Banks' Credit Lines to Nonbank Mortgage Companies and Downstream Mortgage Originations

Key Takeaways

- We study the downstream mortgage origination activity of banks with credit ties with nonbank mortgage companies (NMCs). We show that banks continued to compete with NMCs in the downstream mortgage origination market, despite financing competing NMCs.

- NMC activities remain tight to the originate-to-distribute business model, as most of the mortgages were delivered to government-sponsored enterprises, such as Fannie Mae.

- Their lower on-balance sheet exposure to the mortgage market reduced their interest rate risk exposure, which drove risk during the interest rate hiking period.

Lightly regulated nonbank mortgage companies (NMCs) strongly expanded their origination activities during the pandemic-induced mortgage market boom. In particular, this expansion occurred in the originate-to-distribute mortgage segment1 and was largely financed through warehouse credit lines. Banks are the main arrangers of such funding instruments and the main competitors of NMCs in the downstream mortgage market. This gives banks a central role in the organizational structure of the mortgage market, as they are active at various stages of the credit supply chain.

In a previous article, we showed that, in spite of credit supply frictions, warehouse credit lines from banks (especially liquidity-constrained banks) to NMCs almost doubled during the mortgage boom that followed the quantitative easing (QE) liquidity injection of early 2020. NMCs' mortgage origination almost doubled as well, while banks' direct mortgage origination experienced a smaller increase.

The evidence naturally raises the question of whether banks that provided more credit to NMCs may have stepped back from direct mortgage origination in these markets. This would suggest a shift in the supply-side structure of many residential mortgage markets. Thus, this article addresses two questions:

- Did liquidity-constrained banks — which strengthened their credit-line relationships with NMCs following the 2020 QE liquidity injection — reduce their direct originations in the downstream mortgage market?

- Does their strategy have implications for financial stability?

Warehouse Credit Line Relationships and Mortgage Origination

To analyze if banks' increased provision of credit lines to NMCs has any effects on banks' direct originations in the downstream mortgage market, we first collect a credit-line level sample of bank-NMC credit relationships linked with supervisory mortgage-level information from the confidential version of the Home Mortgage Disclosure Act.

Second, we perform a bank-county level regression. (Our exact equation and specifications can be found in the appendix.) Specifically, we examine how total mortgage volume originated by a specific bank in a specific county changed after QE measures took place in 2020. We focus on GSE-conforming and FHA mortgage originations split by purpose, namely home purchase and refinancing.2

The main independent variable of interest is a bank's exposure measure, which we call "liquidity" and define as a bank's pre-QE percentage of liquid assets (reserves plus cash) over total assets, measured in the second quarter of 2019. We standardized all variables in our regression, so the coefficients measure the percentage change of the dependent variable for a one-standard-deviation change in liquidity.

Crucially, we augment our equation with an interaction term capturing the share of mortgages originated by financed NMCs in the same county. This allows us to check whether a bank increases its mortgage origination in the same counties where the NMCs it finances are operating.

Our regression yields several findings:

- We find a negative and statistically significant coefficient of the main variable of interest (liquidity), suggesting that banks that are more liquidity constrained expanded their direct mortgage originations by a higher magnitude than banks that are less liquidity constrained.

- Overall, a one-standard-deviation increase in liquidity leads to 7.7 percentage point lower expansion of mortgage originations.

- The effect is similar across both home purchase and refinancing.

- The interacted coefficient of liquidity and the county-market share of mortgage originations of financed NMCs is negative and statistically significant. This means that banks continued to expand mortgage originations in the same counties in which financed NMCs perform their operations.

- The interaction coefficient changes little after excluding small banks (those with total assets below $10 billion).

Warehouse Lenders and Instability Risks After the Interest Rate Hike

Banks with lower liquidity positions increased credit supply to NMCs and direct mortgage credit originations. Despite this higher activity, banks' on-balance sheet exposure to the mortgage market — real estate loans and mortgage-backed securities (MBS) — decreased over time. In other words, they increased their operations both in the upstream market for NMC financing and in the downstream mortgage origination market without holding long-term MBS and real estate loans. Exposure to these two asset groups was one of the main drivers that triggered mark-to-market losses and then uninsured deposit reallocations during the hiking period.

In this section, we test whether more liquidity-constrained banks were less exposed to interest rate risk at the end of the mortgage-boom period. To do so, we estimate a dynamic difference-in-difference specification. Our dependent variable represents outcome variables that have been shown in the literature to affect banks' sensitivity to the hiking and financial instability episode of 2022-23.3 This variable includes MBS over assets, asset-based maturity in years, gains on securities over assets and uninsured deposits over assets. For our independent variables, we use the same liquidity variable used in the previous specifications multiplied by the dynamic difference-in-difference time coefficients of interest.

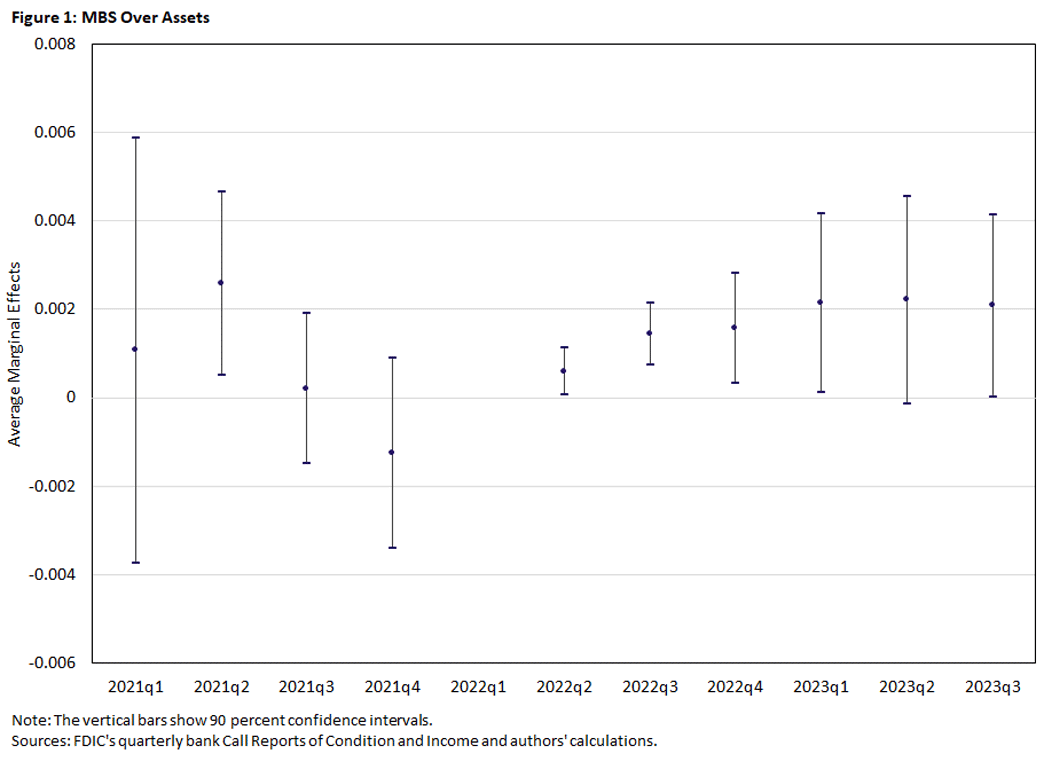

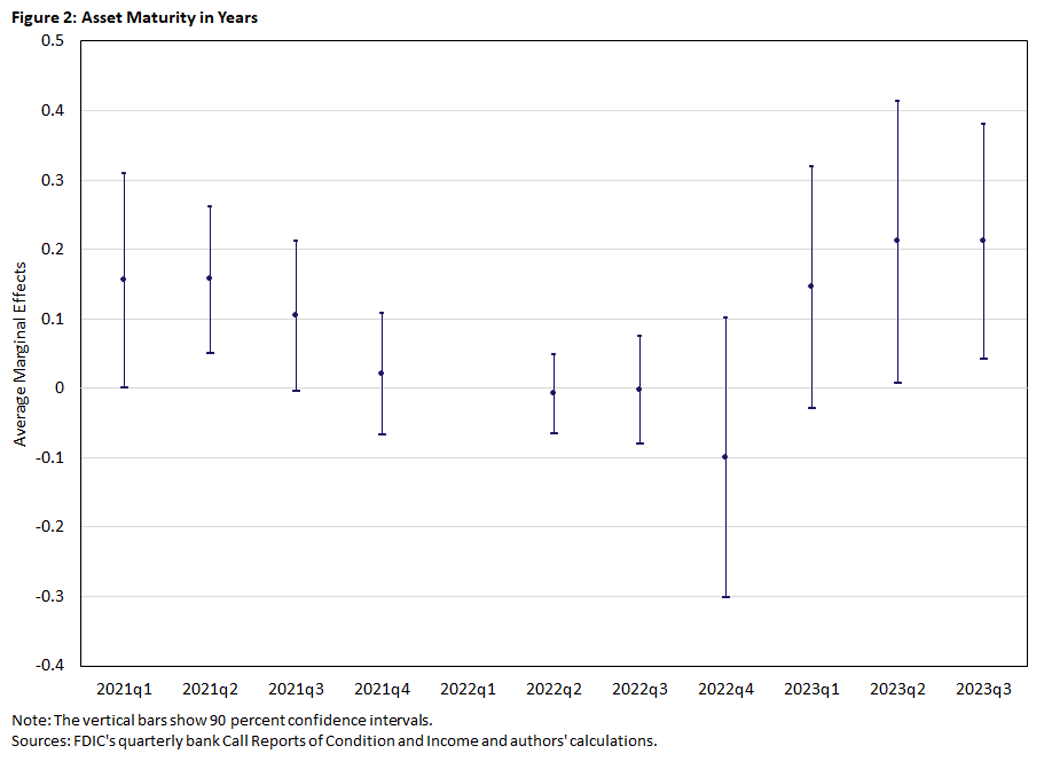

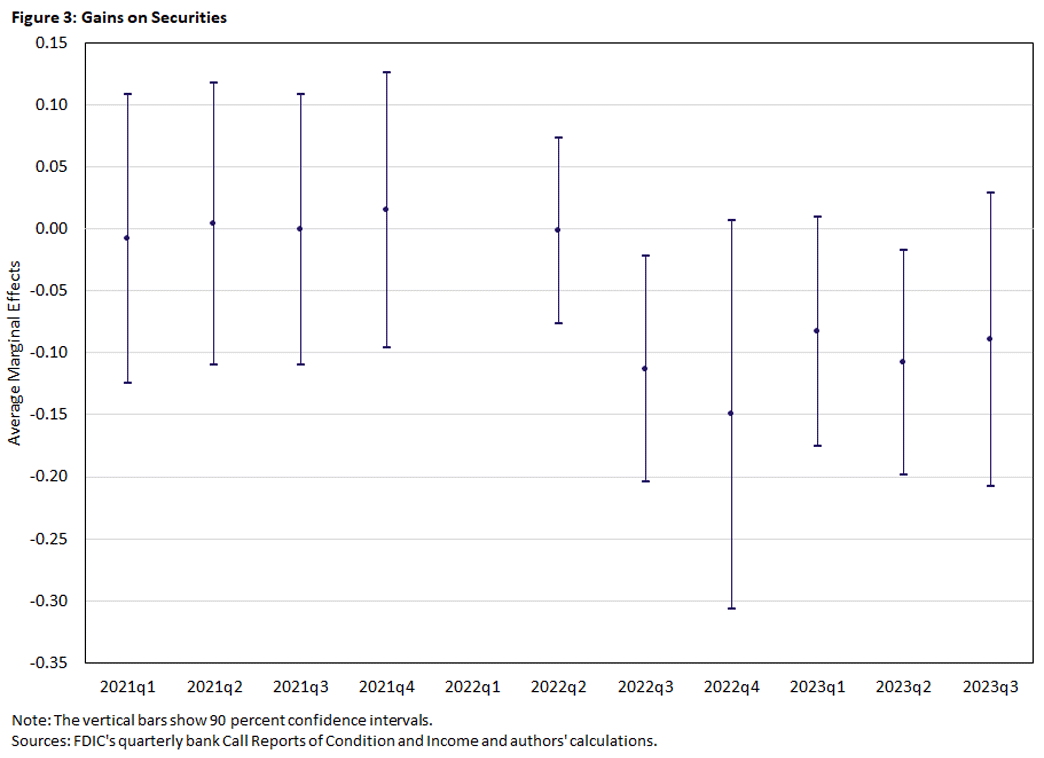

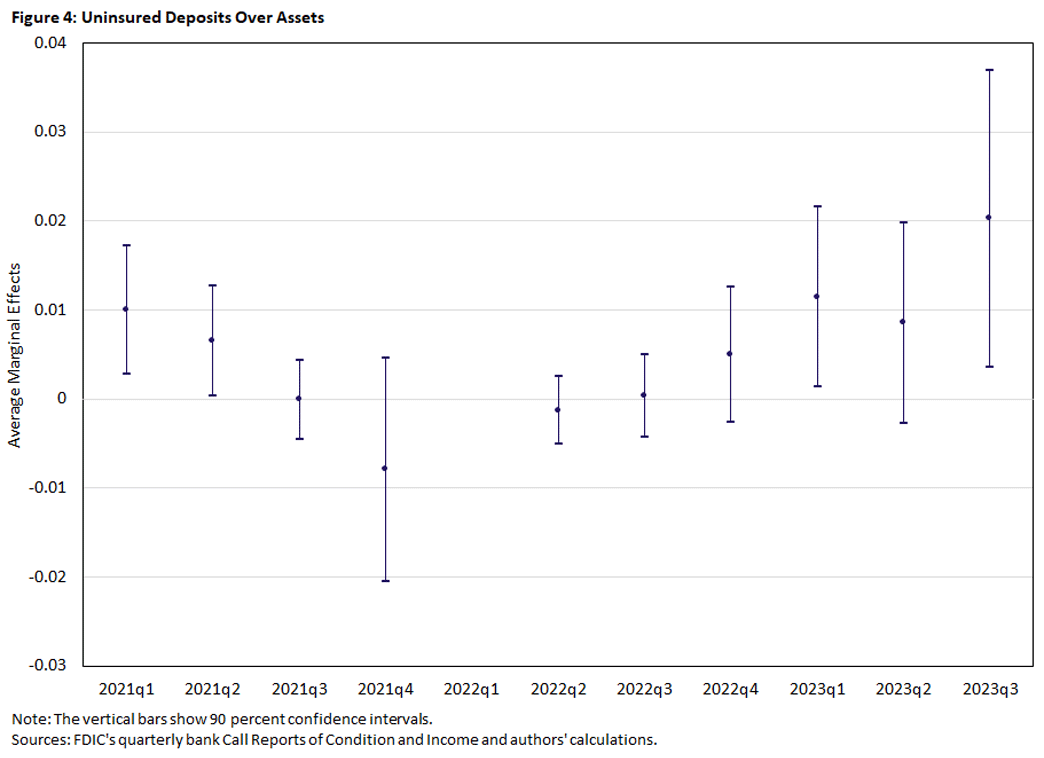

The following figures plot the average marginal effects for the specification's different dependent variables.

Figure 1 shows that less liquid banks entered the interest rate hiking period with a lower exposure to MBS securities.

Figure 2 confirms a lower asset duration for more exposed banks (those with lower liquidity positions), consistent with our main hypothesis on a larger reliance on securitization.

Figure 3 shows that lower asset duration caused fewer losses after the second quarter of 2022.

Figure 4 shows that banks with lower liquidity positions had lower uninsured deposit ratios in 2023. This provides evidence that the initially liquidity-constrained banks — that is, those that we have shown to mainly raise their indirect exposure to real estate via credit lines to NMCs — were more likely than other banks to weather the banking sector turmoil in 2023.

Conclusion

Following the 2020 QE liquidity injection, banks — particularly those that were liquidity constrained — significantly expanded their direct mortgage originations, even in the same counties as NMCs they financed. Banks with lower liquidity positions simultaneously reduced their on-balance sheet exposure to (or holdings of) real estate loans and MBS. This strategy had positive financial stability implications, as the reduction in holdings decreased interest-rate risk, led to fewer mark-to-market losses after the second quarter of 2022 and resulted in lower uninsured deposit ratios in 2023, which enhanced the resilience of these initially liquidity-constrained banks during the 2022-23 banking sector turmoil. This outcome is consistent with NMCs' continued reliance on an originate-to-distribute model, delivering most mortgages to government-sponsored enterprises, which limits banks' long-term holdings.

Alessandro Rebucci is an economics professor in the Carey Business School at Johns Hopkins University. Alex Sclip is an associate professor in the Department of Management at the University of Verona. Horacio Sapriza is a senior economist and policy advisor in the Research Department at the Federal Reserve Bank of Richmond. Daniel te Kaat is an associate professor of finance at the University of Groningen.

This segment consists of companies that create mortgages with the intent to sell them to a third party, rather than potentially hold the mortgages themselves.

Our sample is restricted to first-lien, fixed-rate, 30-year, single-family residential mortgages. We exclude manufactured housing; investment properties; loans on condos, duplex and triples; and reverse mortgages. We also exclude jumbo and VA mortgages.

An example of this literature would be the 2024 paper "Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?" by Erica Xuewei Jiang, Gregor Matvos, Tomasz Piskorski and Amit Seru.

To cite this Economic Brief, please use the following format: Rebucci, Alessandro; Sapriza, Horacio; Sclip, Alex; and te Kaat, Daniel. (October 2025) "Banks' Credit Lines to Nonbank Mortgage Companies and Downstream Mortgage Originations." Federal Reserve Bank of Richmond Economic Brief, No. 25-38.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.