Inflation and the Price Expectations of Firms

In the spring of 2021, inflation started to climb above the Federal Open Market Committee's (FOMC) 2 percent target. By June 2022, the inflation rate had increased to territory not seen since the early 1980s – year-over-year growth in the Consumer Price Index (CPI) reached 9.1 percent, while growth in the Personal Consumption Expenditures Price Index (PCEPI), which is followed most closely by the FOMC, hit 7.0 percent. The most recent inflation readings are still extremely elevated—7.7 percent for the CPI (October 2022) and 6.2 percent for the PCEPI (September 2022).

An ongoing policy priority is ensuring that higher inflation does not work its way into the wage- and price-setting expectations of firms and households. Because this requires knowing those expectations, economists at the Richmond Fed and elsewhere have been closely tracking market-based and survey-based measures of inflation expectations. Here at the Richmond Fed, we've been asking our Fifth District monthly business survey participants a quarterly series of inflation and price expectation related questions since July 2021. In the latest October results, we find that although firms report paying more attention to inflation measures such as the CPI or the PCEPI, they are more likely to factor in labor and non-labor costs of production/service provision when thinking about price expectations for their goods and services. In addition, their expectations for inflation in the next five years remain much lower and less disperse than their expectations for the next year. On the other hand, business contacts do report being more likely to think about aggregate inflation when setting their wage expectations, which may be indirectly feeding into their price expectations.

What Do Our Firms Say About Their Price Levels?

For years, the Richmond Fed has been asking survey participants for their annual, realized growth in both prices paid for inputs and prices received for outputs as well as the growth that they expect over the next year. The chart below represents the average across approximately 200-250 respondents per month, about 30 percent of which are manufacturing establishments. The differences over time between the survey price averages and the CPI/PCEPI is not surprising: Our relatively small panel includes a disproportionately high share of manufacturers, and many of our firms sell to other domestic or global firms, not directly to domestic consumers. Nonetheless, this chart brings to light an important feature of our survey participants' price growth: Although growth in prices received in the last year remains elevated, expectations for that growth remain below realized growth and those expectations are falling. In other words, firms expect their growth in prices to fall in the next year relative to where it was in the past year.

Firms Are Watching Aggregate Inflation

Firms are paying more attention to inflation. When asked how closely they follow inflation in July 2021, about 20 percent reported following inflation "very closely." By October 2022, the share had grown to 33 percent. What is more, this does not appear to be just a learning effect: Firms were more likely to report following inflation in October 2022 regardless of whether they participated in the 2021 survey rounds.

Recent survey research by economists at the Atlanta Fed and economists such as Coibion and Gorodnichenko has sought to understand the extent to which aggregate inflation measures matter when firms are setting prices. Thus far, most of that research has found that costs matter more than aggregate measures of inflation. However, much of this work was also done in a low and steady inflation environment. As high inflation has persisted, it is not surprising that more firms take into account aggregate measures of inflation when setting price expectations. In July 2021, about 26 percent of respondents said that aggregate measures of inflation were "very important" to the prices they will charge customers in the next 12 months. By October 2022, that number was up to 35 percent.

On the other hand, even in October 2022, after 18 months of elevated inflation, both labor and non-labor costs are reportedly more important to how firms set their prices.

This brings to light another result of this survey: Firms report that inflation matters more for wage setting than for price setting. Even in October 2021, 33 percent of respondents reported aggregate inflation to be "very important" when setting expectations for the change in wages they will provide to their employees. That number only went up: In October 2022, 40 percent said that inflation was "very important" for how they think about wage growth, and only 8 percent said that inflation was "not important." Given the role of labor costs in expected prices, it is possible that expectations for aggregate inflation end up in price growth through expected growth in wages.

Another Good Sign When It Comes to Inflation Expectations

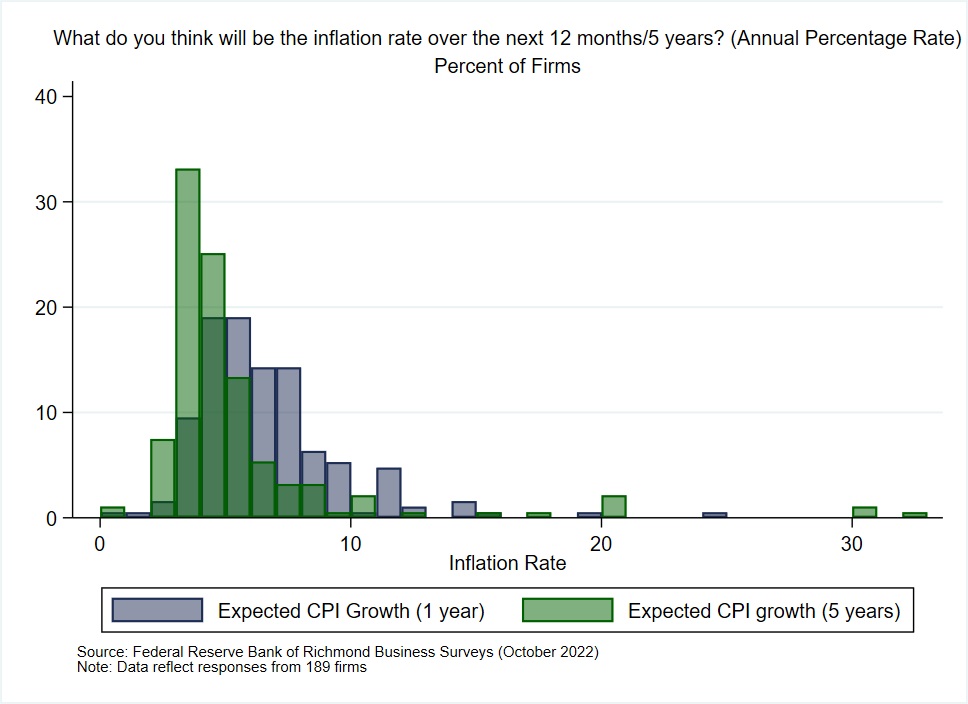

In addition to expecting moderation in their own price growth, firms generally expected moderation in aggregate inflation. The chart below shows the distribution of expected aggregate inflation in the next year and in the next five years. It is good news for policymakers that five-year average expected inflation was not only lower, but less disperse than the one-year expectation.

Conclusion

This article provides a snapshot into some of the results of this quarterly survey, but many questions remain about the extent to which firms' reported expectations translate into action. Over time, and with further analysis, we expect that this survey effort will provide insight into these questions. For example, what is the relationship between expected inflation and expected own-price growth for firms that report factoring aggregate inflation into their price expectations? What is the relationship between expected wage growth and expected price growth, and where do expectations for aggregate inflation fit in? To what extent will panelists continue to follow aggregate inflation measures once inflation moves closer to the FOMC's 2 percent target? For now, however, our policymakers can take comfort that, in spite of the challenges of the last 18 months, firms anticipate aggregate inflation and their own price growth to return over time to more normal levels.