The Effects of Higher Borrowing Costs: Insights from Sovereign Default Models

According to sovereign default models, debt becoming more expensive for a sovereign entity results in several significant effects. The government deleverages, capital investment falls for a prolonged duration, GDP and labor decline gradually with capital, and consumption can drop sharply. Outcomes are asymmetric, as positive shocks compress spreads slightly, but negative shocks can increase spreads substantially. The current account tends to increase due to reduced government borrowing from international lenders. The real exchange rate depreciates, which boosts net exports, but also tends to manifest empirically as currency depreciation and inflation. Failure to deleverage dampens short-term costs but creates a lasting drag on the economy.

Political gridlock associated with raising the debt ceiling has led some to question the long-term willingness of the government to service its debts. This has already showed up in higher default-risk premia in credit default swap markets, and it has the potential to increase U.S. debt-financing costs going forward.

In this article, I consider the effect of higher debt-financing costs through the lens of sovereign default models. I find several effects that occur in response to a persistent increase in expected default risk and borrowing cost increases.

Insights From Existing Work

When the cost of government borrowing increases, the government budget constraint dictates at least one of three options must be selected to avoid a default: cut spending, borrow more or tax more. In sovereign default models, the "borrow more" option is basically never chosen. The sovereign is trying to avoid a costly default, so taking on more debt at a higher cost isn't an attractive option. Instead, the sovereign tends to deleverage.

That leaves only two options:

- Cut spending (reduce public consumption)

- Tax more (reduce private consumption)

Because public and private consumption are complementary, both options should be used rather than just cutting spending or just taxing more. Generally speaking, higher taxation reduces economic activity (including capital investment and labor), and reduced investment reduces the capital stock (resulting in persistent declines in output and labor).

There's a force that links the marginal cost of government spending to the marginal cost of investment. In particular, the marginal cost of raising an additional dollar of revenue via borrowing or taxes should be the same. If these costs aren't the same, one method of raising additional dollars would be favored until they balance out. For example, if the cost were lower to use taxes, the government should increase tax usage and reduce debt usage until the two marginal costs were equated.

As an implication, the rate of return on government borrowing should be roughly the rate of return on private savings. So, when interest rates rise for government debt, there's a tendency for that to pass through to higher private returns on investment. In classic settings, this occurs through a reduction in investment. The mechanism is that an increase in taxes reduces investment, which in turn drives up the return on investment. Because of capital adjustment costs, this process might be slow but should hold over long periods of time.

Additionally, when the need to deleverage becomes apparent, consumption can fall more quickly and drastically than slower-moving output. In the data for small, open economies, this is evident in "excess consumption volatility," where consumption is much more volatile than output unlike in the U.S. and more developed economies. Interest rate shocks are a key part of generating these large consumption swings.

All the above-mentioned forces are active in my paper "Dynamics of Investment, Debt, and Default" with Pablo Guerron. That model is calibrated to Argentina, but the logic applies also to the U.S.

Another insight from the same model is that symmetrically distributed shocks lead to asymmetric risk in high-risk environments. For instance, suppose the default probability is 1 percent. A positive total factor productivity shock might reduce that risk to 0 percent, but it can't push past 0 percent. The same size shock in the opposite direction could increase that risk premium to, say, 4 percent, 8 percent or 16 percent. The best that can happen is the risk premium falls to 0 percent, while the worst is it blows up and the country can't borrow at all. Pablo Guerron and I make this point in our paper "Asymmetric Business Cycles and Sovereign Default," arguing that sovereign default risk explains the asymmetric business cycles that risky small open economies have.

Many sovereign debt models have only a single, freely tradable good, so the real exchange rate (or the relative price of one country's basket to another's) is always 1. When these models are extended to have two goods (tradable and nontradable), taxes used to pay down government debt reduce the amount of tradable goods available domestically. This causes a depreciation in the real exchange rate: Tradable goods become relatively more expensive domestically. Empirically, these real effects tend to show up as an increase in domestic inflation and nominal exchange rate depreciations. Pablo Guerron and I found this in our ongoing research "A Quantitative Theory of Hard and Soft Sovereign Defaults (PDF)."

As the real exchange rate depreciates, net exports tend to rise, importing foreign goods becomes relatively more expensive, and domestically produced goods look cheaper to the rest of the world. Net exports thus provide a cushion to GDP by dampening depreciation's impact. In many small, open economies, there is a currency mismatch problem which cuts the other way, but fortunately U.S. debt is denominated in dollars.

Quantification in a Structural Model

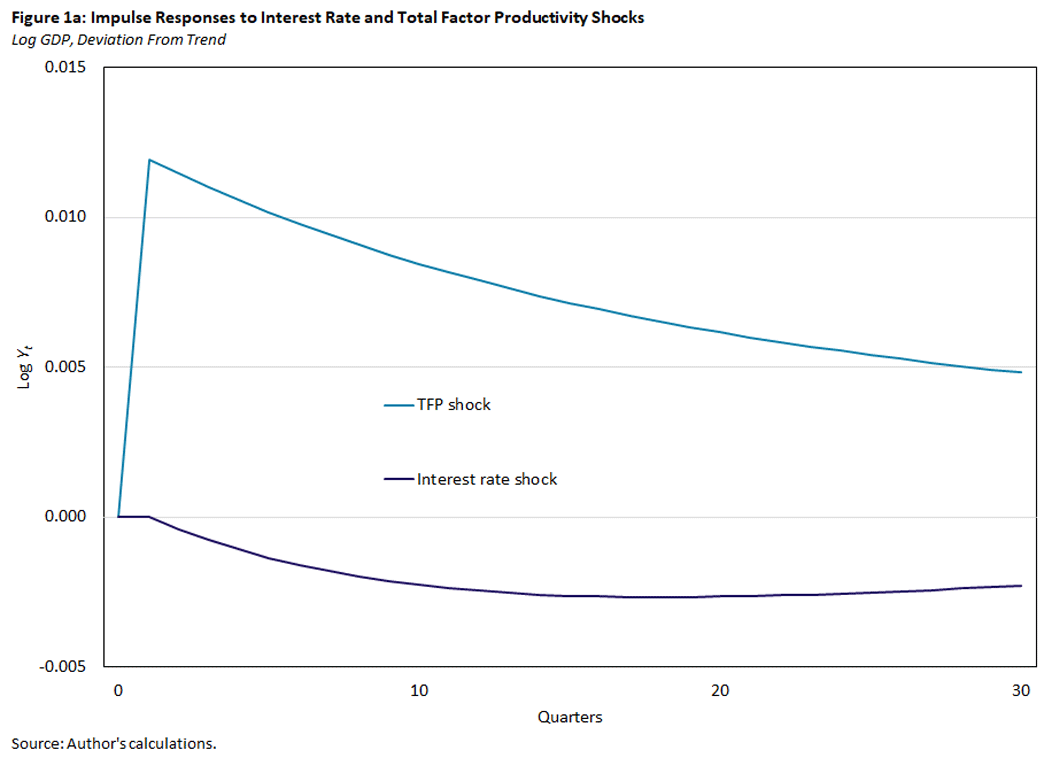

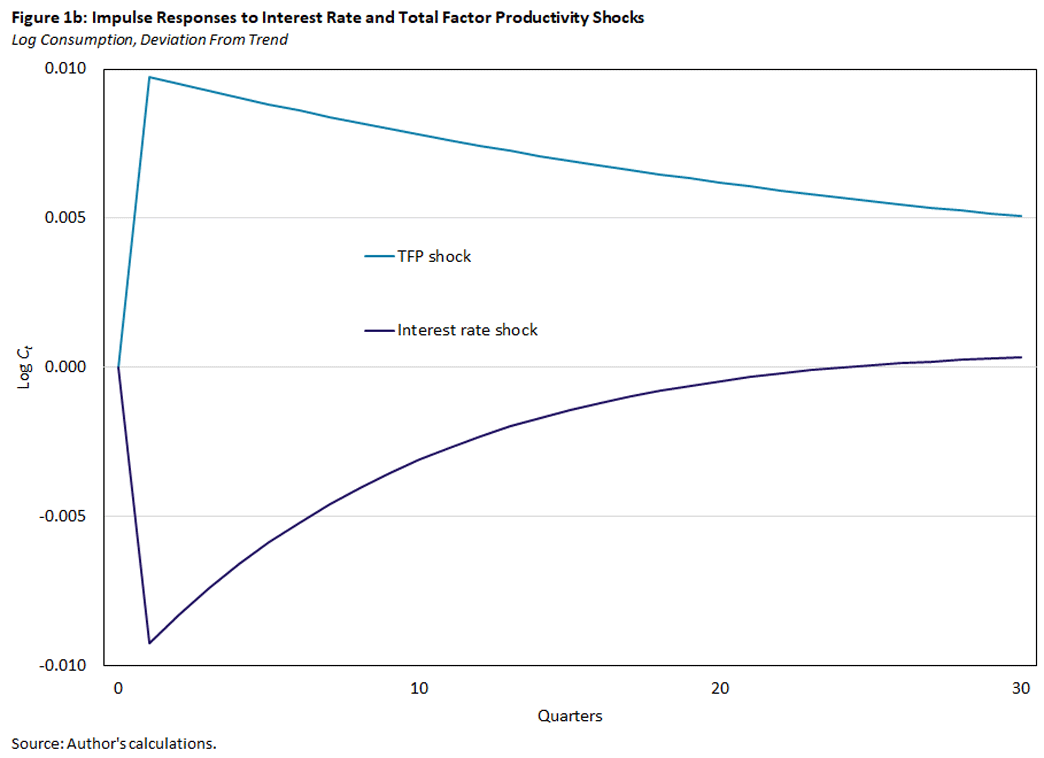

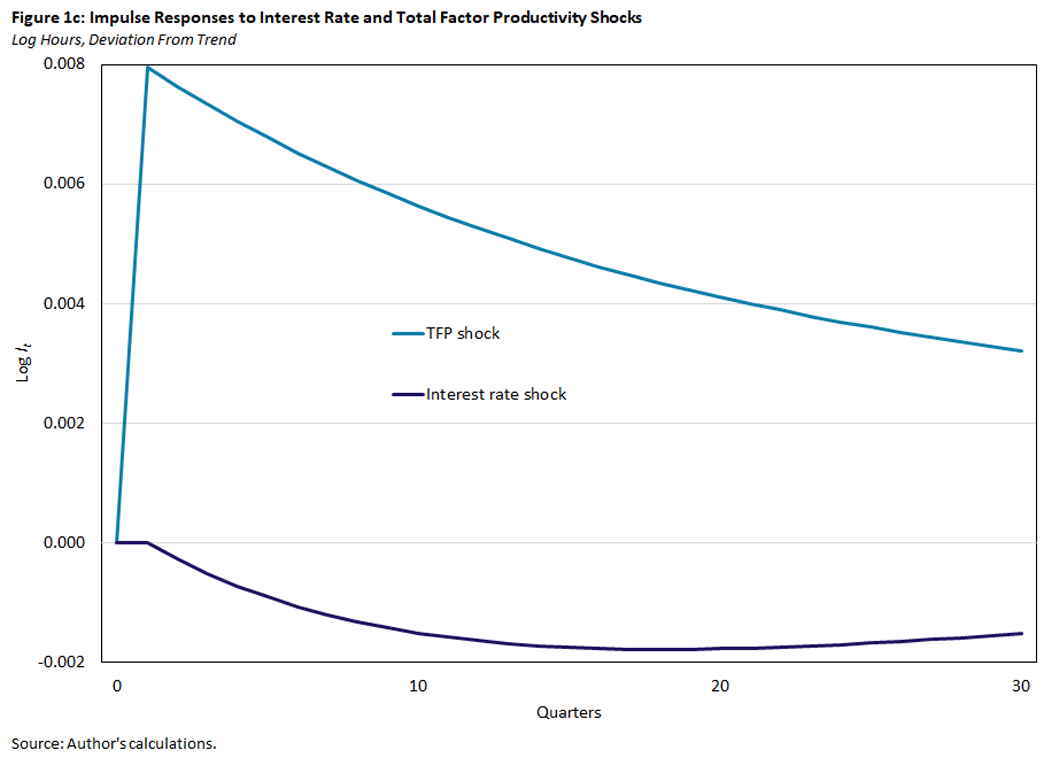

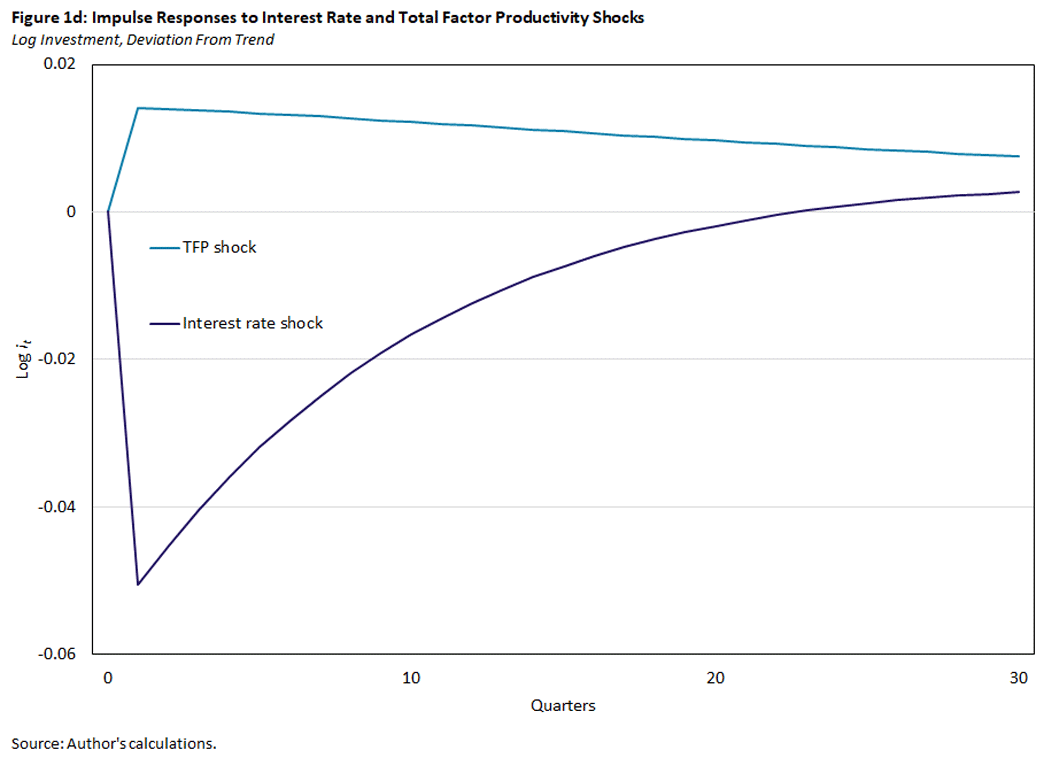

Using a structural open-economy model of the U.S., one can quantify many of these effects in a systematic way. The model here does not have default, but it does have a cost that is increasing in the debt stock, which captures the idea of a default-risk premium. It also incorporates capital adjustment costs, which is important to not exaggerate the effects of a real rate shock. By shocking the economy with a quite persistent increase of 50 basis points in the short-term real interest rate (with a shock half-life of five years), one can trace out the path of macro aggregates using impulse response functions. These are displayed in the figures below, which include a typically sized productivity shock for comparison.

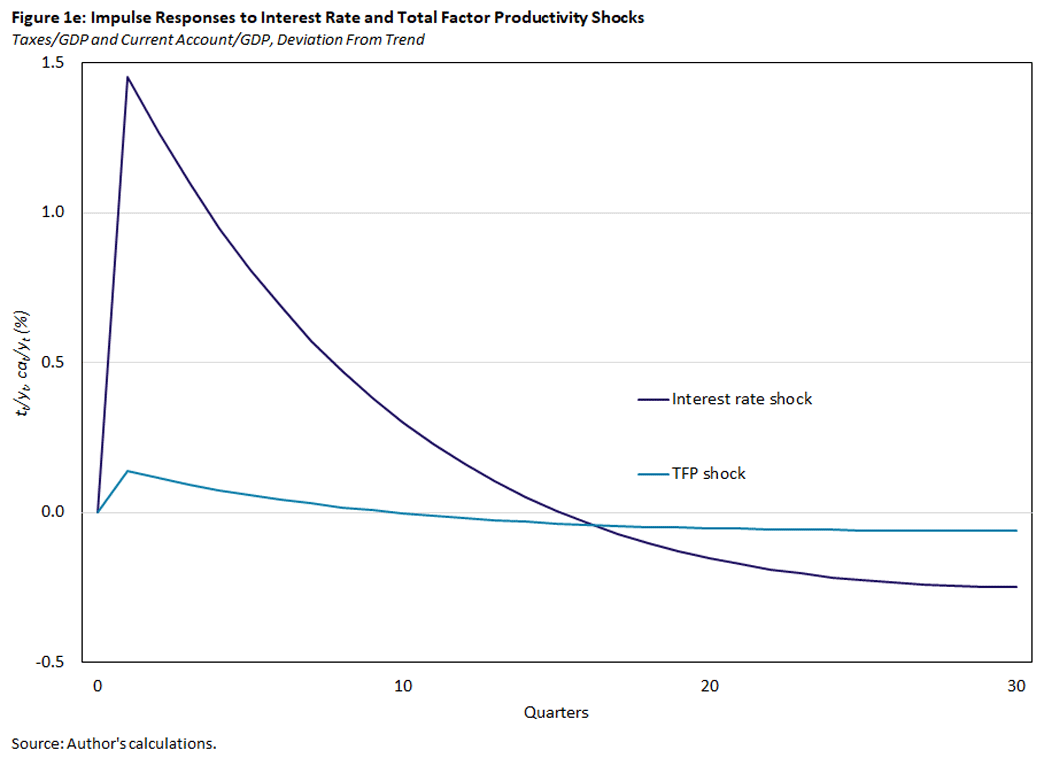

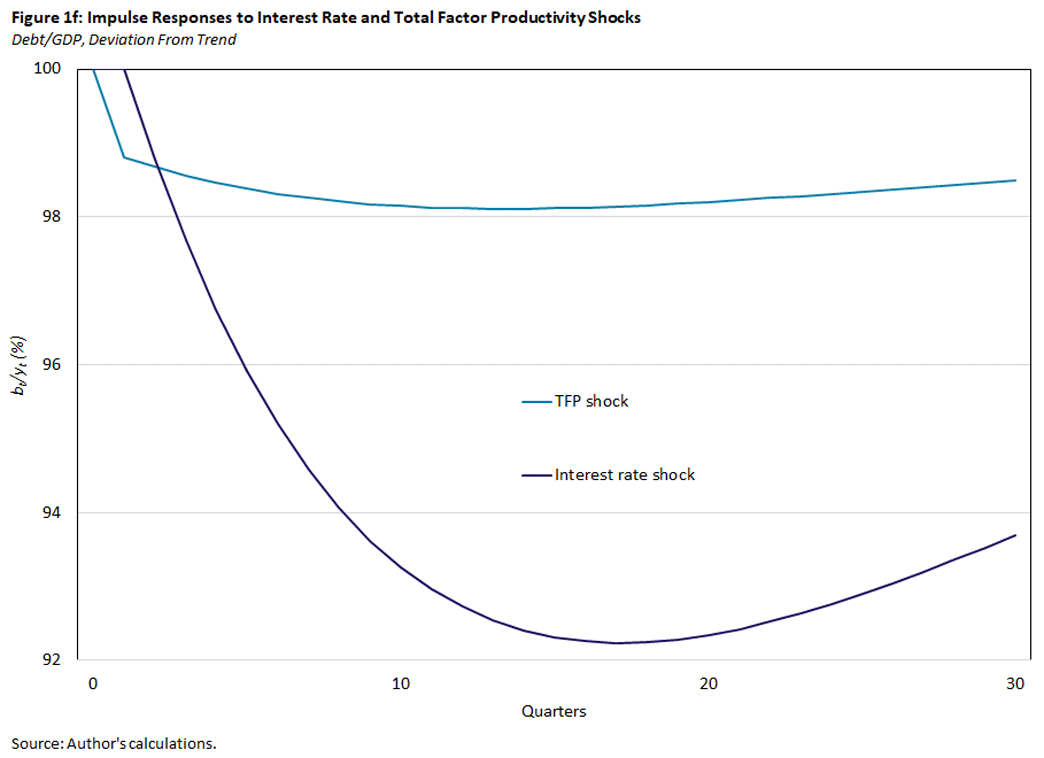

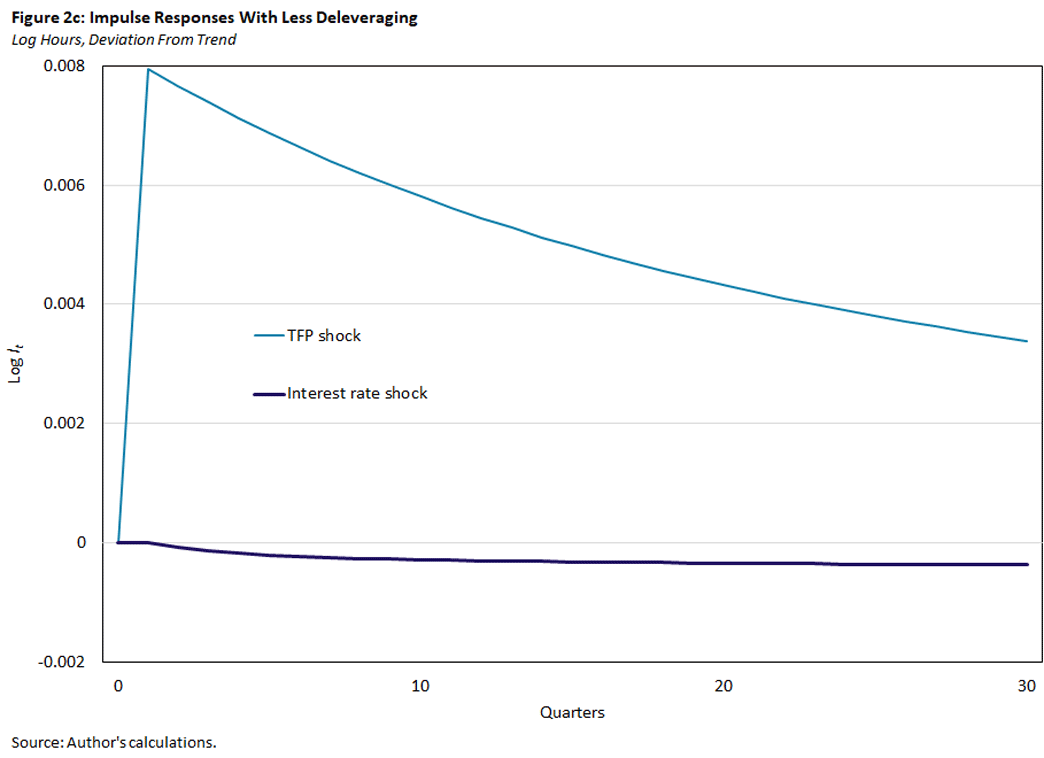

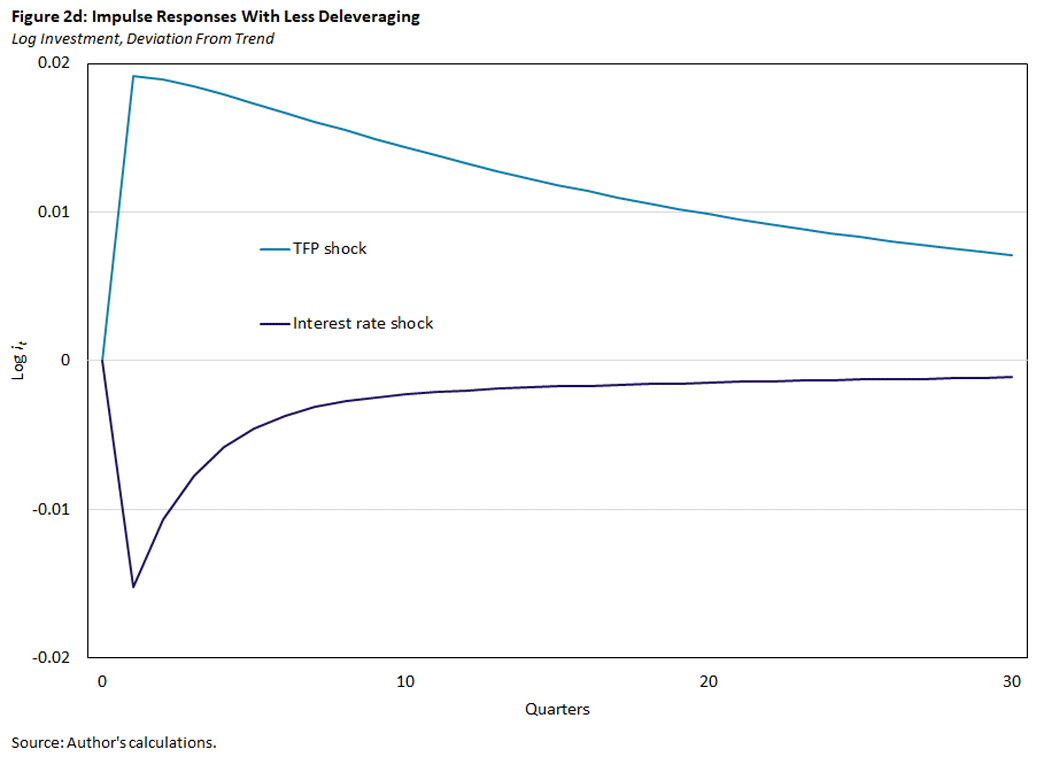

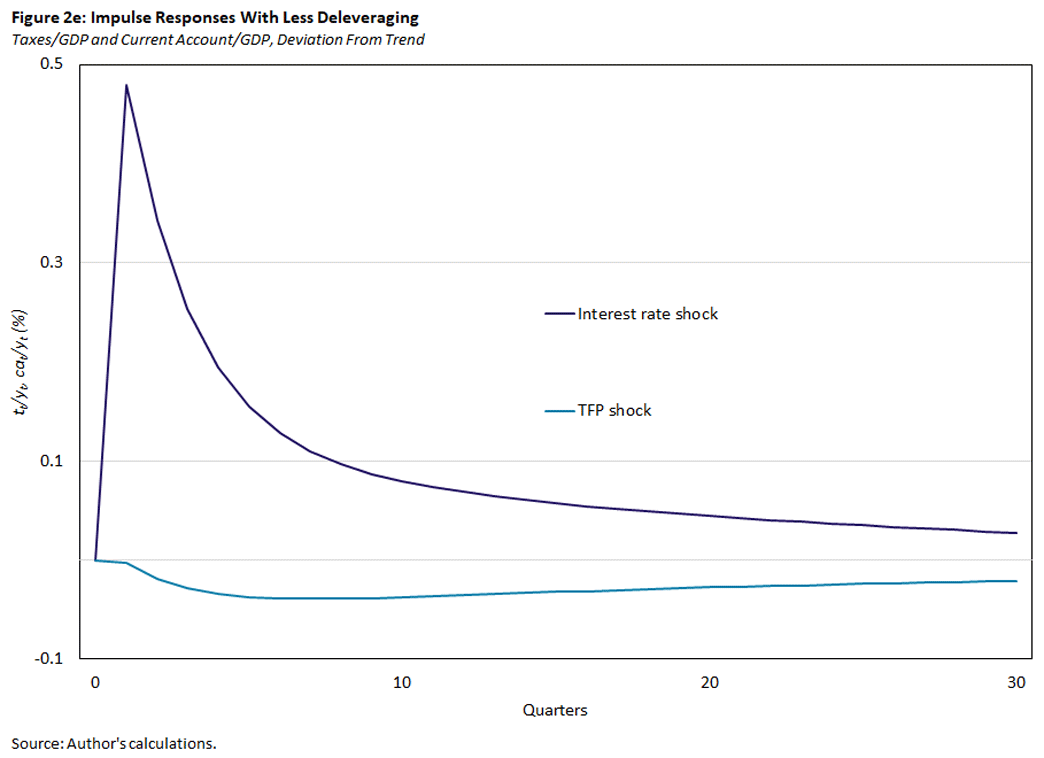

All of the forces discussed earlier can be seen in the above charts, except for asymmetry and the real exchange rate behavior. The real interest rate increase leads to less investment (5 percent on impact, as seen in Figure 1d), which gradually lowers the capital stock and, with it, GDP (30 bps, Figure 1a) and hours (20 bps, Figure 1c). Consumption falls sharply on impact (90 bps, Figure 1b), as the response to higher rates is to deleverage immediately. Taxes go up sharply, and these are sent to creditors abroad, which increases the current account (Figure 1e). In this (rational) setup, the debt/GDP threshold falls as the government borrows less (Figure 1f). While the real exchange rate (RER) here always equals 1, the positive current account response would cause an RER depreciation in a richer model. The asymmetric response comes through asymmetrically distributed borrowing rates, which have been ruled out here.

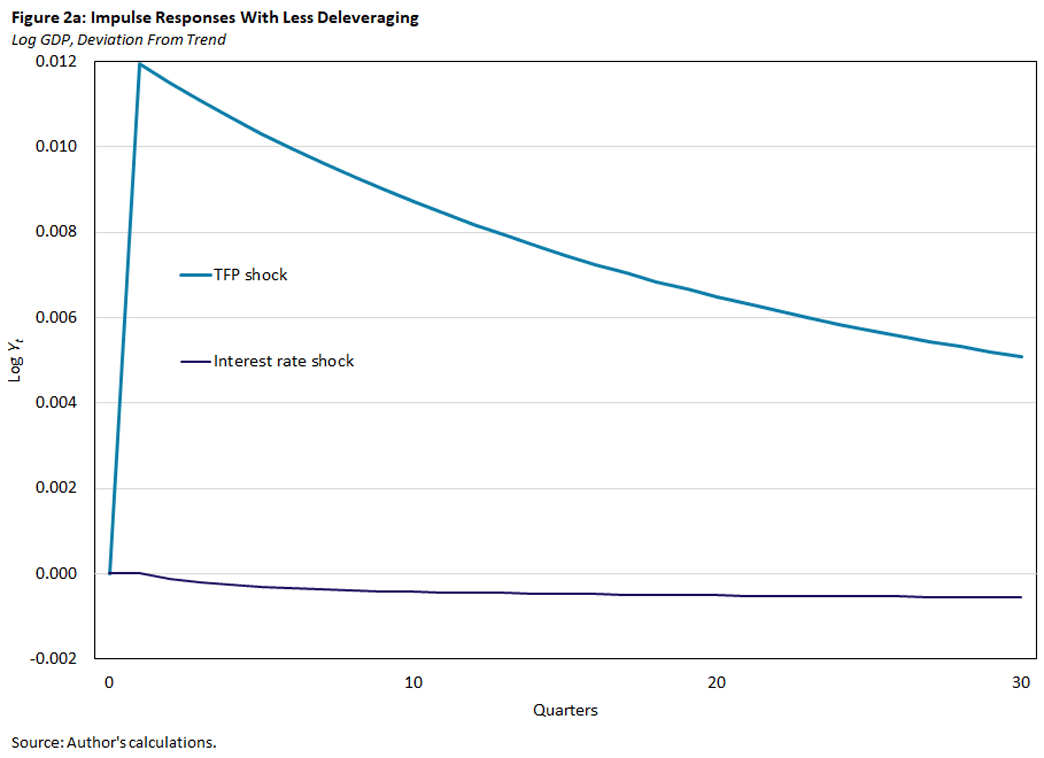

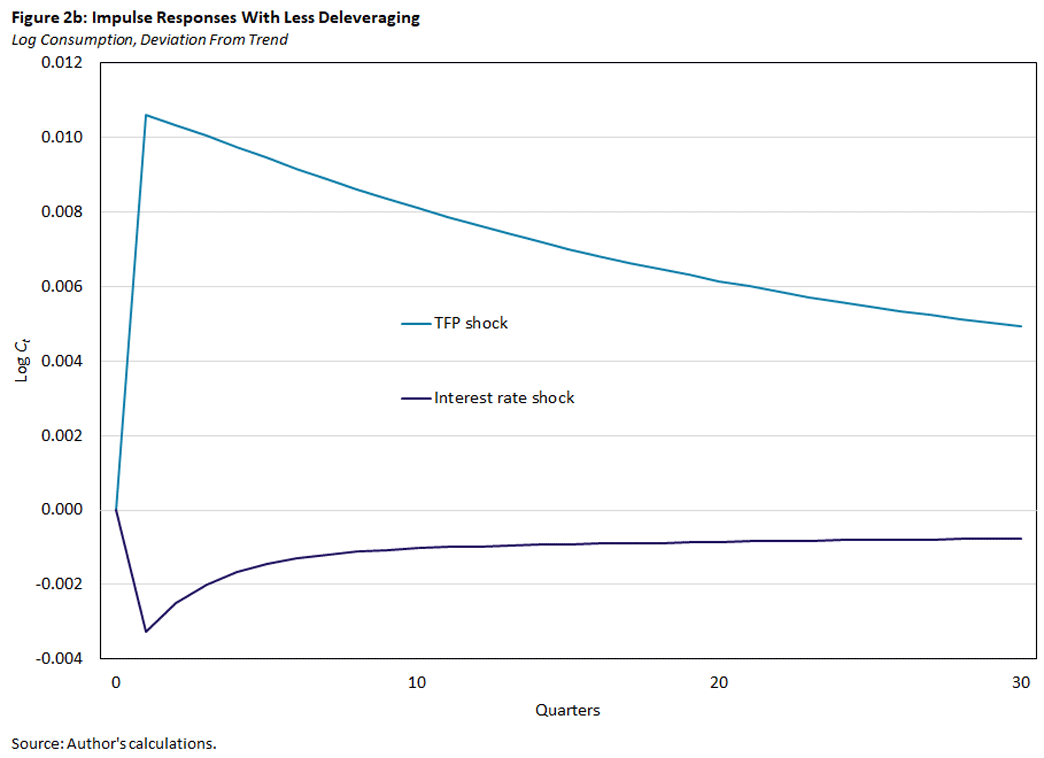

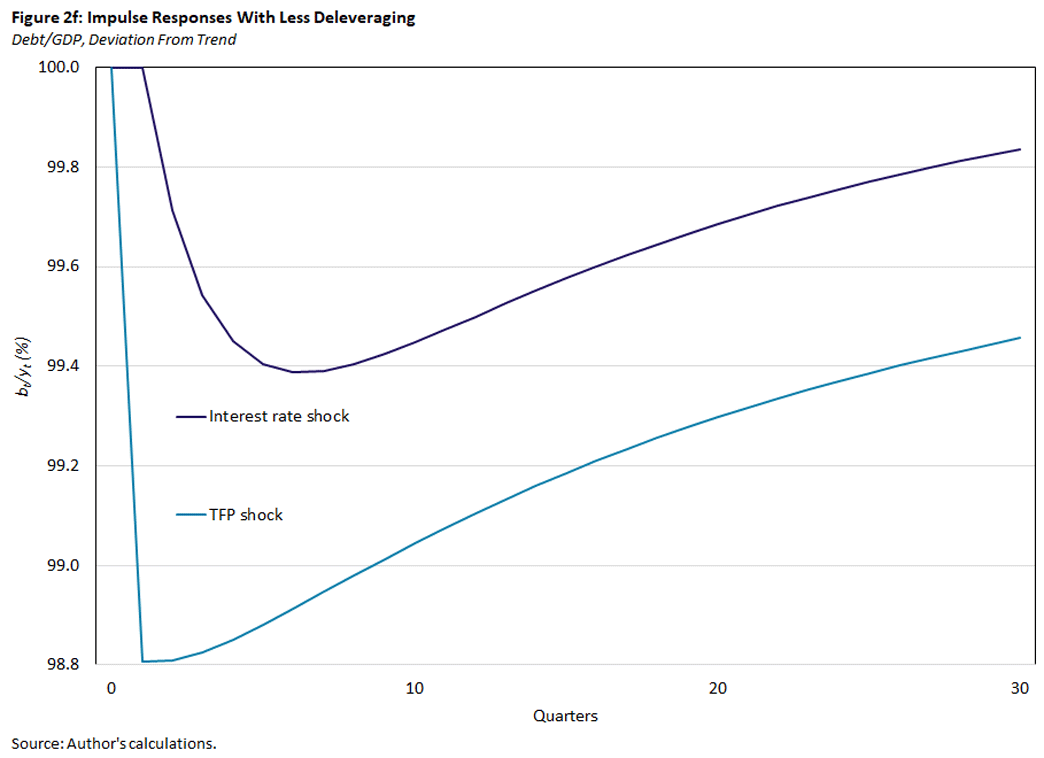

One might be concerned that the government will not deleverage in the current political environment, or at least by less than what the previous figure predicted. By changing the debt adjustment costs, the deleveraging can be dampened, and this is done for the impulse response functions in the figures below.

The debt/GDP ratio still falls, but by a much smaller amount (Figure 2f). In the very short run, this insulates consumption (Figure 2b) and investment (Figure 2d) as taxes do not rise as much as before. The downside is that in the longer-term economic activity is depressed. While consumption and investment were back to trend in 5.5 years in the first set of figures, consumption and investment essentially take longer to return to trend in the second set. Effectively, not dealing with the higher interest rate cost by deleveraging sucks life out of the economy as debt-service costs divert resources away from the private sector.

Conclusion and Implications for the Debt-Ceiling Controversy

Positive real interest rate shocks have negative consequences for consumption, investment, output, labor and real exchange rates. Only net exports and the current account stand to benefit from an interest rate shock. Additionally, risks become asymmetric, with a danger of higher spreads blowing up. These adverse consequences are optimally dealt with by deleveraging rapidly, despite a sharp short-term adjustment to consumption and investment, as it promotes long-run economic health. Failure to deleverage mitigates the short-term pain at the expense of economic stagnation.

There are some signs that raising the debt ceiling will result in effectively higher taxes. A key aspect of the tentative deal is that no more extensions of student loan deferments will be allowed except by an act of Congress. Fiscally speaking, this payment resumption will effectively be an increase in taxes of approximately $366 per month per household.1 This will reduce domestic consumption and investment, in agreement with model predictions.

At the same time, with the proposed lifting of the debt limit, it does not seem that the government is going to deleverage significantly. To the extent that borrowing costs remain high, this will result in ongoing debt-service burdens. Not deleveraging may appear to help the economy by smoothing consumption and mitigating impacts on investment, but it comes at the cost of an inefficiently long economic slump.

Grey Gordon is a senior economist in the Research Department at the Federal Reserve Bank of Richmond.

This calculation is based on the GOP Debt Ceiling Summary, which reported student loan costs as $4 billion a month, and there are 131 million households.

To cite this Economic Brief, please use the following format: Gordon, Grey. (July 2023) "The Effects of Higher Borrowing Costs: Insights from Sovereign Default Models." Federal Reserve Bank of Richmond Economic Brief, No. 23-22.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.