Workers' Shrinking Share of the Pie

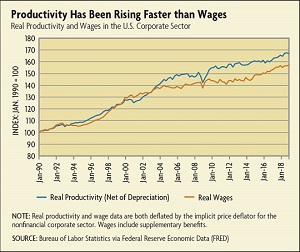

Economists have advanced a wide variety of explanations for why workers' share of overall income has been going down

By most measures, workers' share of U.S. national income has declined substantially in recent years. This development marks a departure from the post-World War II pattern. During 1947-1999, the Bureau of Labor Statistics (BLS) headline number for labor's share ranged between a low of 61 percent and a high of 66 percent. (See sidebar.) During the past decade, in contrast, it averaged only 57 percent.

Three Measures of Labor's Share

There are several measurements of labor's share of national income, and all have declined over the past 20 years.

The relative constancy of labor's share had achieved widespread acceptance as an economic regularity. But the significance of this regularity had been regarded with skepticism by some prominent economists. As early as 1939, John Maynard Keynes referred to it as "a bit of a miracle." Indeed, the economy-wide constancy of labor's share has masked a fair amount of variation across industries at given points in time and across time in various industries. And there was never a satisfactory theoretical explanation as to why these disparate industry trends should have evened themselves out at an economy-wide level.

Nevertheless, labor's share did remain relatively constant for much of the postwar period, and so its recent decline in the United States has been notable, as has been the nearly simultaneous decline of labor's share in most non-U.S. developed markets. And while there have been criticisms of the BLS headline numbers, other measures of labor's share have shown similar declines in recent years.

"Are Markets Becoming Less Competitive?" Economic Brief No. 19-06, June 2019

Globalization has also made it easier for companies to substitute away from domestic workers through foreign direct investment or outsourcing. These alternatives tend to increase the elasticity of demand for labor because they allow companies to respond to increased domestic wages by shifting productive tasks to foreign subsidiaries or suppliers. This can effectively cap wages.

Twenty years ago, the majority of economists tended to downplay the impact of international trade on U.S. wages. This view was based in large part on the relatively small size of U.S. trade with low-income countries (trade with other high-income countries was not considered as relevant because those countries have relative factor supplies similar to those of the United States). But China's emergence as a major manufacturing exporter has prompted a reassessment.

Economists have more recently found ample evidence that globalization has depressed wages — particularly for lower-skilled workers. Avraham Ebenstein of Hebrew University of Jerusalem, Ann Harrison of the University of Pennsylvania, and Margaret McMillan of Tufts University, for example, found evidence that globalized competition has reallocated workers away from high-paying manufacturing jobs and into lower-paying jobs in other industries.

This finding was supported by research of Autor, David Dorn of the University of Zurich, and Gordon Hanson of the University of California at San Diego, who focused on local U.S. labor markets heavily exposed to foreign competition. They found that employment had declined in these localities and that wages had remained persistently depressed. Moreover, lower-wage employees were the hardest hit, suffering larger proportionate declines in income than their higher-wage counterparts. Further support was provided by Bart Hobijn of Arizona State University, Michael Elsby of the University of Edinburgh, and Ayşegül Şahin, now at the University of Texas at Austin, who found evidence that labor share declines during 1987-2011 were more substantial in those industries that had experienced larger increases in exposure to import competition.

Product Market Power

Economists have increasingly examined the hypothesis that the decline in labor's share has been driven by an increase in firms' pricing power. This work looks past the neoclassical paradigm, in which the rewards to capital and labor are set equal to marginal products, and analyzes firms' power to set prices above marginal cost and thereby achieve abnormal profits. (See "Are Markets Becoming Less Competitive?" Federal Reserve Bank of Richmond Economic Brief, June 2019.)

Too Much Capital, or Too Little?

Different economists have advanced starkly different explanations for the decline of labor's share.

Autor, Dorn, Lawrence Katz of Harvard University, and Christina Patterson and John Van Reenen of MIT presented a theory of pricing power that combines technology and globalization in their widely cited National Bureau of Economic Research (NBER) working paper, "The Fall of the Labor Share and the Rise of Superstar Firms." Their account differs markedly from neoclassical models that are based on the behavior of a "representative" or average firm. (For more on how neoclassical models have been used to look at the decline of labor's share, see web-exclusive sidebar.)

"If the story was mostly about capital accumulation due to cheap equipment prices, you would expect it to be happening at most firms," says Autor. "But it's not the case that the median firm has a falling labor share. It's that a lot of economic activity has been reallocated toward firms that are already more capital intensive and have lower labor shares."

According to this view, economies of scale have increasingly favored firms that are able to leverage small competitive advantages — a phenomenon dubbed "winner take most." This trend can be seen across most sectors of the economy, but one of the most obvious examples is retail, where mom-and-pop stores have given way to retail giants such as Walmart and Target. These "superstar" firms have been able to gain an edge through information technology, efficient global supply chains, and the market power that comes from bulk purchasing. They are highly profitable, and their labor shares are among the lowest in the retail sector. And their shares of industry sales have been growing.

The researchers found a great deal of empirical support for the theory. Industries have tended to become more concentrated in a small handful of firms; labor's share has tended to decline most in the most concentrated industries; and industry labor-share declines have been driven primarily by the relative growth of firms with low labor shares.

Labor's Declining Bargaining Power

Labor markets, too, do not always behave according to neoclassical theory, where wages are set equal to marginal products in perfectly competitive markets. On the contrary, a great deal of evidence has shown that firms can and do set wages below competitive levels. This type of labor market power can arise in concentrated labor markets, where competition among employers for workers is relatively weak and firms face inelastic labor supplies. Numerous studies have reported empirical evidence that higher labor market concentration is associated with lower wages. For example, a recent recent working paper by Keven Rinz of the U.S. Census Bureau found support for the linkage based on data from the Internal Revenue Service and the Census Bureau's Longitudinal Business Database.

There is also considerable anecdotal evidence that concentration facilitates collusion — which sometimes occurs in the form of wage fixing and anti-poaching agreements. For example, in a series of prominent cases, the Department of Justice targeted technology firms that had conspired to restrict labor market competition for software engineers and designers. By May 2014, Justice had reached settlements against a large number of major tech players, including Adobe, Apple, Google, Intel, Intuit, and Pixar. (See "No Poaching," Econ Focus, First Quarter 2019.)

But firms are often able to exercise considerable market power even in markets that do not appear, at first glance, to be highly concentrated. This market power is enhanced by frictions that limit wage competition, including search costs, geographical segmentation, and job-specific human capital. According to a 2016 Council of Economic Advisers report, "30 million American workers are currently covered by non-compete agreements, and … these agreements are often imposed broadly on low-income workers or others with no access to trade secrets." These agreements appear to have no other purpose, the report argued, than to "impede worker mobility and limit wage competition."

But the key question for the decline of labor's share is not whether employers exercise market power; rather, the question is: Has there been a change in the trend? By most accounts, labor market concentration has not trended upward over the past two decades. Rinz, for example, showed that although labor market concentration has increased at the national level since 1990, it has actually declined modestly at the local level (which is presumably the relevant level of analysis for labor markets).

But at least some compelling evidence suggests that employers have increasingly exercised market power, despite the lack of a trend in labor market concentration. In a 2018 NBER working paper, Orley Ashenfelter and the late Alan Krueger of Princeton University studied the "role of covenants in franchise contracts that restrict the recruitment and hiring of employees from other units within the same franchise chain." They found that the share of franchisors with these types of "non-poaching" covenants — which limit competition and impede labor mobility — increased from 35.6 percent in 1996 to 53.3 percent in 2016.

Trends in technology and globalization may have weakened labor's bargaining power by increasing the threat of replacement through automation and outsourcing. In a neoclassical world of perfectly competitive markets, these trends may have diminished labor's share on their own, but the insecurity that they have created may well have increased employer negotiating leverage and thereby amplified the decline. This explanation is made more plausible given the weakened influence of labor unions, which historically have provided a countervailing force against employers' labor market power. The overall U.S. unionization rate declined from 20 percent in the early 1980s to 10.5 percent in 2018 (although the bulk of that decline had already occurred by the turn of the century).

Conclusion

So what explains the recent decline in labor's share? Unfortunately, it is difficult to untangle the separate roles of automation, globalization, and changes in market power. Automation has likely played a role, but its independent impact is hard to gauge, due to the difficulty in differentiating the recent wave of automation from previous episodes in which labor's share of national income held steady. Globalization appears to have been a strong contributor — a claim that is buttressed by the near simultaneity of the rise in U.S. trade with China and the decline of labor's share. A variety of evidence also points to firms' increased pricing power in product markets and workers' weakened bargaining power in labor markets. In product markets, information technology and globalization appear to have increased the pricing power and profitability of certain dominant firms. And in labor markets, the insecurity engendered by automation and globalization may have helped to weaken workers' bargaining power. In short, from the perspective of workers, multiple forces have come together to narrow their slice of an expanding economy.

Readings

Autor, David, David Dorn, Lawrence Katz, Christina Patterson, and John Van Reenen. "The Fall of the Labor Share and the Rise of Superstar Firms." National Bureau of Economic Research Working Paper No. 23396, May 2017.

Elsby, Michael W. L., Bart Hobijn, and Ayşegül Şahin. "The Decline of the U.S. Labor Share." Brookings Papers on Economic Activity, Fall 2013.

Giandrea, Michael D., and Shawn Sprague. "Estimating the U.S. Labor Share." Bureau of Labor Statistics Monthly Labor Review, February 2017.

Krueger, Alan B., and Orley Ashenfelter. "Theory and Evidence on Employer Collusion in the Franchise Sector." IZA Institute of Labor Economics Discussion Paper No. 11672, July 2018.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.