Your Attention Please ...

It's a well-accepted precept in economics that people's expectations about future inflation can influence the actual path of inflation. That is why economists and policymakers took note when the January 2022 Surveys of Consumers by the University of Michigan showed consumers expecting 4.9 percent inflation over the next year. And, preliminary results for February indicate expected inflation rose even higher to 5 percent, which would be the highest since the pandemic began.

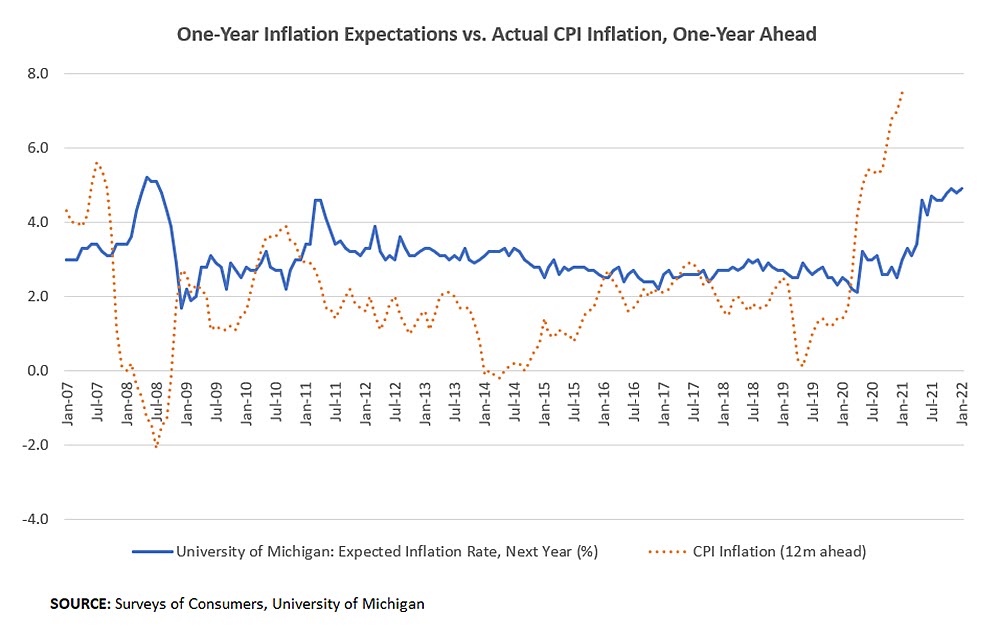

Historically, households have not been very good at predicting inflation. Figure 1 below plots the expected one-year inflation rate from the survey against realized Consumer Price Index (CPI) inflation a year later. Since 2007, the correlation between the two measures has been -0.35, which casts doubt on whether this survey tells us much about future inflation at all. But as we explore in this post, consumers' expectations may now have some additional weight.

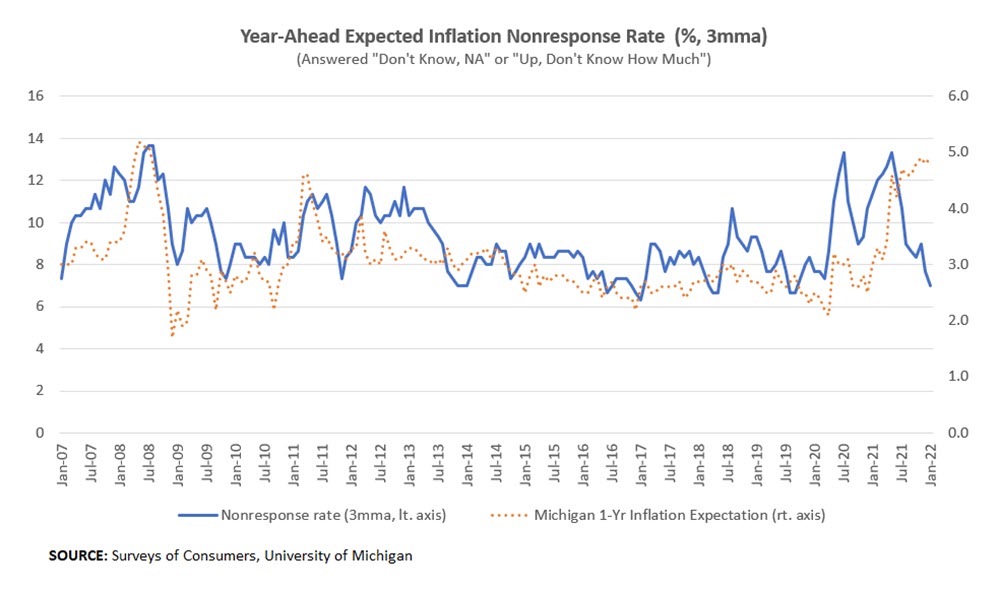

So why should we listen to households now? There's an important difference between January's year-ahead inflation expectation of 4.9 percent and the same expectation recorded two months earlier — more people are paying attention. We can estimate this by looking at how many people respond to the Michigan survey's inflation questions. In addition to asking people whether they think prices will go up, down or remain the same next year, the survey asks respondents by how much they think prices will move. Adding up the share of respondents who skipped the "by how much" question with the share who skipped the prices question altogether gives a measure for how much attention people are paying to inflation.

Figure 2 shows that this attention measure has varied over time. On average, since 1978, 9 percent of respondents did not respond to the inflation questions. But in January 2022, only 6 percent of those surveyed did not respond, following 5 percent the prior month. Since 1978, there's been a small but positive correlation between nonresponse rates and expected inflation, which means that people seem to be paying less attention when expected inflation is higher. So, the current combination of high attention and high expected inflation is quite unusual historically.

Why has consumer attention tended to decline during past periods of higher inflation expectations? According to research by the Federal Reserve Board of Governors, higher nonresponse rates could indicate higher costs of gathering information and learning about future inflation. These costs might be higher when economic stress on households is greater in general. During the trough of the COVID-19 recession in May 2020, the nonresponse rate shot up to 15 percent — the highest since the Great Recession — which could reflect that people had bigger problems to worry about at the time and didn't dedicate many resources to updating their inflation expectations. Other research has found that when households pay less attention to inflation, inflation expectation measures become less predictive of future inflation.

While we can't say for sure why people are paying more attention now, January's unusual combination of high expected inflation and higher attention to inflation could be particularly potent. We provide evidence of that below. In October 2021, Cleveland Fed economists tested how well various measures of inflation expectations predict future inflation, running a regression of year-ahead inflation against current inflation and inflation expectations levels. We augmented their regression by adding a term that captures whether or not households are paying more attention to inflation (i.e., equal to one when the nonresponse rate is below average, zero otherwise) and allowing the impact of expectations to vary by attention level.

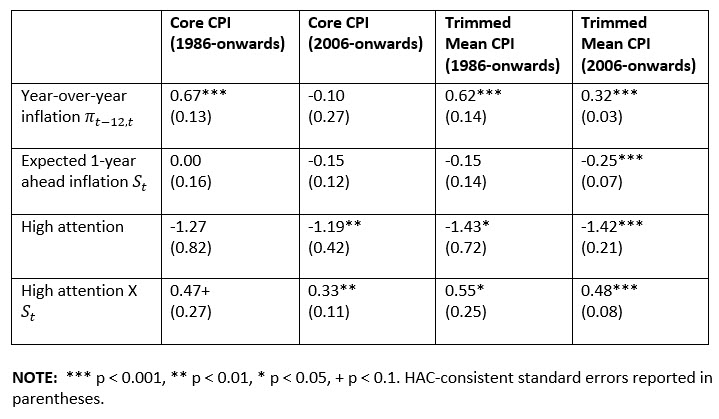

Table 1 below shows the results of this regression. We focused on data starting in the mid-1980s due to a shift in inflation dynamics in that decade. We also considered a sample starting in 2006 to see if results hold for a more recent period. The first two columns show results for core CPI inflation. For the full sample beginning in 1986, there's evidence of persistence in core CPI inflation, with current year-over-year inflation related to one-year ahead inflation, but the relationship breaks down in the sample starting in 2006. The second row shows that expected inflation from the Michigan survey did not have a statistically significant relationship with year-ahead inflation for either sample. The third row is negative, which is in line with the pattern documented above where attention has tended to drop as inflation runs high, and the costs of learning about future inflation increase.

We're mainly interested in the last row, which shows that the impact of inflation expectations is stronger (and positive) when attention is high. The effect is statistically significant at only the 10 percent level for the full sample but stronger in the post-2006 sample. In the last two columns, we show the same results for trimmed mean CPI (an alternative measure of core inflation) and get similar but more statistically significant results. So inflation expectations do matter for inflation, particularly when households are paying attention — and they're paying attention today.

With the Fed pursuing a goal of price stability, you might think it would welcome the increased attention to inflation. In fact, households paying more attention could be an unwelcome precursor to expected (and actual) inflation becoming unanchored, which is one reason why a former Fed chair called price stability an environment where inflation "does not materially enter into the decisions of households and firms." In the meantime, make sure to pay attention to this blog for more updates on the situation.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.