Have Wages Kept Up with Inflation?

With only 194,000 jobs added to nonfarm payrolls, September's employment report was a disappointment relative to previous months. However, wages continued to grow strongly. Average hourly earnings rose 0.6 percent monthly to $30.85. This is 4.6 percent higher than a year ago and 8.2 percent higher than the pre-pandemic level. The year-over-year growth rate was the highest in data starting from 2007 through the onset of the pandemic in March 2020. (The spike in AHE in the early days of the pandemic was due to lower-paid workers in high-contact services industries being laid off or furloughed, temporarily driving up the average before a more normal trajectory resumed around summer 2020.)

"... Elevated headline inflation readings may start to have more of an impact on workers’ labor supply decisions."

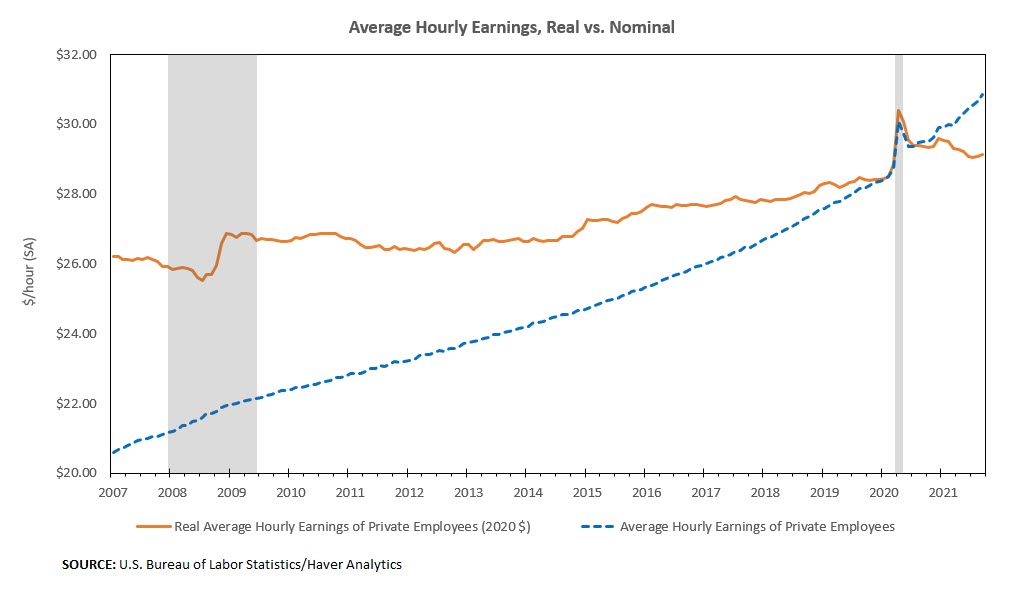

But with inflation running high — the latest readings show September CPI inflation at 5.4 percent and August PCE inflation at 4.3 percent — real (i.e., inflation-adjusted) wage growth has been more muted. (See Figure 1 below.) Adjusted for inflation, average hourly earnings rose 0.2 percent monthly in September but was 0.8 percent lower versus the prior year and only 2.2 percent higher compared to February 2020.

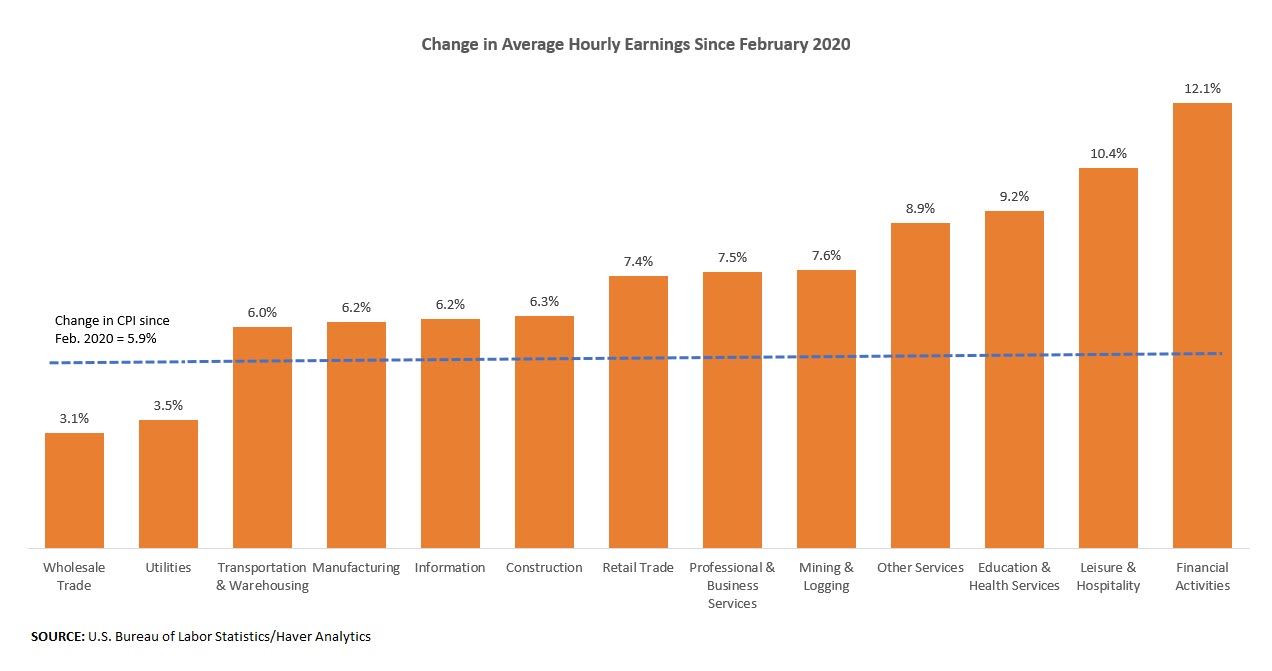

Figure 2 below shows how wages across industries have increased since February 2020, compared to the growth in CPI over the same time period. While average hourly earnings in most industries have kept up with CPI inflation, this is not the case in utilities and wholesale trade.

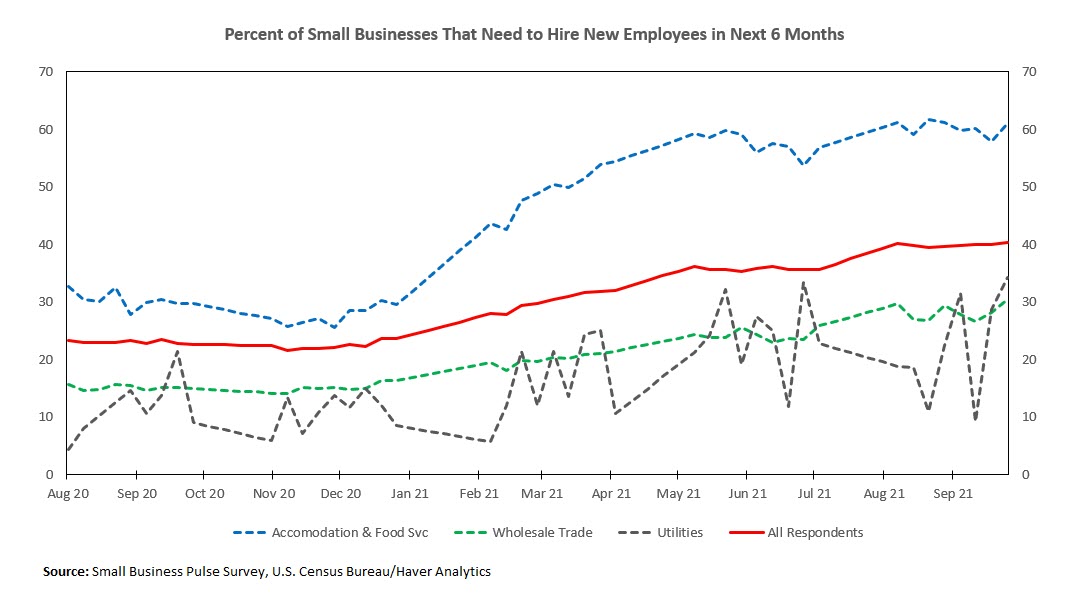

Differences in the pace of wage growth likely reflect differences in the level of labor demand across industries. According to the U.S. Census Bureau's Small Business Pulse Survey, as of October 2, 28.8 percent of businesses in the utilities industry and 28.2 percent of businesses in the wholesale trade industry indicated a need to hire new employees in the next six months, compared to 40.1 percent of small businesses overall. In contrast, 57.9 percent of small businesses in accommodation and food services needed to hire new employees over the next six months, with strong labor demand contributing to a faster pace of wage growth relative to inflation. (See figure 3 below.)

Although real wages for workers in utilities and wholesale trade have fallen since February 2020, labor demand remains positive and appears to be on an upward trend — in line with the trend for small businesses overall. To meet this demand, we may see employers offer more wage increases in the future.

Meanwhile, elevated headline inflation readings may start to have more of an impact on workers' labor supply decisions. If workers are paying attention to the purchasing power of their paychecks, we could see them demand additional pay raises and become more willing to switch jobs in search of higher pay — an upside risk to inflation and further complicating the recovery in the labor market.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.