Career Progressions and Wage Growth: Is There a One-Size-Fits-All Job Ladder?

Differences in earnings across workers are large and become larger as workers age. In this article, we explore the contribution of different career dynamics to the earnings gap between poorer and richer workers. We emphasize how poorer workers do not lack opportunities to change jobs, as they have high job mobility rates. Thus, they potentially could work at increasingly better-paying firms but seldom do so in practice. Indeed, despite many job changes, wages and employer quality are stagnant over the life cycle for poorer workers. We discuss this finding in light of previous economic literature and relate it to a leading framework for the labor market: the job ladder model. We conclude that postulating a common job ladder for both poorer and richer workers is not supported by the data.

In their seminal 1992 paper "Job Mobility and the Careers of Young Men," Robert Topel and Michael Ward wrote, "Job changing is a critical component of workers' movement toward the stable employment relations of mature careers." This notion is intuitive and well-exemplified by real-world career progression examples:

- A restaurant worker starts by washing dishes, moves on to kitchen assistant, progresses to prep cook, line cook and sous chef, then finally becomes a head chef.

- An academic may start as a post-doctoral scholar, then move through a progression of assistant professor, associate professor and, ultimately, full professor.

While some firms have internal structures that allow workers to make these career steps within the firm, many workers change employers when they progress in their careers. This notion has exerted considerable influence over labor economists and policymakers alike in the past several decades. The idea that job changes are essential to wage growth constitutes the core of the so-called job ladder theory, a field of labor economics which has been very fruitful, both empirically and theoretically.

In this article, we survey some of the most recent developments in this literature and investigate what they reveal about career-building opportunities and potential pitfalls for workers.1

What Is a Job Ladder?

The concept of a job ladder refers to the mechanism through which workers ascend to better employment opportunities over time. Job ladder theory posits that individuals start their careers at lower-paying and potentially less-desirable jobs but gradually "climb the ladder" as they gain experience, skills and qualifications.

Job ladder models especially emphasize the dynamic nature of labor markets, where workers continuously seek better opportunities and firms compete to attract and retain skilled workers. The key feature of these models — as summarized in the 2013 paper "Stochastic Search Equilibrium" — is that "given a chance [in the job ladder framework], a worker always moves from a less into a more productive firm."2 The 2005 article "The Job Ladder Over the Business Cycle" had a similar sentiment: "Workers often build their careers through job-hopping. Over time, they tend to move toward higher paying jobs that last longer (Topel and Ward 1992). These career paths are facilitated by job-to-job flows: When a worker has a better offer from a different employer, she will usually quit her job to take the new, better one."3 This upwards progression is often labeled as "climbing" the job ladder, with jobs at more productive, better-paying firms referred to as the ladder's "rungs" or "steps."

Is There Only One Job Ladder?

However, there is no consensus on how universal this pattern of upward career progression is. Is it a good description of all workers' experience? How much wage growth do workers experience as they climb the ladder? How does the growth differ for different types of workers? In our research paper "Heterogeneous Job Ladders," we provide new evidence on workers' career dynamics and offer some caveats to generalizing job ladder dynamics for all workers.

In particular, we study one cohort of Austrian workers (born between 1960 and 1962), for which we observe their entire careers from age 23 until age 55. Austrian data provide an especially fruitful setting, compared to other economically advanced countries (including the U.S.): It contains the universe of employees, contains all spells at different jobs and in unemployment, and provides daily wage information. We analyze career profiles of workers who are in lower-paying, median-paying and higher-paying jobs at the end of their careers. This retrospective look at their careers helps us understand how these workers get into these jobs.

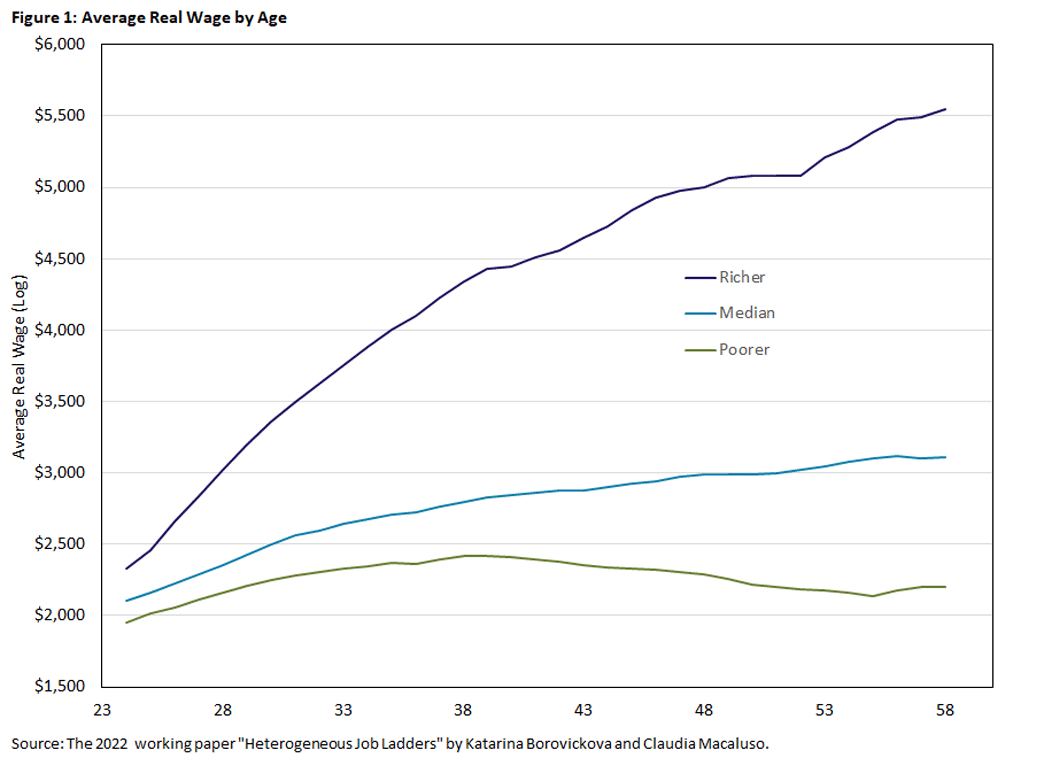

Figure 1 shows that workers with different end-of-career earnings experience very different career paths. Wages in initial jobs (around age 24) are very similar for all workers but soon start to differ. While workers who end up in higher-paying jobs experience steady wage growth, wages of median workers do not grow much. And wages of workers who end up in lower-paying jobs even experience wage declines after age 40. This suggests that the "job ladder" is very different for these groups of workers.

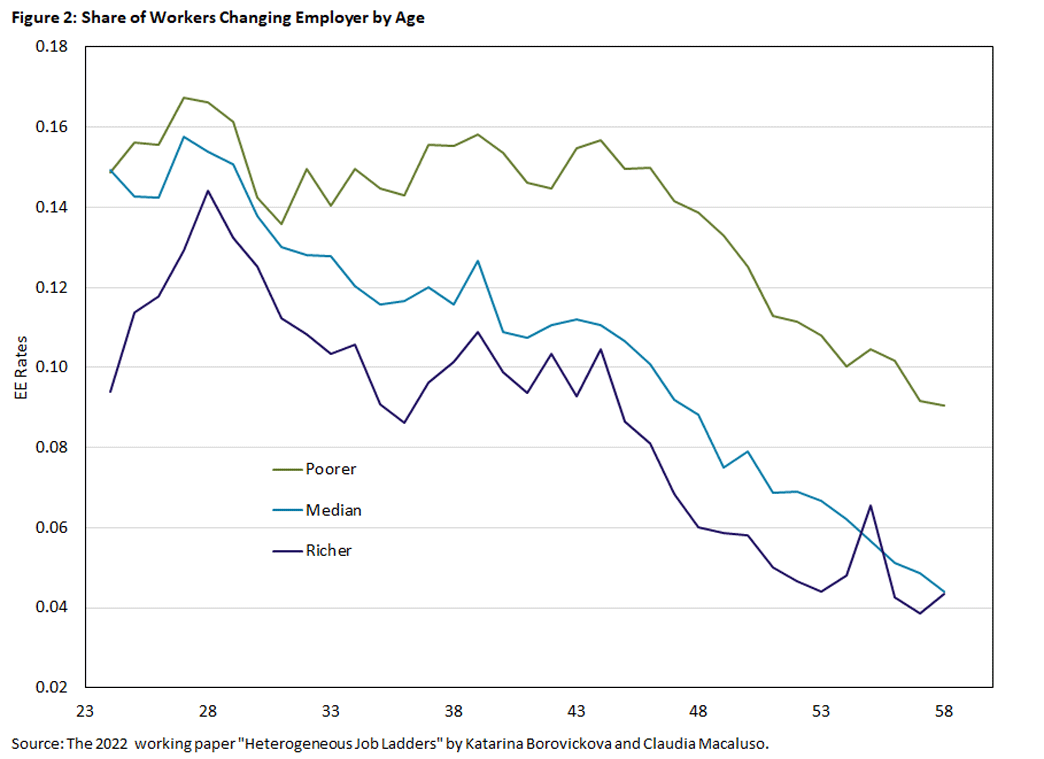

We further examine the components of the job ladder, namely how often workers move from one employer to another and what type of employer they move to. Figure 2 shows the share of workers who change their employers at the given age, again separately for different groups. One might expect that the reason poorer workers do not experience much wage growth is because they change employers less frequently than richer workers. However, Figure 2 shows exactly the opposite: At any age, richer workers are less likely to change employers than poorer workers.

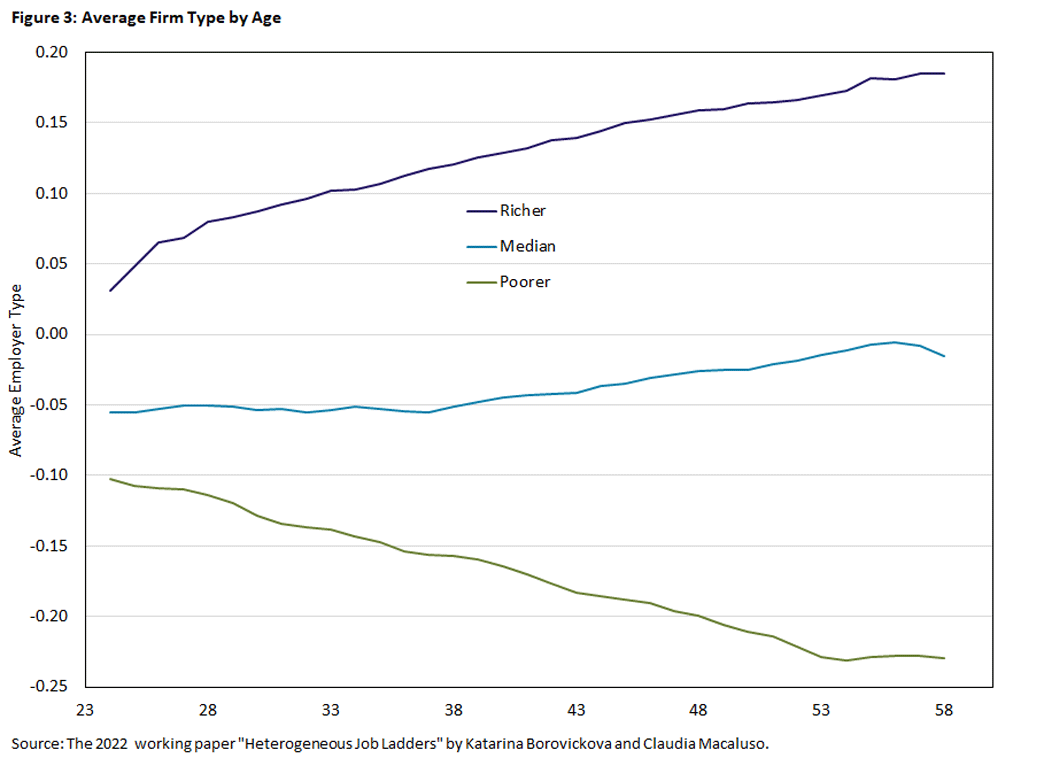

Even though poorer workers are more mobile, it turns out that these workers are not always to moving to better firms. We depict this in Figure 3. For each firm in our sample, we compute the average log wage it pays to all its employees and call it the firm type. Figure 3 then depicts the mean firm type. We observe that richer workers tend to move to better firms, median workers tend to stagnate, and poorer workers move to worse-paying employers over their careers.

Thus, we document that job ladders differ in terms of both frequency of job changes (that is, how often workers take a step on the ladder) and the type of employers that workers transition to (that is, the size and direction of each step in terms of wage gain).

Different Job Ladders

Our findings reject the presence of an upward job ladder for poorer workers. Indeed, the career dynamics we document are starkly different than the climbing mechanism typically assumed for the job ladder theory. Workers at the bottom of the earnings distribution at the end of their work lives ("poorer" workers) have higher employer-to-employer transition rates than richer workers. However, these high rates of labor market mobility do not translate to upward earnings trajectories. Instead, poorer workers work for worse-paying firms as they age; they actually go down the ladder. They are also more likely to undergo unemployment spells at all ages and are significantly less likely to grow their wages early in their career, despite frequent job-to-job transitions. Therefore, poorer workers experience a significant drop in average employer quality and stagnant average real wages over the life cycle.

Workers who are at the top of the earnings distribution at career-end have the opposite labor market path. Their careers are well-described as climbing the job ladder. They change employers somewhat infrequently, but they tend to work for better-paying firms when they do change. Their wages go up steeply as they age, nurtured by a faster rate of wage increases in their early years. This higher wage growth is not purely a result of workers changing employers. Richer workers (compared to poorer workers) also have higher wage growth at young age when they stay with the same employer.

In the Sept. 11, 2024 episode of the Speaking of the Economy podcast, Katarína Borovičková and Claudia Macaluso describe their research on differences in wage growth between workers as they progress in their careers.

Literature on Worker Heterogeneity

Our paper fits into the literature that aims to understand the extent of heterogeneity in the labor market and how this shapes workers' careers. While these other papers do not explicitly focus on workers' life cycles, they do investigate differences in how workers move between employment and unemployment (and how that's related to wages) and also uncover substantial heterogeneity in these experiences across workers.

The 2021 working paper "The Alpha Beta Gamma of the Labor Market" delineates three distinct categories of workers and clarifies their respective roles in income inequality and labor market dynamics:4

- "Alpha type" workers are characterized by enduring job tenures, brief periods of unemployment and comparatively higher income levels.

- "Gamma type" workers exhibit short tenures with employers, long gaps of unemployment between jobs and a higher likelihood of experiencing unemployment or changing employers.

- "Beta type" workers are positioned between Alpha and Gamma workers.

Alpha type workers constitute the majority of the workforce, while Gamma type workers have the lowest income among the three types and represent less than one-fifth of the labor force, but more of the unemployed.

Through analysis of U.S. employment data, the paper's authors investigate how each type interacts with various labor market phenomena. They observe a significant and enduring decline in earnings following displacement for workers with lengthy tenures, irrespective of their type. However, Alpha type workers tend to recover from such displacement more swiftly than Gamma type workers, who continue to experience substantial earnings losses for several years following displacement. The authors also highlight a diminishing likelihood of finding new employment while unemployed, which is particularly pronounced for Gamma type workers as the duration of unemployment extends. The types are therefore strongly associated with distinct dynamics in the labor market.

Similarly, the 2023 paper "The Dual U.S. Labor Market Uncovered" discusses three worker types that govern the labor market experience of individual workers.5 Most workers are in the "primary sector," characterized by consistent employment and fluid transitions from non-participation to employment. The next largest type works in the "secondary sector," experiencing frequent job turnover along with elevated risk of unemployment and layoffs. The remaining workers are in the "tertiary sector" or home production, participating in the labor market only infrequently and encountering challenges with unemployment upon attempting to enter.

Both papers find that the "types" are important for understanding labor market dynamics. But what are these types? Demographic characteristics explain only a small fraction of the likelihood of being a particular type. Hence, the type is determined by a set of characteristics not observed in a typical dataset. To make progress, one needs to rely on a structural model to determine which characteristics are important.

In our work, we specify that workers differ in their initial level of human capital (or knowledge) and also in their ability to accumulate new human capital during employment. Firms differ in how productive they are and what learning environments they offer to employees. Thus, how much workers learn and how much their wages increase depend on both worker ability and employment firm. We then investigate which characteristics are important for understanding the differential labor market experience of workers. This is similar to the 2023 paper "Anatomy of Lifetime Earnings Inequality: Heterogeneity in Job-Ladder Risk Versus Human Capital,"6 though that paper does not consider differences in firms' learning environments.

Can Policies Help Struggling Workers?

To sum up, the economic literature on labor market dynamics has recently provided more evidence of heterogeneity in the career paths of workers that is intimately linked to their earnings levels and growth. One natural next question is whether anything can be done to improve the conditions of the workers who see lackluster wage growth as they age because of the negative job dynamics we and others have documented.

We find that differences in workers' ability to accumulate human capital and firms' ability to support workers' learning are crucial. The relative importance of these two channels determines which policies can help workers at the bottom of the income distribution to grow. For example, if differences in learning environments across firms are important, then policies helping poorer workers find jobs at better firms can be effective. This is because workers accumulate more human capital at these high-learning employers, which translates into wage growth. On the other hand, if worker ability mostly drives the differences, these policies will not be very effective. Instead, policies would have to be targeted at a worker's learning capacity, which is plausibly formed before they enter the labor market through both the education system and family environment.

Katarína Borovičková and Claudia Macaluso are economists in the Research Department at the Federal Reserve Bank of Richmond. The authors thank Brooke Hansbrough for her excellent research assistance.

This article is the first in a series of two. Here we illustrate the empirical challenges to traditional job ladder models: what evidence in the data contradicts the notion that all workers are subject to job ladder dynamics as they age. In a future article, we will propose and illustrate an alternative framework and evaluate real-world policies, such as internship programs, with it.

Authored by Giuseppe Moscarini and Fabien Postel-Vinay.

Authored by John Haltiwanger, Henry Hyatt and Erika McEntarfer.

Authored by Victoria Gregory, Guido Menzio and David Wiczer.

Authored by Hie Joo Ahn, Bart Hobijn and Ayşegül Şahin.

Authored by Serdar Ozkan, Jae Song and Fatih Karahan.

To cite this Economic Brief, please use the following format: Borovičková, Katarina; and Macaluso, Claudia. (May 2024) "Career Progressions and Wage Growth: Is There a One-Size-Fits-All Job Ladder?" Federal Reserve Bank of Richmond Economic Brief, No. 24-14.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.