When Nations Don't Pay Their Debts

Treasury bonds in the United States are widely considered among the safest financial assets in the world. But in 2011, a political standoff over the debt ceiling prompted some to call that safety into question. Rating agency Standard & Poor's downgraded U.S. debt for the first time from the flawless AAA to the merely excellent AA+, a rating it maintains today.

To be sure, the downgrade does not mean the United States will face a debt crisis anytime soon. Indeed, the other two major rating agencies, Moody's Investors Service and Fitch Ratings, still rate U.S. debt as triple-A. But in the wake of the political standoff over the debt, policymakers and researchers have discussed what might happen if the United States ever did default. Recent examples from other countries could provide some clues.

In 2010, a crisis over Greece's debt created hardship for the nation and the rest of the European Union. Closer to home, Puerto Rico announced in 2015 that it would not be able to pay its debts, resulting in economic pain for the island territory and some uncertainty in the United States as Congress rushed to implement a solution.

Such episodes are actually fairly common throughout history. In their 2009 book This Time is Different, which surveys 800 years of financial crises, Harvard University economists Carmen Reinhart and Kenneth Rogoff found that most countries that have borrowed have at some point struggled to repay what they owe. Even the United States, which has a strong reputation for always paying its debts, defaulted early in its history following the War of 1812. And President Franklin Roosevelt's suspension of the gold standard in 1933 and subsequent revaluation of the dollar also represented a default of sorts because those actions substantially changed the value of the dollars used to repay previous debt contracts.

The ever-present possibility of sovereign default raises a question: How are countries able to borrow huge amounts in the first place? It's a puzzle many economists have attempted to solve. Their research sheds light on what happens to governments that default and helps explain why many of them do honor their debts — eventually.

The Burden of Debt

The weight of public debt can become harder to bear the more it piles up. Several studies have documented a negative correlation between rising public debt and economic growth. While correlation does not necessarily imply causation, it is easy to see how public debt could harm the economy. As debt increases, the required interest payments on that debt become a larger share of the budget, crowding out other spending. This has become a concern in the United States as public borrowing has grown to unprecedented levels.

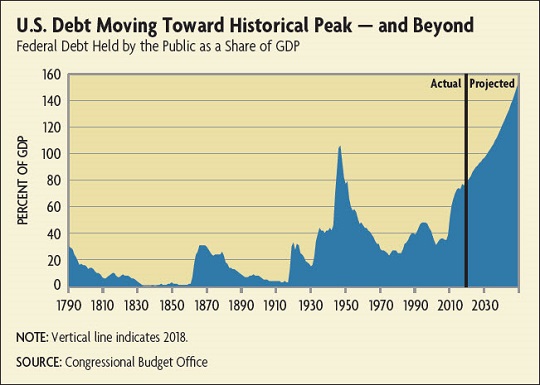

"Right now, our debt-to-GDP ratio is the highest it has ever been except for a few years around World War II," says William Gale, a senior fellow at the Brookings Institution and co-director of the Urban-Brookings Tax Policy Center.

In June 2018, the Congressional Budget Office reported that the amount of federal debt held by the public was 78 percent of GDP, and it is projected to reach nearly 100 percent within the next decade. (See chart below.) As a result of growing debt and rising interest rates, federal spending on servicing the debt is slated to soon surpass several other major categories of government spending, such as the military and Medicaid. As the government devotes more resources to interest payments, it leaves less money for everything else.

"The Transmission of Quasi-Sovereign Default Risk: Evidence from Puerto Rico," Working Paper No. 18-03R, September 2018.

"The Politics of Sovereign Defaults," Economic Quarterly, Third Quarter 2010.

"The Economics of Sovereign Defaults," Economic Quarterly, Spring 2007.

"It's not hard to get a legal judgment against a country that is in default validating that they owe you money," says Mark Wright, research director at the Minneapolis Fed. "The problem is actually collecting."

In the case where the creditors are sovereign nations themselves, they may be able to use diplomatic or military pressure on defaulters to collect what they're owed. This sort of "gunboat diplomacy" was more common at the turn of the 20th century than it is today. In a 2010 article, Kris James Mitchener of Santa Clara University and Marc Weidenmier of Chapman University documented a number of episodes from 1870 to 1913 where creditor nations took military action against delinquent borrowers. For example, a group of European nations imposed a naval blockade on Venezuela in late 1902 to early 1903 over delinquent debts.

Evidence on the effectiveness of such direct intervention is mixed. Moreover, it isn't an option available to private creditors. But in a 2011 article entitled "Lending to the Borrower from Hell," Mauricio Drelichman of the University of British Columbia and Hans-Joachim Voth of the University of Zurich described how a coalition of private bankers did exert power over King Philip II of Spain: They cut him off from future borrowing.

Most of King Philip's loans came from the same group of Genoese bankers, giving them considerable power over the monarch's future credit. According to Drelichman and Voth, the bankers would refuse to lend until the monarch resumed payments on his past debts. "The king's borrowing needs were so high that he would eventually have to settle with the Genoese coalition," the authors wrote.

Even in modern times, the pain of credit market exclusion remains a very real cost for governments facing default. In a 2018 paper, Anusha Chari and Ryan Leary of the University of North Carolina at Chapel Hill and Toan Phan of the Richmond Fed found that as Puerto Rico's debt crisis worsened, borrowing became increasingly expensive. This in turn hurt employment growth and increased the cost of capital.

Private lenders may also be able to use legal proceedings to enforce sovereign debt contracts. While it was long believed that creditors had little legal power over sovereigns, a recent paper by Julian Schumacher of the European Central Bank, Christoph Trebesch of the Kiel Institute for the World Economy, and Henrik Enderlein of the Hertie School of Governance argued that lawsuits against defaulting nations have become much more common over the last several decades.

After Argentina defaulted in 2001, a hedge fund that held some of the country's debt refused to accept a restructuring deal and instead filed a lawsuit to demand full repayment. U.S. courts ordered Argentina's bond trustee not to process payments to its other creditors who had agreed to the debt restructuring until it paid the holdouts who had not. The injunction resulted in Argentina defaulting on its restructured debt in 2014 and ultimately prompted a new settlement with the holdout creditors. The legal rulings that led to that injunction were somewhat controversial, however, so it's not clear that future creditors would necessarily have the same success.

Building a Reputation

Another long-term cost defaulting sovereign nations may face is damage to their reputations, which can affect the terms they receive from credit markets in the future. The incentive to rebuild that reputation can explain why, even in the absence of direct enforcement, governments that have defaulted will restructure debt agreements with creditors and seek to prove themselves as trustworthy borrowers once again.

In a pair of 2017 articles (published in January and October), Phan of the Richmond Fed showed how sovereign debt acts as a reputational signal to investors. Foreign creditors in particular do not have full information about the government they are lending to. Default signals that the government is unreliable, which will dissuade foreign investment. When governments restructure and repay their debts after a default, they are signaling improved political and economic conditions in order to attract new foreign investment. Phan showed that, in theory, some countries may even borrow not because they need the money but because they want to send these positive signals to investors.

"Historically, we've seen that countries in default typically don't borrow a lot, or if they do borrow, it is at very high rates," says Wright. "That suggests they are facing worse terms as a result of the default. But is it because everyone sees that they are unlikely to repay because they just defaulted and their economy is not doing very well? Or is it because they are being punished?"

Economists disagree about which of the two explanations drives the market response to default. What is clear is that defaulting countries lose access to markets until they are able to restructure their debts and rebuild their reputations, and Wright's research suggests this can take a long time — roughly seven years on average.

Reputation may also explain why attempting to lighten the load of debt issued in a country's own currency by engineering inflation or currency devaluation is rarely successful in the long run. Phan's research shows that the reputational costs of strategically inflating away debt are similar to those of defaulting. Countries that devalue their currencies to escape debt lose credibility with regard to monetary stability and independence. The loss of this reputation negatively affects a government's ability to borrow in the future.

Even setting aside the reputational costs, it's unclear that attempting to inflate away debt is always effective. Some scholars have pointed to the elevated inflation of the years immediately following World War II as instrumental in easing America's wartime debt burden. Indeed, Joshua Aizenman of the University of Southern California and Nancy Marion of Dartmouth College estimated in a 2011 paper that inflation was responsible for reducing the postwar debt-to-GDP ratio by more than a third over the course of a decade.

But Aizenman and Marion argued that it is unlikely such an intervention would work as well today. Average maturity for U.S. debt was more than twice as long in the late 1940s than it is today, making it more susceptible to surprise inflation. Today, rising inflation would be met with creditor demands for higher interest rates or inflation-indexing on future debt securities, limiting the power of inflation to diminish the debt burden. Thus, inflation doesn't necessarily help the debtor government get ahead.

"There is also some evidence that countries that run high inflation to escape debt end up destroying their financial markets, and it can take a long time to recover from that," says Wright.

The Breaking Point

As history shows, attempting to escape sovereign debt through default or strategic inflation rarely pays off. But what happens when default becomes inevitable rather than a choice?

Predicting when a country will be unable to sustain its debts is fraught with difficulty. Although the debt-to-GDP ratio is an oft-reported metric of public indebtedness, it is not necessarily the best indicator of debt sustainability. For example, Greece's debt-to-GDP ratio was 126 percent when its debt troubles began in late 2009. Meanwhile, Japan's debt-to-GDP ratio surpassed 200 percent in the same year and has remained above that threshold for nearly a decade with no signs of impending default.

"One of the things that puzzles researchers is that some countries are able to borrow a lot without defaulting while others can only borrow very little," says Wright.

The spread between the interest on a sovereign's debt and a risk-free rate can be a sign of impending crisis. For example, as the Greek crisis intensified, the yield on Greek bonds increased from 3 to 9 percentage points higher than the relatively riskless German bonds. But this spread typically only spikes when a default crisis is imminent, leaving little time to prepare.

The strength of a country's economic growth relative to the growth of its deficits can be another signal of future difficulties. While current economic growth in the United States is strong and is projected to remain so, government revenues remain too small to prevent public debt from increasing, says Gale. Still, that in itself may not necessarily be a concern.

"I don't see anyone pricing in a default premium into the U.S. debt for economic reasons anytime soon," says Gale. "We're a strong country, a safe place to invest, we print our own currency, and our inflation rate is low."

But political standoffs over the debt ceiling could be a different story. After the 2011 political battle led to the S&P downgrade, Congress again fought over the debt limit in 2013. In a 2015 report studying the aftermath of the event, the Government Accountability Office found that interest rates on some Treasuries did increase, resulting in slightly higher federal borrowing costs.

Predicting the likelihood of sovereign default may be next to impossible, but history shows the costs of such episodes. Once lenders re-evaluate a borrowing nation's creditworthiness on the basis of new information, the adjustment can lead to swift and significant economic consequences.

Readings

Aizenman, Joshua, and Nancy Marion. "Using Inflation to Erode the U.S. Public Debt." Journal of Macroeconomics, December 2011, vol. 33, no. 4, pp. 524-541. (Article available with subscription.)

Phan, Toan. "A Model of Sovereign Debt with Private Information." Journal of Economic Dynamics and Control, October 2017, vol. 83, pp. 1-17. (Article available with subscription.)

Schumacher, Julian, Christoph Trebesch, and Henrik Enderlein. "Sovereign Defaults in Court." European Central Bank Working Paper No. 2135, February 2018.

Tomz, Michael, and Mark L.J. Wright. "Empirical Research on Sovereign Debt and Default." Annual Review of Economics, August 2013, vol. 5, pp. 247-272. (Article available with subscription.)

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.