Social Security: An American Evolution

The story of our biggest government program is not just about politics. It’s also about the influence of a diverse group of economists

Ida May Fuller, a retired secretary in rural Vermont, was running errands in the town of Rutland one day in November 1939 when she decided to make a detour. She stopped by the local office of the recently established Social Security Administration to ask whether she might be eligible for benefits. "It wasn't that I expected anything, mind you," she explained later. "But I knew I had been paying for something called Social Security and I wanted to ask the people in Rutland about it."

After Fuller filed her claim, the Treasury Department grouped it into the batch of the very first 1,000 payments to be sent out. Hers was at the top of the list, which is how she became the first American to receive a monthly Social Security check. Dated Jan. 31, 1940, it totaled $22.54 — about a fifth of average monthly wages back then.

What started as a modest check to a Vermont secretary has become the largest government program on the books. In 2015, it provided about $897 billion in payments to 60 million beneficiaries, covering seniors, dependent survivors, and those on disability — about 5 percent of U.S. gross domestic product. It is the most important source of cash support for low-income seniors and consistently ranks as one of the most popular government programs.

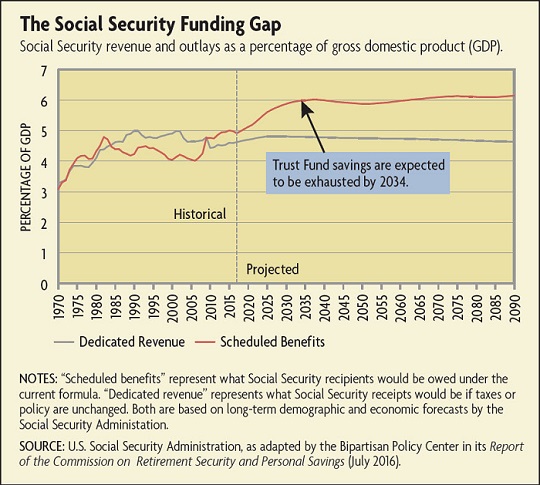

Still, Social Security has been getting fresh scrutiny. Some lawmakers are urging action to address long-standing gaps, especially for widows and single mothers without long work histories, who are more likely to fall into poverty in old age. At the same time, the financing challenges stemming from declining fertility and baby boomer retirements are becoming more acute: Fewer workers will be available in coming decades to support more retirees. Whereas four workers supported each recipient in 1965, that ratio will fall to an estimated 2 to 1 in 2030. Due to these pressures, government forecasts project the Social Security Trust Fund (the accumulation of past surpluses, invested in U.S. Treasuries) will start to be drawn down in 2020 and then be depleted in 2034. This means that, absent a policy fix, anyone who becomes eligible that year or after would get substantially reduced benefits, by about a fifth.

What did Social Security achieve, and why did it evolve the way it did? In part, the program's history has been shaped by the usual give-and-take of political bargaining. But it also reflects the application of research by some of the most influential American economists as the modern postwar welfare state grew — and then came under strain. Among the most seminal figures are Robert Ball, whose four-decade government career profoundly shaped the program; Alan Greenspan, who led the bipartisan commission in the early 1980s that pulled Social Security back from insolvency; and two of the most famous postwar Keynesians, Paul Samuelson of the Massachusetts Institute of Technology and James Tobin of Yale, both Nobel laureates. In more recent decades, another influential scholar has been Martin Feldstein, the Harvard economist who has been among the most prominent backers of a more market-based approach to reform. In very different ways, each left an imprint that is visible today in the debates about the program's future.

'The Hazards and Vicissitudes of Life'

Most Americans today wouldn't recognize the program as it was laid out in the 1935 Social Security Act. It covered only about half of all workers, and until 1939, it didn't even offer benefits to spouses, widows, or children who lost a wage-earning parent. Benefit payments, relative to wages, were more modest than today's average replacement rate of around 40 percent. But other core principles have remained intact. One has been "pay as you go" financing through payroll taxes, split between employer and employee — a feature that President Franklin Roosevelt sought so that the program would neither add to the deficit nor be subject to the vagaries of congressional appropriators. (In fact, monthly payments weren't initially scheduled to start until 1942, so that reserves could be built up; responding to public pressure, Congress decided in 1939 to start disbursing checks early.) Another principle has been that the expected benefit is tied to career earnings and, in turn, to the amount of payroll taxes paid. However, Roosevelt also pushed a progressive payment formula so that lower-income seniors got a larger share of their wages than their better-off counterparts. In short, Social Security was a fusion of two approaches. It was a transfer program in that there was some redistribution of income from current workers to retirees along progressive lines. But it was also an insurance program in that the government applied the funds to protect against old-age risks such as outliving savings.

More broadly, the 1935 Act was part of a bigger shift — a global evolution toward old-age insurance that began in the 19th century. In the United States, the earliest of such schemes was a Civil War benefit for disabled Union veterans and family survivors. These benefits evolved into a broad Republican political strategy in the decades following the war, so much so that by 1900, around three-quarters of surviving soldiers got disability benefits. Financed mostly by tariff revenue, the program was one of the biggest items in the federal budget. Meanwhile, other industrializing nations, starting with Germany, began developing public insurance policies to help their aging citizens who could no longer work or rely on extended family support, something that often fell away as workers moved to cities. Last but not least, life expectancy was growing, so much so that by the 1930s, a 65-year-old American man could expect to live to 77, while a 65-year-old woman typically lived to 79.

The convergence of urbanization, industrialization, and longevity meant that older Americans in the early 20th century were increasingly likely to fall into poverty once they could no longer work. This trend became acute during the Depression, when the poverty rate of those over 65 rose to 78 percent, compared to about a third of all households. After the Civil War generation passed on, some U.S. states developed their own old-age insurance programs but these tended to be limited. To the New Dealers, then, a federal effort to combat old-age poverty and smooth out wage-volatility risk was a core goal. "We can never insure one hundred percent of the population against one hundred percent of the hazards and vicissitudes of life," said Roosevelt at the bill's signing. "But we have tried to frame a law which will give some measure of protection … against the loss of a job and against poverty-ridden old age."

The Age of Expansion

The Great Depression provided the political catalyst for Social Security, but its theoretical framework can be traced to a group of scholars known as institutional economists, starting around World War I. This approach, technocratic in bent and tied to the Progressive movement, heavily influenced the labor movement and the New Dealers, and two well-known institutional economists, Edwin Witte and Arthur Altmeyer, helped draft the 1935 Act. It also happened to make an imprint on the studies of a young Robert Ball as he pursued a master's degree in economics at Wesleyan University in the mid-1930s.

After working in mid-level positions in the Social Security Administration during World War II, Ball's first major role came in 1947 when he was appointed as staff director to a government panel to assess whether benefits — which remained modest and grew very slowly in the 1940s — should be enhanced. The panel's 1949 report helped persuade Congress to substantially hike benefits so they moved above subsistence and to expand eligibility to more workers. Starting in 1950, Congress approved a series of benefit hikes as well as the inclusion of domestic, agricultural, and self-employed workers — all initiatives Ball continued to push as he took on more senior positions. The introduction of disability benefits followed in 1956. In effect, Social Security was supplanting the traditional patchwork of state old-age programs, becoming the universal program known today as old-age and survivors' insurance. Amid strong wage and population growth, by the end of the 1950s, the government had authorized four major increases in payments, effectively doubling average monthly benefits and expanding covered jobs to most of the work force, while lifting the payroll tax by only 2 percentage points and the taxable income base from $3,000 to $4,800. By 1959, the poverty rate for the elderly had dropped to 35 percent compared to about 18 percent of the working-age population. In 1961, early retirement (at age 62) was extended to men. And after Ball took over as commissioner in 1962, the program saw further expansion through more generous disability benefits.

Throughout the program's growth, Ball held certain concepts constant. First, he maintained that benefits should provide enough assistance that they keep the retiree above poverty, but they shouldn't be so generous that they are the only source of support — otherwise, workers might not save enough themselves. Second, he believed in universal coverage not only as a way to achieve poverty reduction, but also to give the program the broadest political support possible. Finally, he argued that benefits should remain tied to average wages in some way so that workers would view Social Security as an "earned" benefit rather than a handout.

"The thing that has appealed to me most … is that it supplies a continuing income to groups who without it would be most susceptible to poverty," Ball said in 1973, when he retired as commissioner. "Yet it does this through their own effort — the protection grows out of the work they do."

‘The Greatest Ponzi Game'

As Social Security began transforming American retirement in the postwar years, economists began analyzing the ways that social insurance more broadly could coexist with a market economy. One of the most influential was Paul Samuelson, who famously developed a model in the 1950s to explain how old-age insurance could be financed across generations. As he described it in a 1958 paper, two "overlapping generations" coexist in an economy: working adults and the nonworking elderly. In their working years, people are able to save more, while in old age they tend to consume more and save less. But under a program such as Social Security, a retiree can receive far more in benefits than he or she has paid in, because those payments are financed by taxes drawn from an ever-growing economy and an ever-growing population of workers (in effect, expanding the transfer component). As long as the rate of return on tax revenue is compounded each year, Samuelson explained, the amount drawn from the wages of current workers is always greater than the taxes paid by preceding generations. "Social Security is squarely based on what has been called the eighth wonder of the world — compound interest," he wrote in 1967. "A growing nation is the greatest Ponzi game ever contrived."

James Tobin, like Samuelson, was keenly interested in social insurance schemes. Starting in the 1950s, he complemented Samuelson's work by analyzing, among other things, how people price risk in their investment choices, how demographics and productivity impact Social Security forecasts, and whether payroll taxes diminish the propensity to save. Both in his academic and public work, he argued that a universal, inflation-indexed old-age insurance system was economically efficient if run well: It prevented adverse selection while providing stronger guarantees against a greater range of risks. Those risks included outliving your private savings and pensions (since we don't know when we'll die), surviving a spouse who had provided support, or seeing inflation erode the value of personal assets. (Tobin would also note that the richer and more stable an economy, the lower those risks will be in the aggregate.) Finally, as he saw it, because the government made a political decision in the New Deal to protect people against extreme indigence, even if they didn't save during their working years, the commitment must go both ways — and that meant mandatory participation through payroll taxes.

"Since we know as a country and a government that we will bail such people out," he explained in a 1990 speech, "we have a right to insist that they save at least the minimal amounts that would be necessary to prevent the government from having to intervene in that way."

Years of Retrenchment

Two developments in the 1970s upended core assumptions of the postwar social insurance models. One was that population and economic growth began to slow down from the boom years, which meant the expectation of sufficient compounded rates of return might no longer apply to later generations. The other was that inflation was increasing far more quickly than before — and policymakers had a poor grasp of how to contain it. Without a way to control inflation and a way to peg Social Security benefits to prices, retirement security would quickly erode.

These were the challenges Ball had to grapple with late in his career as Social Security commissioner. Starting in the late 1960s, Congress approved ad hoc benefit increases that often exceeded inflation. In total, from 1940 to 1974, nominal benefits rose by 391 percent, whereas inflation increased by only 252 percent. A key objective for lawmakers was to find a way to adjust benefits automatically for inflation, so they didn't have to keep revisiting the issue. Congress passed in 1972 the first-ever legislation pegging benefits to the consumer price index. But policymakers soon discovered that their formula accidentally made benefits far more expensive than intended because it erroneously adjusted them for inflation twice. By 1975, two years after Ball stepped down as commissioner, Social Security began to run deficits, and in 1977 Congress passed amendments to bring benefits closer to real wage growth. Those reforms helped, but they failed to restore fiscal balance, in part because of stagflation's extreme effects on wages and inflation.

In 1981, the Social Security Administration projected that the trust fund had only two years left before it would be fully depleted, forcing benefit cuts. The Reagan administration first floated a proposal to cut benefits, including sharp reductions for early retirees, which the Senate unanimously rejected. The administration then decided to convene a bipartisan panel of experts and key lawmakers to find a more palatable alternative. The commission's leader: Alan Greenspan, who had served as chair of the Council of Economic Advisers in the Ford administration.

The Grand Bargain

Greenspan had spent most of his career as a forecaster, not an academic, and he had published little on specific fiscal programs. But for decades, he had warned about the general risk of unsustainable growth of government spending. In a 1971 paper, for example, he warned that an inevitable fiscal squeeze would lead to a rationing of government benefits, including Social Security, and cause "polarization of societal groups." Later, in his 2007 memoir, he would write that his own preference for any Social Security reform had always been a private-account approach that would invest some of the payroll tax into the stock market.

On the panel, however, Greenspan took on a pragmatic role. With help from Ball, who had been tapped for his technical expertise, Greenspan convinced the group to first agree on the numbers so that they could define the solvency crisis before doing anything else. After hard bargaining throughout 1982, all agreed that they could sign off on limited concessions as long as they were distributed equally. The final report in early 1983 won Republican support by temporarily freezing the inflation adjustment and cutting benefits for future retirees by lifting the full retirement age from 65 to 67 — but very slowly and incrementally and not starting until 2000 (effectively masking some of the costs of reform). The plan brought along Democrats by making adjustments on the revenue side, including taxing Social Security benefits for the first time. The bipartisan weight behind the report galvanized Congress to act within months. But deadline pressure may also have had something to do with it. By the time the final legislation passed in April, the trust fund was estimated to be only four months away from depletion.

In his memoir, Greenspan called the episode a "virtuoso demonstration of how to get things done in Washington." The episode also built his credentials as an effective leader, four years before Reagan tapped him as chairman of the Federal Reserve Board. The 1983 legislation brought the trust fund back into balance two years later, and to this day many experts see the mix of benefit cuts and higher taxes as a template for any future fix. Talk of curbing the growth of future Social Security benefits came up again in 2011, for example, during unsuccessful bipartisan talks on a budget "grand bargain." Most recently, the Bipartisan Policy Center, a nonprofit led by former lawmakers from both parties, has called for a similar balance between benefit cuts and tax hikes as part of a comprehensive plan on retirement security. The political challenge of addressing solvency is so daunting, however, that no overhaul has come close to passage since 1983.

Getting Personal

The 1983 reform ensured solvency through the early decades of the 21st century. But Ball, Tobin, Greenspan, and many other economists also realized at the time that the lower birthrates of the modern era, and the onset of baby boomer retirements, would mean that fewer workers had to support a growing population of retirees in the generations thereafter. (See chart below.) By the 1990s, the implications of the demographic crunch were becoming evident with each Social Security Trustee Report. At the same time, the robust stock market led many Americans to expect higher returns on their investments in general. And as the budget surplus emerged in the late 1990s on the heels of the boom, some policymakers asked whether part of that money might finance a "down payment" on a Social Security reform in the direction of privatization. Indeed, starting in the 1980s, some nations began limited experiments in privatized pension financing. The idea was that personal saving and investment should take on a greater role in retirement security, reducing the need of the government to raise taxes or cut spending to fund the pensions of an ever-growing population.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.