Consumer Debt Load Continues to Rise

In the depths of the pandemic — when many stores were closed and opportunities to spend were curtailed — many households used their forced savings and pandemic fiscal support to pay down their debt. But now, debt is bouncing back as consumers borrow more to pay today's higher prices. So, how has consumer debt trended in recent months?

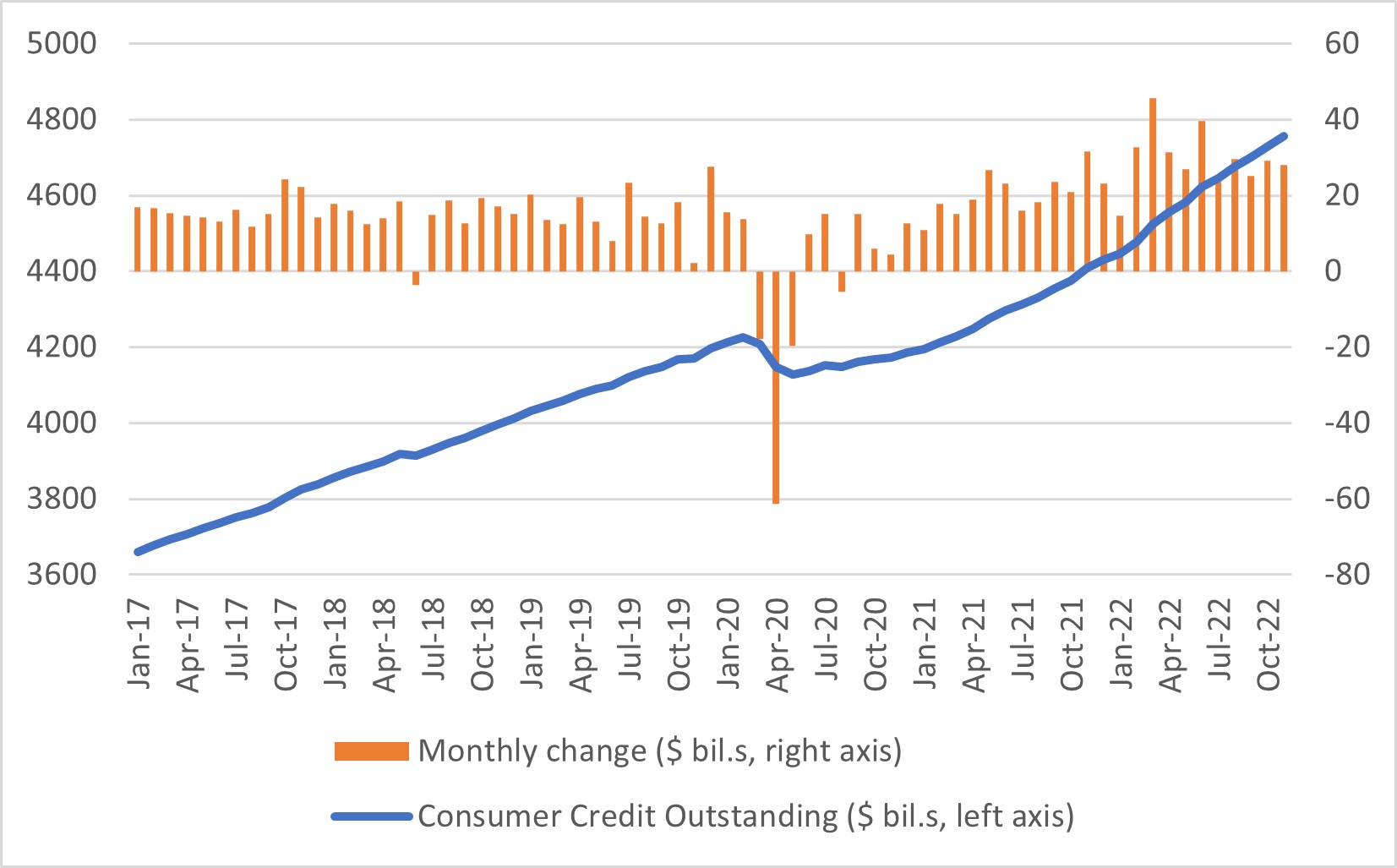

In November, total consumer credit outstanding — which captures most short-term and intermediate-term lending to consumers, but not loans secured by real estate such as mortgages — stood at $4.8 trillion, or 14.1 percent higher than the same month in 2019, as seen in Figure 1 below.

There are two main types of consumer credit:

- Revolving, which allows consumers to borrow up to a prearranged limit and repay the debt in installments (such as credit card borrowing).

- Nonrevolving, which is generally a set amount of borrowing and is repaid on a prearranged schedule (such as auto and student loans).

While credit card spending has helped support rapid business recovery from the COVID-19 recession, consumers with credit card balances may now find themselves more vulnerable to rising interest rates, compared to consumers who rely more on nonrevolving credit.

Most credit cards charge a variable annual percentage rate that increases as the federal funds rate increases. As of the fourth quarter of 2022, credit card interest rates are up 4.6 percentage points year over year, compared to a more modest 1.9 percentage point increase for 60-month new car loan rates. According to data from TransUnion, credit card users are carrying balances that are 13 percent higher on average compared to 2021, and the share of credit card users who carry a balance has risen to 46 percent from 39 percent a year ago.

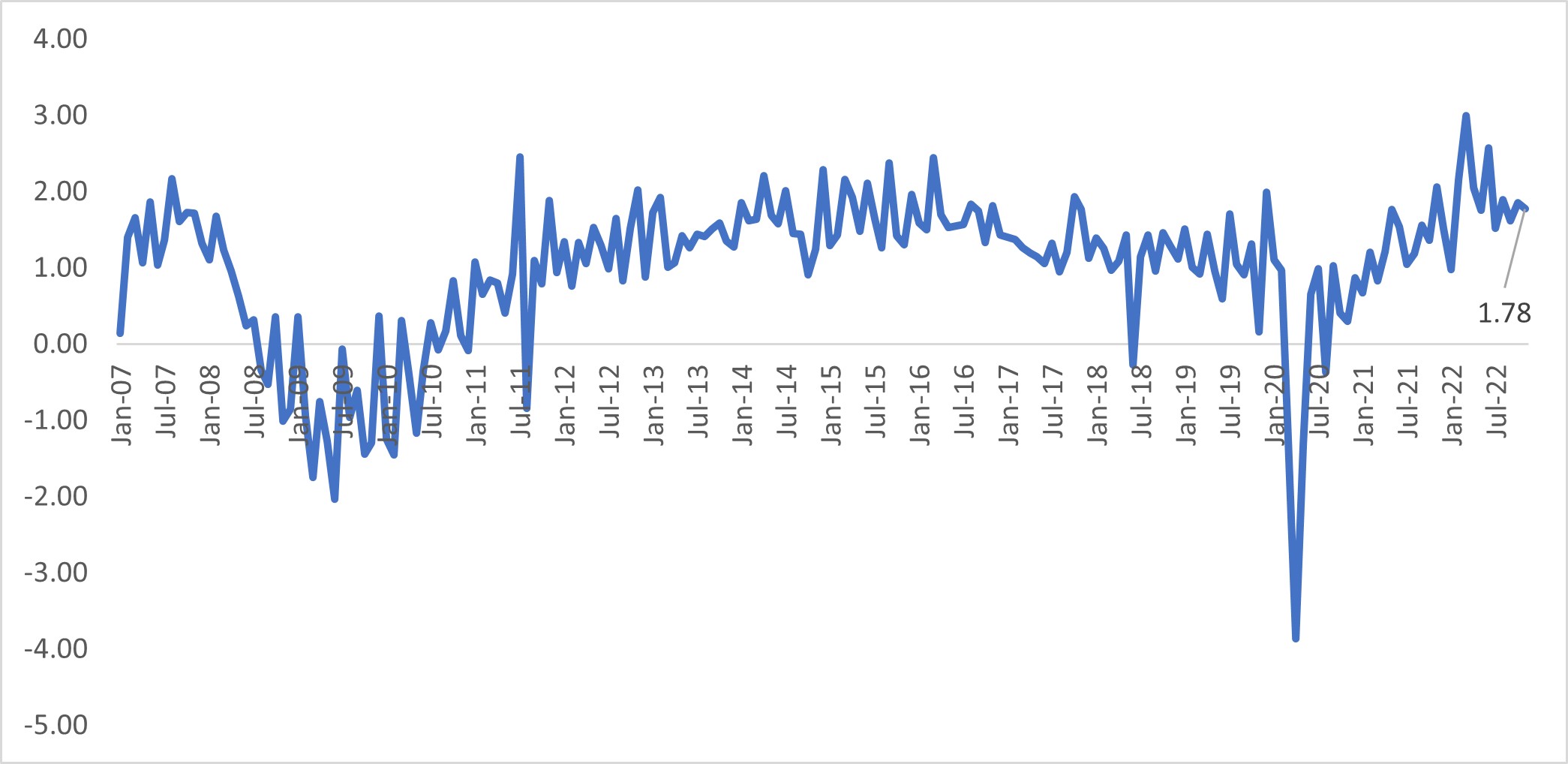

On the other hand, incomes have risen along with borrowing. Relative to income, monthly flows (that is, net changes in outstanding balances) of consumer credit appear to just be normalizing to pre-pandemic ratios. In November, consumer credit flows were 1.8 percent of monthly disposable personal income. In the five years before the pandemic, that monthly ratio averaged 1.4 percent and fluctuated between -0.3 and 2.5 percent, as seen in Figure 2 below.

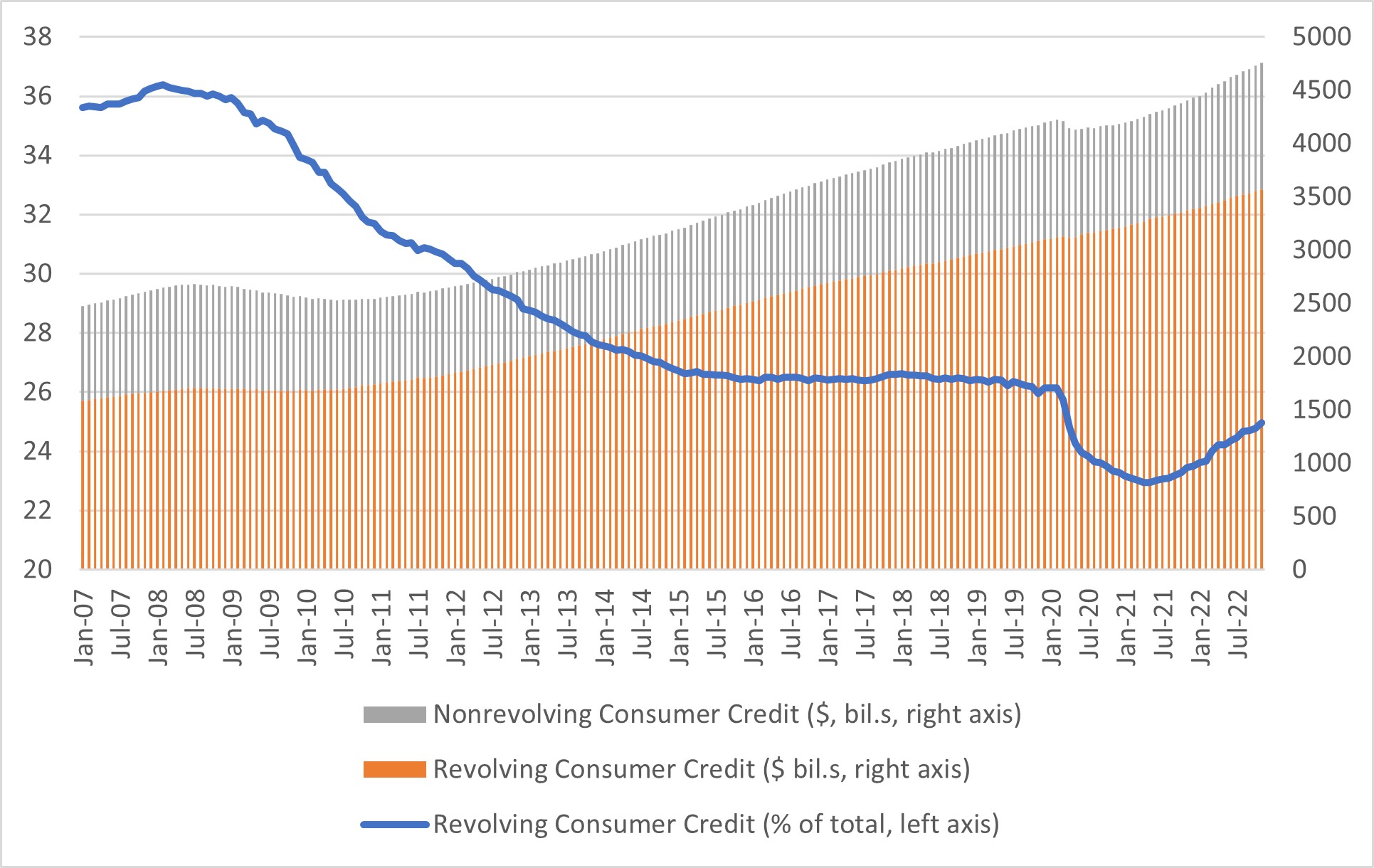

Another positive development may be that the composition of consumer credit (in aggregate) is less tilted toward revolving credit today. Revolving credit's share of total consumer credit outstanding is lower now (25 percent in November 2022) than before the pandemic (26.1 percent in February 2020). This continues a broad declining trend in that share, which started after the Great Recession.

However, Figure 3 above also shows that the share of revolving credit has been rising since June 2021, coinciding with the elevated inflation that started in spring 2021. This could simply be another recovery to trend after a sharp drop during the COVID-19 recession. But it could also be a sign that high inflation is causing consumers to rely on higher-interest revolving debt to sustain their spending. As this year unfolds, we'll be watching the data on consumer credit carefully to assess the health and sustainability of consumer spending.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.