Subprime Securitization Hits the Car Lot

The car dealers deliberately inflated borrowers' incomes — sometimes without the borrowers' knowledge — to ensure the loan applications would be approved and they'd make the sale. The lender knew the applications were fraudulent and the borrowers were likely to default, but it didn't care because it could package the loans into securities and sell them off to investors. At least, that's the version of events described in an action brought by the attorneys general of Massachusetts and Delaware against Santander Consumer USA, a subsidiary of the Spanish bank Banco Santander that specializes in auto financing. In March 2017, Santander agreed to a $26 million settlement that includes $19 million in relief to more than 2,000 borrowers.

To many observers, Santander's alleged lending practices look alarmingly similar to those that contributed to the housing boom and bust a decade ago, lending weight to broader concerns that rising delinquencies indicate an auto lending "bubble" is about to burst. "Auto Loan Fraud Soars in a Parallel to the Housing Bubble,"proclaimed one headline. "Are Car Loans Driving Us Towards the Next Financial Crash?" asked another.

Regulators and policymakers also have expressed unease. In the fall of 2016, for example, the Office of the Comptroller of the Currency warned that auto lending risk was increasing and that some banks did not have sufficient risk management policies in place. Fed Gov. Lael Brainard pointed to subprime auto lending as an area of concern in a May 2017 speech; her concerns were repeated — and amplified — the next month in a speech by then-Gov. Stanley Fischer.

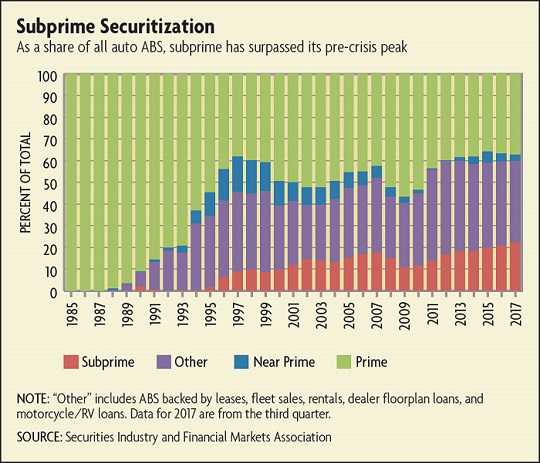

While it's not obvious whether the increase in subprime auto lending is a significant departure from past cycles, it has raised eyebrows coming so soon after the mortgage crisis — especially as delinquencies have begun to rise. In addition, an increasing share of those loans have been securitized and spread through the financial system, much like mortgages before the housing bust. Still, even if the auto finance industry were poised for a fall, the effects on the financial system could be limited — although the auto industry itself might take a hit.

Buy Now, Pay Later

In 1919, General Motors (GM) had a problem. The innovation of the assembly line a half-dozen years earlier by Henry Ford had made it cheaper and easier to build cars, but that meant GM needed its dealers to buy in bulk — and the dealers needed people to buy more cars. The solution was credit, but banks were leery of making loans for a relatively new invention they didn't know how to value. (Around the same time, the Federal Reserve warned banks against financing "automobiles that are used for pleasure.") So GM launched its own financing company, the General Motors Acceptance Corporation (GMAC), to enable dealers to stock more inventory and consumers to buy more cars. Other car manufacturers eventually followed suit, and today, every major auto manufacturer has its own "captive" finance company.

The next major innovation in auto finance arrived half a century later. Banks and credit unions had entered the market by this point, but loans generally were only available to borrowers with strong credit histories. That began to change in 1972, when Detroit businessman Don Foss founded Credit Acceptance, an independent finance company, to finance sales at his network of used car dealerships. Credit Acceptance was the first company to specialize in auto loans to borrowers with limited or poor credit history, known today as "subprime" loans, and its success spawned numerous competitors.

One of those was Ugly Duckling, an Arizona-based used car dealership that expanded quickly during the 1990s. (The company is now known as DriveTime.) Ugly Duckling mainstreamed the "buy here, pay here," or BHPH, dealership format, in which the dealer is also the lender, typically to borrowers with very poor or no credit. BHPH dealerships often require borrowers to make their payments in person, hence the name; interest rates may be as high as 30 percent.

Today, roughly 86 percent of all new cars in the United States are purchased via financing; about two-thirds of those transactions are loans and one-third are leases. Captives and banks issue the majority of new car loans and leases; as of the second quarter of 2017, they had 53 percent and 29 percent market share, respectively. Credit unions currently finance around 13 percent of new cars, with the remainder financed by independent finance companies, BHPH dealerships, and other lenders. In the used car market, about 55 percent of cars are financed, the vast majority via loans. At present, banks make 35 percent of used car loans, slightly more than their share of the new car market. Credit unions, independent finance companies, and BHPH dealerships play a much larger role in the used car market than they do in the new car market, with 27 percent, 17 percent, and 13 percent market share, respectively.

While a consumer can work directly with a lender and shop for a car with a pre-approval in hand, about 80 percent of car financing is arranged through dealerships. The dealer sends the loan application to a number of lenders with whom it has a relationship, and a lender who is willing to make the loan will respond with a "buy" rate. The dealer then has some discretion to either lower the rate and absorb the difference in order to make the sale, or to charge the purchaser a higher rate and keep the difference as compensation for serving as middleman.

Motor Trends

Household auto debt fell during the Great Recession, as did all types of household debt excepting student loans, but has rebounded more quickly than other types. Between the second quarter of 2010 and the second quarter of 2017, outstanding auto debt increased nearly 70 percent, from $700 billion to $1.2 trillion, according to the New York Fed's Quarterly Report on Household Debt and Credit. In contrast, credit card debt increased just 5 percent, from $7.4 billion to $7.8 billion. Auto loans are now the third-largest form of debt behind mortgages ($8.7 trillion) and student loans ($1.3 trillion).

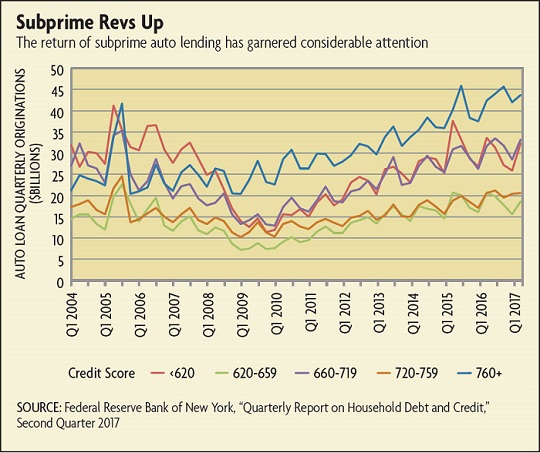

Subprime auto debt contracted sharply during the Great Recession but growth resumed soon after. While there is no legal definition of prime or subprime, a credit score of 620 is generally the cutoff in auto finance; credit scores range from 300-850. Between 2010 and 2015, average quarterly originations to subprime borrowers more than doubled, from $15 billion per quarter to $31 billion per quarter (albeit still below the high of $34 billion per quarter in 2005), according to New York Fed data.

With the mortgage crisis fresh in many people's memories, the increase in subprime auto lending garnered considerable attention. But the growth was comparable to growth in other credit categories. Loans to borrowers with a credit score between 660 and 719 increased from an average of $17 billion per quarter to $31 billion per quarter. Loans to "super prime" borrowers, those with a credit score above 760, grew less in percentage terms but have surpassed the pre-recession peak. (See chart below.) "The subprime pipe was turned off after the financial crisis," says Melinda Zabritski, the senior director for automotive finance solutions at Experian. "When the pipe got turned back on, the increase looked dramatic, but we were coming out of a trough."

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.