Philadelphia Business Review, Third Quarter 2015, vol. 98, no. 3, pp. 1-9.

" Federal Reserve Bank of Philadelphia Business Review, Third Quarter 2015, vol. 98, no. 3, pp. 1-9.

Armona, Luis, Samuel Kapon, Laura Pilossoph, Ayşegül Şahin, and Giorgio Topa. "Searching for Higher Wages.![]() " Federal Reserve Bank of New York, Liberty Street Economics Blog, Sept. 2, 2015.

" Federal Reserve Bank of New York, Liberty Street Economics Blog, Sept. 2, 2015.

Daly, Mary C., and Bart Hobijn. "The Intensive and Extensive Margins of Real Wage Adjustment.![]() " Federal Reserve Bank of San Francisco Working Paper No. 2016-04, March 2016.

" Federal Reserve Bank of San Francisco Working Paper No. 2016-04, March 2016.

Daly, Mary C., Bart Hobijn, and Benjamin Pyle. "What's Up With Wage Growth?![]() " Federal Reserve Bank of San Francisco Economic Letter No. 2016-07, March 7, 2016.

" Federal Reserve Bank of San Francisco Economic Letter No. 2016-07, March 7, 2016.

Elsby, Michael W. L., Bart Hobijn, and Ayşegül Şahin. "The Decline of the U.S. Labor Share![]() ." Brookings Papers on Economic Activity, Fall 2013, pp. 1-52.

." Brookings Papers on Economic Activity, Fall 2013, pp. 1-52.

Federal Reserve Bank of Atlanta Wage Growth Tracker![]() .

.

Kudlyak, Marianna. "What We Know About Wage Adjustment During the 2007-09 Recession and Its Aftermath." Federal Reserve Bank of Richmond Economic Quarterly, Third Quarter 2015, vol. 101, no. 3, pp. 225-244.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.

As a new subscriber, you will need to confirm your request to receive email notifications from the Richmond Fed. Please click the confirm subscription link in the email to activate your request.

If you do not receive a confirmation email, check your junk or spam folder as the email may have been diverted.

You can unsubscribe at any time using the Unsubscribe link at the bottom of every email.