A debate is now unfolding over whether the long duration of low inflation — despite apparently loose monetary policy — requires fresh thinking by the Fed. This question has immediate policy implications in terms of how and when the Fed should act in continuing to tighten monetary policy. But it also raises the broader question of just what it means to "meet" or "miss" inflation targets. For example, does it matter if inflation remains modestly lower than the target? The Fed's inflation target is "symmetrical," but over what horizon should symmetrical fluctuations be expected to occur? And if the Fed considers inflation "too low" at some point, should it rethink its target or its tools?

A Question of Credibility

When the Federal Open Market Committee (FOMC) announced the 2 percent target in January 2012, it emphasized two objectives. One was that it would help "anchor," or firmly establish, long-run expectations that inflation would stay low and stable. The other was that it would let the Fed achieve more transparency and accountability in communicating monetary policy. With regard to anchoring, the undershooting of the target has caused some economists, and Fed critics more broadly, to ask whether the Fed can in fact remain credible if, in their view, it keeps missing the target — especially as it makes the case for higher interest rates.

On the FOMC, this concern has been most frequently expressed by Minneapolis Fed President Neel Kashkari, who contends that the Fed should be worried about missing the target — and if need be, hold off on tightening until inflation data are consistently moving higher. He sees the risk of holding off on further hikes (potentially leading to higher inflation) as more benign than tightening too soon (potentially hurting the recovery). While most labor market indicators have strengthened, he argues that there is still slack, most notably in the relatively low labor force participation rate for prime-age workers.

has been most frequently expressed by Minneapolis Fed President Neel Kashkari, who contends that the Fed should be worried about missing the target — and if need be, hold off on tightening until inflation data are consistently moving higher. He sees the risk of holding off on further hikes (potentially leading to higher inflation) as more benign than tightening too soon (potentially hurting the recovery). While most labor market indicators have strengthened, he argues that there is still slack, most notably in the relatively low labor force participation rate for prime-age workers.

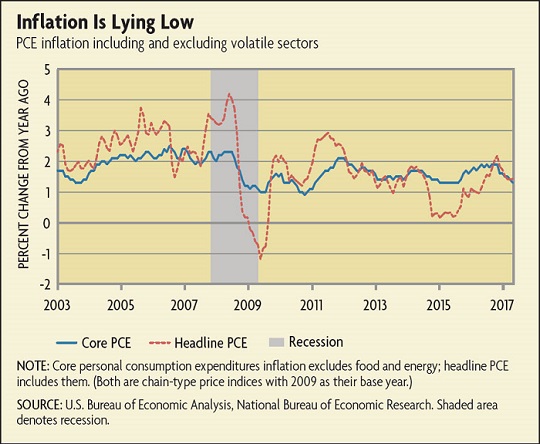

But many economists still share the view that this low average inflation doesn't constitute a true "miss." For example, core PCE steadily rose from late 2015 to late 2016 to graze 2 percent. This group also notes the 2 percent inflation target is a long-run objective that smooths out price volatility, whereas the recent inflation softness is likely temporary and driven by sector-specific price decreases — such as in cell phone services, housing, and health care; these are all examples of how a degree of volatility and uncertainty is built into overall inflation measurements in the short to medium term.

"This is a very important debate, but to call low inflation a 'puzzle' at this point is overstated," says Johns Hopkins University economist Laurence Ball, who has argued for a higher inflation target of 4 percent. "So much depends on the time period in question and which measure you use. The numbers bounce around a lot and there are large error terms. If we're seeing inflation at 1.6 percent instead of 2 percent, I'd call that normal statistical noise."

To most on the FOMC, including Chair Janet Yellen, these short-term fluctuations also don't undermine the view that long-run inflation will be moving back toward 2 percent in the next couple of years. Yellen has reasserted this view in recent testimony and speeches, albeit with some caveats.

"We continue to anticipate that inflation is likely to stabilize around 2 percent over the next few years," she said in a Sept. 26 speech . "But our understanding of the forces driving inflation is imperfect, and we recognize that something more persistent may be responsible for the current undershooting of our longer-run objective."

. "But our understanding of the forces driving inflation is imperfect, and we recognize that something more persistent may be responsible for the current undershooting of our longer-run objective."

A Post-Recession Conundrum

Whatever the implications of low inflation may be, most economists still agree that its persistence has been a surprise given other fundamentals. Since the recession, U.S. growth has been steady, if slow, while unemployment has fallen sharply. Most other labor-market indicators have also tightened. In addition, monetary policy has been highly stimulative since 2008 — benchmark interest rates were near zero from 2008 to 2015, and the rate hikes ever since have been incremental. The mystery is that this stimulus, combined with the increase in labor utilization, hasn't been met by an uptick in inflation — the scenario that most economists and the markets had expected.

Such consistently low inflation to date is also below the Fed's own inflation projections. Since the 2012 inflation-target announcement, the FOMC's Summaries of Economic Projections (SEP) — a quarterly report with forecasts of key indicators — have regularly overestimated future inflation as well as gross domestic product growth and the committee's expected trajectory of short-term interest rate hikes (known as the "dot plot"), according to a 2016 study by the Kansas City Fed. In essence, the Fed projected a quicker return to strong growth and higher inflation, which in turn would let the FOMC pursue "liftoff" — getting interest rates off the "zero lower bound" — and eventually shrink its balance sheet holdings of $4.5 trillion that expanded through its bond-buying campaign. But as the report also notes, the Fed was hardly alone in assuming higher inflation and stronger growth — this was also the consensus of private-sector projections.

by the Kansas City Fed. In essence, the Fed projected a quicker return to strong growth and higher inflation, which in turn would let the FOMC pursue "liftoff" — getting interest rates off the "zero lower bound" — and eventually shrink its balance sheet holdings of $4.5 trillion that expanded through its bond-buying campaign. But as the report also notes, the Fed was hardly alone in assuming higher inflation and stronger growth — this was also the consensus of private-sector projections.

One part of this surprise involves the relationship known as the Phillips Curve, named after the British economist A.W. Phillips. It states that when unemployment falls, inflation rises, one reason being that real wages go up as available workers become scarcer. Higher wages prompt employers to pass those costs on to consumers, which causes prices to rise. When unemployment is high, by contrast, employers have room to cut wages, which eases inflationary pressure. Empirically, however, this relationship has not been consistent over the decades. For example, the correlation was stronger in the mid-to-late 1960s, whereas the current environment of falling unemployment amid low inflation is quite similar to the early 1960s and the late 1990s. Today, most economists agree there is no tight, fixed correlation; rather, some argue there are occasional circumstances when the correlation is stronger, such as when the labor market is very tight.

Nonetheless, many economists and FOMC members generally expected at the start of the recovery that inflation would rebound once the labor market healed. This has not happened. Unemployment is now 4.1 percent, down from the 2009 high of 10 percent, while inflation has stayed quiescent. This apparent "flattening" of the Phillips Curve has received much attention from economists. Among some tentative explanations is the rising importance of long-term inflation expectations relative to unemployment in determining actual inflation in the short term; very low inflation expectations might keep inflation muted even if unemployment is also falling. Other economists point to the importance of understanding how different measurements of inflation, as well as the type of workers who are unemployed, play a role in shaping the curve. (Research by the Federal Reserve Board of Governors suggests labor force slack did account for a large part of the inflation "shortfall" below 2 percent after the recession, but less so in recent years as more transitory factors came into play.) Amid these competing explanations, many economists today say that more study is needed to understand the causal relationship between inflation and unemployment — if there is one — and what truly "anchors" inflation in the long run.

The 'New Normal'

Another reason why low inflation is unexpected lies on the monetary policy side. Since the recession, the Fed and most other major central banks have pursued exceptionally accommodative policies by keeping benchmark rates near zero. Inflation-adjusted (or "real") interest rates have sometimes dropped below zero as a result of very low nominal rates, while another key conceptual measure — the equilibrium or "natural" interest rate — has also dropped below zero by most estimates.

The natural rate is important for understanding, among other things, the degree of accommodation. It represents the inflation-adjusted short-term interest rate when the economy is at full employment. It's not observed but is estimated as a function of other variables such as productivity, savings, demographics, and expected long-term growth. When it falls, it's often interpreted as an indication that long-term growth prospects are also falling — perhaps the result of an aging population or slowing productivity. When short-term real interest rates fall below the natural rate — which has generally been the case during most of the recovery — monetary policy is considered accommodative. Most models see the estimated natural rate as having slightly risen in the past couple years, and this is one reason some economists argue that higher nominal interest rates are now appropriate.

Where is the natural interest rate today, and what is its relationship to inflation? While estimates differ somewhat, economists generally believe the natural rate has fallen dramatically since the recession, both in the United States and abroad. According to a well-known San Francisco Fed model that incorporates data on inflation, output, and nominal interest rates, the U.S. natural rate averaged between 2 percent and 2.5 percent in the 2000s. It then dropped from about 2 percent at the start of the Great Recession to zero in late 2010 and has hovered around zero since then, with a slight uptick in the last few years. A Richmond Fed model produces a similar trend with a slightly higher natural rate at present. And while the natural rate is independent of inflation — and is independent of monetary policy — a low natural rate may push down inflation expectations by reinforcing the belief among consumers and firms that monetary policy will be constrained by the zero bound in the future.

In short, inflation has behaved in unexpected ways, staying subdued despite growing labor market tightness and a historic degree of accommodation. Some economists — pointing to the fact that low inflation, along with a low natural rate, is actually a global phenomenon — say this environment marks a "new normal."

Raising Expectations

How much are inflation expectations changing in the "new normal"? One challenge is that many different gauges can come into play. For example, survey-based measures that poll individuals or firms are more stable and tend to give higher readings, while measures that are drawn from financial market participants tend to be lower, and some have shown a recent decline, according to recent San Francisco Fed research. Some economists are pointing to these different trends to ask whether inflation expectations, in the aggregate, are falling. In some recent speeches, Yellen has suggested that when interest rates are close to the zero lower bound, the management of inflation expectations becomes even more important than usual in controlling inflation. One tool she pointed to was the Fed's practice of "forward guidance," which involves making public statements that not only outline future policy, but say which factors could change that policy. In this "new normal"environment, she noted, such tools are even more critical — and if a central bank seeks long-run inflation at 2 percent, it has to understand how to move long-run expectations upward as well. (See "When Talk Isn't Cheap," Econ Focus, First Quarter 2013.)

that when interest rates are close to the zero lower bound, the management of inflation expectations becomes even more important than usual in controlling inflation. One tool she pointed to was the Fed's practice of "forward guidance," which involves making public statements that not only outline future policy, but say which factors could change that policy. In this "new normal"environment, she noted, such tools are even more critical — and if a central bank seeks long-run inflation at 2 percent, it has to understand how to move long-run expectations upward as well. (See "When Talk Isn't Cheap," Econ Focus, First Quarter 2013.)

"We need to know more about the manner in which inflation expectations are formed and how monetary policy influences them," said Yellen in a 2016 speech, noting that both actual and expected inflation are ultimately tied to the inflation target. But it's not clear how this anchoring takes place, she added.

"Does a central bank have to keep actual inflation near the target rate for many years before inflation expectations completely conform?" she asked. "Can policymakers instead materially influence inflation expectations directly and quickly by simply announcing their intention to pursue a particular inflation goal in the future?"

A Fresh Strategy?

As noted above, one important reason behind the Fed's 2012 announcement of the 2 percent target was transparency: The Fed wanted to present a benchmark that would convey to the public its view of how much inflation to expect in the long run and anchor expectations accordingly. And recent FOMC minutes indicate that almost all committee members still believe that this target is appropriate.

But there is an alternative approach, advocated by San Francisco Fed President John Williams, known as "price-level targeting," which gives the Fed the flexibility to adjust its inflation targets so it can "catch up" on future inflation when it's low — and vice versa. As he sees it, a more flexible approach like a price-level target would shore up the Fed's credibility. This strategy would adjust the inflation target to the trajectory of prices and deviations from the natural unemployment rate rather than a fixed numeric target. In essence, when inflation is unusually low, the Fed could set a higher target; when inflation picks up, the Fed would adjust the inflation target back downward. To Williams, price-level targeting can also work around the constraint set by the zero lower bound because it signals to the public that the Fed is willing to pursue higher inflation even when real and nominal rates are around zero.

"A price-level target provides greater clarity on where prices will be 5, 10, and 30 years into the future, time horizons that people think about when buying a car, a home, or planning for retirement," Williams said in a presentation last May. "This should lend itself to greater transparency and clarity for the public — especially when interest rates are constrained by the lower bound."

Most other FOMC members, by contrast, have not publicly embraced such an approach or any change to the 2 percent target. And Yellen has expressed skepticism that a varying or higher target would have made much difference during and after the recession, as well as concern that the Fed's commitment to stable inflation could come into question if it changed the target "opportunistically."

Beyond the relatively narrow question of the nominal target, however, economists inside and outside the Fed are giving fresh attention to understanding the relationship between inflation and inflation expectations and to whether the anchoring process has changed. "Extreme economic events have often challenged existing views of how the economy works and exposed shortcomings in the collective knowledge of economists," noted Yellen in her speech last fall, citing the Great Depression of the 1930s and Great Inflation of the 1970s. "The financial crisis and its aftermath might well prove to be a similar sort of turning point."

Readings

Ball, Laurence, and Sandeep Mazumder. "A Phillips Curve with Anchored Expectations and Short-Term Unemployment." National Bureau of Economic Research Working Paper No. 20715, November 2014. (Paper available with subscription.)

Blanchard, Olivier, Eugenio Cerutti, and Lawrence Summers. "Inflation and Activity: Two Explorations and their Monetary Policy Implications." National Bureau of Economic Research Working Paper No. 21726, November 2015. (Paper available with subscription.)

Christensen, Jens H.E., and Jose A. Lopez. "Differing Views on Long-Term Inflation Expectations." Federal Reserve Bank of San Francisco Economic Letter No. 2016-11, April 4, 2016.

Kahn, George A., and Andrew Palmer. "Monetary Policy at the Zero Lower Bound: Revelations from the FOMC's Summary of Economic Projections." Federal Reserve Bank of Kansas City Economic Review, First Quarter 2016, vol. 101, no. 1, pp. 5-37.

Lubik, Thomas and Christian Matthes. "Calculating the Natural Rate of Interest: A Comparison of Two Alternative Approaches." Federal Reserve Bank of Richmond Economic Brief No. 15-10, October 2015.