GDP Fall Doesn’t Tell All

The first quarter fall in real GDP has sparked considerable concern, but an alternative measure of economic activity provides hope that the economy didn't fare as poorly as the GDP data suggest.

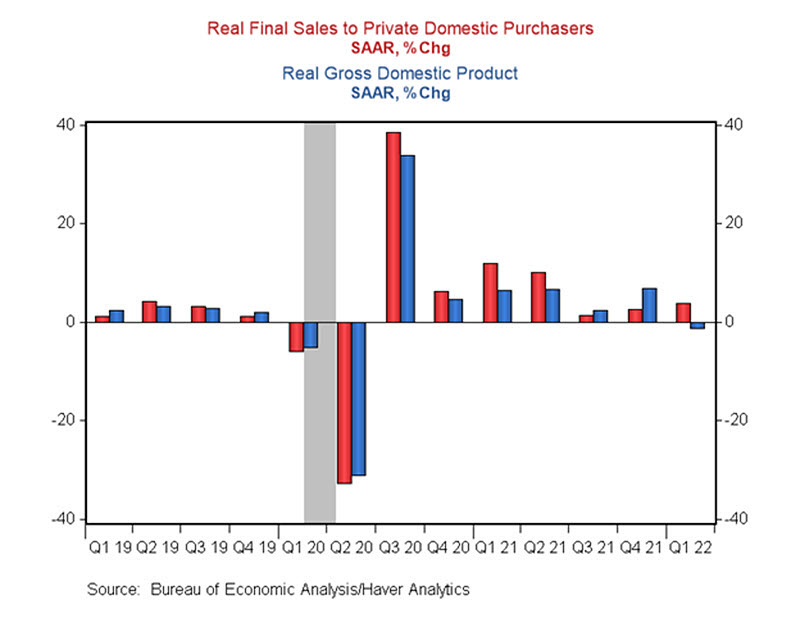

Real GDP fell 1.4 percent at an annualized rate in the first quarter following the fourth quarter's 6.9 percent expansion. This fall was driven by declines in private inventory investment (weighed by retail and wholesale motor vehicle inventories), exports and government spending, along with an increase in imports. First quarter personal consumption rose at a 2.7 percent annual rate versus expectations for 3.5 percent annualized growth. Keep in mind this is only the first estimate of GDP and we've seen significant revisions in the past. Seasonal patterns in monthly data have been disrupted by factors such as the omicron variant and Russia's invasion of Ukraine.

"... Perhaps GDP itself has become a much noisier measure of economic growth in the aftermath of the pandemic."

Domestic demand looks stronger when you smooth out the more volatile components of inventories (which subtracted 0.84 percentage points from annualized growth) and net exports (which subtracted 3.2 percentage points from annualized growth). Real final sales to private domestic purchasers — which measures private demand in the domestic economy and is the sum of consumer spending and private fixed investment — accelerated to 3.7 percent in the first quarter after increasing 2.6 percent in the fourth quarter (see Figure 1 below). Within that category, nonresidential fixed investment showed that companies are preparing for strong growth in consumer demand, rising 9.2 percent in the first quarter (versus 2.9 percent in the fourth quarter) and driven by equipment investment.

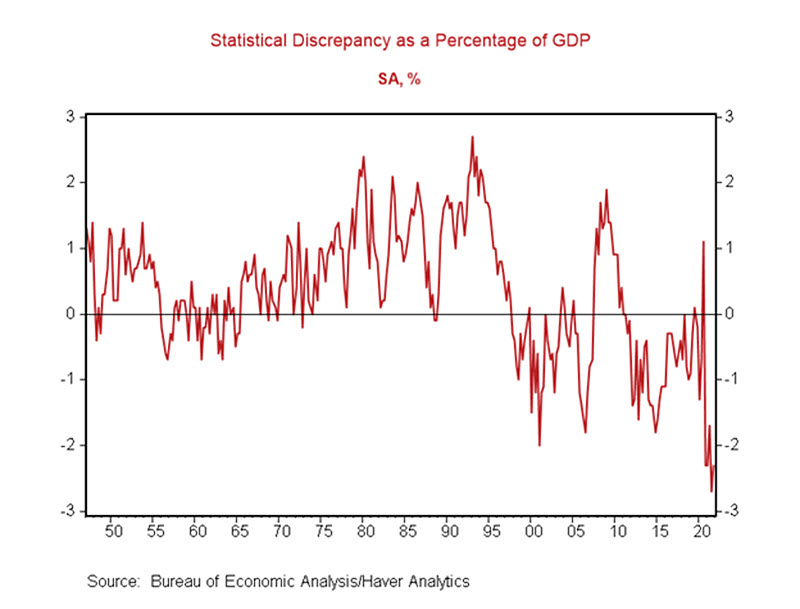

But going beyond the makeup of last quarter's GDP, perhaps GDP itself has become a much noisier measure of economic growth in the aftermath of the pandemic. One way to see this is via the gap between GDP and gross domestic income (GDI):

- GDP measures the value of goods and services produced by the U.S. economy.

- GDI measures the incomes earned and the costs incurred in producing GDP.

In principle, GDP and GDI should be equal. However, over the past year, the gap between the two has reached historically high levels relative to GDP. In the third quarter of 2021, it reached a record of 2.7 percent in absolute terms, recovering slightly to 2.3 percent in the fourth quarter (see Figure 2 below). Past work by the Bureau of Economic Analysis has looked at whether there's any systematic relationship between the magnitude of the statistical discrepancy and various economic indicators, but no robust relationship has been found.

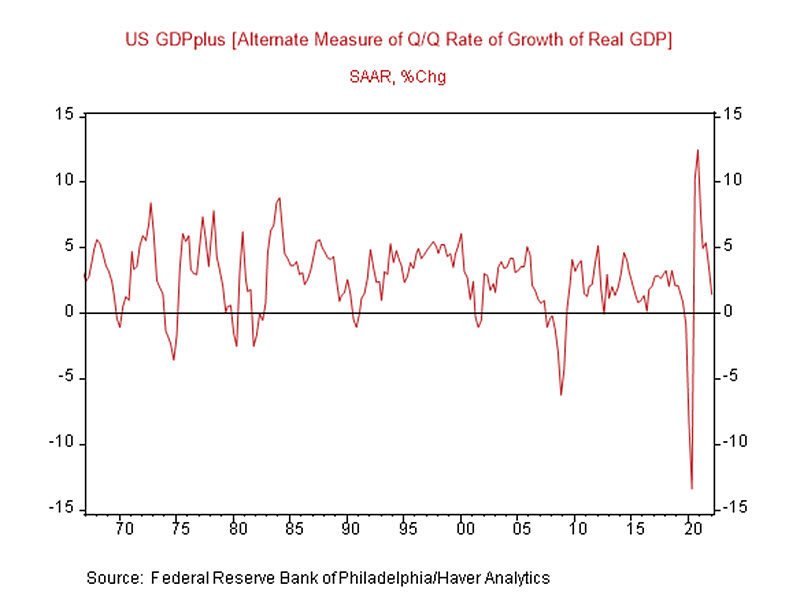

Based on the idea that GDP and GDI both provide a noisy signal of underlying economic activity, economists at the Philadelphia Fed developed a measure called GDPplus that combines information from both approaches to form an alternative estimate of growth. The latest reading of GDPplus — produced April 28 after first quarter GDP figures were published — suggests that the economy grew at an annualized rate of 1.4 percent in the first quarter (see Figure 3).

Subsequent revisions of official GDP may yet corroborate this alternative measure. The economy at the start of 2022 may be in a better position than the advance estimate of GDP suggests.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.