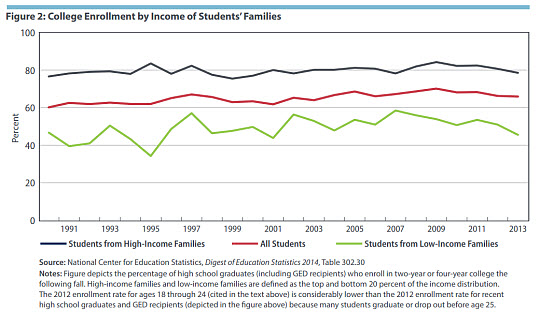

Not only do fewer students from low-income families enroll in college after high school, they also are less likely than students from high-income families to complete college after they enroll. In 2002, the NCES began surveying a cohort of about 15,000 high school sophomores.3 Follow-up surveys were conducted in 2004, 2006, and 2012. Students were assigned a composite score for socioeconomic status (SES) based on their parents' education levels, occupations, and income and grouped into low, middle, and high SES. Low-SES students were defined as those in the bottom quartile of scores, middle-SES students were in the middle two quartiles, and high-SES students were in the top quartile. By 2012, 77 percent of the high-SES students who were enrolled in a four-year college in 2006 had earned a bachelor's degree or higher. But only 50 percent of the low-SES students attending a four-year college in 2006 had completed their degrees by 2012.

One possibility is that low-SES and high-SES students differ in their academic ability, which would affect the likelihood they enroll in or complete college. To study this, the NCES survey also collected information about students' standardized test scores in high school. Even among students with similar academic achievement, low-SES students were less likely to complete college than high-SES students. For students in the top quartile of mathematics test scores, 41 percent of low-SES students had earned a bachelor's degree 10 years later, versus 74 percent of high-SES students.

Modeling Education Decisions

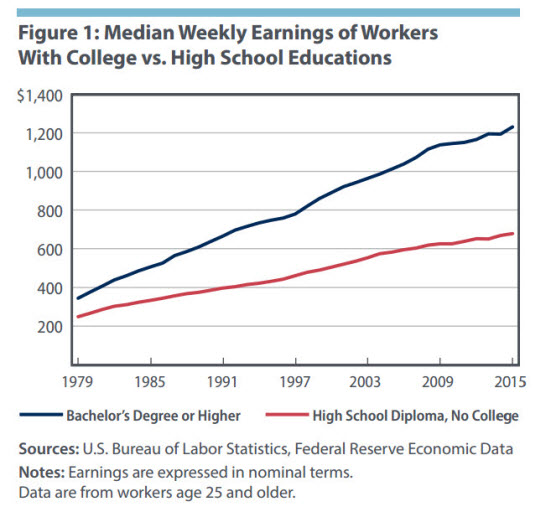

Given the large wage premium to earning a bachelor's degree, why don't more students choose to enroll, and why do so many fail to graduate? And what explains the disparities between students from low-income and high-income families?

The strong correlation between family income and educational attainment has led many researchers to focus on the role of credit constraints in preventing some students from enrolling in or graduating from college. Intuitively, access to credit markets should mitigate some of the advantage that students from higher-income families have in financing college or in financing consumption while attending college. But the evidence on the influence of credit constraints is mixed at best. In a 2011 article, Lance Lochner of the University of Western Ontario and Alexander Monge-Naranjo of the St. Louis Fed find that credit constraints increase the importance of family income for college attendance, and that expanding government loan programs can increase human capital investment.4 However, Michael Keane of Oxford University and Kenneth Wolpin of Rice University find in a 2001 article that while the size of parental transfers influences a child's educational attainment, this does not appear related to the existence of credit constraints. In their model, relaxing borrowing constraints affects students' decisions about how much to work and how much to consume while in college, but it has little effect on the decision to attend in the first place.5 And in a 2008 article, Ralph Stinebrickner, professor emeritus at Berea College, and Todd Stinebrickner of the University of Western Ontario conclude that while credit constraints likely have a causal effect on some students' decisions to drop out of college, for most students other factors drive the dropout decision.6 Even under a policy in which all the direct costs of college attendance are removed and loans are available to finance consumption, a substantial number of students still would drop out. In related research, Stinebrickner and Stinebrickner find that many students are overoptimistic about their academic ability and grade performance, and that about 40 percent of the dropout decision can be attributed to what students learn about their ability after they enroll in college.7

This process of learning about self-ability appears to operate differently for students of different socioeconomic backgrounds, as demonstrated in a 2015 working paper by Ali Ozdagli of the Boston Fed and Nicholas Trachter, one of the authors of this Economic Brief.8 In their model, students enroll in college and are endowed with a particular wealth level. The students differ in their ability level, either low or high, and this ability is not observable. Instead, students learn about their ability level by taking exams and earning grades of excellent, pass, or fail. Each time students take an exam, they update their beliefs about their abilities and weigh the expected gains from completing college against the costs of remaining in college. If students believe they have high ability, they expect that upon graduation they will become workers in the high-skill sector, which makes it more profitable to remain in college. If students believe they have low ability, they find it more profitable to drop out of college and join the workforce. Because students do not know their abilities for certain, there is always some risk associated with investing in college.

Ozdagli and Trachter demonstrate that students' initial wealth levels affect their belief threshold for dropping out. Wealthier students are less risk-averse and thus more likely to continue investing in the risky asset, that is, to continue attending college. Poorer students are about 27 percent more likely to drop out and also drop out about one year earlier. These results are obtained without introducing any explicit credit constraints into the model, which suggests that policy changes such as increasing access to student loans would be unlikely to affect differences in educational attainment.

The Value of the Dropout Option

In a 2015 article, Trachter studies the enrollment, dropout, and transfer decisions of students attending two-year academic colleges (as opposed to vocational schools) and four-year colleges.9 Using data from the National Longitudinal Study of the High School Class of 1972, Trachter finds that 59 percent of students who enroll in a two-year college drop out and 32 percent transfer to a four-year school prior to graduation. Only 5 percent graduate. The remaining 4 percent transfer to a vocational school. At four-year colleges, 41 percent of students drop out and 56 percent graduate; very few students transfer to a two-year college or vocational school.

These data suggest that for many students, academic programs at two-year colleges are "stepping stones" to four-year colleges. To test this theory, Trachter develops a model in which individuals must decide whether to join the labor force or pursue postsecondary education. Individuals vary in their initial asset levels and in their ability to acquire human capital at college, but, as in Ozdagli and Trachter (2015), the individuals are unsure of their own abilities. Students with a low initial belief about their ability level join the workforce directly after high school. Students with a medium belief level enroll in a two-year college, and students with a high belief level enroll in a four-year college. Over time, students enrolled in either type of college receive signals about their ability by taking exams and receiving credits, and in each period, they decide whether to drop out, transfer, or continue at their current institution.

Trachter finds that because college, particularly a four-year college, is a risky option, the dropout and transfer options are highly valued by students: the dropout option accounts for 31 percent of the return to enrolling in a two-year school and the transfer option accounts for 69 percent. At four-year colleges, the dropout option accounts for 87 percent of the average return to enrollment. If students were risk-neutral rather than risk-averse, enrollment in two-year colleges would fall from about 16 percent to 10 percent and enrollment at four-year colleges would increase from 27 percent to about 50 percent.

Trachter's results also suggest that two-year and four-year colleges are highly substitutable. When he changes the tuition rates in the model, total enrollment is essentially the same as in the baseline economy, but the distribution of enrollment changes significantly. When two-year colleges become cheaper, a large fraction of students who would have enrolled in a four-year college now enroll in a two-year college, leading to lower dropout rates and higher transfer rates from two-year to four-year colleges. When four-year colleges become cheaper, more students attend four-year colleges, but dropout rates increase. This suggests that students value two-year colleges because they are a cheap and safe way to learn about ability, not because they provide unique academic value in and of themselves.

The model also implies that the overall welfare effect of academic programs at community colleges might be relatively small. Eliminating these programs has no effect on students who enroll in four-year colleges in the first place. Most students who would have enrolled in two-year colleges simply enroll in four-year colleges with little change in value, and the remaining students join the workforce. Overall, community colleges increase participation in postsecondary education by about 7 percent in Trachter's model.

Conclusion

College enrollment and graduation rates appear to be inconsistent with the large and persistent wage premium earned by college graduates on average. One explanation is that credit constraints prevent some students from enrolling in or graduating from college, but the evidence in favor of this explanation is mixed at best. Instead, models that treat college as a risky investment and in which individuals learn about their ability over time could explain enrollment and graduation rates, particularly with respect to disparities between students from low income and high-income families. This research also suggests that the option value of dropping out or transferring accounts for a large portion of the value of enrolling in college.

Jessie Romero is an economics writer and Nicholas Trachter is an economist in the Research Department of the Federal Reserve Bank of Richmond.

![]() "

"