Do Black Households Face Higher and More Volatile Inflation?

Inflation affects different households in different ways. I use detailed data on spending in retail outlets by Black and White households in the U.S. and study the racial inflation disparity. I find that Black households experienced slightly higher and significantly more volatile inflation in consumer goods from 2004 to 2020 compared to White households. More than two-thirds of the difference in inflation volatility can be explained by the fact that Black households are disproportionately more likely to consume goods with volatile prices.

This is the first article in a series by Munseob Lee, Claudia Macaluso and Felipe Schwartzman on price volatility and how it can vary among families of different demographics.

It is often assumed that inflation affects all households the same. But recent measurements of inflation inequality show this is far from true. In this article, I provide evidence from spending in retail outlets over the period 2004-2020 that Black households in the U.S. faced higher and more volatile inflation than White households.

Measuring Inflation for Black and White Households

I start by measuring price indexes for Black and White households using a standard price index — the Laspeyres price index. This index is used to measure the economy's general price level and cost of living, and it has two components:

- The consumption basket at the base period

- The price change from the base period to the observation period

To construct race-specific price indexes, we need data on race-specific consumption basket and price changes, which are not readily available. To overcome this measurement challenge, I use detailed data on household spending in retail outlets to analyze how average prices for purchases changed for Black and White households.

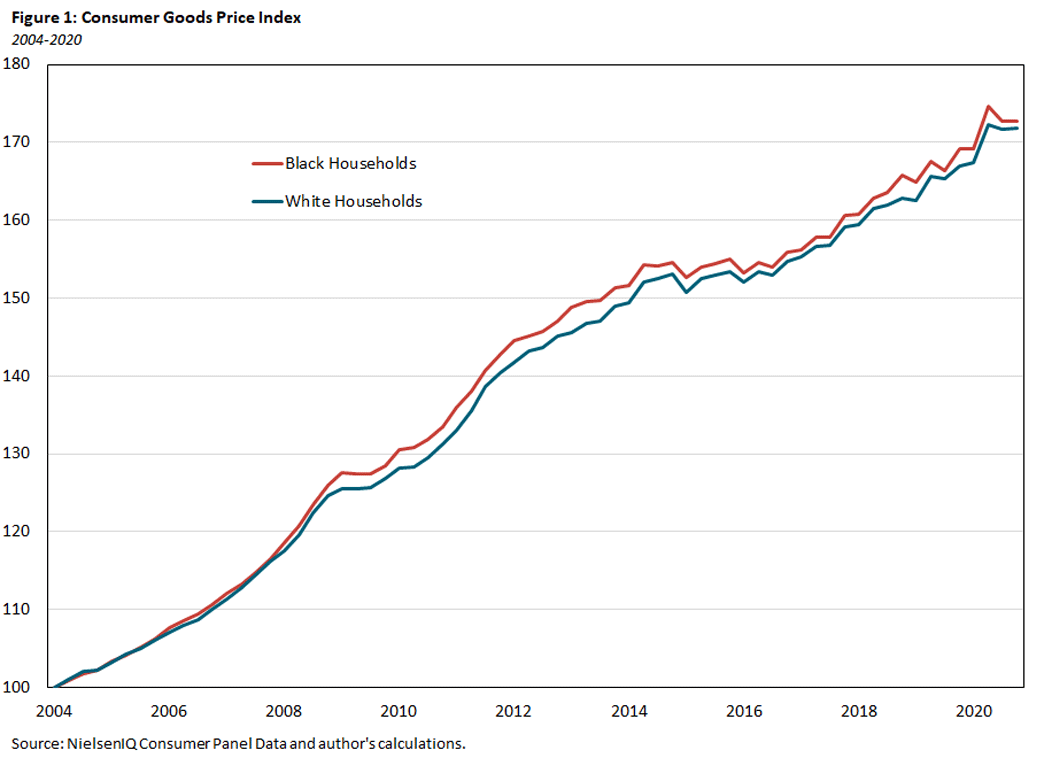

The data represent a longitudinal panel of about 60,000 U.S. households that continually provide information about what products they buy and when and where they make purchases. Race is self-reported by households by one of four options: White, Black, Asian and Other. Most households (82.2 percent) identified as White, and 10.0 percent of households identified as Black. Figure 1 shows price indexes in consumer goods from 2004 to 2020 for Black and White households.

Black households started facing higher inflation rates than White households during the Great Recession in 2008. The gap has persisted, although it narrowed after 2014. At least the early phase of the COVID-19 pandemic, the gap didn't increase further.

Black Households and Inflation Volatility

The next question is whether Black households faced more volatile inflation. Price volatility makes it difficult for households to evaluate how much their money will buy from period to period. So, price stability is of special importance to households that may rely on regular paychecks for necessary purchases.

A recent article reported that the typical Black family has $1,500 in liquid savings, while the typical White family has more than five times that amount. The typical Black family also does not have enough savings to avoid costly borrowing or missed payments when unexpected events arise, which makes them especially vulnerable to inflation volatility.

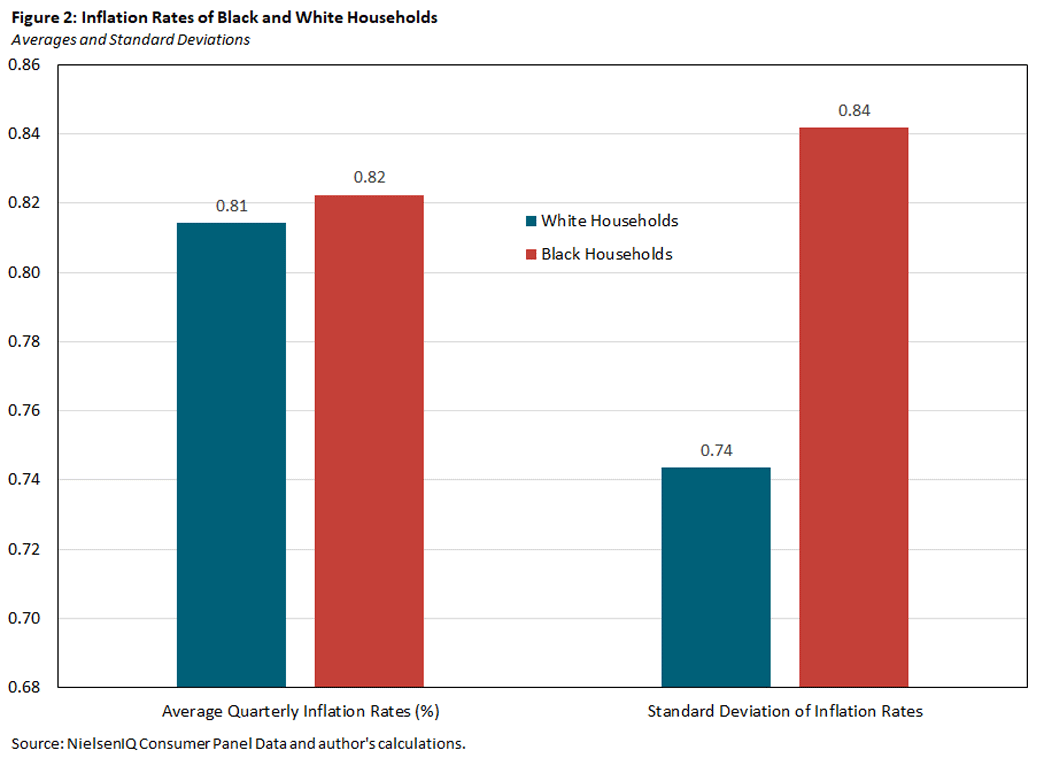

From the price index, we can calculate the growth rate of price (which is the inflation rate) for every quarter. The average quarterly inflation rates from 2004 to 2020 were 0.82 percent for Black households and 0.81 percent for White households, as shown in Figure 2. Thus, Black households did face higher inflation, but the difference was quantitatively small.

However, they faced substantially more volatile inflation in consumer goods. The standard deviation of inflation rates over the period 2004-2020 was 0.84 for Black households and 0.74 for White households. In other words, Black households faced 13.5 percent higher inflation volatility, making it more difficult to predict and recalibrate their consumption and savings.

Additional Research on Inflation Volatility and Black Households

This finding on higher inflation volatility is consistent with my working paper "Minority Unemployment, Inflation and Monetary Policy," co-authored with Claudia Macaluso and Felipe Schwartzman. In that paper, we examined whether Black households were more exposed to inflation fluctuations than White households.

The Bureau of Labor Statistics produces official U.S. inflation statistics and Consumer Expenditure Survey microdata, which allow us to calculate race-specific consumption baskets. However, because the price data are collected from stores rather than households, we cannot calculate race-specific price changes.

Despite this limitation with price changes, we could calculate race-specific inflation volatility for the entire sector from 1998 to 2020 by using race-specific consumption baskets. We found that Black households faced 8 percent higher inflation volatility on average than White households, which is consistent with the result in Figure 2. The two findings are complementary: This article exploits race-specific price changes in consumer goods that account for around 30 percent of household expenditure, while the working paper's calculation covers the entire economy with a longer time span.

Shares of Impacts on Inflation Volatility

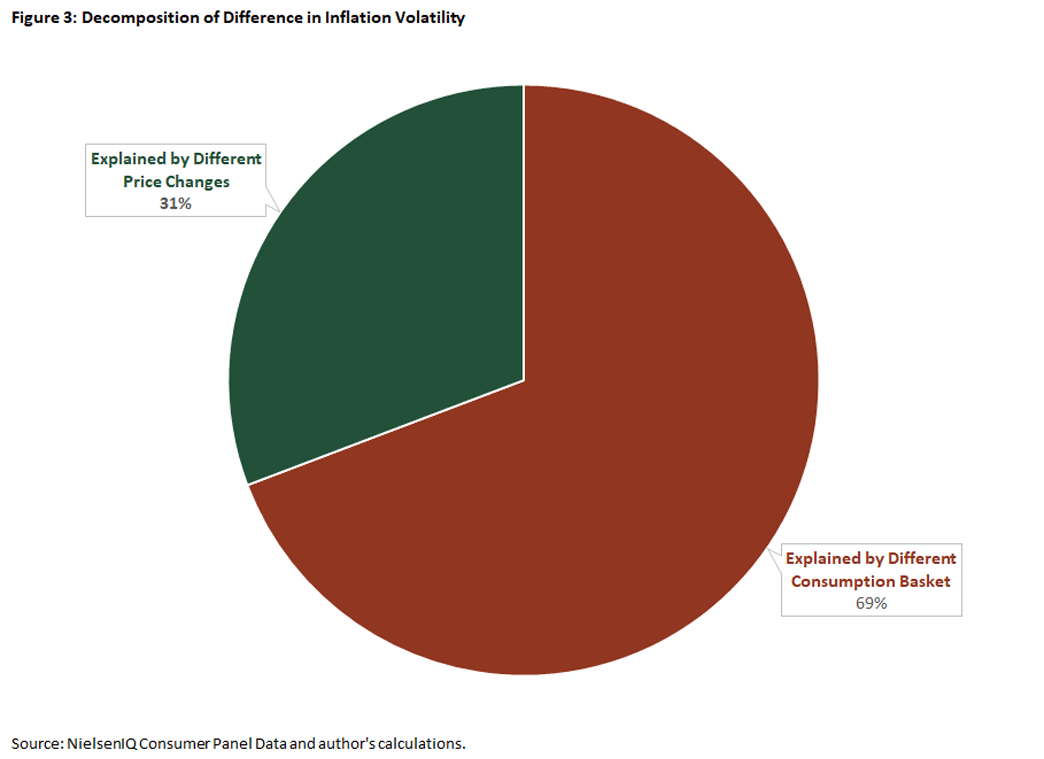

Because the price index I constructed has two components — race-specific consumption baskets and race-specific price changes — I can decompose the difference in inflation volatility that comes from these components by constructing a hypothetical price index that uses race-specific consumption baskets and common price changes. Figure 3 shows that 69 percent of the different inflation volatility came from different consumption baskets. Different price changes also contributed to the gap, but those were quantitatively small.

In other words, Black households are disproportionately more likely to consume goods with volatile prices. For example, Black households allocate their expenditure more on necessary goods like eggs and flour that exhibit higher price volatility. On the other hand, White households allocate their expenditure more on luxury goods like pet care and wine that show lower price volatility.

Income Differences and Inflation Volatility

Income differences explain some of the variation between Black and White households. My 2020 publication "Cost of Living Inequality During the Great Recession" — co-authored with Penn State University professor David Argente — constructed income-specific price indexes for the period 2004-2016. We found substantial differences in inflation experienced across income groups during the Great Recession. The differences in annual inflation between the lowest and highest quartiles of income distribution were as follows:

- 0.22 percentage points for 2004-2007

- 0.85 percentage points for 2008-2013

- 0.02 percentage points for 2014-2016

That is, the gap arises at the onset of the Great Recession, grows moderately during the subsequent recovery and stabilizes after 2014. This is precisely when variables such as output, household income and employment reached their prerecession levels.

One significant reason that inflation inequality grows during recessions and shrinks during expansions is that low-income households devote a higher share of their income to purchasing necessities. The prices of these goods tend to increase more than prices of discretionary or luxury goods during recessions. Thus, low-income consumers have a much more difficult time responding to rising food costs at the grocery store.

We identified three ways people adjust to food inflation, and all three are much more difficult if you are a lower-income household:

- Shopping at a cheaper store: Lower-income households are often already shopping at the cheapest nearby supermarkets.

- Using coupons: High-income households are more likely to use coupons during high inflationary periods because low-income households may lack the time to gather and use coupons effectively.

- Trading down to lower-quality foods: Low-income households naturally have little room to maneuver.

Conclusion

In sum, I found that Black households experienced slightly higher and significantly more volatile inflation in consumer goods from 2004 to 2020 compared to White households. More than two-thirds (69 percent) of the difference in inflation volatility can be explained by the difference in consumption baskets: Black households are disproportionately more likely to consume goods with volatile prices.

The increased overall inflation currently being experienced is generating pressure to improve inflation measurement. Because the digital revolution has given rise to vast new data sources (such as the one used in this article), statistical agencies around the world are now collecting price and quantity data at granular level with high frequency. In May, a report by the National Academies of Sciences, Engineering and Medicine called on the Bureau of Labor Statistics to publish inflation by income.

Given the challenges minorities face in the U.S., I believe that increasing our ability to measure inflation by race would also be extremely informative.

Munseob Lee is an assistant professor of economics at the University of California San Diego School of Global Policy and Strategy. Claudia Macaluso is an economist and Felipe Schwartzman is a senior economist in the Research Department at the Federal Reserve Bank of Richmond. Researcher's own analyses calculated (or derived) based in part on data from Nielsen Consumer LLC and marketing databases provided through the NielsenIQ Datasets at the Kilts Center for Marketing Data Center at The University of Chicago Booth School of Business. The conclusions drawn from the NielsenIQ data are those of the researcher and do not reflect the views of NielsenIQ. NielsenIQ is not responsible for, had no role in, and was not involved in analyzing and preparing the results reported herein.

To cite this Economic Brief, please use the following format: Lee, Munseob. (July 2022) "Do Black Households Face Higher and More Volatile Inflation?" Federal Reserve Bank of Richmond Economic Brief, No. 22-25.

This article may be photocopied or reprinted in its entirety. Please credit the author, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.