Who Wants to Start a Bank?

Virtually no new banks have opened since the Great Recession began. What's behind this drought, and should we be worried?

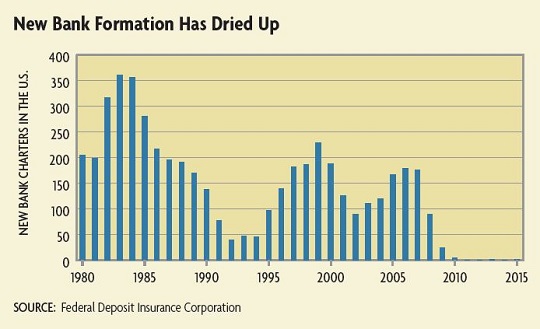

In late 2013, the Bank of Bird-in-Hand opened its doors in Pennsylvania's Amish country. Even in normal times, a bank featuring a drive-through window built for a horse and buggy would have drawn curious onlookers. But the Bank of Bird-in-Hand made headlines for another reason: It was the first newly chartered bank anywhere in the United States in three years. According to the Federal Deposit Insurance Corporation (FDIC), there have been only seven new bank charters since 2010. By way of comparison, there were 175 new banks (or "de novos," as they are called in the industry) in 2007 alone. Indeed, from 1997 to 2007, the United States averaged 159 new banks a year.

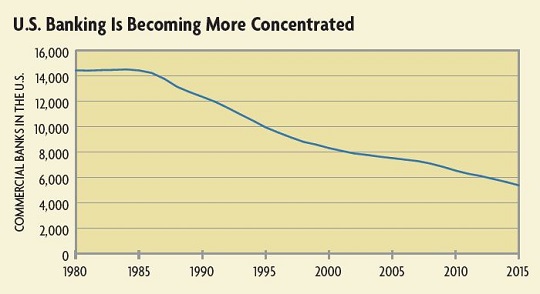

To be sure, the number of banks has been falling for decades. Before the late 1970s, banks were prohibited from operating branches in most states, which inflated the number of unique banks in the country. States gradually did away with these unit banking laws in the 1970s and 1980s, a process that culminated on a national level with the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994. The total number of banks has fallen by about 9,000 since the mid-1980s, as weaker banks merged with stronger ones. (See chart below.) But there was always a steady influx of new banks to replace some of those lost — until now.

Sidebar: Opening Your Own Bank

It’s not as simple as just hanging up a sign and taking in deposits.

"I firmly believe that community banks build better communities," says Jim Marshall, president and CEO of blueharbor bank in Mooresville, N.C. A third-generation community banker, Marshall values the ties between small banks and their community. Blueharbor maintains a presence in clubs, churches, and civic organizations in Mooresville, and Marshall sees these links as vital to serving local businesses. "Community banks try to find ways to mitigate any weaknesses that an entrepreneur might have, whereas the big banks tend to just look at a credit score."

If small businesses are primarily reliant on banks for funding, they may face troubling effects from the dearth of de novos. According to a 2014 working paper by Karen Mills and Brayden McCarthy of Harvard University, small-business owners surveyed by the National Federation of Independent Businesses reported tighter credit markets than before the financial crisis of 2007-2008.

Additionally, Marshall says regulations have increased the number of steps needed to process each new loan, making smaller loans less attractive for banks. "If you can process a $100,000 loan one time versus processing 10 $10,000 loans 10 times, and all carry the same expense to review and book, you'd rather have the $100,000 loan," he says.

Another potential issue from the decline in bank entry comes from the fact that banking has become increasingly concentrated at the top. Even before de novos started drying up, small banks were disappearing by the thousands. According to the FDIC, banks with fewer than $100 million in assets account for virtually all of the decline in total banks since the 1980s. Over the same period, total assets held by the four largest banks grew from $228 billion in 1984 (6.2 percent of industry assets) to $6.1 trillion in 2011 (44.2 percent of industry assets). With no new banks entering the system, this consolidation seems likely to continue, if not accelerate.

True, industry consolidation can bring a number of benefits. Allowing more efficient firms to absorb less efficient ones can improve the profitability of the sector. Larger firms are often better able to take advantage of economies of scale, allowing them to offer cheaper services to their customers. But evidence on the benefits of consolidation in the banking sector has been mixed. While studies in the late 1990s and early 2000s found that consolidation improved bank profit and payment system efficiency, there was little evidence that consumers enjoyed many cost savings.

Changing Lending Landscape

There is also some evidence that the recent changes in banking may be part of a longer trend. Small banks have been facing greater competition for small business loans from large banks. According to a 2015 paper by Julapa Jagtiani of the Philadelphia Fed and Catharine Lemieux of the Chicago Fed, community banks held 77 percent of of loans worth less than $1 million in 1997, but this share had fallen to 43 percent in 2015. For loans valued at less than $100,000, the decline is even more dramatic, with the share held by community banks falling from 82 percent in 1997 to 29 percent in 2015.

To the extent that big banks are stepping in to provide loans to small businesses, policymakers may be less concerned about fewer community banks. In fact, in a 2013 paper updating his work on relationship lending, Berger, along with William Goulding of the Massachusetts Institute of Technology and Tara Rice of the Fed Board of Governors, found no evidence that small businesses actually prefer community banks for financing. The authors suggest that while small banks may have once enjoyed an advantage in this area, changes in technology (such as the adoption of credit scoring in some small-business lending) and the relaxation of branching restrictions have enabled large banks to more easily provide loans to local businesses.

On the other hand, there are signs that banks in general have been moving away from small-business lending. According to a 2013 paper by Ann Wiersch and Scott Shane of the Cleveland Fed, the share of banks' nonfarm, nonresidential loans worth less than $1 million has fallen steadily from just above 50 percent in 1995 to less than 30 percent in 2012. Some of this decline more recently may be due to increased competition from nonbank online lenders. While their share of consumer lending is still small, it is growing: In 2014, these marketplace lenders equaled under 4 percent of traditional consumer lending, but by 2015 their share had jumped to more than 12 percent.

These many changes highlight the uncertainty of banking's future. Will new bank entry bounce back as interest rates eventually rise? And if it does, will those new banks look like the community banks of previous generations?

Marshall says blueharbor is sticking with the old model. "We're just a good old-fashioned, general consumer community bank. If we tried to specialize in any one thing, we wouldn't be serving our community," he says. At the same time, he recognizes the environment is changing. His daughter is studying banking and finance in college (he hopes she will be the fourth-generation banker from his family), but he says many of the young bankers he meets or works with have expressed frustrations with current regulatory and economic conditions. "There are a lot of folks who say it's just not worth it to start a bank today," he says.

Mahan thinks the future is bright for new banks — if they're willing to adapt to changing consumer demands. "You've got to be focused on technology and deliver products and services with a beautiful user experience," he says. "Because at the end of the day, who wakes up and thinks about their bank?"

Readings

Adams, Robert M., and Jacob Gramlich. "Where Are All the New Banks? The Role of Regulatory Burden in New Bank Formation." Review of Industrial Organization, March 2016, vol. 48, no. 2, pp. 181-208. (Previous version![]() available online.)

available online.)

Ash, Preston, Christoffer Koch, and Thomas F. Siems. "Too Small to Succeed? – Community Banks in a New Regulatory Environment.![]() " Federal Reserve Bank of Dallas Financial Insights, December 2015, vol. 4, no. 4, pp. 1-4.

" Federal Reserve Bank of Dallas Financial Insights, December 2015, vol. 4, no. 4, pp. 1-4.

Berger, Allen N., William Goulding, and Tara Rice. "Do Small Businesses Still Prefer Community Banks?![]() " Federal Reserve System Board of Governors International Finance Discussion Papers No. 1096, December 2013.

" Federal Reserve System Board of Governors International Finance Discussion Papers No. 1096, December 2013.

Berger, Allen N., and Gregory F. Udell. "Small Business Credit Availability and Relationship Lending: The Importance of Bank Organisational Structure." Economic Journal, February 2002, vol. 112, no. 477, pp. F32-F53. (Article![]() available online with subscription.)

available online with subscription.)

Jagtiani, Julapa, and Catharine Lemieux. "Small Business Lending: Challenges and Opportunities for Community Banks.![]() " Federal Reserve Bank of Philadelphia Working Paper No. 16-08, Feb. 29, 2016.

" Federal Reserve Bank of Philadelphia Working Paper No. 16-08, Feb. 29, 2016.

McCord, Roisin, and Edward S. Prescott. "The Financial Crisis, the Collapse of Bank Entry, and Changes in the Size Distribution of Banks." Federal Reserve Bank of Richmond Economic Quarterly, First Quarter 2014, vol. 100, no. 1, pp. 23-50.

Peirce, Hester, Ian Robinson, Thomas Stratmann. "How Are Small Banks Faring under Dodd-Frank?" Mercatus Center at George Mason University Working Paper No. 14-05, February 2014.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.