One of the most important reasons to develop a central bank — to furnish an elastic currency that could expand or contract with demand — was also illustrated in the 1915 Annual Report. “Credit is shortest in supply in the months of August and September, and, as a rule, is easiest immediately following the maturing of cotton in the early fall.” The inelasticity of the currency and the subsequent rise in interest rates during the periods of highest demand (primarily harvest season, holiday seasons, and financial crises) was a driver of the movement to reform the U.S. financial system that resulted in the Federal Reserve Act.

In addition to a strong agricultural presence, the Fifth District manufacturing sector had started to develop. According to the 1910 Census, 11.6 percent of employment (of those 10 years of age and older) in the District was employed in manufacturing, compared with 17.3 percent in the nation as a whole. This varied considerably by state, with 19.9 percent of Maryland workers employed in manufacturing, compared with only 0.6 percent of workers in West Virginia.

Changes in the Role of the Richmond Fed

In 1913 — as is still the case today — the United States operated under a dual banking system in which a bank can either be nationally chartered or state chartered. The Federal Reserve Act required the approximately 7,500 national banks in the United States to be members (although they continued to be supervised by the Office of the Comptroller of the Currency), but state-chartered banks had a choice of whether or not to be members of the Federal Reserve System. (The Fed now has supervisory authority over all bank holding companies as well, regardless of whether the subsidiary bank of the holding company is a national bank, state member bank, or state nonmember bank.) As of June 30, 1915, only 17 of nearly 20,000 state banks had elected to join the Federal Reserve System; one year later, that figure had increased to only 34. In the Fifth District, by the end of 1915, all 503 national banks and five of the state banks were members of the Federal Reserve System. By the end of 1920, the number of national banks had grown to 554 and state members to 56 banks — still a very small percentage of state banks in the Fifth District in that year.

The 1920s were a period of rapid economic growth, fueled by the development of the automobile, radio, major appliances, and innovations in the organization of production. But the agricultural sector remained depressed for the entire decade, and large numbers of bank failures occurred almost every year. The failure of banks was not necessarily in line with economic growth — although the pace of bank failure generally grew during the Great Depression from 1929 through 1934. Richmond Fed economist John Walter showed in a 2005 Economic Quarterly article that the ratio of the number of banks to GDP fell notably from 1921 to 1934. As U.S. banks dropped from a peak of more than 30,000 in 1920 down to a little more than 15,000 in 1934, the number of banks in the Fifth District (excluding Washington, D.C.) dropped from about 2,200 in 1920 to about 1,100 in 1935. Some of these failures might have been due to macroeconomic weakness, although some have argued that the banking industry generally had become overbuilt and that it was the macroeconomic shocks in conjunction with overbuilding that produced the 12-year retrenchment in the banking industry.

Another reason for steady declines in the number of banks in the country was changes to branching laws. According to a 2007 Journal of Law and Economics article by Rajeev Dehejia and Adriana Lleras-Muney of New York University and the University of California, Los Angeles, respectively, in 1919 only Maryland of all Fifth District states allowed branching. The McFadden-Pepper Act, passed in 1927, allowed national banks to establish local branches in the city of their home office if state law allowed branching. In 1933, the Glass-Steagall Act permitted national banks to branch within any state that allowed state banks to branch. States were still free to set branching regulations for state banks. By 1931, in the Fifth District, only West Virginia prohibited state bank branching. In 1994, with the passage of the Riegle-Neal Interstate Banking and Branching Efficiency Act, interstate branching by national banks became legal regardless of state laws. The steady decrease in the number of banks in the Fifth District and in the United States over the 20th century largely reflected the consolidation in the banking industry that resulted from this slow liberalization of restrictions on bank branching.

The operation of the supervision and regulation function in the Fifth Federal Reserve District has also been affected by the steady technological innovation and cultural changes of the 20th century. In the 1940s, the examination staff consisted of 10 examiners and 11 assistant examiners. They were all white males who were supported by the “girls” of the office staff. Also in that decade, the Examining Department got electric typewriters, with the following report from a Richmond Fed publication: “The girls in the Examining Department are finding it a little difficult to become accustomed to the machines but are hoping to soon love them, as those who are experienced predict.” The first female and black bank examiners were hired across the System in the late 1960s.

An addition to the supervision and regulation role came in 1977 when Congress enacted the Community Reinvestment Act (CRA), which was intended to encourage depository institutions to help meet the credit needs of the communities in which they operate, including low- and moderate-income neighborhoods. By requiring that each depository institution’s record in helping to meet the credit needs of its communities be evaluated by its regulator, the CRA in effect required the Reserve banks to have bank examination staff qualified to conduct these exams. At the Richmond Fed, a compliance unit was formed in 1977 and separate consumer affairs examinations began to be conducted.

Interstate Banking and Charlotte

Charlotte has always played a big role in the operations of the Richmond Fed, particularly for supervision and regulation staff. Although North Carolina was the last of the 13 original states to charter a privately owned bank, it allowed branching early: In 1814, its General Assembly gave bank directors permission to establish branches or agencies at any locations they saw fit. In 1911, Wachovia National Bank and Wachovia Loan and Trust Company merged, forming the Wachovia Bank and Trust Company, with $4 million in deposits and $7 million in total assets. In 1927, the Richmond Fed expanded to open a branch in Charlotte (the first branch was opened in Baltimore in 1918).

The importance of North Carolina as a banking center increased with the rise of a second major institution. By 1960, through a series of mergers and acquisitions, North Carolina National Bank (NCNB) emerged as the second-largest bank in North Carolina ($500 million in assets, behind Wachovia’s $658 million); by 1972, NCNB had surpassed Wachovia in total assets.

In 1981, NCNB used a loophole in the McFadden Act to buy a Florida bank because it already owned a trust company in the state. NCNB bought First National Bank of Lake City and the Fed signed off on the purchase, so NCNB became a two-state bank. In June 1985, the U.S. Supreme Court upheld regional banking compacts that allowed banking companies in Southern states to acquire and be acquired by banking companies in other Southern states, enabling them to grow without fear of competition from the much larger Northern banks. In 1988, NCNB bought First RepublicBank Corporation in Dallas. Once the acquisition was complete, NCNB nearly doubled in size to $55 billion in assets, making it the nation’s 10th biggest bank. At the end of 1991, NCNB became NationsBank.

By the end of 1997, with help from the passage of the Riegle-Neal Interstate Banking Act and another series of mergers and acquisitions, Charlotte was the nation’s number-two banking city by assets. In the fall of 1998, the Richmond Fed set up a permanent staff of examiners in Charlotte. That year, NationsBank and BankAmerica (headquartered in San Francisco) merged to become Bank of America, headquartered in Charlotte. In 2001, First Union merged with Wachovia to create the fourth largest bank in the nation, named Wachovia and headquartered in Charlotte. Thus, Charlotte now had the second- and fourth-largest banks in terms of assets.

Although Charlotte lost one of its big bank headquarters when Wachovia was bought by Wells Fargo at the end of 2008, several developments caused the number of supervision and regulation staff in Charlotte — particularly those examining large banks — to keep growing. First, Bank of America grew through its acquisition of Merrill Lynch. Second, all Federal Reserve Banks took on more responsibility with regard to large bank operations, primarily as outlined by the most comprehensive piece of banking legislation since 1935: the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The Richmond Fed’s supervision and regulation function will continue to adapt to changes in the banking environment, such as the decline in the number of community banks and the increased public scrutiny of large banks after the financial crisis.

Payments and Check Processing

Facilitating payments systems — and most particularly in 1914, the clearing of checks — was a critical part of the Federal Reserve System’s early responsibility. Checks were the most convenient and secure means of payment, but outside of the major cities, clearing checks could be a hassle, even with the correspondent banking system. The Richmond Fed Transit Department opened with seven people in 1915, but quickly grew to 276 people by 1920, and continued to grow.

In fact, the number of checks handled by the Fed grew quickly in the Fed’s first 75 years. The same was true in the Fifth District. In 1920, the Richmond Fed processed about 33 million checks; by 1950 that number had more than quadrupled to almost 150 million, and by 2000 the Richmond Fed was processing over 1.7 billion checks per year. In 1970, a regional check-clearing center opened in the Baltimore branch — the first operation of its kind to be established by a Federal Reserve Bank. In 1974, regional check-processing operations began in the Richmond and Charlotte offices, as well as in Columbia. Another regional check-processing center in Charleston, W.Va., became fully operational in 1977.

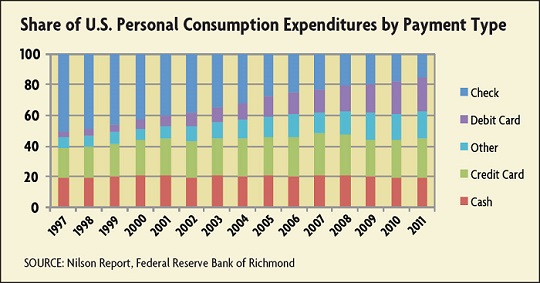

Technological developments again created a need for change in the way the Fed operated. In 2003, Congress passed legislation endorsing Check 21, an electronic means of processing checks, which took effect in October 2004. Also in 2003, the number of electronic payments exceeded the number of check payments for the first time, and the gap has only widened since. (See Chart 2.) In response, check-clearing operations across the country began to close, including those in the Fifth District. In 2003, the Federal Reserve System had 45 check-processing sites; in 2009, the Fed went down to one paper-processing site in Cleveland and one Check 21 site in Atlanta. On the other hand, the Fed continues to process and distribute cash, the demand for which has remained high among consumers despite the proliferation of electronic means of payment.