Why Are Startups Important for the Economy?

Startups come in all shapes and sizes. While small in number, a small group of successful startups is important for understanding aggregate outcomes such as employment and productivity. In this article, we look at some distinguishing characteristics of startups and what makes them important for the aggregate economy. Furthermore, we dig into the cause behind the long-run decline in U.S. entrepreneurism and whether the recent pandemic broke these trends. While the recent surge in business applications seems encouraging at first, there are signs that it reflects a restructuring of the economy instead.

Why do we care about startups and their impact on the economy? In this article, we look at some distinguishing characteristics of startups and what makes them important for aggregate outcomes such as employment and productivity. In addition, we discuss long-run trends in the decline of U.S. entrepreneurism, their causes and whether the recent pandemic broke these trends.

Startups Are Different

Startups and their entrepreneurs come in all sizes and shapes, but two "types" jump out, as noted in the 2010 paper "The Divide Between Subsistence and Transformational Entrepreneurship":

- Subsistence entrepreneurs: people starting businesses meant purely to provide subsistence income

- Transformational entrepreneurs: people who aim to create large, vibrant firms and provide jobs and income for other individuals, typically by providing a new good or service or by entering markets previously unserved

This dichotomy between firms is clearly visible in the data for employers.1 Startups/young firms display so-called "up-or-out" dynamics: A very small fraction of startups displays extraordinary growth in employment and/or revenues, but many others fail in the process. In fact, slightly over 50 percent of startups in a given year will not be in business by their fifth year, as noted in the 2017 book chapter "High Growth Young Firms: Contribution to Job, Output and Productivity Growth." Furthermore, exit rates also strongly decline with firm age. The average exit rate for a firm in its first two years of activity (15 percent) is almost twice as high as the average exit rate for a firm already 5 or 6 years old.

Regarding the growth of startups that don't fail within five years of launching, the book chapter notes that, on average, firms that are 1 to 2 years old grow almost by three times as much (12 percent) as firms that are 3 to 4 years old. This ratio becomes even larger when comparing to firms older than four years.

These high-growth firms are sometimes referred to as "gazelles" in the literature, as seen in the 2021 paper "The Nature of Firm Growth." These gazelles are entirely responsible for the fact that, conditional on survival, young firms grow faster in terms of employment and revenues.

It is important to note that the key observable is firm age, not size. It was commonly assumed that small firms created the most jobs and, hence, we should think of policies promoting small businesses. However, the influential 2013 study "Who Creates Jobs? Small Versus Large Versus Young" showed that the relationship between firm growth and size breaks down after controlling for age. The reverse, however, is not true: The relationship between firm growth and age does not break down when controlling for size.

Young firms' up-or-out dynamics are important for an economy's growth. To perfect novel business concepts, a lot of experimentation is required. Success results in improvements in technology (which promote economic growth), but failure is inherent to the experimentation process to which startups disproportionately contribute. The 2018 paper "Growth Through Heterogeneous Innovations" quantifies that 25.7 percent of aggregate growth that comes through innovation is accounted for by entering firms alone.

Secular Decline in U.S. Business Dynamism: Aggregate Impacts of Startups

Startups comprise only a small portion of the total number of firms. Furthermore, the stock of aggregate employment due to startups is also small (less than 5 percent of employment). However, their contribution to aggregate employment growth is substantial: Startups alone are responsible for more than 15 percent of aggregate job creation, according to the aforementioned "Who Creates Jobs?" paper. As a result, startups are often referred to as "the engine of economic growth."

However, the prevalence of startups (and young firms) has been dramatically declining in the past few decades. The 2014 paper "The Role of Entrepreneurship in U.S. Job Creation and Economic Dynamism" also refers to this as the "secular decline in U.S. business dynamism."2 This drop in U.S. entrepreneurism is driven by three observations:

- A fall in the startup rate, or the proportion of startups relative to the total number of firms

- A drop in the share of aggregate job creation due to young firms (including startups)

- A fall in job reallocation rates, which reflects how easily jobs flow around in the economy and is partly a reflection of the ease at which firms can hire and fire workers

While these three facts are all important, the fall in the startup (or firm entry) rate has gained most traction in the academic literature. This is not surprising given the magnitude of its decline: The startup rate has declined from 13.7 percent in 1978 to 8.4 percent in 2020. Thus, entrepreneurial activity in the form of the firm entry rate has declined by more than one-third. Academic researchers and policymakers alike have been worried about this phenomenon, as the heart of the engine of economic growth has been beating less vigorously over the past four decades.

Obviously, a fall in the startup rate does not immediately imply a loss in gazelles. While some research — such as the 2020 paper "The State of American Entrepreneurship: New Estimates of the Quantity and Quality of Entrepreneurship for 32 U.S. States, 1988-2014" — has argued that the quality of startups has not necessarily declined in the U.S. economy, there is consensus that gazelles are disappearing.3

Effects of the Fall in the Startup Rate

How significant is the fall in the startup rate for aggregate outcomes such as employment and productivity? Early evidence from the 2001 book chapter "Aggregate Productivity Growth: Lessons From Microeconomic Evidence" indicates that the consequences of a fall in the startup rate could be large. The authors find that more than 25 percent of aggregate productivity growth in the U.S. manufacturing sector is due to the net entry margin, or the role of entering net of exiting firms. While these numbers are a good indicator for the importance of startups, they do not provide quantitative evaluations for the secular decline in the startup rate.

Two studies have filled this gap, however. First, the 2016 paper "Older and Slower: The Startup Deficit's Lasting Effects on Aggregate Productivity Growth (PDF)" shows that the fall in the startup rate has sizable effects on aggregate productivity. In their counterfactual exercise (holding the economy's startup rate and firm age distribution constant at their 1980 values), the paper's authors find that aggregate productivity over the period 1980 to 2014 could have been 3.1 percent higher. To put this "startup deficit" in perspective, real income for a median family would have been $1,600 higher in 2014 alone.

Second, the 2019 paper "Grown-Up Business Cycles" finds that the observed secular decline in the startup rate has a significant impact on aggregate employment. If the startup rate had remained constant between 1987 and 2012, aggregate employment would have been, for example, 11.4 percent higher in 2008. Furthermore, there are important implications for the economy at business cycle frequencies. In one of their examples, the authors show that aggregate employment would have recovered almost a full year earlier after the Great Recession if the startup rate decline would not have occurred.

All in all, several studies have indicated that startups' dynamics are important for understanding aggregate outcomes. Given the observed secular decline in startups, does this imply that we should subsidize entrepreneurs to promote new business entry? This is not a straightforward question since startups show up-or-out dynamics: Untargeted subsidies could fall in the hands of entrepreneurs who lead failing businesses. Obviously, one would want to subsidize gazelles instead.

The problem, however, is that it is difficult to identify them ex ante. Previous work has found some evidence of firms that register as corporations or protect their business ideas through patents or trademarks displaying higher future employment growth.4 In addition, the 2017 paper "Eponymous Entrepreneurs" finds that firms being named after their owners (i.e., eponymy) is correlated with better firm outcomes: Entrepreneurs who are more confident in their businesses are also more willing to put their own names at stake. However, the evidence behind eponymy is mixed across countries and does not seem to be present in the U.S. economy. Moreover, if such indicators became a basis of subsidies, they could readily be gamed.

Proposed Causes for the Secular Decline in U.S. Business Dynamism

As explained above, startups can be important in understanding key aggregate statistics. As a result, a natural follow-up question is: What is behind the secular decline in U.S. business dynamism? While the academic literature is still far from reaching a consensus, several narratives have been proposed.

The first (and, so far, most popular) explanation is demographics. Labor supply growth has declined following a surge in the growth rate of the working-age population in the early 1980s. A key prediction of standard models in firm dynamics is that negative shocks to labor supply growth do not affect real wages. In equilibrium, incumbents' labor demand will then not react.

However, a change in labor supply must reflect a change in labor demand in equilibrium. This happens through the extensive margin: Changes in labor supply growth are entirely absorbed through the entry margin. The 2022 papers "From Population Growth to Firm Demographics: Implications for Concentration, Entrepreneurship and the Labor Share" and "Demographic Origins of the Startup Deficit" show that this channel of demographics can explain a large fraction of the decline in the startup rate.

A second narrative is rooted in market power. The 2020 paper "The Rise of Market Power and the Macroeconomic Implications" recently documented a rise in firms' market power in product markets, and the 2022 follow-up study "Quantifying Market Power and Business Dynamism in the Macroeconomy" showed that this rise in market power has been accommodated by a decline in the startup rate. This can be caused by the fact that it is less attractive for entrepreneurs to start their businesses in an economic climate with incumbents reaping more profits or because incumbent firms are able to put up more entry barriers with increased market power.

The last and third mechanism — proposed in the 2021 paper "Ten Facts on Declining Business Dynamism and Lessons from Endogenous Growth Theory" — is the decline in the intensity of knowledge diffusion from industry leaders to followers. The authors argue that industry leaders have widened their technological advantages to such a broad extent that their competing followers "lose hope in leapfrogging the leader." As a result, followers (and potential entrants) have almost no incentives to innovate to beat their respective market leaders. Thus, discouraged potential entrants lead to low startup rates.

While several channels can induce such industry dynamics, the authors argue that a reduction in the amount of knowledge diffusion in the economy is most consistent with the data. In particular, it has become increasingly harder for industry followers to copy their respective leaders' technology. This can be caused by at least two factors:

- Innovation is becoming increasingly concentrated at the top.

- Patents have been used more strategically since the 2000s.

An attractive feature of the setup in this paper is that it can explain a wide variety of secular trends in the U.S. economy.

COVID-19 Pandemic

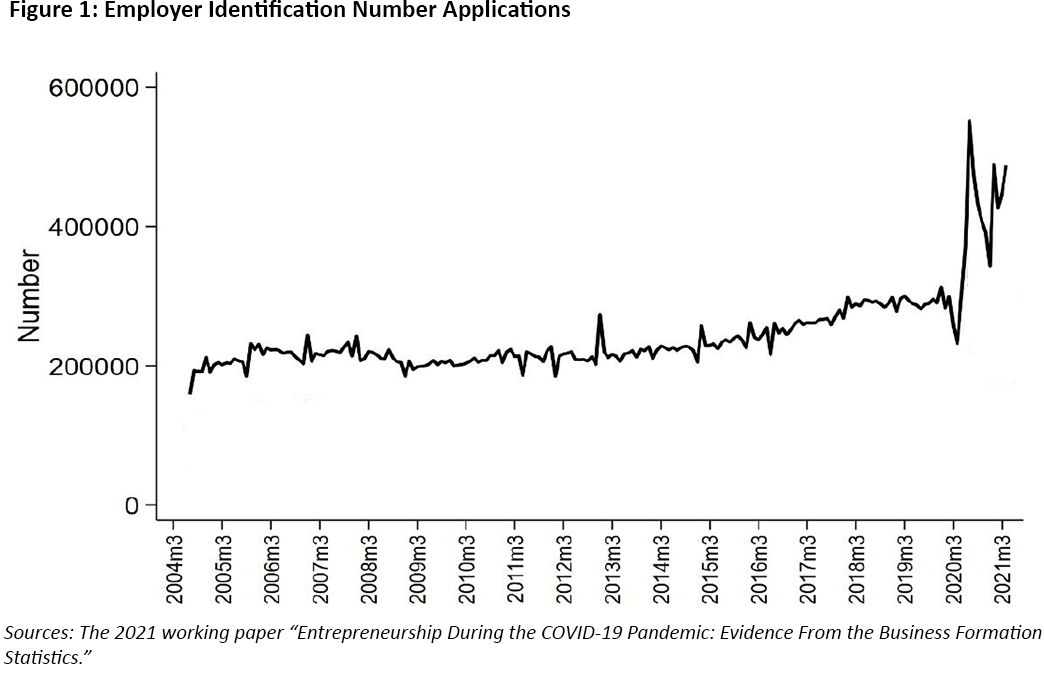

While the startup rate has been in a decades-long decline, another measure of new businesses forming has seen a spike since the pandemic started. The number of applications to the Internal Revenue Service for Employer Identification Numbers (EINs) — which are required for every new business — has skyrocketed during the pandemic, as seen in Figure 1.

While this spike seems to be encouraging, some caution is required. An increase in EIN applications does not necessarily translate to a similar increase in employer startups. This is because entrepreneurs have additional incentives for obtaining an EIN. For example, EINs help entrepreneurs with building business credit history, which is important for obtaining private business loans, even for businesses not planning to hire any workers.

However, some of this caution has been alleviated by the 2022 article "Surging Business Formation in the Pandemic: Causes and Consequences (PDF)." It showed that the spike in EIN applications was followed by a significant increase in establishment openings and job creation. Most importantly, this increase is larger than what we observe in a typical year.

Also, the sectoral breakdown in EIN applications reveals some interesting patterns. Non-store retailers (including online retailers) were responsible for almost one-third of the spike in EIN applications. The COVID-19 pandemic induced many individuals (including, presumably, laid-off workers) to start their own businesses. An example would be creative artists putting their work on platforms such as Etsy.

Finally, most of the rise in EIN applications was concentrated in sectors that were able to adapt most easily to the new "work from home" lifestyle. For example, a prominent sector is "Professional, Scientific and Technical Services," which includes interior designers adapting rooms into home offices and IT system managers setting up remote-working capabilities. These findings could be indicative of a temporary surge in startups that reflects only a restructuring of the economy necessary to adapt to a post-pandemic lifestyle of working from home. As a result, the pandemic surge in startups will not necessarily be followed by a boost in aggregate employment and productivity.

At this moment, a lack of data prevents us from understanding the macroeconomic consequences of the COVID-19 startup boom. Only in time will we be able to understand whether this pandemic episode is associated with the innovative benefits of a cohort of startups.

Conclusion

Startups make up a relatively small fraction of the total stock of firms, but there is a tremendous amount of heterogeneity among them, characterized by their "up-or-out" dynamics: Only a handful of startups are fortunate enough to reap the benefits of their innovations, and their success drives aggregate outcomes such as employment, productivity and economic growth. However, many others fail in the process, with most startups not staying in business for more than five years.

The prevalence of startups in the U.S. economy has been falling over the past four decades. In particular, the startup rate has declined substantially. Yet despite the economic turmoil associated with the COVID-19 recession, the number of EIN applications surged during the pandemic. In turn, this has been followed by a substantial amount of establishment openings and job creation, presenting a clear break from the secular decline in business dynamism.

Several important questions arise, though. Is the pandemic surge in businesses the start of a new era in U.S. business dynamism? Moreover, is this spike the sign of a burst in innovation leading to economic growth? Or is it only temporary and a mere restructuring of the economy to accommodate the new lifestyle of working from home? Researchers are eagerly waiting for future data to answer these questions.

Chen Yeh is an economist in the Research Department at the Federal Reserve Bank of Richmond.

In the remainder of this article, we will be focusing on businesses hiring workers, that is, employer firms.

A "secular" trend is a long-run movement in some economic outcome occurring at a frequency lower than the business cycle.

See, for example, the aforementioned 2021 paper "The Nature of Firm Growth."

See, for example, the aforementioned 2020 paper "The State of American Entrepreneurship."

To cite this Economic Brief, please use the following format: Yeh, Chen. (February 2023) "Why Are Startups Important for the Economy?" Federal Reserve Bank of Richmond Economic Brief, No. 23-06.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.