Career Progressions and Wage Growth: Decreasing the Gap Between Richer and Poorer Workers

Key Takeaways

- We study mechanisms generating wage gaps between richer and poorer workers.

- We find that the deterioration of human capital, employment in low-productivity firms and scarce on-the-job learning opportunities are the key drivers of these differences.

- Giving low-wage workers opportunities to work in good firms early in their careers decreases the gap between poorer and richer workers as these workers gain valuable skills.

In our previous article, we explored the contribution of different career dynamics to the earnings gap between poorer and richer workers. We emphasized how poorer workers do not lack opportunities to change jobs, as they have high job mobility rates. Thus, they potentially could work at increasingly better-paying firms but seldom do so in practice. Looking at previous economic literature — including a leading framework for the labor market: the job ladder model — we argued that postulating a common job ladder for both poorer and richer workers is not supported by the data. In this article, we illustrate an alternative framework and evaluate real-world policies with it.

Differences Between Richer and Poorer Workers

Our work starts with documenting several stylized facts that distinguish workers who are at the ninth decile of the lifetime earnings distribution ("richer") from those who are at the first decile ("poorer"). In particular, the earnings of richer workers grow faster than those of poorer workers over the life cycle. Lackluster wage growth could be brought about by a deficit in labor market mobility for poorer workers compared to richer ones, but we find no evidence in favor of this hypothesis. Indeed, the data actually suggest that poorer workers cycle through employers and jobs at higher rates than rich workers do. Why, then, do frequent job-to-job transitions result nonetheless in poor wage growth for lower-wage workers?

We propose a theoretical framework to understand these differences. Our theoretical model can help us in understanding differences in career progressions in two ways:

- We gain insights into previously unexplored mechanisms.

- We can evaluate the relative importance of these mechanisms using a calibrated model and analyze policies that policymakers might want to implement.

Modeling Wages and Employment

The use of calibrated models is the economists' equivalent of an experiment. Because economists study the behaviors of individuals and organizations, it is impossible to reproduce the study environment in the same manner as, say, a laboratory for physics or chemistry studies. While physicists and chemists can reproduce the very same experiment, economists cannot do the same while adding a single twist.

In practice, economists create a simplified model of the economy that nonetheless reproduces salient features of the world and contains what we identify as the key ingredients behind specific economic outcomes. In our case, the salient features are wage and employment dynamics, and the key ingredient is the accumulation and decumulation of human capital. In other words, the behavior of wages and job flows in the model is very similar to what is seen in the empirical data, and this is achieved through a specific learning mechanism that we postulate.

We use the model as both an investigation tool and a testing ground for different policies, and we interpret differences in the model-generated wage and employment dynamics as "what would happen if the world were different/the policy changed."

Factors in Differences Between Richer and Poorer Workers

Going back to what determines different wage growth across workers and why, our model offers a nuanced way to quantify differences across workers, who are presumed to differ along three dimensions:

- Their productivity level: the human capital they bring to production, such as cognitive or manual skills

- Their ability to learn or gain more production skills: that is, the extent to which they can take advantage of learning opportunities in their workplace

- Their noncognitive skills: a form of human capital that captures reliability and dependability, summarized through a worker-specific risk of job loss

Throughout their careers, workers are employed at different employers, which are diverse as well. For instance, some firms are more productive than others, meaning they have better technology to produce output. Firms also differ in how much they support workers' learning, with some firms having programs to help workers grow and other firms forgoing such programs.

In this environment, learning happens on the job by way of learning-by-doing. While employed, workers are exposed to technology, which triggers human capital accumulation. The extent to which this happens varies both across employers and (within the same employer) across workers. Therefore, the speed at which human capital accumulates depends on both workers' abilities and how good of a learning environment their employers offer. Human capital for unemployed workers, however, deteriorates steadily.

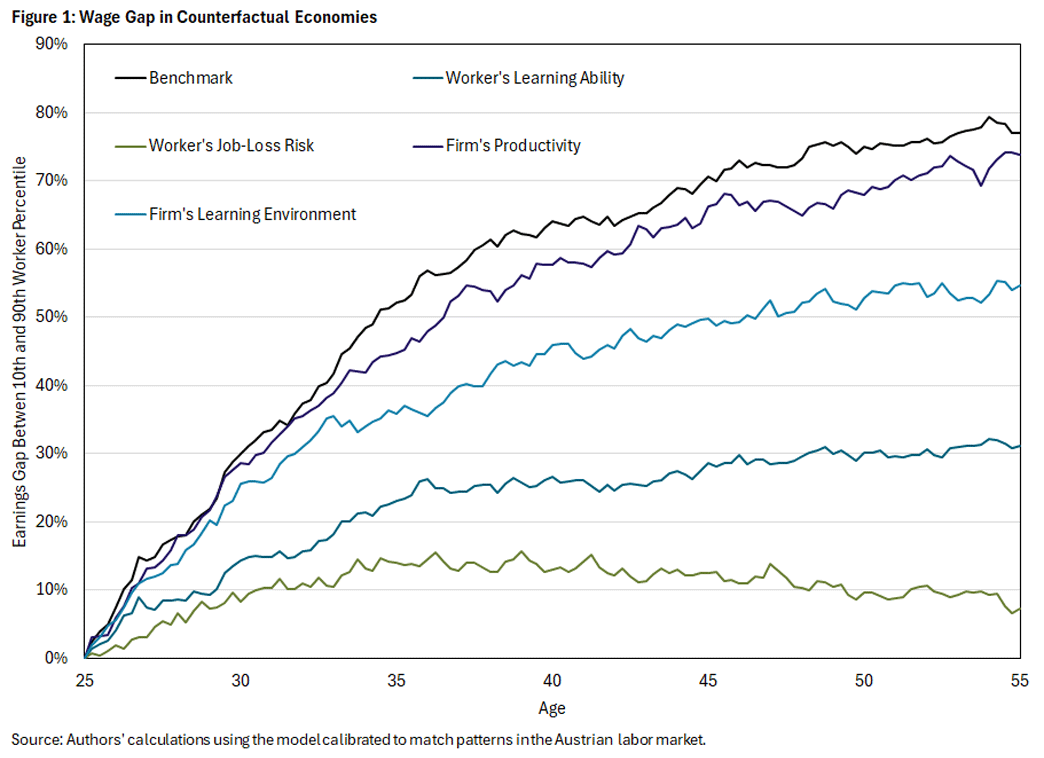

To understand which mechanisms are most important — differences across workers, differences across firms or a combination — we calibrate the model so that it well describes the patterns in the data we described above. We then use the model to analyze a counterfactual world where some mechanisms are not present. We first ask how different the wages are that richer and poorer workers earn at different ages in a world where all workers had the same ability to learn or face the same risk of losing the job. The results from this experiment are shown in Figure 1.

The black line shows the percentage difference between wages of richer and poorer workers (the wage gap) at different ages in the benchmark economy, which represents "real world." The gap is normalized to be zero at age 25 so that we can focus on forces that contribute to widening the gap as workers age.

The dark blue line shows the wage gap in a world where were all workers have the same learning ability, and the green line shows a world where all workers face the same unemployment risk. We see that the wage gap is considerably smaller in these alternative worlds, rising to only 31 percent (learning ability) or 7 percent (job-loss risk) at the end of careers (age 55), compared to 77 percent in the benchmark economy. This implies that an important reason why poor workers do not see their wages increase throughout their careers is their limited ability to gain new skills in their jobs, as well as their ability to keep these jobs long enough to benefit from the skill acquisition.

We next investigate the importance of differences across firms. The purple line in Figure 1 shows the evolution of the wage gap in a world where all firms have the same technology, and the light blue line shows a world where all firms equally support their employees' learning. We find that the wage gap at each age decreases compared to the benchmark economy in both cases, but less so than in the previous two experiments. This leads us to conclude that, while firm heterogeneity is important in understanding the differences documented at the beginning of the article, it is less important than differences in workers' abilities.

Policy Intervention and the Wage Gap

Finally, we study how policy interventions can affect the career progression of poorer workers. Understanding such policies is relevant because equity concerns and concerns about societal costs from poverty have spurred a variety of measures to sustain the earnings of the poor. Many of these interventions focus on improving job matches for young workers, either through educational institutions' placement or apprenticeship offices.1 Our exercise helps with understanding whether attempts at improving employer quality for young workers are likely to be successful in setting them on a path to earnings growth.

In our model-based experiment, we pair young low-wage workers with "good" employers, namely those with average firm-level wages, wage growth and profits per worker.2 We then ask whether securing a "good job" (that is, a job with a good employer) is sufficient to change earnings trajectories for poor workers and, if so, which measure of such a job is the most useful measure.

We find that the answers are subtle. First, policy is most successful when it pairs young low-wage workers with high-profit employers, but not necessarily with high-wage or high-wage growth employers. Second, improving employer quality along this margin has a nonnegligible positive impact on workers' earnings growth. Early career access to a high-profit employer increases lifetime earnings for those workers by as much as 10 percent. This "good job effect" increases to 17 percent if workers are shielded from separation for two years, that is, if their noncognitive skills improve alongside the jobs' productivity and learning opportunities offered by their employers.

Conclusion

To summarize, our analysis implies that lower abilities to learn new skills and to keep jobs are the key determinants of why some workers do not see their wages grow over their careers. While these issues are hard to tackle directly through policy, there are potential avenues for policymakers to help these workers. We find that matching these workers to good jobs early in their careers can help, through both giving them higher earnings and helping them accumulate new skills. These programs are more effective if combined with letting workers stay in these jobs for at least two years.

Katarína Borovičková and Claudia Macaluso are economists in the Research Department at the Federal Reserve Bank of Richmond.

Recent policy actions along these lines include the "The Good Jobs Initiative" by the Department of Labor.

We chose metrics that policymakers could access via tax data or stock market valuations.

To cite this Economic Brief, please use the following format: Borovičková, Katarína; and Macaluso, Claudia. (October 2024) "Career Progressions and Wage Growth: Decreasing the Gap Between Richer and Poorer Workers." Federal Reserve Bank of Richmond Economic Brief, No. 24-32.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.