Spend as I Do, Not as I Say

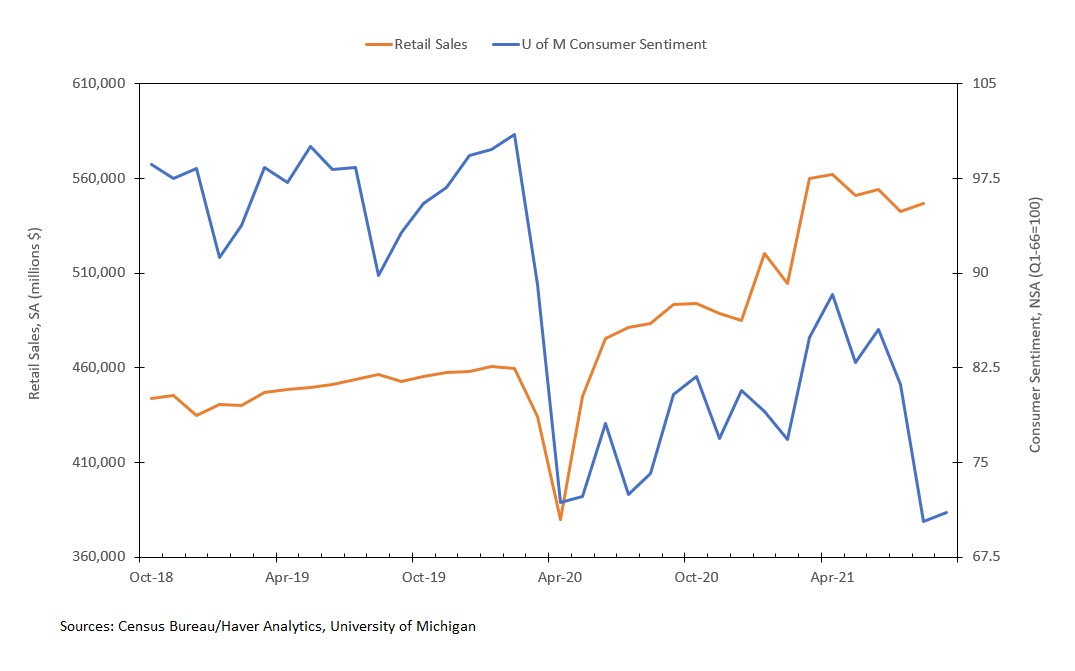

How consumers respond to the ongoing outbreak of the Delta variant of COVID-19 has been a key question facing the economy. Leading consumer confidence indicators have given reason to worry: The University of Michigan consumer sentiment index plummeted from 81.2 in July to 70.3 in August, and the preliminary September reading just barely improved, rising to 71. Both readings were even lower than the early pandemic trough of 71.8 in April 2020. Sentiment about making big purchases also fell below "peak lockdown" levels: The sentiment index for buying large household durables like furniture, refrigerators, and TVs fell to 84 in September, compared to 86 in April 2020. The vehicle purchase sentiment index fell to 62, compared to 116 in April 2020. Homebuying sentiment fell to 60, compared to 105 in April 2020.

"... Demand remained robust despite bad news on the virus."

Fortunately, consumer spending is holding up better than in spring 2020, and better than consumer sentiment surveys would have suggested (see Figure 1 below). In August, retail sales rose by 0.7 percent versus July. The Delta variant outbreak did leave an imprint in the data: Sales at food services and drinking places were flat compared to July. But in-person spending increased at general merchandise stores (up 3.5 percent), food and beverage stores (up 1.8 percent), and furniture and home furnishing stores (up 3.7 percent).

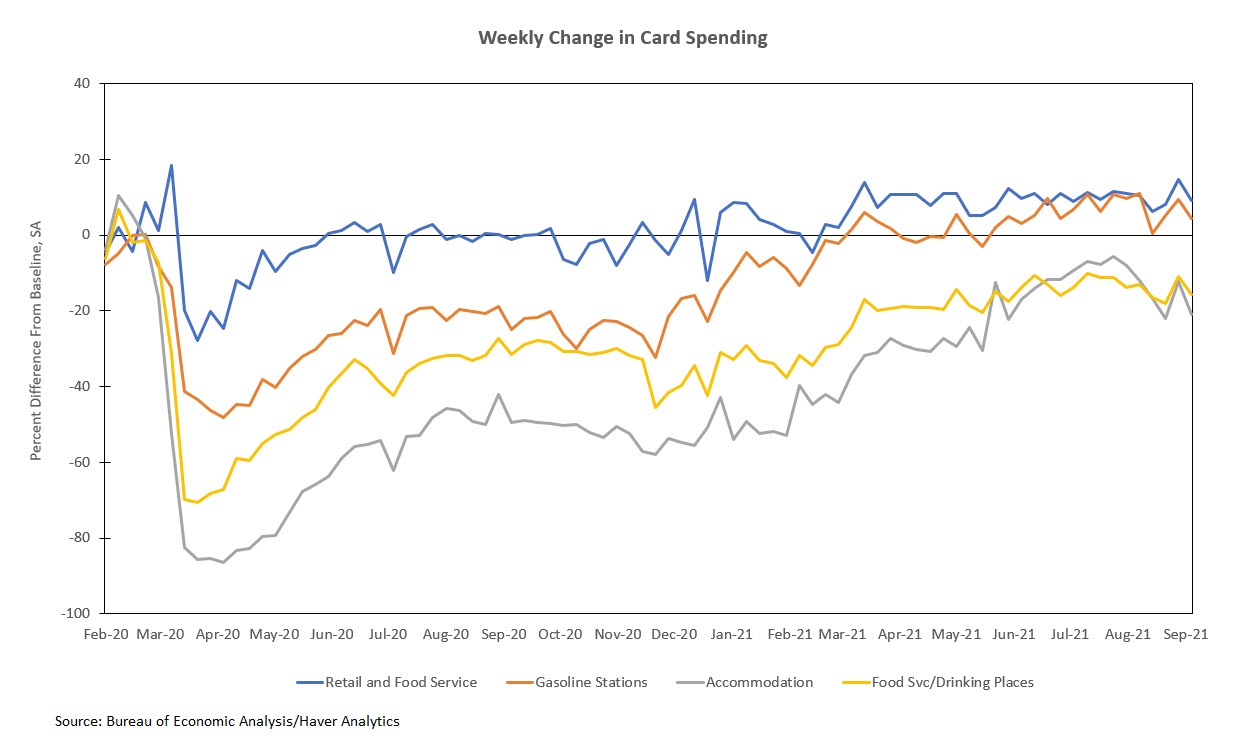

Though the growth in retail sales in August beat consensus forecasts for a monthly decline, the monthly reading was not necessarily a huge surprise. It matched signals from high-frequency data on consumers' credit and debit card spending, which suggested that demand remained robust despite bad news on the virus. One public source of such data is the Bureau of Economic Analysis (BEA), which uses daily payment card transaction data to estimate the impact of the pandemic on spending. While the data do have limitations — for example, they may not necessarily be representative of total spending by industry — the weekly readings through the month of August were similar to those in the prior three months. And, they corroborated the August retail sales report showing household spending did not plummet as a result of escalating case numbers. Figure 2 below shows that even in food services and drinking places, where customer demand has been sensitive to pandemic news, the latest readings indicate spending remains about 10 percent below 2019 levels, which is within the range of spending in June and July.

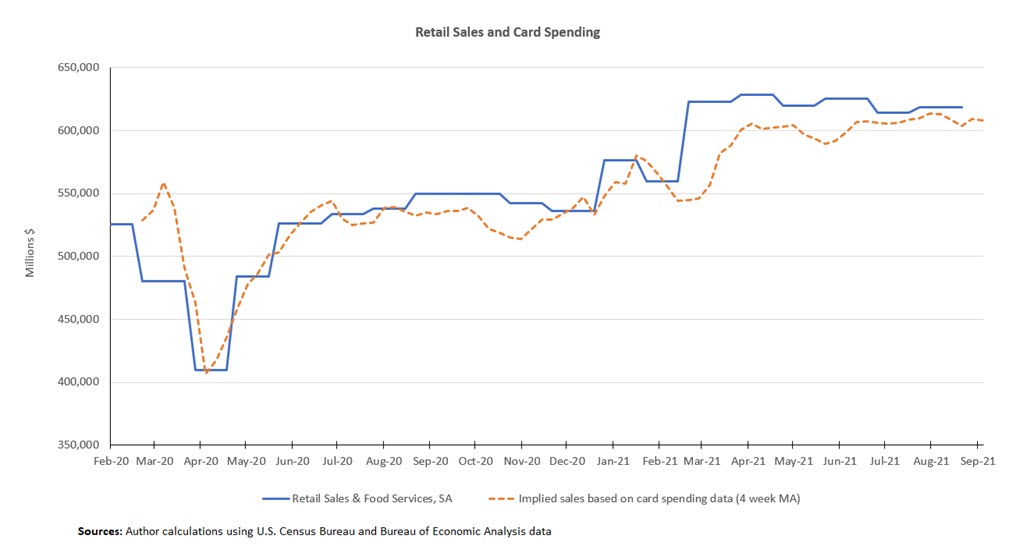

A simple exercise one might try is to use the card spending data to make a real-time guess of where retail sales might end up for the current month. The weekly card spending data from the BEA shows the difference in spending from a "typical level" prior to the pandemic, calculated from data starting in 2017 through early 2020. Figure 3 shows a rough calculation that applies the weekly percentage difference in card spending to an estimate of trend retail spending based on monthly data from January 2017 through February 2020, and then taking a four-week moving average. Figure 3 shows that this yields an estimate of retail sales that has performed reasonably well, including during times of high pandemic uncertainty like in spring 2020, when other models had some trouble identifying turning points in the data.

Throughout 2021, estimated retail sales have been slightly lower than what we've actually seen. Still, both datasets point to a recovery where consumers may have learned to better adapt to negative news about the virus, and one where demand is more resilient despite louder griping in consumer sentiment surveys.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.