Leaving LIBOR

The Fed has developed a new reference rate to replace the troubled LIBOR. Will banks make the switch?

In 2010, the British bank Barclays came under investigation for manipulating a reference interest rate called the London Interbank Offered Rate, or LIBOR. At the time, LIBOR underpinned more than $300 trillion worth of financial contracts worldwide. Over the next several years, authorities would learn that multiple global banks, including U.S.-based institutions JPMorgan Chase and Citigroup, were guilty of manipulating LIBOR; the banks would end up paying more than $9 billion in fines, and more than 20 people faced criminal charges.

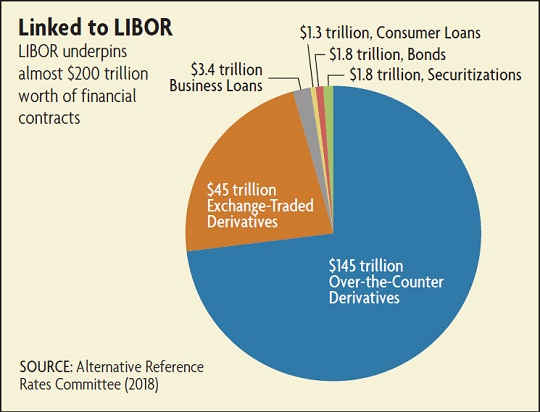

The scandal exposed serious flaws in how LIBOR was calculated and spurred international regulators to seek out alternative benchmarks. In the United States, this effort has been led by the Alternative Reference Rates Committee (ARRC), a private-sector group convened by the Federal Reserve and other regulators. The committee has recommended that markets adopt a new reference rate, and although the transition is underway, there are still about $200 trillion — 10 times the level of U.S. GDP — worth of outstanding contracts based on the U.S. dollar LIBOR. (The rate is also calculated for the Swiss franc, the euro, the British pound, and the Japanese yen; before the scandal, LIBOR was calculated for 10 different currencies.) In addition, new contracts referencing the rate continue to be written, even though it's likely to disappear after 2021. Will the financial sector leave LIBOR in time?

What is LIBOR?

LIBOR is based on how much banks pay to borrow from one another. Each day, a panel of 20 international banks responds to the question, "At what rate could you borrow funds, were you to do so by asking for and then accepting interbank offers in a reasonable market size just prior to 11 a.m.?" The highest and lowest responses are excluded, and the remaining responses are averaged. Not every bank responds for every currency; 11 banks report for the franc, while 16 banks report for the dollar and the pound. For each of the five currencies, LIBOR is published for seven different maturities, ranging from overnight to 12 months. In total, 35 rates are published every applicable London business day.

About 95 percent of the outstanding contracts based on LIBOR are for derivatives. (See chart below.) It's also used as a reference for other securities and for variable rate loans, such as private student loans and adjustable-rate mortgages (ARMs). In 2012, the Cleveland Fed calculated that about 80 percent of subprime ARMs were indexed to LIBOR, as well as about 45 percent of prime ARMs. Prior to the financial crisis, essentially all subprime ARMs were linked to LIBOR.

"Does Bank Lending Matter for Large Firms' Investment?" Economic Quarterly, Fourth Quarter 2015.

"Reforming Money Market Mutual Funds," Economic Brief No. 14-02, February 2014.

"Instruments of the Money Market," Special Report, 1993.

Later research has supported these claims. In ongoing research, Skeie, along with Dennis Kuo, a former researcher at the New York Fed, and James Vickery of the New York Fed, has compared LIBOR rates between 2007 and 2009 with other measures of borrowing costs, including Term Auction Facility bids and Fedwire transfers. While LIBOR generally tracked these other measures, it was consistently 20 to 30 basis points below them. The authors considered several explanations for the disparity and concluded that it was consistent with banks trying to avoid the appearance of financial distress.

As regulators investigated underreporting, they learned that banks had another motivation for fudging the numbers: Beginning at least in 2003, banks had been submitting LIBOR reports that would benefit their trading positions. Rate submitters and traders at different banks and brokerages also conspired with each other to manipulate LIBOR, promising each other steaks, Champagne, and Ferraris (among other perks). Internal emails and instant messages revealed the scheme. As one trader wrote, "Sorry to be a pain but just to remind you the importance of a low fixing for us today." Another wondered "if it suits you guys on hiking up 1bp on the 6mth Libor in JPY [one basis point on the six- month LIBOR in Japanese yen] ... it will help our position tremendously." At least 11 financial institutions faced fines and criminal charges from multiple international agencies, including the Commodity Futures Trading Commission (CFTC) and the Justice Department in the United States. Separately, in 2014 the FDIC sued 16 global banks for manipulating LIBOR, alleging that their actions had caused "substantial losses" for nearly 40 banks that went bankrupt during the financial crisis. The lawsuit is pending in the U.S. District Court for the Southern District of New York.

For the past five years, LIBOR has been regulated and administered by the United Kingdom's Financial Conduct Authority (FCA) and the Intercontinental Exchange Benchmark Administration. The organizations have made a number of changes to prevent false submissions, including developing a new, less-subjective methodology, but post-crisis there's another problem: Banks no longer borrow from each other at longer maturities very often. That means the market underlying LIBOR is very thin; on a typical day, there are only six to seven transactions underpinning the one- and three-month LIBOR, two to three for the six-month LIBOR, and one — if any — for the one-year LIBOR. As a result, banks have to make a judgment call about what rate to report. Even if it isn't intentionally misleading, that judgment could be wrong.

Winds of Change

In 2013, as the investigations continued, the Financial Stability Board (FSB), a global monitoring agency, began reviewing whether and how to reform LIBOR. After a year of work, the FSB issued a report calling for the development of new benchmarks. An effective reference rate, according to the report, should meet three criteria: First, it should minimize the opportunities for market manipulation. Second, it should be anchored in observable trans- actions wherever feasible. And third, it should command confidence that it will remain resilient in times of financial stress. (The International Organization of Securities Commissions published more detailed principles in 2013.)

The FSB asked international regulators to help engineer the transition. "Reference rates are vital to efficient market functioning," says Lieber. "But they affect a range of market participants in considerably different ways, so different types of institutions might have conflicting incentives. This means there's an important role for the official sector to play in helping develop an optimal rate."

In the United States, the Federal Reserve convened the new ARRC in cooperation with the Treasury department, the CFTC, and the U.S. Office of Financial Research. It's currently composed of around two dozen participants from the private sector, including representatives from banks, investment firms, trade associations, and other financial institutions. Representatives from regulators and other government agencies serve on an ex officio basis.

As the committee was beginning its work in 2014, the New York Fed was also working with the Office of Financial Research to develop several new reference rates based on Treasury repurchases, or repos, in an effort to create greater transparency in that market. (Repos function as short-term loans; one party sells a security with a promise to buy it back, usually the next day.) In mid-2017, the ARRC decided to recommend one of these rates — the Secured Overnight Financing Rate, or SOFR — as a replacement for the dollar LIBOR.

The committee chose SOFR for several reasons. First and foremost, it's based on a large volume of observable transactions — more than $800 billion per day, much larger than any other U.S. money market. And because it covers multiple segments of the repo market, it can evolve as the market evolves, according to the New York Fed. In addition, SOFR was designed from the beginning to comply with the new international standards for reference rates.

Some observers are concerned that changing benchmarks could create a disconnect between banks' assets and liabilities; because LIBOR is based on banks' borrowing costs, it enables them to hedge against changes in those costs. As the scandal demonstrated, however, LIBOR is not necessarily an accurate gauge. Moreover, banks are no longer the only users of LIBOR. "When it comes to floating rate loans and interest rate swaps for commercial banks, it does make conceptual sense to have a benchmark tied to a bank funding rate," says Skeie. "But so much financial intermediation is now outside of commercial banking, and LIBOR has become the reference rate for such a vast amount of contracts. For these other players, SOFR is likely a much better instrument."

Keep Calm and Trade On?

The other reason to make a switch is that LIBOR is unlikely to exist in a few years.

Today, many banks participate in the LIBOR panel only at the urging of the United Kingdom's FCA. That's because, after the rate manipulation came to light, banks were wary of being associated with LIBOR. And as the market grew thinner, they became more and more reluctant to essentially guess what rate to submit. In 2013, several banks announced they were planning to quit the panel, and the agency (at the time called the Financial Services Authority) sent letters intimating that doing so would damage their relationship with regulators. But the agency can't legally make banks participate indefinitely, and it's announced that it won't pressure them to do so after 2021. Most industry observers expect LIBOR to vanish at that time.

The ARRC has estimated that about 20 percent of existing dollar LIBOR contracts mature after 2021, which could create major headaches for the parties to those contracts if and when LIBOR disappears. While most contracts include "fallback language" that applies if the underlying reference rate is unavailable, the provisions are inconsistent, and the language is designed to address a temporary disruption — not a permanent disappearance. "Permanent cessation without viable fallback language in contracts would cause considerable disruption to financial markets," the ARRC has warned. "It would also impair the normal functioning of a variety of markets, including business and consumer lending."

The ARRC and other groups are developing guidance to help financial institutions revise their contracts, but so far, not much progress has been made. "It's very complex and costly to change," notes Skeie. "Since you still have a few years until the real uncertainty hits, it's a lot easier to not go first."

Encouraging market participants to renegotiate existing contracts is one challenge. Encouraging them to write new contracts based on SOFR rather than LIBOR is another. "Because everybody prefers to be in the high-liquidity club, there is a coordination problem," wrote Darrell Duffie of Stanford University and Jeremy Stein of Harvard University. (Stein is also a former Fed governor.) "No individual actor may be willing to switch to an alternative benchmark, even if a world in which many switched would be less vulnerable to manipulation and offer investors a menu of reference rates with a better fit for purpose."

Many observers have voiced concern that the financial system won't be ready when LIBOR goes away. But in some respects the switch is ahead of schedule. For example, the Chicago Mercantile Exchange launched SOFR futures in May 2018, and the clearing house LCH cleared the first SOFR swaps in July — well before the expected timing outlined in a transition plan developed by the ARRC. The growth of SOFR-based derivatives activity has been encouraging, and the participation has been diverse, says Lieber, but "we need to see more take-up for it to become meaningful. It's been good so far but not sufficient." While regulators might lead traders to SOFR, they can't make them use it.

Readings

Alternative Reference Rates Committee. Second Report. March 2018.

Duffie, Darrell, and Jeremy C. Stein. "Reforming LIBOR and Other Financial Market Benchmarks." Journal of Economic Perspectives, Spring 2015, vol. 29, no. 2, pp. 191-212.

Financial Stability Board. Reforming Major Interest Rate Benchmarks. July 22, 2014.

Finch, Gavin, and Liam Vaughan. The Fix: How Bankers Lied, Cheated and Colluded to Rig the World's Most Important Number. West Sussex: John Wiley & Sons, Ltd., 2017. (Excerpt available via Bloomberg News.)

Kuo, Dennis, David Skeie, and James Vickery. "A Comparison of LIBOR to Other Measures of Bank Borrowing Costs." Manuscript, April 2018.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.