In the aftermath of the Great Recession, the United States saw unemployment rates rise to levels it had not seen since the early 1980s as employers shed workers by the millions. Workers who had lost their jobs could not find other work and flooded into unemployment offices around the nation applying for benefits to ease the shock to their household income. Unemployment insurance claims and payouts soared, straining programs from coast to coast.

Before all was said and done, 36 states were overwhelmed and saw their programs reach insolvency, requiring them to borrow money from the federal government to continue paying benefits to qualifying workers. The trauma to states' unemployment insurance trust funds prompted policymakers in several states to make significant changes to their programs in order to place them on a more sustainable footing for the next recession. Two of those states lie in the Fifth District: North Carolina and South Carolina. This article looks at the two states' unemployment insurance programs after the Great Recession and how they have changed as a result. Moreover, it looks at how well prepared each is to weather the next economic downturn and what recent changes will mean for workers when it hits.

Employment During and After the Recession

The Great Recession had an uneven impact on employment and unemployment in the nation as well as in the Fifth District. Twelve months into the downturn, employment in the District was faring better than the nation as a whole. The District of Columbia and, to a lesser extent, Maryland and Virginia were buoyed by the stabilizing presence of the federal government. Meanwhile, the nascent renaissance in energy production was benefiting West Virginia. Thus, none of these four jurisdictions saw job losses that matched those of the nation. In fact, employment in Washington, D.C., was actually higher than it had been when the recession got under way.

Without the omnipresence of the federal government or an energy revolution of their own, North Carolina and South Carolina felt the effects of the recession immediately and severely. And the severity of the job losses persisted there throughout. By the time employment had reached its trough in February 2010, 8.7 million jobs had been lost nationally, amounting to a 6.3 percent decline, but job losses in North Carolina and South Carolina amounted to 7.8 percent and 8.2 percent, respectively

The outsized employment reaction in the Carolinas could have been expected given the severity of the downturn and the region's economic structure. Prior to the recession, both states were much more heavily concentrated in manufacturing and construction, two sectors that were particularly hard hit and where job losses were much more acute.

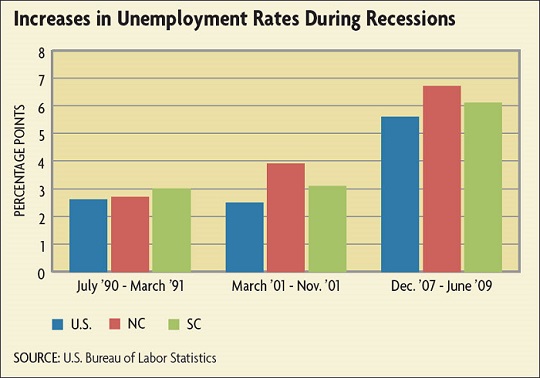

While the national rate of unemployment climbed 5.6 percentage points as a result of the Great Recession (from 4.4 percent to 10 percent), North Carolina's rate jumped by 6.7 percentage points (to 11.3 percent) and South Carolina's by 6.0 percentage points (to 11.7 percent).

But even the rise in the unemployment rates did not fully reflect the level of strain that was and would be placed on the states' unemployment insurance programs. One of the more extraordinary facets of this labor market downturn was the record high percentages of workers who were unemployed for more than 26 weeks — the long-term unemployed. Even as the number of workers entering the unemployment insurance pipeline began to wane in early 2009, still fewer were leaving it.

As a result, 36 states depleted the balance of revenues within their unemployment insurance accounts at some point during or after the recession and took out federal loans to continue paying benefits. North Carolina and South Carolina were among the most affected states. At certain points during their programs' financial crises, North Carolina had the second-highest federal loan-to-total wage bill in the country, and South Carolina was once ranked seventh.

Due to the severity of the trust fund crises, the two states took steps to reduce benefit payouts to pay down their debt to the federal government and put their programs on better-prepared footing.

Changes to Maximum Duration of Benefits

The federal-state unemployment insurance program is currently celebrating its 82nd year of existence. In the early decades of the program's history, there was quite a bit of variability in the maximum duration of unemployment insurance benefits that state legislators had written into law. And in most instances, the maximum duration was less than 26 weeks.

That began to change in the 1960s during President Johnson's "Great Society" and "War on Poverty" as states began moving toward a consensus of 26 weeks. So since the middle part of the 1960s up until the Great Recession, every state had a maximum unemployment insurance duration of at least 26 weeks.

Yet while the vast majority of state legislatures chose to set the maximum duration of unemployment insurance benefits at 26 weeks, there was (and is) nothing in federal law that mandates a maximum duration of 26 weeks.

It is somewhat surprising that this basic structure of maximum duration of benefits has held for so long. According to the National Bureau of Economic Research, prior to the Great Recession, the U.S. economy had gone through six economic downturns since the middle part of the 1960s, and state legislators across the nation made no significant adjustments. Why?

There are a variety of reasons why states choose not to undertake such reductions in maximum durations. One of the biggest lies in the spirit of the program itself — to provide some support to workers who have lost their job through no fault of their own. The unemployment insurance payments help ease the blow to households'ability to continue spending to meet basic needs while simultaneously easing the shock to the broader macroeconomy, since consumer spending is such a big part of it.

Another reason maximum durations were not reduced during those prior downturns is that none were nearly as severe as the Great Recession, nor did they have the same impact on the solvency of states' unemployment insurance programs. Reducing the maximum duration during a "regular" downturn is politically unpopular, while reducing it during an expansion is not a political priority.

The severity of the Great Recession changed the math. States that reach insolvency are still required by law to make benefits payments to qualified recipients. To do so, they borrow money from the federal government. Those funds, however, do not come without their costs — employers in affected states are assessed an additional payroll tax until the state has paid off its debt, thereby increasing effective labor costs in the state.

Following the Great Recession, policymakers in North Carolina and South Carolina were forced to balance objectives that were somewhat at odds: paying off the federal debt, providing benefits to ease the burden of unemployment on households, and keeping taxes on employers low to stimulate job creation.

In 2011, South Carolina was in the first wave of states that passed legislation to decrease the maximum number of weeks of eligibility, reducing its maximum from 26 weeks to 20 weeks effective on June 14, 2011. This change remains in effect today. South Carolina's law change was pretty straightforward, with the maximum duration simply tied to the individual claimant's eligibility to continue receiving benefits.

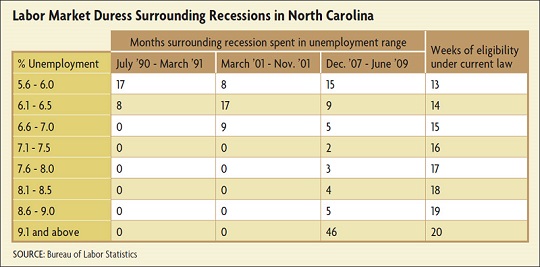

North Carolina's changes were slower in coming, more complex, and somewhat controversial. In the 2013 legislative session, North Carolina's assembly passed a law that not only reduced the maximum duration for eligibility, but also instituted a variable maximum that is dependent on the state's unemployment rate. (See table below.) The state's maximum eligibility ranges from 12 weeks (when North Carolina's unemployment rate is less than 5.5 percent) to 20 weeks (if the unemployment rate tops 9 percent). An individual's maximum benefits duration is determined by the state's seasonally adjusted unemployment rate at the beginning of a six-month "base period" in which the initial claim was filed. The six-month base periods begin in January and July each year.

Today, North Carolina's maximum benefit duration is 12 weeks because the state's unemployment rate was at 5.3 percent in January 2017, the benchmark used to establish the duration. If recent unemployment trends hold (the rate was 4.1 percent in July), North Carolina's maximum duration will still be 12 weeks in the first half of 2018, tying it with Florida for the lowest maximum duration of any state in the nation.

Changes to Maximum Weekly Benefits

The other conceivable step that states could have taken to reduce unemployment insurance benefits payouts in the aftermath of the Great Recession was to reduce the maximum benefit amount. During the period in which states' trust funds were under the most duress, however, there was a strong disincentive to take that step.

Early on in the recession, Congress passed a supplemental appropriations bill that created a temporary emergency unemployment compensation program, EUCO8, to help hard-hit states by providing additional weeks of emergency unemployment benefits that were funded entirely by the federal government's general revenues fund. (This program was in addition to a permanent program already in place that extended unemployment insurance benefits; that program was funded by both the federal government and the states equally.) But one key stipulation in EUCO8 was a "nonreduction rule" that prohibited states from receiving the federal funding if they "actively" changed the method by which maximum benefits were calculated in order to reduce that benefit. (Some states had laws on the books prior to EUCO8's enactment that automatically reduced the maximum benefit amount in certain circumstances, most notably if the state's economy-wide average wage decreased. Such "passive" adjustments were allowed under the nonreduction rule.)

So reluctant were states to give up those federal funds that only two chose to do so — New York and North Carolina. In February 2013, North Carolina's legislature enacted legislation that included provisions to actively reduce the weekly benefit amounts in the state beginning with claims filed on or after July 1, 2013. Important changes to the program included reducing the maximum weekly benefit amount from $535 to $350, eliminating indexing, and making workers wait a week before receiving unemployment insurance benefits each time they file a claim. In enacting this legislation, the state violated the "nonreduction" rule, effectively ending North Carolina's participation in the program.

The impact of North Carolina's efforts to reduce its weekly benefits payments is noticeable in its rankings relative to other states. In the fourth quarter of 2012, North Carolina's average weekly benefit amount expressed as a percent of average weekly wages in the state was 36.6 percent, the 21st highest in the nation. By the first quarter of 2017, that percentage had fallen to 27.6 and its ranking to 43rd.

Implications for Public Finance and Workers

Both states' unemployment insurance programs have returned to solvency. A combination of improving economic conditions and reductions in benefits payments allowed both North Carolina and South Carolina to clear their program's federal loan balances by the end of the first quarter of 2015. With the federal debts paid off, employers in the two states are no longer paying the tax penalty. Today, only California has not yet repaid all of its federal program loans.

But while the states' programs have recovered from the prior economic downturn, how well prepared are they for the next? And what might workers expect when it comes?

The national economic expansion is currently in its ninth year, long of tooth by historical standards, so it is prudent for states to ponder these questions.

Regarding the first, analysts' best measure of a state's unemployment insurance program preparedness is its average high cost multiple, or AHCM. The AHCM is based on the state's reserve ratio (total funds to total wages) and its benefit cost rate (roughly speaking, benefits paid as a percentage of total wages). In particular, the AHCM is the state's calendar year reserve ratio divided by its average high cost rate (the average of the three highest calendar year benefit cost rates of the last 20 years, or last three recessions). An AHCM of 1.00 is believed to be the minimum level of funding for a state to withstand an average recession for one year. In the first quarter of 2017, North Carolina's trust fund was barely minimally funded with an AHCM of 0.99 while South Carolina's was not, with an AHCM of 0.60.

So what implications do these changes to state unemployment insurance programs have for unemployed workers when the next recession comes? In South Carolina, the picture is pretty straightforward. Unemployed workers in the Palmetto State can anticipate receiving up to 20 weeks of regular unemployment benefits (as opposed to 26 weeks during the Great Recession).

In North Carolina, the picture is much more complex, as the maximum duration of weekly benefits will depend on the unemployment rate in January and July each year. With the unemployment rate currently at 4.1 percent, workers in the state are eligible to receive up to 12 weeks of unemployment insurance compensation. For unemployed workers to be eligible for an additional week, the state's unemployment rate would have to rise by 1.5 percentage points from its current level. And for workers to be eligible to receive the maximum benefits duration of 20 weeks, the unemployment rate would need to increase by roughly 5 percentage points.

Since no two recessions are identical, it is difficult to predict what will happen when the next one hits North Carolina. But history shows that the state's labor markets tend to deteriorate more than the national average during downturns. (See chart below.) Thus, applying today's laws to yesterday's recessions can be illustrative.

During the labor recession of the early 1990s, North Carolina's unemployment rate increased from a low of 3.4 percent in January 1990 to a high of 6.1 percent, a rate that prevailed from January 1992 until August 1992. The unemployment rate was above 5.5 percent (the state's new threshold for increasing the maximum eligibility duration by one week) for 25 months. It was above 6.0 percent for eight of those months. (See table above.) If the current law were in effect then, unemployed workers would have been eligible to receive 13 weeks of unemployment insurance compensation during two base periods, and 14 weeks of eligibility for two others.

During the 2001 recession, the state's unemployment rate started its ascent at 3.0 percent, eventually rose as high as 6.9 percent, and spent 34 months above 5.5 percent. If the current state law were in effect then, workers would have been eligible to receive up to 13 weeks of regular unemployment insurance benefits in one six-month base period, 14 weeks in two periods, and 15 weeks in two more.

An Unemployment Insurance Squeeze?

The upshot is that if the next recession is anything close to the two that preceded the Great Recession, unemployed workers in North Carolina should not expect to receive more than 15 weeks of regular unemployment insurance benefits. Moreover, they can expect much less in average weekly benefits during the weeks they are unemployed.

In enacting laws that shortened the maximum duration of benefits, many policymakers argue that unemployment insurance creates a disincentive for unemployed workers to find suitable employment, creating a friction in the labor market and keeping the unemployment rate higher than it would be otherwise. It is important to recognize, however, that that argument is predicated on an assumption that there is a demand for labor.

A good proxy for the strength of labor demand in a state is growth in its total employment level. After all, firms hire additional workers when they see, or expect to see, an increase in the demand for the goods and services that they produce. Thus, changes in payroll employment can shed some light on the demand for labor.

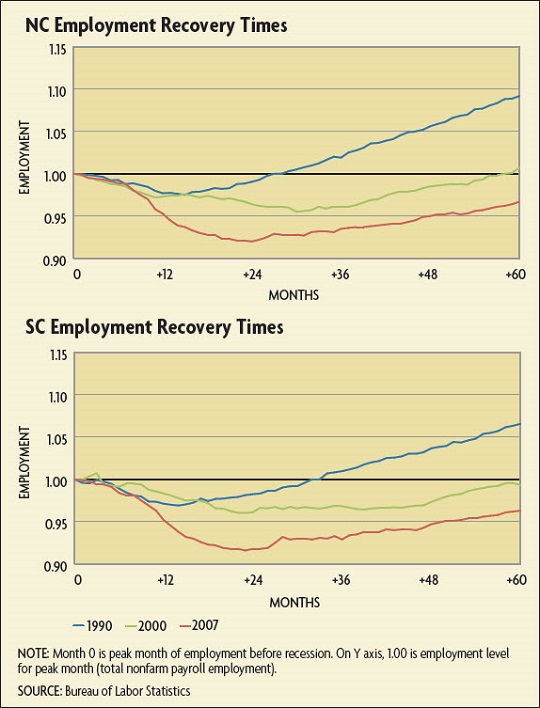

Here again, recent historical experience is useful in thinking about how the changes in unemployment insurance programs may affect workers in the next economic downturn. During the recovery from the 1990-1991 national economic recession, a period that was famously referred to as the "jobless recovery," it took North Carolina 28 months to recapture all of the jobs that were lost during the downturn, on net. In South Carolina, 32 months passed before pre-recession levels of employment were restored.

As bad as the experience was during the jobless recovery of the early 1990s, it was even worse coming out of the recession that occurred a decade later. During the recovery from the brief, shallow economic downturn of 2001, approximately five years elapsed before employment in North Carolina and South Carolina returned to pre-recession levels. And following the Great Recession, it took almost seven years for pre-recession job levels to be restored in the United States and the Carolinas. (See charts below.)