Hurricane Helene: Exposing Gaps in Flood Risk and Insurance

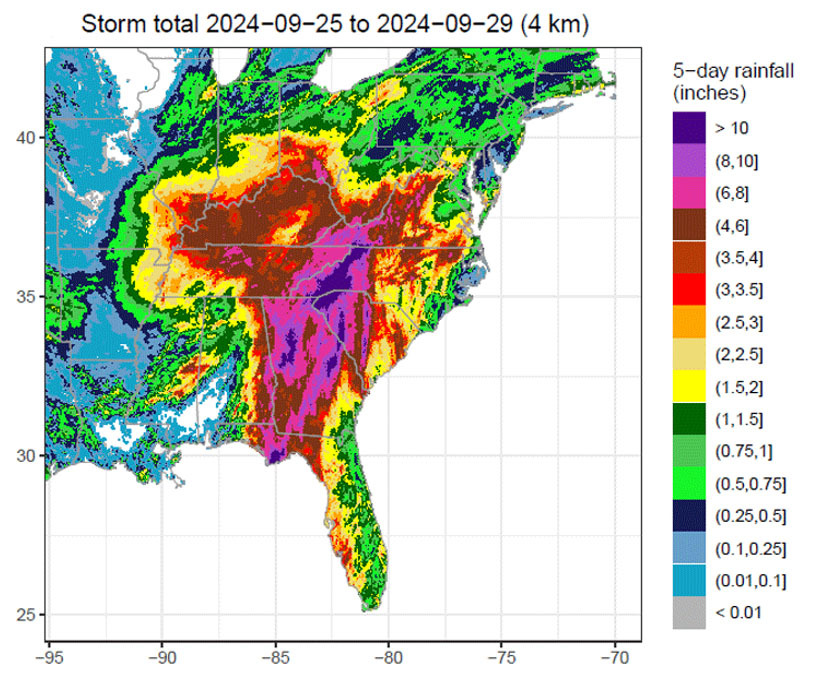

As the devastation from Hurricane Helene continues to be addressed, some attention is turning to the economic fallout, both immediate and long term. One such area that recent hurricanes have brought attention to is in exposing potential vulnerabilities in how flood risk is managed and insured. As highlighted by Helene, flooding can come not only from storm surges around the coast, but also extreme rainfall across inland communities (as seen in Figure 1 below).

Consequently, such damage can occur outside of historical floodplain maps, that is, the Federal Emergency Management Agency's (FEMA) Special Flood Hazard Areas (SFHAs). For example, almost 80 percent of the properties affected by Hurricane Debby in 2024 were outside SFHAs. Similarly, projections by the First Street Foundation show that cities like Asheville, N.C. — which was overwhelmed by Helene — have a far greater flood risk than FEMA maps suggest. While only 2 percent of Asheville properties are within the SFHA, First Street projects that 15.8 percent are at flood risk. (For more on flood risk in North Carolina — including a graphic highlighting outdated flood maps from 2020 in the state — see "Community Effects of Climate Change in North Carolina," Econ Focus, Fourth Quarter 2022.)

Low Uptake of Flood Insurance

Flood insurance uptake remains remarkably low outside of SFHAs.1 For example, in Buncombe County (where Asheville is located), only 0.7 percent of housing units have flood insurance through the National Flood Insurance Program. As a result, when storms like Helene cause widespread flooding in areas like these, most damages go uninsured. With insurance so low, many homeowners are at risk of losing everything, as flood repairs often exceed their financial capacity.

Impact on Mortgage Performance

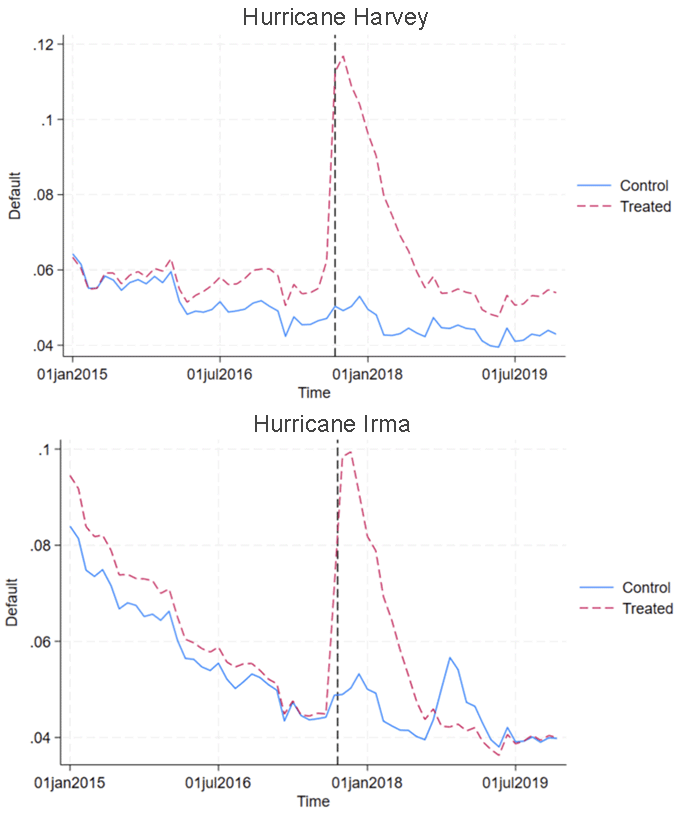

Beyond physical damage, Helene is expected to impact mortgage performance. Past natural disasters have shown that uninsured properties face a much higher risk of mortgage default, while insured properties tend to see increased prepayment rates. Disaster loan forbearance programs — especially for loans held by government-sponsored enterprises — offer some temporary relief. The Federal Reserve Board, along with federal and state financial regulatory agencies, also issued guidance to lenders to work with borrowers in need of relief following Helene. However, mortgage defaults tend to rise sharply overall in affected areas compared to mortgages in unaffected ZIP codes. Figure 2 below shows impacts for hurricanes Irma (which hit Florida in 2017) and Harvey (which hit Texas in 2017).

It is still too early to know the full extent of the direct physical damages of Helene across our Fifth District and the indirect financial impact on household finance and the mortgage market. However, the hurricane serves as a reminder of extreme weather risks — especially flooding, even for areas that are traditionally less exposed to such events (such as the inland and elevated city of Asheville) — and the importance of financially and physically preparing for such events.

Flood insurance is voluntary outside of SFHAs. Only about 2 percent of households outside of SFHAs have flood insurance coverage from the National Flood Insurance Program.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.