Subzero Interest

In late January, Japan's central bank, the Bank of Japan, surprised markets by announcing an unusual policy. Rather than paying banks a positive rate of return on excess reserves, it would begin charging 0.1 percent. The central bank hopes that this negative interest rate will encourage banks to increase lending and thereby spur greater economic activity in a country that has suffered from weak growth for almost two decades.

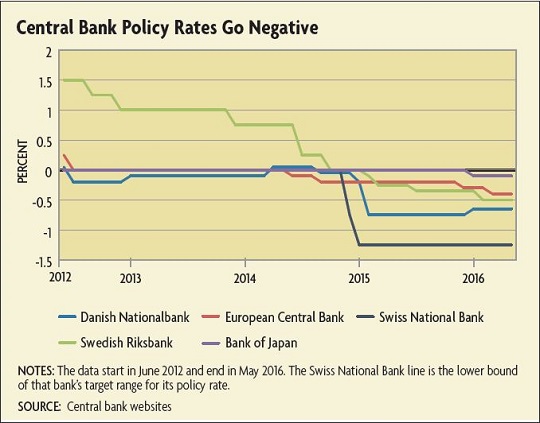

While highly unorthodox, negative interest rates are not unheard of. Switzerland adopted negative rates on foreign deposits in the 1970s to counter outside pressure on its currency. And the Bank of Japan is actually the fifth central bank to dip its toes into negative territory in more recent times. (See chart below.)

The Cash Problem

As an asset that always has a nominal return of zero percent, cash presents a sticking point for interest rates. As economist John Hicks wrote in 1937, "If the costs of holding money can be neglected, it will always be profitable to hold money rather than lend it out, if the rate of interest is not greater than zero."

Of course, the costs of holding money are not negligible. As a result, economists have long suspected that the "zero lower bound" created by cash was not exactly zero. There would be some wiggle room because it is not entirely free to hold and transact in cash, particularly in large amounts. Cash takes up some amount of physical space and is subject to theft or damage, so there is a cost associated with secure storage. Conducting large transactions with cash is also cumbersome and involves physically transporting bills. This explains why large depositors in Europe and Japan have, so far, been willing to accept slightly negative rates. Indeed, data in 2015 did not show a dramatic uptick in demand for cash in the European countries that have adopted negative rates.

But while larger clients may be more accepting of negative rates, at least for now, most banks are concerned that smaller depositors would be less forgiving. Banks in Denmark and Sweden have been willing to pass on the benefit of negative rates to borrowers like those with home mortgages, for example, but they have been reluctant to charge negative rates to depositors. Banks are concerned that retail depositors would have a much lower tolerance for negative rates, choosing instead to withdraw cash and store it under the proverbial mattress. Also, the first bank to begin charging savers could see a flight of customers to its competitors. And there are signs that even large depositors have limited tolerance for negative rates. In March, German reinsurance company Munich Re announced that it would experiment with storing physical cash in order to avoid paying the ECB's negative rates.

In a 2015 speech, James McAndrews, executive vice president and director of research at the New York Fed, noted that the expected duration of these policies also affects firms' decisions to hold cash. "The longer the negative rates are expected to persist, and the lower they are, the more favorable are the returns to investing in a vault. Once the vault investment has been made, maintaining negative rates would likely become more difficult," he said.

All together, these signs have led most economists and policymakers to believe that interest rates likely cannot go much lower. "We are basically at the effective lower bound," Jean-Pierre Danthine, former vice chairman of the governing board of the Swiss National Bank, said at a June Brookings Institution conference.

Thus, despite slightly negative rates in Europe and Japan at the moment, economist Marvin Goodfriend of Carnegie Mellon University, formerly with the Richmond Fed, says "the zero lower bound remains a serious constraint on monetary policy." Moreover, he says, uncertainty over the duration of negative rate policies can exacerbate the reluctance of banks to pass on negative rates to retail depositors, weakening the effect of the policy by inhibiting the transmission of negative rates through the rest of the economy.

Breaking Through the Lower Bound

To take interest rates more deeply negative, central banks need some way to prevent depositors from fleeing to cash. The simplest approach would be to have cash pay the market interest rate (whether positive or negative) rather than zero percent. Doing so is complicated by the anonymous nature of cash, however. Without a way to track interest payments, there would be no way to prevent currency holders from claiming multiple positive interest payments on the same bill. And if rates went negative, cash holders would have no incentive to voluntarily pay what they owed.

Economists have offered a number of solutions to this problem over the years. The earliest one came from German economist Silvio Gesell in the early 1900s. Gesell suggested that bills could be stamped to show that interest had been paid, and only stamped currency would be accepted as legal payment. Goodfriend proposed a modern take on this same idea in a 2000 article. He suggested that bills be imbedded with a magnetic strip that would track the interest due at the time of deposit.

Others have proposed doing away with cash entirely and switching to a digital currency. In a 2014 National Bureau of Economic Research working paper, Harvard University economist Kenneth Rogoff noted that paper currency comes with a number of costs to society. Because it is anonymous, cash facilitates tax evasion and criminal activity. Rogoff cited estimates that more than half of the currency in circulation is likely used to hide transactions.

At the same time, Rogoff acknowledged that there would be potential costs to eliminating currency. The U.S. Treasury currently earns a profit on each dollar issued equal to the difference between its face value and the cost to produce it (known as "seigniorage"). To the extent that demand for cash is driven by a desire for anonymous transactions, transitioning to an electronic currency that is not anonymous could result in some lost revenue for the government as demand for currency declines. Additionally, Rogoff noted that moving to a new monetary standard could shake confidence in the dollar, which might have unforeseen consequences.

Attempts to eliminate currency would likely face political opposition from those who value anonymity in legal transactions. Still, some countries, like Sweden, have inched closer to an all-digital currency. According to a 2015 report from the Bank for International Settlements (BIS), physical bills and coins in circulation are equal to only about 2 percent of Sweden's GDP (compared to roughly 7 percent for the United States). In fact, some of Sweden's largest banks no longer accept cash deposits.

In the long run, the likelihood that most countries move to all-electronic currency is quite high, Goodfriend argues. "If you give me a long time horizon of 150 or 200 years, I'd be absolutely shocked if societies did not move to eliminate the zero lower bound by making currency electronic," says Goodfriend. "As society gets increasingly digitized, the inconvenience and costs of using paper currency will become glaringly high."

Goodfriend also notes that while holders of digital currency may lose money in times of negative rates, they could actually earn a positive return when rates are above zero, something paper money currently lacks. "If we expect that interest rates are going to be positive most of the time, then for most of the imaginable future, people are going to benefit from earning interest on currency."

It may not be necessary to eliminate cash completely to achieve negative rates, however. Kimball has argued central banks could establish an exchange rate between physical currency and electronic currency at the cash window. For example, if the Fed wanted to adopt interest rates of negative 4 percent, the exchange rate for physical currency in terms of electronic currency would depreciate at 4 percent per year. Banks and financial markets would then pass along the negative rates on physical currency as well as electronic accounts to the rest of the economy. To alleviate banks' concerns about losing retail depositors, Kimball has said the Fed could reduce banks' payments to the Fed of negative interest on reserves in order to subsidize their provision of zero interest rates to small-value bank accounts. This would shield most retail depositors from the effects of negative rates.

Additionally, he argues that the depreciation of paper currency would likely be invisible in most everyday transactions, at least to a point. "If you go to the grocery store now where they accept both credit cards and cash, they're likely to accept both payments at par," says Kimball. That's despite the fact that both payment methods are not equal for merchants. They pay a fee to card networks for card transactions but don't typically pass that charge on to customers. As a result, Kimball suspects many merchants would be willing to accept the "fee" of a small depreciation of cash without passing it on to customers.

"If merchants are still accepting cash at par at the store and you're still getting a zero interest rate at your local bank, what do negative interest rates in the financial markets look like to you?" he says. "On things like car loans, they just look like lower positive rates. Most people wouldn't personally see any negative interest rates."

Uncharted Waters

While recent experiences suggest negative rates are at least possible, some have questioned whether such moves are necessary or wise.

In a recent working paper, John Cochrane of the Hoover Institution at Stanford University argued that recent experiences in the United States, Europe, and Japan have shown inflation can be stable when interest rates are at zero. This seems to contradict fears that economies could be stuck in a deflationary spiral when interest rates are near zero, which would remove some of the incentive to quickly push inflation up using unconventional policies like negative nominal rates.

Deputy General Manager of the BIS Herve Hannoun suggested in a 2015 speech that negative rates could have a number of unintended consequences. They could encourage governments to borrow more heavily, further eroding fiscal discipline. They would impose a burden on savers, particularly on retirees who rely on savings and interest income. And because of their unprecedented nature, negative rates could signal that policymakers are even more pessimistic about economic conditions than the public believed, further eroding market confidence and actually inducing more saving rather than spending. In fact, something like this happened when Japan surprised markets by going negative in January. Normally, negative rates would be expected to depreciate a currency, but the yen actually appreciated as market participants panicked and clung even more tightly to safe assets like cash.

This is why communication from central banks is critical with these policies, says Goodfriend. "Any unorthodox move is complicated if the public has not been prepared for it. In that case, the central bank cannot be sure that these things will work as intended," he says. But Goodfriend says most of the costs cited by critics of negative rates do not kick in only once rates fall below zero — they apply to all rate cuts. Cutting rates within positive territory also hurts savers and lessens the burden of public debt.

Still, negative rates represent largely uncharted territory for economists and policymakers, and many unanswered questions remain. The good news for monetary policymakers at the Fed and elsewhere is that they can wait and see how the experiments in Europe and Japan play out before making any decisions on negative rates. If it works, Goodfriend says he wouldn't be surprised to see negative rate policy spread.

"If you're standing around a pool and you don't know what the temperature of the water is," he says, "it's a whole lot easier to jump in if somebody else goes first and tells you the water's fine."

Readings

Bech, Morten, and Aytek Malkhozov. "How Have Central Banks Implemented Negative Policy Rates?" Bank for International Settlements Quarterly Review, March 2016, pp. 31-44.

Buiter, Willem H. "Negative Nominal Interest Rates: Three Ways to Overcome the Zero Lower Bound." National Bureau of Economic Research Working Paper No. 15118, June 2009.

Cochrane, John H. "Do Higher Interest Rates Raise or Lower Inflation?" Working Paper, Feb. 10, 2016.

Goodfriend, Marvin. "Overcoming the Zero Bound on Interest Rate Policy." Journal of Money, Credit and Banking, November 2000, vol. 32, no. 4, pp. 1007-1035. (Previous version available online.)

Kimball, Miles S. "Negative Interest Rate Policy as Conventional Monetary Policy." National Institute Economic Review, November 2015, vol. 234, no. 1, pp. R5-R14.

McAndrews, James. "Negative Nominal Central Bank Policy Rates: Where is the Lower Bound?" Speech at the University of Wisconsin, May 8, 2015.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.