The Persistence of Financial Distress

Household financial distress is pervasive. Is this pattern driven by a small share of individuals experiencing persistent distress, by the majority facing more occasional distress, or something in between? Recent research indicates that over a lifetime, financial distress is unlikely for most but very persistent for some. Models that account for the uncertain evolution of consumers' earnings over time and the availability of formal consumer bankruptcy cannot explain — by themselves — this pattern, but a model that also allows for informal default and variation in consumers' willingness to sacrifice future wealth for current spending can.

At any point in time, many households in the United States are in precarious financial positions. According to a 2018 report from the Federal Reserve, four in ten adults would not be able to pay an unexpected expense of $400 or would cover it by selling something or borrowing money. The same report found that more than one-fifth of adults are not able to pay all of their current month's bills in full.1

Do these proportions of "financially distressed" individuals or families represent a small group that is chronically distressed, or do they reflect the exposure of a much larger set of households to more temporary risks? The answer matters for deciding how to appropriately interpret, and perhaps devise policy responses to, numbers such as those above. In addition, the effects of many fiscal policies depend on knowing who is constrained in their access to credit and by how much.2

In a 2017 working paper (revised in July 2018), Kartik B. Athreya of the Richmond Fed, José Mustre-del-Río of the Kansas City Fed, and Juan M. Sanchez of the St. Louis Fed provide a novel and detailed description of the incidence and concentration of financial distress among U.S. consumers.3 They also develop a simulation model that successfully reproduces these facts as arising from household borrowing and repayment decisions in the face of risks to their incomes. A key element of the model's success is allowing variation in the rate at which households effectively seem to prefer spending today over spending later. Athreya and his coauthors' research contributes to the growing body of literature that concludes differences in such measures of "patience" are an important feature of the data. More broadly, their work also adds to the progress economists have made in introducing many different types of heterogeneity into macroeconomic models.4

As the authors note, the implied variation in the "discounting" of the future is a stand-in for a variety of unobserved forces that contribute to households' demands for consumption. Importantly, the appropriate interpretation of their findings is not necessarily that individuals have different innate levels of patience, but rather that many consumers are persistently rendered impatient by a host of other factors. Future work that allows for more detail on household-level shocks, intrahousehold bargaining, and other sources of variation in household resources is therefore essential.

Empirical Findings

The data come from the Federal Reserve Bank of New York Consumer Credit Panel/Equifax Data. The sample includes individuals with complete credit histories who were age twenty-five through fifty-five in the first quarter of 1999. By the end of the observation period, in the second quarter of 2017, the oldest individuals in the sample were seventy-three and the youngest were forty-three. The researchers limit their measurements to individuals through the age of sixty-five in order to focus on default and delinquency behavior before retirement.

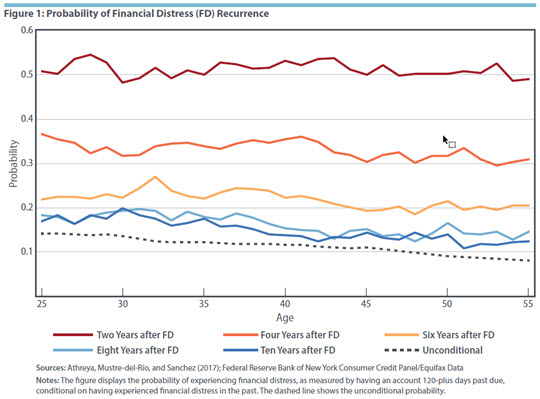

One measure of financial distress is having a severely delinquent account — one that is 120 days or more past due. By this definition, around 14 percent of twenty-five-year-olds experience financial distress. The share falls below 10 percent for fifty-five-year-olds. Although a relatively small share of adults are in distress at any given time, distress is highly persistent. Individuals who have a severely delinquent account today are three times more likely to have a severely delinquent account in six years than individuals who are not currently distressed. (See Figure 1.) In addition, more than 30 percent of consumers who experience distress are distressed for at least one-quarter of the time they are in the sample. One-tenth of consumers experience distress four or more times. The story is similar when the authors define distress as a consumer depleting his or her available credit—"maxing out" credit cards—rather than as having a delinquent account. Overall, they find that financial distress is highly concentrated, with around 80 percent of the observed distress accounted for by just 20 percent of consumers. (These results are consistent across different subperiods of the 1999–2017 time period and thus do not seem to result from the financial crisis or the Great Recession.)

Although financial distress is frequent and persistent, it might not be overly detrimental to a household's well-being if the delinquent debts are trivial. For example, an overdue store credit card bill of $50 is likely to cause less stress or harm than an overdue mortgage or car payment. But the authors find that the delinquent debts are a significant fraction of households' liabilities. Distressed borrowers have almost 80 percent of their total debt in delinquency, and this intensity decreases only slightly with a borrower's age. Additionally, among distressed borrowers, average delinquent balances are substantial — about $2,000 for twenty-year-olds and $6,700 for fifty-five-year-olds. If people are categorized as being in financial distress based on the fact that they have an account at least 120 days past due, it's likely that most of their debt and most of their accounts are seriously delinquent.

Overall, Athreya, Mustre-del-Río, and Sanchez conclude that financial distress among U.S. households, measured in a variety of ways, is driven by a relatively small proportion of individuals who experience significant and persistent debt-repayment problems that apply to nearly all of their debts.

Accounting for the Facts

The data on U.S. consumers show that financial distress is persistent. For example, Athreya and his coauthors found a gap of 60 percentage points between the conditional and unconditional probabilities of being in financial distress at the one-year mark. In other words, individuals presently in distress are 60 percentage points more likely to be in distress one year later than individuals not currently in distress. But widely used models of unsecured consumer debt and default over the life cycle imply a gap of only 15 percentage points.5 In addition, the distress enerated by standard models is more transitory than the distress observed in the data.

Athreya, Mustre-del-Río, and Sanchez extend the standard model in two primary ways. The first extension is to allow households to vary in the extent to which they value consumption today over consumption tomorrow. (In financial models, this is known as the discount rate—the higher an individual's discount rate, the more he or she values consumption today.) The second extension is to allow for both informal default, in the form of delinquency, and formal default, such as declaring bankruptcy.

By allowing for informal default, the model captures an empirically relevant pathway for nonrepayment, as reflected by the substantial delinquency rates observed in U.S. data. In contrast, formal default, predominantly Chapter 7 bankruptcy, is by construction very short-lived. Because bankruptcy eliminates all unsecured debts, models that include only formal default fail to describe the ongoing difficulties many households experience. In other words, informal default is the path for the many who are not ready to take the more extreme step of declaring bankruptcy but nonetheless face potentially lengthy periods of financial distress. Allowing for informal default as an option for borrowers also enables the model to capture the complications default risk poses for credit pricing and availability. In particular, terms across borrowers will vary, both over time for a given borrower and across different borrowers at any given time, in response to the evolution of their balance sheet and future earnings prospects.

With the addition of heterogeneity in discount rates and both formal and informal default, the model successfully generates the observed levels and persistence of financial distress. To confirm that these are in fact the important features of the model, the researchers estimate several alternative models in which heterogeneity and informal default are suppressed. These alternative models do not accurately generate the empirical facts.

Contributions and Policy Implications

Athreya, Mustre-del-Río, and Sanchez's findings are somewhat intuitive. In particular, it is perhaps not surprising that when credit gets tighter as borrowers' conditions worsen, and when default comes with negative consequences, financial distress would not be routinely utilized other than early in life and would not be utilized often unless a borrower felt that a current spending need was urgent.

Still, while the findings are intuitive, developing a model that successfully generates the persistence of financial distress is important because there are many potential underlying narratives that might have produced the observed data. A model based on consumers' decision-making allows researchers to evaluate how harmful a given situation actually is and to understand how risks matter for individuals' well-being. Most of all, a successful model features a clear mechanism that translates features of the environment in which people live (such as the risks to their income) to decisions. With that in hand, economists and policymakers can run counterfactual policy exercises for which there is no obvious natural experiment to rely on for guidance.

When analyzing bankruptcy policy, for example, a model that includes only formal default might lead to the conclusion that stricter bankruptcy laws reduce the amount of default. But in fact, it might be the case that stricter bankruptcy laws push consumers into other forms of default rather than reducing default overall. And for deciding how to interpret financial distress, such analyses inform choices about whether blanket or targeted policy responses are warranted.

Kartik B. Athreya is executive vice president and director of research and Jessie Romero is an economics writer in the Research Department at the Federal Reserve Bank of Richmond.

Board of Governors of the Federal Reserve System, "Report on the Economic Well-Being of U.S. Households in 2017," May 2018.

See Kartik B. Athreya, Andrew Owens, and Felipe F. Schwartzman, "Does Redistribution Increase Output? The Centrality of Labor Supply," Federal Reserve Bank of Richmond Working Paper No. 14-04R, March 2014, revised December 2016.

Kartik B. Athreya, José Mustre-del-Río, and Juan M. Sanchez, "The Persistence of Financial Distress," Federal Reserve Bank of Richmond Working Paper No. 17-14R, November 2017, revised July 2018.

Kartik B. Athreya and Renee Haltom, "The Spice of Life: Allowing for Heterogeneity in Macro Models," Federal Reserve Bank of Richmond Economic Brief No. 12-04, April 2012.

These include models based on Igor Livshits, James MacGee, and Michèle Tertilt, "Consumer Bankruptcy: A Fresh Start," American Economic Review, March 2007, vol. 97, no. 1, pp. 402–418; and Kartik B. Athreya, "Default, Insurance, and Debt over the Life-Cycle," Journal of Monetary Economics, May 2008, vol. 55, no. 4, pp. 752–774.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.