Central Banks and Climate Risks

Some researchers look at climate change and see economic uncertainty. Central banks are beginning to take notice

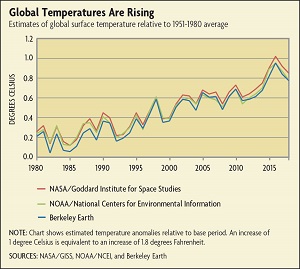

Temperatures are rising. The National Academy of Sciences estimates that global average surface temperatures have risen by 0.8 degrees Celsius (1.4 degrees Fahrenheit) since 1900. According to data from the National Oceanic and Atmospheric Administration (NOAA), the National Air and Space Administration (NASA), and the climate research center Berkeley Earth, global surface temperatures in the past 40 years have consistently surpassed the 1951-1980 average. (See chart below.)

The Economists' Statement on Carbon Dividends calls for a tax on carbon dioxide emissions to combat global climate change.

These changes have led policymakers and economists to examine what climate change may mean for communities, governments, and the economy. More than 3,000 economists recently signed a statement in support of a carbon tax (see sidebar), and a leading finance journal hosted two conferences in 2017 and 2018 to promote research on the financial risks related to climate change. And as the discussion surrounding climate change heats up, central banks around the world are attempting to understand and prepare for its potential risks.

Challenges to Economic Growth

In a recent article, Riccardo Colacito of the University of North Carolina, Bridget Hoffmann of the Inter-American Development Bank, and Toan Phan of the Richmond Fed found that rising temperatures are associated with reduced economic growth. They analyzed temperature and output growth by season and industry, finding that for every 1 degree Fahrenheit increase in the average summer temperature, the annual growth rate of state-level output decreases by 0.15 to 0.25 percentage points on average. When combined with future temperature projections, their findings indicated that U.S. economic growth could decrease by as much as one-third over the next hundred years if this association continues.

Rising temperatures could influence growth through several different mechanisms. In their article, Colacito, Hoffmann, and Phan pointed to reductions in the growth rate of labor productivity as one such mechanism, citing previous research as well as their own data. Phan suggests that changes in labor productivity alone can't explain their findings, however.

"One potential mechanism could be hotter summer temperatures coming along with more intense disasters like heat waves or wildfires," Phan says. "The effects of disasters can be twofold. If disasters damage physical capital or crops or property, that's one immediate channel. Another channel is through making people more attentive to future risk, which is reflected in asset prices."

He points to a working paper by Piet M. A. Eichholtz of Maastricht University, Eva Steiner of Cornell University, and Erkan Yönder of Concordia University. These authors examined commercial real estate prices after Hurricane Sandy, which hit New York City in 2012, and found that the prices of properties exposed to flood risk appreciated more slowly after Sandy than they did in regions unaffected by flood risk. Remarkably, this trend held not only in New York, but also in Boston, which experienced no physical damage from Sandy. The authors argued that this effect can be explained by a persistent increase after Sandy in the salience of flood risk to investors in coastal areas of Boston.

"Temperature and Growth: A Panel Analysis of the United States." Journal of Money, Credit and Banking, vol. 51, nos. 2-3, March-April 2019. (Working paper version and Economic Brief)

"Does the Fed Have a Financial Stability Mandate?" Economic Brief No. 17-06, June 2017.

"The Case for Direct Methods to Address CO2 Emissions and Other Negative Environmental Externalities." Economic Brief No. 09-10, October 2009.

In addition to their aggregate findings, Colacito, Hoffmann, and Phan analyzed the influence of rising temperatures on output growth at the industry level. They found that higher summer temperatures negatively affected most industries, even those where most work takes place indoors. The most negatively affected sector was, as it happens, the so-called FIRE sector: finance, insurance, and real estate. For central banks, especially those specifically tasked with maintaining financial stability, this result is especially relevant. But how exactly could climate change affect the financial system?

Is Financial Stability at Risk?

Some economists contend that climate change imposes physical and transition risks on the financial system, threatening its stability. In a January 2018 working paper, Sandra Batten, senior economist at the Bank of England, wrote that physical risks arise from a combination of adverse climate-related events and systemic vulnerabilities. These risks, she argued, include both demand- and supply-side shocks to the financial system. For example, on the demand side, rising sea levels might decrease demand for coastal homes, while on the supply side, changes in precipitation patterns could affect crop yields. Climate change may also shift investment patterns by diverting resources to adaptation investments instead of the productive investments that would have been made otherwise.

Extreme weather events, such as droughts, wildfires, and hurricanes, are often named as key sources of physical risk. A recent article in the Journal of Financial Stability by Jeroen Klomp of Wageningen University & Research in the Netherlands supports such a connection. In an analysis of data on commercial banks from over 160 countries, Klomp found that natural disasters are associated with a higher likelihood of bank default, although not of system-wide crisis. The extent of climate change's influence on natural disasters, the study of which is known as event attribution, is an active area of research. A 2016 report by the National Academies of Sciences, Engineering, and Medicine indicates that scientists are most certain when attributing extreme heat and cold, drought, and precipitation to climate change, since these can be directly traced back to temperature changes. Scientists are less confident, however, about the extent of climate change's impact on extratropical cyclones, wildfires, and severe convective storms.

In a recent publication, Glenn Rudebusch, senior policy advisor and executive vice president at the San Francisco Fed, included extreme weather events as one source of future climate-related economic transformation. Rudebusch wrote that an increase in the frequency and severity of extreme weather events, as well as higher temperatures and other consequences of climate change, could adversely affect the economy and financial system by reducing business profitability and asset values, disrupting operations, damaging infrastructure, and weakening labor productivity.

"I think of climate change as a problem multiplier, even where it's not the sole cause. For example, we've always had hurricanes, but a changing climate is going to exacerbate them — and the same is true for economic insecurity and inequality," Rudebusch says.

Along with physical risks, some economists also note the transition risks from a shift toward low-carbon energy sources. In a 2016 report for the German Federal Ministry of Finance, Martin Stadelmann of the South Pole Group, a Swiss consulting firm in the area of climate finance, and Viola Lutz, now at Institutional Shareholder Services, wrote that transition risks present a much greater threat to financial stability than physical risks. Batten wrote that, were emissions-reduction policies to be implemented, short-term output would likely fall as carbon-intensive firms adjust. In fact, some estimates of global losses from transition risks are as high as $20 trillion. And transition risks could also affect monetary policy. In a 2018 speech, Benoît Coeuré, a member of the Executive Board of the European Central Bank (ECB), indicated that a transition to low-carbon policies would affect relative energy prices. He said that this, in turn, could shift inflation expectations, which are directly relevant to monetary policy.

George Economides and Anastasios Xepapadeas of the Athens University of Economics and Business modeled the impacts of climate change on monetary policy in a 2018 working paper. They found that climate change presents shocks to total factor productivity, a measure of how efficiently an economy uses its labor and capital inputs. This means that in the presence of climate change, economic fluctuations tend to be both longer and more frequent than in its absence. But a decrease in output resulting from these shocks also decreases demand for fossil fuels, which boosts productivity by slowing the pace of temperature increases. Finally, they found that while a carbon tax curbs short-run output, it increases long-run output. Their findings indicate both physical and transition risks from climate change and policy.

What We Don't Know Could Hurt Us

Another key feature of climate change is uncertainty about its extent and its economic effects. One area of uncertainty is the extent of temperature increases and the probability of catastrophe. Martin Weitzman, an economist at Harvard University who passed away in August, researched "fat tail" probability distribution functions, in which catastrophic climate change — and thus, catastrophic economic damage — is more likely than is typically assumed in climate models. In a 2011 article, Weitzman argued that, because of the lack of substantive historical data on past catastrophes, it is possible that extreme events are more likely than most models assume. He concluded that cost-benefit analyses of climate change should incorporate this structural uncertainty.

"A fat-tailed model increases tail risk generally. There's more weight in the tails relative to what's expected," Weitzman told Econ Focus. "The huge problem is that nobody knows the probability or consequences."

Uncertainty also affects models of climate change's economic impact. Economists commonly use integrated assessment models (IAMs), which feature both climate science and economic modules, to analyze this issue. The climate science modules project future GHG emissions and resulting global temperatures, while the economic modules estimate the economic consequences of unmitigated climate change and the costs and benefits of emissions-reduction policies. In a 2013 article, Robert Pindyck, a professor at the Massachusetts Institute of Technology, identified significant flaws in these models. First, because they are calibrated only to small temperature increases, they are not informative about the economic effects of a climate catastrophe such as an extreme rise in temperature. Second, they rely on arbitrary constructions of the damage function, an element of the model that estimates economic losses from climate change. Because of these flaws, Pindyck argued, "IAMs are of little or no value for evaluating alternative climate change policies." In a later op-ed, he noted that his critique is an argument not against taking action but for improving the models in order to better guide that action and imposing a carbon tax as a form of insurance in the meantime.

Yet another source of uncertainty is how well societies will adapt to climate change, which could offset some of its downside risks. Stadelmann and Lutz suggested that while large storms could raise insurance premiums, the insurance sector's ability to gradually adjust those premiums could allow it to adapt fairly well to climate change in the short to medium term. This could change in the long term, though, especially if temperatures increase by more than 2 to 3 degrees Celsius. In that case, Stadelmann and Lutz wrote, there is too much uncertainty to reject the possibility of more severe systemic effects. In her paper, Batten gave several examples of adaptation efforts, including investing in physical capital to accommodate new temperature and weather patterns and innovating GHG-removal technology. Adaptation might also entail planting more heat-resistant crops, updating infrastructure in order to better withstand floods, or enacting transition policies such as a carbon tax.

Still, some researchers and officials argue that uncertainty alone does not remove the need for action. "If anything, standard economic theory points us to the fact that when uncertainty rises, we insure against the worst-case scenario," Phan says.

Central Banks' Response

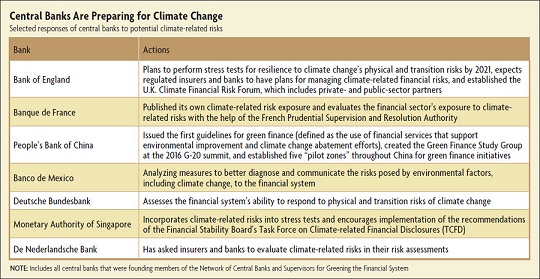

In 2015, Mark Carney, governor of the Bank of England, deemed climate change "the tragedy of the horizon." He warned that "once climate change becomes a defining issue for financial stability, it may already be too late." Four years later, central banks are beginning to incorporate climate-related risks into their economic forecasts. Some are even taking policy steps to mitigate those risks. (See table below.)

From the Director of Research

Changes to the Earth's climate matter to monetary policymakers.

First, appropriate monetary policy depends fairly directly on the growth potential of the economy. A faster-growing economy means a higher average level for the appropriate central bank interest rate, and vice versa. Any force that changes this potential, as climate change certainly could, therefore matters for our approach to policy.

Second, changes in risks to the financial system matter to taxpayers who ultimately insure depositors and who occasionally, during crises, have bailed out creditors more generally. As a primary regulator of banks and other financial institutions, it is critical for the Fed to understand all the risks, including climate-related ones, that these entities face.

Notice that for a central bank, climate change can be viewed as simply one force among many that changes the growth potential of the economy and the risks to it. But unique or not, its implications need to be understood.

The Fed's role also has significance for how it should think about climate change. The political system, not the Fed, selects fiscal and regulatory policies (apart from some specific areas of financial regulation that Congress has delegated to us). These policies as a whole, implicitly and explicitly, balance the well-being of different groups in our society: Think, in particular, about policies that affect the rich and poor differently, or people who are currently old versus those currently young or yet to be born. Thus, the Fed's role is to take those verdicts of the political process and do the best it can to pursue its dual mandate to deliver price stability and maximum employment.

There is, however, an exception where it may be appropriate for the Fed to do more. This is the extent to which we think climate change leaves all of us — young, old, rich, poor — worse off. In this instance, and perhaps only in this instance, we would be on firm ground in suggesting changes. One example is that by raising the risk to coastal cities, of which there are many in the Fifth Federal Reserve District, unabated climate change exposes us to losing significant economic and cultural "capital" that cities appear to deliver through the geographic concentration of talent and companies. Additionally, so long as public programs like flood insurance are not priced to reflect climate risks, building patterns will place all taxpayers at risk. Understanding and publicizing such distortions is valuable. Indeed, the nonpartisan nature of our institution places it well to look impartially at thorny issues with potentially significant economic implications.

There is much to be learned about the effects of climate change and how individuals and institutions should respond to it. I hope you'll find the accompanying article helpful as you think about these issues.

— Kartik Athreya is executive vice president and director of research at the Federal Reserve Bank of Richmond.

Readings

Batten, Sandra. "Climate Change and the Macro-economy: A Critical Review." Bank of England Staff Working Paper No. 706, January 2018.

Colacito, Riccardo, Bridget Hoffmann, and Toan Phan. "Temperature and Growth: A Panel Analysis of the United States." Journal of Money, Credit and Banking, March-April 2019, vol. 51, nos. 2-3, pp. 313-368.

Economides, George, and Anastasios Xepapadeas. "Monetary Policy under Climate Change." CESifo Working Paper No. 7021, April 2018.

Pindyck, Robert. "Climate Change Policy: What Do the Models Tell Us?" Journal of Economic Literature, September 2013, vol. 51, no. 3, pp. 860-872. (Article available with subscription.)

Rudebusch, Glenn D. "Climate Change and the Federal Reserve." Federal Reserve Bank of San Francisco Economic Letter No. 2019-09, March 25, 2019.

Weitzman, Martin L. "Fat-Tailed Uncertainty in the Economics of Catastrophic Climate Change." Review of Environmental Economics and Policy, Summer 2011, vol. 5, no. 2, pp. 275-292.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.