The Public Perils of Private Debt

Debt makes the wheels of commerce turn. But under certain circumstances, it can also heighten financial crises and recessions

The story of the Great Recession is, in many ways, a story about debt — private debt that borrowers did not repay.

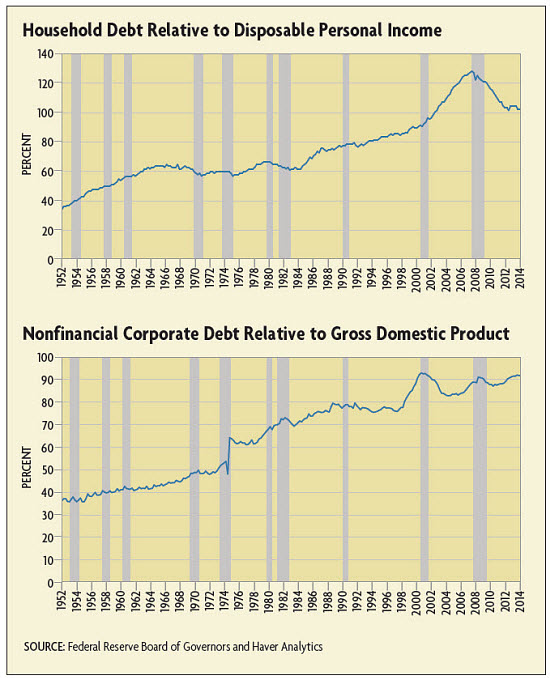

In the United States, household debt grew rapidly in the 1990s and 2000s. In the early 1990s, average household debt burden was about 80 percent of disposable personal income. By 2000, it had reached 90 percent, and in 2007 it peaked at 129 percent. Most of this increase came in the form of housing debt, which grew from about $6 trillion in 2004 to nearly $10 trillion in 2008, according to data from the New York Fed. As a percentage of gross domestic product (GDP), nonfinancial corporate debt also grew in the years leading up to the recession of 2007-2009 (see charts below).

These developments were not unique to the United States. A 2014 study by Òscar Jordà of the San Francisco Fed, Moritz Schularick of the University of Bonn, and Alan Taylor of the University of California, Davis examined the growth in public and private debt in 17 advanced economies between 1870 and 2011. For the first half of the 20th century, public debt surpassed bank lending (an indicator of private debt) as a percentage of GDP. But starting in the 1960s, private debt began outpacing public debt rapidly. By the 2000s, private debt was well over 100 percent of GDP, while public debt remained close to 70 percent.

"There seems to be a striking difference between what was going on before World War II and what has been going on since then," says Jordà.

The collapse in assets serving as collateral also hurts the firms and households that invested most heavily in those assets. Additionally, their ability to borrow further against those declining assets is constrained, cutting off one means of servicing their debt. Debt contracts are designed to be fairly rigid to enforce repayment. Most require regular minimum payments for the borrower to avoid default. And many financial debt contracts require borrowers to put up additional collateral or cash if the existing collateral loses value, increasing the costs of falling collateral for borrowers.

The debt built up by some firms and households during the boom weighs on their spending during downturns. In a 2009 paper, Mian and Sufi found that households with the highest debt growth going into the Great Recession cut their consumption sooner and more deeply than households with less debt. Similarly, highly leveraged firms were the first to make cuts. Xavier Giroud of MIT's Sloan School of Management and Holger Mueller of New York University's Stern School of Business found in a 2015 working paper that highly leveraged firms were more likely to lay off employees in response to falling consumer spending; in contrast, low-leverage firms were able to borrow to cover shortfalls and avoid cutbacks. Moreover, highly leveraged firms may forgo investing in profitable projects because they know that most of the proceeds would go to pay their creditors. Economists call this effect "debt overhang," and it can also slow recovery from a recession.

Some believe that when borrowers cannot cut spending enough to meet their obligations and are forced to default or sell assets into a distressed market, prices could fall through "fire sales," as other borrowers and creditors are unloading similar assets on the market at the same time. Andrei Shleifer of Harvard University and Robert Vishny of the University of Chicago's Booth School of Business wrote in a 2011 Journal of Economic Perspectives article that fire sales occur in part because the buyers that would place the highest value on the assets being sold are in the same boat as the sellers. They too are highly leveraged from investing during the credit boom and are also liquidating assets. The only available buyers, Shleifer and Vishny wrote, are "nonspecialists" who place a much lower price on the assets.

Such distress sales lower the prices other sellers can receive for similar assets. "It creates a chain reaction where the price of the asset you're trying to sell just keeps spiraling down," explains Jordà. "Pretty quickly, everyone is caught in the same net."

Yale University economist Irving Fisher first described such a downward spiral in 1933. He argued that "debt-deflation" cycles could explain how a financial shock turns into a recession or depression. In his view, the first wave of fire sales is driven by the most cash-strapped households and firms. Their actions depress the prices on similar assets, which increases the burden on the households and firms with the next highest level of debt, starting the cycle anew.

Economists disagree about the effects of fire sales on the markets for those assets. To study the effect of fire sales on the housing market during the Great Recession, Mian and Sufi along with Francesco Trebbi of the University of British Columbia compared states with different foreclosure laws. Some require mortgage lenders to go through the courts to evict defaulted borrowers, while other states do not. In the latter case, foreclosures can happen more quickly, and Mian, Sufi, and Trebbi found that house prices fell more deeply in those states during the recession of 2007-2009. On the other hand, a 2012 working paper by Kristopher Gerardi of the Atlanta Fed, Eric Rosenblatt and Vincent Yao of Fannie Mae, and Paul Willen of the Boston Fed found that the negative effect of foreclosed houses on nearby home properties was fairly small, ranging from between a half a percent to slightly more than 1 percent drop in sale prices.

Regardless of magnitude, it seems that higher levels of household debt wreaked at least some harm on economic growth. Such an effect "is the opposite of the traditional view," says Mian. "In the traditional model, if you see higher household debt today, it must be that people are smoothing consumption by borrowing against even higher future income. So higher household debt growth predicts higher income going forward. But that's not what we find in the data at all. That tells us that there is something missing from those traditional models."

Debt Externalities?

What's missing from some standard models, says Mian, is the possibility that borrowing could be too high from a social perspective. Recently, some economists have proposed models where agents overborrow during credit booms because they ignore or underestimate the costs that their deleveraging will have on the rest of the economy during a downturn. A 2012 Quarterly Journal of Economics paper by Gauti Eggertsson of Brown University and Nobel laureate Paul Krugman of the City University of New York proposes one such model of these "aggregate demand externalities." When borrowers cut consumption to reduce their debt, interest rates fall as the demand for debt goes down. Eventually, low interest rates lead households and firms that did not borrow previously to begin borrowing, which helps counteract the drop in demand. Eggertsson and Krugman argue that, in the recent crisis, private debt had grown so substantially that the subsequent deleveraging pushed interest rates to zero, and this created new challenges for monetary policymakers.

"A key insight of these models is that when people are deciding how much to borrow at the individual level, they are less likely to take into account the implications of their decisions for the macroeconomy," says Mian. "So in a decentralized world where financial markets allow people to borrow as much as they like, you can often end up in situations where they overborrow from a macro perspective."

Mian and his colleagues also view fire sales as a potential source of debt's social costs. If debt is priced in a manner that ignores the possibility of fire sales, they argue, borrowers and creditors could use debt in a way that contributes to a deflationary spiral in asset prices during a downturn. On the other hand, there is some evidence that borrowers and lenders do consider the costs that future fire sales could have on them when writing debt contracts, at least to some degree. A 2010 paper by Hernán Oritz-Molina of the University of British Columbia and Gordon Phillips of the University of South Carolina's Marshall School of Business found that firms in industries with more buyers for their assets (making fire sales less likely) had lower borrowing costs.

Additionally, the extent to which borrowers and lenders disregard fire-sale risks could be driven more by policy actions taken to minimize the damage of fire sales after the fact rather than by inherent characteristics of debt. Like the moral hazard associated with insurance, protecting borrowers and lenders from fire sales gives them less incentive to worry about those risks upfront.

Economists generally agree that institutional factors already play a role in promoting the overuse of debt. In the United States, many forms of debt enjoy tax subsidies that encourage their use. Homeowners who itemize can deduct the interest on their mortgages from their taxable income; firms can deduct the interest on their debt as a business expense, but not dividend payments to shareholders. (See "President's Message.")

To be sure, equity holders also receive some tax benefits, which may be partly passed through to firms in the form of cheaper equity financing. For example, the tax collector doesn't recognize increases in the value of stock holdings as income until the shares are actually sold. Also, long-term capital gains are taxed at preferential rates. Still, the consensus is that the differing tax treatment of debt and equity has put debt financing at an artificial advantage.

"At a minimum," says Mian, "we should remove the biases favoring debt currently in place. But there is also good reason to actually flip that bias in the opposite direction."

The Goldilocks Level

During a downturn, equity financing has some advantages over debt. It spreads the risks of asset price changes more evenly between both parties, which could help to soften the blow of economic shocks. From the parties' point of view, however, this distribution of risk is not always desirable.

For instance, firms funded entirely by equity would have an incentive to conceal the truth about their prospects in order to pay less to their shareholders. Managers of those firms may be less likely to take on profitable risks if most of the rewards would accrue to shareholders. It would be prohibitively costly for investors to constantly monitor those firms to ensure they are behaving honestly at all times. As MIT economist Robert Townsend demonstrated in a seminal 1979 Journal of Economic Theory article, debt aligns the incentives of creditors and borrowers and its fixed payment structure removes the need for constant monitoring. (For a more detailed discussion, see "Building a Better Market,” Region Focus, Winter 2008.)

That makes determining the right balance between debt and equity from society's perspective "a very difficult question to address," says Taylor. "At the moment, there's no theory to say what the 'optimal' level of debt is." A 2011 paper by Stephen Cecchetti of Brandeis University’s International Business School and Madhusudan Mohanty and Fabrizio Zampolli of the Bank for International Settlements attempted to shed some empirical light on that question by studying debt levels in 18 developed countries between 1980 and 2010. The authors estimated that household debt starts to become a drag on economic growth once it reaches 85 percent of GDP, but they noted the effect was very imprecisely measured.

Even if it were possible to calculate the optimal level of debt, Taylor says that that figure would likely vary dramatically "across countries and possibly across time."

A New Kind of Contract

Since debt is here to stay, should policymakers attempt to contain its negative amplifying effects during a crisis? One option proposed in the immediate aftermath of the recession of 2007-2009 was to encourage lenders to renegotiate mortgages with borrowers. Modifying the terms of the mortgage in line with the borrower's ability to pay would reduce the need for them to cut consumption, which, in turn, would reduce the number of defaults. Since foreclosures and forced sales can depress the value of similar assets, it may even be in a lender's best interests to renegotiate rather than attempt to sell the collateral into a depressed market.

But lenders, like borrowers, will fail to internalize the macroeconomic costs of their decisions. It may be preferable from a lender's perspective not to renegotiate a loan, since doing so opens the door to renegotiations with other borrowers. Seizing and selling collateral from borrowers who default can also be the optimal choice for an individual lender, even if such decisions impose costs on the rest of the economy.

If the drop in home prices is exacerbated solely because of the inability to swiftly renegotiate loan terms, policies spurring such dealmaking could offer social benefits. Indeed, the Making Home Affordable Program of 2009 was adopted with such a goal in mind. But despite the policy, few renegotiations took place. Many attributed this to the securitization of loans, which split individual mortgages into securities held by many different parties; most borrowers could not just negotiate with their local bank to modify their mortgages. Even in the absence of such obstacles, policymakers must also weigh the possibility that changing the terms of debt contracts after the fact could have unintended consequences on the pricing and availability of loans in the future.

Given these challenges, some have suggested that a better approach might be to restructure debt contracts so that they adopt the risk-sharing characteristics of equity during downturns, potentially preventing spillovers from occurring in the first place. Unlike firms, individuals cannot readily issue equity to finance long-term purchases or investments. Hybrid contracts such as these could grant them access to the beneficial risk-sharing aspects of equity during a crisis, while retaining the positive contractual form of debt in normal times. In their book, Mian and Sufi proposed such a change for mortgages. The "shared-responsibility mortgage," as they call it, would tie mortgage repayments to local house price indices. When prices are steady or increasing, the mortgages act as traditional debt. But when housing prices in an area fall, homeowners' monthly payments would automatically shrink by the same proportion. Tying this adjustment to a local index preserves the incentives homeowners have to maintain their property, since they cannot influence their payments by reducing their home’s value alone.

"Our proposal looks like standard debt in most scenarios because debt is often the optimal contract," says Mian. "The economics literature shows that you want to impose risks on the borrower to the extent those risks are under his or her control. What we are trying to do in our proposal is address the negative aspects of debt that are macro in nature."

To give lenders an incentive to provide this downside insurance to borrowers, Mian and Sufi propose allowing lenders to reap some of the reward of rising house prices by earning a portion of the proceeds when households sell or refinance their homes. So far, few lenders have experimented with such contracts. Mian suggests that because the government has historically driven housing policy, shared-responsibility mortgages might require support from policymakers before they become more widespread. At the same time, he acknowledges there may be many other solutions worth considering.

Ultimately, improving private debt requires a greater understanding of debt's role in the economy. And on that front, Jordà says economists still have much to learn. “I don't think we have fully appreciated the role that credit plays in the economy,” he says. "As a consequence, events like the recession of 2007-2009 may be more repeatable than we think."

Readings

Cecchetti, Stephen G., Madhusudan S. Mohanty, and Fabrizio Zampolli. “The Real Effects of Debt![]() .” Bank for International Settlements Working Paper No. 352, September 2011.

.” Bank for International Settlements Working Paper No. 352, September 2011.

Eggertsson, Gauti B., and Paul Krugman. “Debt, Deleveraging, and the Liquidity Trap: A Fisher-Minsky-Koo Approach.” Quarterly Journal of Economics, August 2012, vol. 127, no. 3, pp. 1469-1513. (Previous version available online![]() .)

.)

Fisher, Irving. “The Debt-Deflation Theory of Great Depressions![]() .” Chicago Econometric Society, University of Chicago, October 1933.

.” Chicago Econometric Society, University of Chicago, October 1933.

Gerardi, Kristopher, Eric Rosenblatt, and Paul S. Willen. “Foreclosure Externalities: Some New Evidence![]() .” Federal Reserve Bank of Atlanta Working Paper No. 2012-11, August 2012.

.” Federal Reserve Bank of Atlanta Working Paper No. 2012-11, August 2012.

Giroud, Xavier, and Holger M. Mueller. “Firm Leverage and Unemployment during the Great Recession![]() .” Working Paper, June 2015.

.” Working Paper, June 2015.

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. “Sovereigns versus Banks: Credit, Crises, and Consequences![]() .” Federal Reserve Bank of San Francisco Working Paper No. 2013-37, February 2014.

.” Federal Reserve Bank of San Francisco Working Paper No. 2013-37, February 2014.

Kiyotaki, Nobuhiro, and John Moore. “Credit Cycles![]() .” Journal of Political Economy, April 1997, vol. 105, no. 2, pp. 211-248.

.” Journal of Political Economy, April 1997, vol. 105, no. 2, pp. 211-248.

Korinek, Anton, and Alp Simsek. “Liquidity Trap and Excessive Leverage![]() .” IMF Working Paper No. 14-129, July 2014.

.” IMF Working Paper No. 14-129, July 2014.

Mian, Atif, and Amir Sufi. House of Debt: How They (And You) Caused the Great Recession, and How We Can Prevent it From Happening Again. Chicago: The University of Chicago Press, 2014.

Mian, Atif, Amir Sufi, and Emil Verner. “Household Debt and Business Cycles Worldwide![]() .” National Bureau of Economic Research Working Paper No. 21581, September 2015.

.” National Bureau of Economic Research Working Paper No. 21581, September 2015.

Townsend, Robert M. “Optimal Contracts and Competitive Markets with Costly State Verification![]() .” Journal of Economic Theory, April 1979, vol. 21, pp. 265-293.

.” Journal of Economic Theory, April 1979, vol. 21, pp. 265-293.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.