How Much Do State Business Taxes Matter?

States hope to attract businesses by cutting their taxes, but it’s not clear how well it works

On Jan. 1, 2016, North Carolina lowered its top state corporate income tax rate to 4 percent. One of the highest-taxed states in the South prior to a comprehensive tax reform package signed by Gov. Pat McCrory in 2013, North Carolina now has the lowest top state corporate income tax rate of the 44 states with such taxes.

"North Carolina's tax reform was one of the three biggest state tax reforms in the last 30 years," says Scott Drenkard, director of state projects at the Tax Foundation, a free-market-oriented tax policy research organization. But it's hardly an isolated example; over the past several years, states across the country have been cutting taxes on businesses in an effort to foster economic growth. Within the Fifth District alone, West Virginia slashed its top marginal corporate net income tax rate from 9 percent to 6.5 percent between 2006 and 2014. And Virginia Gov. Terry McAuliffe recently proposed cuts for his own state, claiming that it needs to remain competitive with its southern neighbor.

The Carolina Comeback?

The economic argument behind lowering state taxes on businesses is relatively simple: Everything else equal, lower tax rates in a state reduce the costs of doing business and consequently should make it more attractive for corporations to locate and expand there. North Carolina and Kansas are the two states that have perhaps embraced this philosophy the most since the end of the Great Recession. McCrory, for instance, echoed the view of many North Carolina lawmakers when he said that cutting business taxes would "help North Carolina compete for new businesses while growing existing ones." Likewise, Kansas Gov. Sam Brownback argued that "pro-growth tax policy" would be a "shot of adrenaline into the heart of" his state's economy.

Most businesses don't actually pay taxes via the corporate income tax. More than 90 percent of firms, including S-corporations, sole proprietorships, and partnerships — what most people consider "small businesses," as well as some larger companies — are classified as pass-through entities, meaning their owners pay individual income taxes on their businesses' profits; the corporate income tax only applies to profits on C-corporations, a category including most "big businesses." For this reason, personal income taxes are also de facto business taxes, so state-level business tax reforms often target both personal and corporate income taxes.

North Carolina made cuts to both its personal and corporate income tax rates, lowering taxes for all businesses. But it also eliminated an income tax exemption on the first $50,000 of net income for pass-through entities, a policy change that helped to create a more consistent business tax structure in the state even while dramatically lowering tax rates.

By most measures, North Carolina has had one of the stronger-performing state economies over the past few years and has experienced significant improvement in its performance relative to the rest of the nation. "At the beginning of the recovery, North Carolina's GDP growth rate was 36th among the 50 states," says Michael Walden, an economist at North Carolina State University. "By 2015, it ranked 10th."

Last year, North Carolina's real personal income grew about 3.9 percent, compared to the national average of less than 3.4 percent. The state's unemployment rate, well above the national average from 2008 through 2013, equaled the national rate of 4.9 percent in June. Looking at all these figures plus statistics on housing, corporate equity, and other factors, a March 2016 Bloomberg News article concluded that the state "has gained the most economic ground over the past three years of any U.S. state."

Many give North Carolina's 2013 tax reforms much of the credit for this performance, arguing that they drastically improved the state's business climate and encouraged more businesses to locate there. Prior to 2013, North Carolina had the highest top personal and corporate income tax rates in the Southeast. In response to these reforms, Drenkard notes, the state has had the biggest-ever improvement in the Tax Foundation's annual state business tax climate rankings. "We used to rate North Carolina 44th in the country, which really stood out like a sore thumb in the South, and now we rank the state 15th," he says.

Trouble in Kansas

Some states slashing business taxes haven't been as lucky as North Carolina. Kansas also implemented major business tax reforms starting in 2013. While these reforms didn't directly lower its top marginal corporate income tax rate of 7 percent, they did lower personal income taxes and, most importantly, completely eliminated the income tax on pass-through corporations. This policy change has meant that small businesses and S-corporations in Kansas no longer pay any income tax, even as larger C-corporations still face the state's relatively high 7 percent top marginal rate. The governor's office predicted that this would create more than 20,000 jobs in the state by 2020 and initiate an economic boom.

Instead, Kansas has seen extremely poor economic performance. The state's GDP shrunk during three of the four quarters of 2015, technically putting the state in a recession under one common definition of the term, and Kansas lost about 5,400 total jobs between February 2015 and February 2016. Between 2013, when the tax reforms went into effect, and the end of 2015, Kansas saw personal income growth of less than 4 percent, compared to over 6 percent from 2010 through 2012. This situation prompted Federal Funds Information for States, an organization tracking the impact of federal policies on state budgets, to rank the state's economy as the sixth worst in the nation.

Part of Kansas' troubles certainly results from recent declines in agricultural prices. But Kansas still lags behind its Great Plains neighbors such as Nebraska, which shares very similar demographic, geographic, and economic characteristics. Additionally, over 85 percent of recent job growth in the Kansas City metropolitan area has occurred in Missouri instead of Kansas. "It's difficult to identify the role Kansas' tax reforms have played in its weak economy, but it's very hard to argue that they've had the positive effects proponents predicted they would," says Peter Fisher, an economist at the University of Iowa and the Iowa Policy Project, a left-leaning think tank analyzing tax and budget issues.

What explains this huge difference between the experiences of Kansas and North Carolina? Some argue that North Carolina's tax changes were better for growth because they applied to and encouraged all forms of business activity. In this view, lowering overall business tax rates but eliminating the small-business exemption and other loopholes created both a more equitable and lighter tax burden. By leaving the corporate income tax unchanged but eliminating income tax on pass-through entities, Kansas effectively gave preferential treatment and exemptions to a certain category of businesses, argues Drenkard, creating perverse incentives in the process; since 2013, a large number of Kansas firms have reorganized themselves as pass-through entities to escape paying taxes on profits. This trend suggests that the tax changes have likely encouraged companies to change their corporate statuses more than they actually stimulated additional small-business activity.

As a general rule, economists and tax experts prefer a simple business tax structure with lower overall rates to one with higher rates but riddled with loopholes, deductions, and incentives. Jason Furman, a former senior fellow at the Brookings Institution, summed up the rationale behind this principle of tax neutrality: "Generally the tax system should strive to be neutral so that decisions are made on their economic merits and not for tax reasons." Fisher agrees that "revenue-neutral reform that eliminates tax preferences and incentives while lowering rates would be sensible policy, though it is not clear that it would have much effect on growth."

A Changing Consensus

Although there seems to be wide agreement among economists who have studied the issue that North Carolina-style tax reforms are preferable to Kansas-style ones, at least in terms of the incentives they create, the economics profession still remains divided over the true impact of broadly reducing statewide business taxes, as North Carolina did —even after grappling with this question for decades and conducting hundreds of studies on the matter. There has long been reason to believe that corporate income tax cuts probably have more of an effect on business activity than personal income tax cuts. A 1989 article in the Southern Economic Journal observed that when large corporations expand, they usually consider several potential sites, and tax rates may play some role in their decision. In contrast, smaller businesses usually form or expand where their owners already live; it is quite unusual for an individual to move to another state specifically to start a small business, let alone allow tax rates to influence where they move. "Among taxes that could have an impact on state economic growth, first and foremost would be the corporate income tax," says North Carolina State's Walden. A 2015 working paper by Xavier Giroud of the Massachusetts Institute of Technology and Joshua Rauh of Stanford University found that C-corporations are indeed more responsive, in terms of both employment and business creation, to corporate income tax cuts than are pass-through entities to personal income tax cuts.

Up through the 1980s, there existed a general consensus that, because state taxes were fairly small compared to federal taxes and other business costs, a state's corporate tax rates had no statistically significant effect on its wages, employment, or economic growth. This consensus in turn implied that personal income tax cuts failed to expand the business of tax-through entities too. In fact, economists believed that business tax cuts, at least at the state level, were mostly a zero-sum game, in a similar manner to targeted tax incentives (see sidebar below).

Sidebar: Targeted Tax Incentives

In addition to cuts in overall state-level business taxes, state and local governments frequently use targeted tax incentives, which are tax breaks designed to entice specific businesses to relocate to a region.

Since the mid-1980s, this consensus has broken down; a number of papers have found that state business tax cuts do have statistically significant positive economic effects, even as other studies continue to find otherwise. For several decades, research on the topic faced several challenges, making it difficult to isolate the effects of state tax changes — for example, states often adjust tax rates in response to changing economic conditions, making it tricky to separate the effects of the tax change from those of the economic environment that led to the change. Some say the breakdown of this consensus has resulted from the use of increasingly sophisticated statistical techniques and methodologies allowing researchers to get around these problems. In an influential 1998 article in the Journal of Political Economy, University of Minnesota economist Thomas Holmes examined the effects of right-to-work laws on state economies by looking only at counties along state borders between states with and without such laws. This approach controlled for many economic factors in addition to policy changes between states, allowing Holmes to focus on causal effects of state policies. Since then, many economists have used this approach to examine other policies such as state corporate and personal tax rates. In a 2015 working paper, Alexander Ljungqvist of New York University and Michael Smolyansky of the Federal Reserve Board of Governors examined counties along borders between states that either increased or decreased their corporate income tax rates. The authors found an interesting asymmetric result: State corporate tax increases led to "significant reductions in employment and income," but decreases failed to boost economic activity.

There is disagreement among economists over whether cuts in state business taxes have any effect on a state's economic performance, but they mostly agree that if they do, the impact is at most quite small. Syracuse University economist Michael Wasylenko conducted a literature review on the topic and summed up the majority view: "Taxes do not appear to have a substantial effect on economic activity among states," except in hypothetical scenarios where one state's business tax rates are exceptionally high compared to those of its neighbors and other similar states.

Small Costs, Small Benefits

The most direct explanation for the fairly modest effects of state business tax cuts is what many economists have believed for decades: State-level personal and corporate income taxes are too small to be of much consequence to businesses. According to the Iowa Policy Project, total state and local business taxes constitute less than 2 percent of average total business costs across every state. Moreover, taxes on business income comprise only about 10 percent of the total amount paid in such taxes. In his literature review, Wasylenko estimated that a 1 percent decrease in total state taxes paid by businesses would eventually increase that state's GDP by about one-fifth of a percent. In practice, this means that, for instance, a 25 percent reduction in a state's business income tax rates would only increase its GDP by one-half of a percent — hardly the economic boom often hoped for by policymakers in such instances.

While supporters of tax cuts often say that by spurring economic activity they expand the tax base and partially pay for themselves, they almost always lead to a net reduction in tax revenue. Since 49 states are required to balance their budgets, this means either lower spending or tax hikes in other areas as well. As a result of Kansas' tax reforms, its tax revenues have plummeted; at the end of the 2016 fiscal year in June, the state had over a $100 million budget shortfall, with tax collections for May alone nearly $75 million less than expected. (North Carolina has not faced similar issues, partly due to heavy population growth and the elimination of certain tax exemptions.)

Many studies have found that increased state spending on items such as infrastructure and education does positively influence state economies, much more so than state tax cuts. If state tax cuts force budget cuts as well, then the effects may essentially cancel each other out. A 1990 article in the Review of Economics and Statistics found that tax increases had negative economic repercussions only when the increased revenue was used to fund transfer payments such as unemployment insurance or state welfare programs; likewise, tax cuts could be harmful if they forced cuts on health care, education, and infrastructure. Fisher argues that many studies on state tax rates find statistically significant results only because they hold state spending constant instead of taking into account the inevitable impact of tax cuts on budgets. It's possible that Kansas, which has cut millions of dollars in funding for higher education and been forced to delay numerous road improvement projects, may actually be made worse off by its tax cuts.

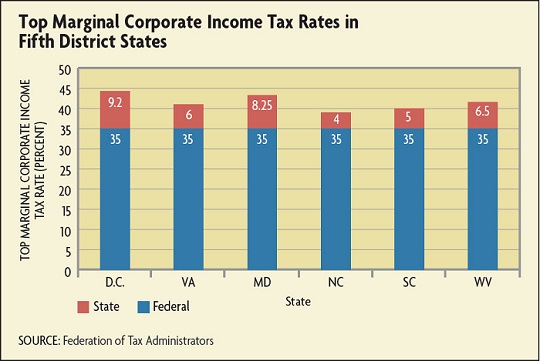

Of course, businesses pay federal as well as state taxes. A C-corporation faces a top state-level corporate income tax rate between 5 percent and 8 percent in most states, with Iowa having the highest rate at 12 percent. Likewise, a small-business owner usually pays a top state-level personal income tax rate of 3 percent to 7 percent and no more than 13.3 percent (in California). In contrast, the federal government imposes a 35 percent top corporate income tax rate on C-corporations, more than any other government within the Organisation for Economic Co-operation and Development. Similarly, pass-through entities are taxed at up to a rate of 39.6 percent.

Thus, federal tax rates dwarf their equivalent state rates and minimize the relative impact of variations between state tax regimes. (See chart below.) A large corporation that moves from, say, North Carolina to Louisiana doubles the top state corporate income tax rate it pays. But because it pays the same federal rate, it increases the total top rate it pays by barely 10 percent. For this reason and others, many economists have advocated heavy reductions in the federal corporate income tax to promote economic activity even as most of the profession remains skeptical of large positive effects of state tax cuts. (See "Taxing the Behemoths," Econ Focus, Third Quarter 2013.)

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.