Who Values Access to College?

A quantitative model of college enrollment suggests that the value of college access varies greatly across individuals. Forty percent place no value on the option to attend despite large public subsidies, while 25 percent would enroll even without the subsidies. In the model, redirecting public funds from those who attend college irrespective of subsidies to those who don’t attend even with subsidies both preserves college enrollment and improves overall outcomes. While these two groups are clearly visible only in the model, and not in the data, this analysis suggests that more-targeted policies have potential.

At first glance, attending college appears to be quite valuable. Individuals with at least a four-year degree tend to earn more over their working lives than workers without a four-year degree and are far less likely to become unemployed. But there are caveats to these benefits. First, a large share of students who enroll in college do not graduate, and there is relatively little reward in the labor market for partial college completion.1 Second, even graduation is no guarantee that an individual will realize the average returns, as these returns are subject to both economy-wide risks (for example, a recession) and individual risks (for example, illness).

There is some evidence that would-be enrollees understand the individual risks and rewards they face. Recent research has shown that individual characteristics related to college preparation, such as high school grades and standardized test scores, are strongly correlated with the chances of successful college completion.2 Some students thus may determine prior to enrolling that they have a small chance of graduating, which would lower the value of attending, and choose not to enroll in the first place.

College is also heavily subsidized. One of the authors of this Economic Brief (Athreya) and Janice Eberly of Northwestern University have estimated that subsidies reduce the direct cost of attending a public university by between 40 percent and 50 percent.3 (Around three-quarters of U.S. students attend a public university.4) But for the many high school graduates who are not well-prepared to attend college, and who thus may choose not to enroll, this subsidy is likely of little value. In a recent paper, four authors of this brief — Athreya, Ionescu, Neelakantan, and Vidangos — examine how the value of college varies across the population of U.S. high school graduates and the importance of the college subsidy to this valuation. They also study whether it might be possible, at least potentially if not in practice, to improve outcomes via policies that are more targeted than the blanket reduction currently in place.5

The Model

To study these questions, the authors develop a model that allows for differences across high school graduates with respect to their initial skill level (that is, their initial "human" capital); how efficiently they can further accumulate human capital; how likely they are to complete college; the individual-specific uninsurable earnings risks they face, such as job loss or illness; and their initial wealth. The students in the model then must make choices about whether to enroll in college, how to finance it if they do enroll,6 how much they want to consume, how much time they want to allocate to learning, and what assets to invest in.

Since variations across enrollees' ability to complete college and accumulate human capital are inherently unobservable, the authors calibrate their model to be consistent with observed earnings and college-completion outcomes. The authors use data from the Current Population Survey on annual earnings from 1963 through 2013.7 College enrollment and completion data come from the Beginning Postsecondary Student Longitudinal Study 2004/2009 and from the National Education Longitudinal Study for 1988, which followed a sample of eighth graders from 1988 until 2000. These surveys also include data on the students' "expected family contributions" from their federal student aid applications, which determine how much federal aid students are eligible to receive. This measure serves in the model as a proxy for students' initial wealth.

Who Values College?

To determine the value individuals place on college, Athreya and his coauthors conduct a thought experiment made possible by the ability to compare their baseline economy (which is set to reflect current U.S. policy) to a hypothetical economy in which college is not available. The "value" is the gain, in terms of consumption, that individuals realize when they move from the no-college economy to the baseline. A key element of this comparison is that in the alternative economy, individuals can still make decisions about other financial and human capital investments, such as investing in risky versus risk-free assets or on-the-job training, knowing that college is not available. This helps ensure that the value of college is not overstated.

The researchers find that overall, individuals place a value of about $6,000 per year on access to college, or nearly 15 percent of their total consumption (assuming that average consumption is about $40,000 annually).8 But there are interesting insights beyond this simple value. At one end of the distribution, nearly half of the population appears to place no value on access to college. At the other end, about one-quarter of the population values college at a level equivalent to 30 percent of their total consumption.

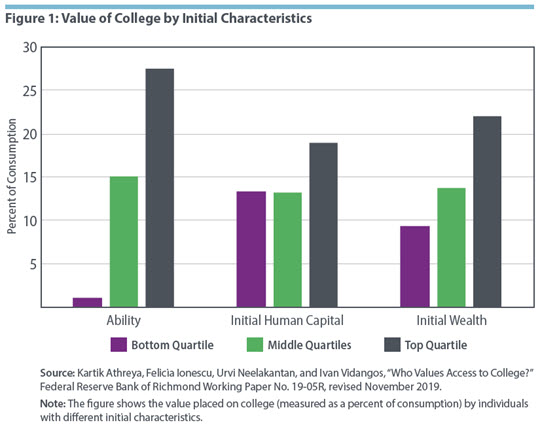

The variation in the value of college comes from the variation implied by the model in students' "initial conditions" — learning ability,9 initial human capital, and initial wealth. (See Figure 1 below.) For those in the lowest quartile of the ability distribution, access to college is worth very little on average — about 1 percent in consumption-equivalent terms. The value rises rapidly with ability, reaching about 28 percent of consumption, on average, for those in the top quartile of ability. This is not surprising, as college completion is nearly guaranteed for these individuals; given the large college earnings premium, the opportunity to invest in college is worth a lot to them.

The story is similar for initial wealth. Individuals in the bottom quartile value college the least, on average, while those in the top quartile value it the most, on average, although the gains do not rise quite as sharply as in the case of ability. This result is mainly driven by a positive correlation between initial wealth and other individual characteristics, as implied by the model-estimation procedure. The gains are less clearly ordered when it comes to the role of initial human capital, reflecting a trade-off: those with low initial human capital face both a higher marginal return to investing in college (in part because they experience lower foregone earnings while in college) and a higher risk of non-completion.

The Importance of Subsidies for the "College-Value Proposition"

How much do current subsidies contribute to the value that individuals place on college? The authors address this question by comparing their baseline model to an economy in which college is not directly subsidized. They find that, overall, college is about 5 percentage points less valuable without the direct subsidy. But like the value of college, the importance of the subsidy varies considerably across individuals for the same reasons. For the students most poorly positioned to do well in college (because of their initial characteristics), the subsidy makes no difference — the value of college access is zero with or without the subsidy. This result largely stems from the fact that these students foresee that their chances of completion are low and choose not to enroll in college even when it's available. People with favorable initial conditions, in contrast, place a very high value on the subsidy. At the same time, these individuals place a high value on college even without the subsidy, which suggests that although they value the subsidy, they still would enroll in college without it. Overall, the authors identify three categories of people in the model: those who would always enroll in college, with or without the subsidy (24 percent of the population); those who would never enroll (46 percent); and the remaining 30 percent, whose enrollment depends on the presence of the subsidy. The authors dub these individuals "switchers."

Benefits from Targeted Subsidies

The fact that nearly a quarter of the population would enroll in college even without any subsidy while 46 percent wouldn't attend even with subsidies suggests that enrollment outcomes could be preserved and average well-being improved by redirecting funds from the "always enroll" group to the "never enroll" group. To study this possibility, Athreya and his coauthors consider an experiment in which college is no longer subsidized for those who always enroll, and the funds that were accruing to this group are divided among those who never enroll in the form of a stock index fund that becomes available in the first year of retirement.10 Two important features of this experiment are that 1) it simply redirects, but does not increase, existing public funding, and 2) it perfectly preserves current college investment decisions since no funds are diverted from the switchers.

The researchers choose a stock index fund at retirement as the alternative policy for two reasons. First, research has shown that stocks offer returns and risks similar to investing in college.11 Second, making the fund available only at retirement makes it comparable to human capital in the sense that both assets are subjected to risks throughout working life but can be nonetheless borrowed against to some extent. Unlike human capital, however, the returns to the stock market are unaffected by individual characteristics or idiosyncratic risk — by construction, a stock market index fund carries the same return and risk for all investors.

Not surprisingly, the individuals who always enroll in college — and place a high value on the subsidy — strongly prefer the baseline economy with the subsidy, while those who never enroll prefer to receive the stock index retirement fund. But because the group that never enrolls is about twice the size of the group that always does, there is an aggregate welfare gain of about 1 percent from reallocating the provision of subsidies. Put another way, the average person in the economy would experience gains worth about $400 annually.

This demonstration of a beneficial reallocation of public support is not intended as a policy proposal, since it is not practically possible to group students in the way the experiment requires. It is intended solely to illustrate the size of potential missed opportunities that may currently exist. First, the finding that the subsidy has the most value for already-well-prepared students suggests that the existing structure of support is not wholly consistent with the motivations that may drive subsidizing college, such as increasing equality of opportunity. Second, while college does not differ from stocks as an investment in the broad nature of its financial returns, it clearly differs from stocks as a target for public support. This research suggests that such divergence may warrant further consideration.

Athreya and his coauthors stress also that their findings should not be read as a sweeping statement about, or indictment of, college education nor as an exhortation to enter the stock market. Instead, the findings highlight the importance of college readiness. Differences in college readiness drive differences in college returns, so much so that poor preparation almost fully nullifies the high payoffs accruing to those who complete college. Put another way, the high current payoffs to college completion contain a clear signal about the importance of college preparation. These findings provide additional support for the large body of research that has found early childhood environments are critical in determining how effectively individuals can acquire human capital in the future.

Kartik Athreya is director of research and Jessie Romero is director of research publications at the Federal Reserve Bank of Richmond. Felicia Ionescu is chief of banking and financial analysis and Ivan Vidangos is a principal economist in labor markets at the Board of Governors of the Federal Reserve System. Urvi Neelakantan is senior research director at the Centre for Advanced Financial Research and Learning, which is affiliated with the Reserve Bank of India. She also is a senior policy economist in the Research Department of the Richmond Fed.

According to the National Center for Education Statistics, 40 percent of first-time, full-time students who enrolled in a public four-year university in the fall of 2011 did not complete their degrees within six years.

Lutz Hendricks and Oksana Leukhina, "How Risky Is College Investment?" Review of Economic Dynamics, October 2017, vol. 26, pp. 140–163.

Kartik Athreya and Janice Eberly, "Risk, the College Premium, and Aggregate Human Capital Investment," Federal Reserve Bank of Richmond Working Paper No. 13-02R, revised November 2018.

The College Board, Trends in College Pricing 2018.

Kartik Athreya, Felicia Ionescu, Urvi Neelakantan, and Ivan Vidangos, "Who Values Access to College? " Federal Reserve Bank of Richmond Working Paper No. 19-05R, revised November 2019.

Students have numerous options to finance college in the model, including any accumulated savings, borrowing on the student loan market, and borrowing on the open credit market. They also have access to need-based and merit-based grants.

Data obtained through IPUMS at the University of Minnesota.

In 2014 dollars.

The ability to accumulate human capital — "learning ability" — must be interpreted with care. The authors assume, as is standard in the class of models they employ (so-called "Ben-Porath" models), that it is fixed over time for each agent. In other words, by the time agents enter the model, they have learned as much as they can about how to learn. Ability reflects learning tools and skills conferred on the young and, in sum, measures the effectiveness with which an individual can turn time into human capital. In contrast, initial human capital represents the actual stock of learning accumulated by the time the individual completes high school, which may be the result of investments made in the individual’s human capital by his or her parents, the school system, and the community at large. Since learning is lifelong, human capital can increase over the course of the individual’s life as long as he or she invests time in it.

This proposal is similar in spirit to policies that encourage asset building among households, such as the child-development accounts that have been promoted in many countries. For an overview, see Vernon Loke and Michael Sherraden, "Building Assets from Birth: A Global Comparison of Child Development Account Policies," International Journal of Social Welfare, March 2009, vol. 18, no. 2, pp. 119–129.

See Kenneth Judd, "Is Education as Good as Gold? A Portfolio Analysis of Human Capital Investment," Manuscript, 2000; also see George Psacharopoulos and Harry Anthony Patrinos, "Returns to Investment in Education: A Decennial Review of the Global Literature," World Bank Policy Research Working Paper No. WPS 8402, April 2018.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.