What Are "Core Retail Sales?"

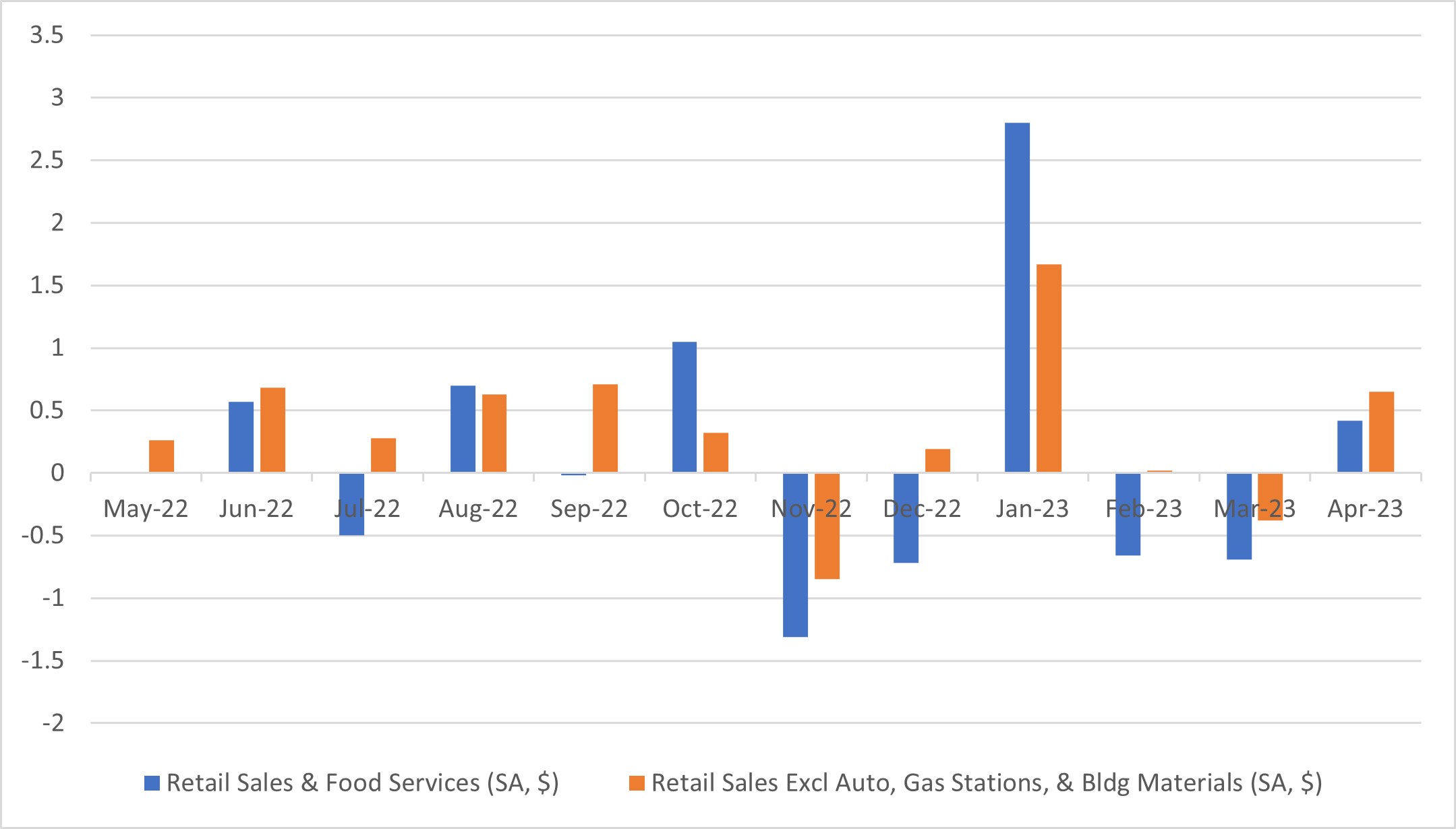

April's advance monthly retail sales report showed consumer demand expanding to kick off the second quarter of 2023. Total nominal retail sales including food services rose 0.4 percent monthly, following two months of 0.7 percent declines. Even more impressively, "core retail sales" — which exclude automobiles, gasoline, building materials and food services — rose 0.7 percent monthly after a 0.4 percent drop the previous month. But why do some economists and economy-watchers emphasize the core measure of retail sales, and why exclude these four categories?

The Census Bureau (which produces the monthly retail trade report) does not officially report a measure of core sales in its monthly release. The idea of "core retail sales" reflects how a portion of the data in this report are incorporated into the Bureau of Economic Analysis (BEA) estimates of personal consumption expenditure. According to the BEA, the personal consumption expenditures (PCE) estimates for most goods — known as the "PCE control group" — are prepared using the "retail control method," which estimates the growth rate of certain categories of PCE by matching growth rates of corresponding categories in the Census Bureau's retail trade surveys.

Not all the retail sales data are used. In some cases, other sources of data are more comprehensive than the Census's survey when it comes to spending coverage. For automobiles, the BEA uses data reported by domestic and foreign motor vehicle manufacturers and aggregated by industry data providers, rather than a sample of auto dealers' sales.

Similarly, the BEA uses data compiled by the Department of Energy (DOE) for gasoline consumption rather than the monthly sample of gas stations surveyed in the Census's report. One reason the DOE data are more comprehensive for gasoline consumption is that a considerable share of gasoline sales occurs outside of gas stations at places such as grocery stores, convenience stores and big box retailers. As a result, "core retail sales" drops these two categories.

What about building materials? The reason these sales are dropped from core retail sales is largely a matter of definition. Many of these purchases — such as lumber, roofing materials, plumbing and HVAC — are more closely related to homebuilding, which the BEA considers residential investment rather than personal consumption.

As for food services, this category technically does not need to be dropped from the "core," because the BEA uses the Census Bureau's reporting of sales by food services and drinking places to benchmark the "purchased meals and beverages" component of PCE for services. However, the monthly Census's report makes a sectoral distinction between "retail sales" and "food services." As a result of this distinction, food services drops out of core retail sales even though the category falls under the BEA's "PCE control" group.

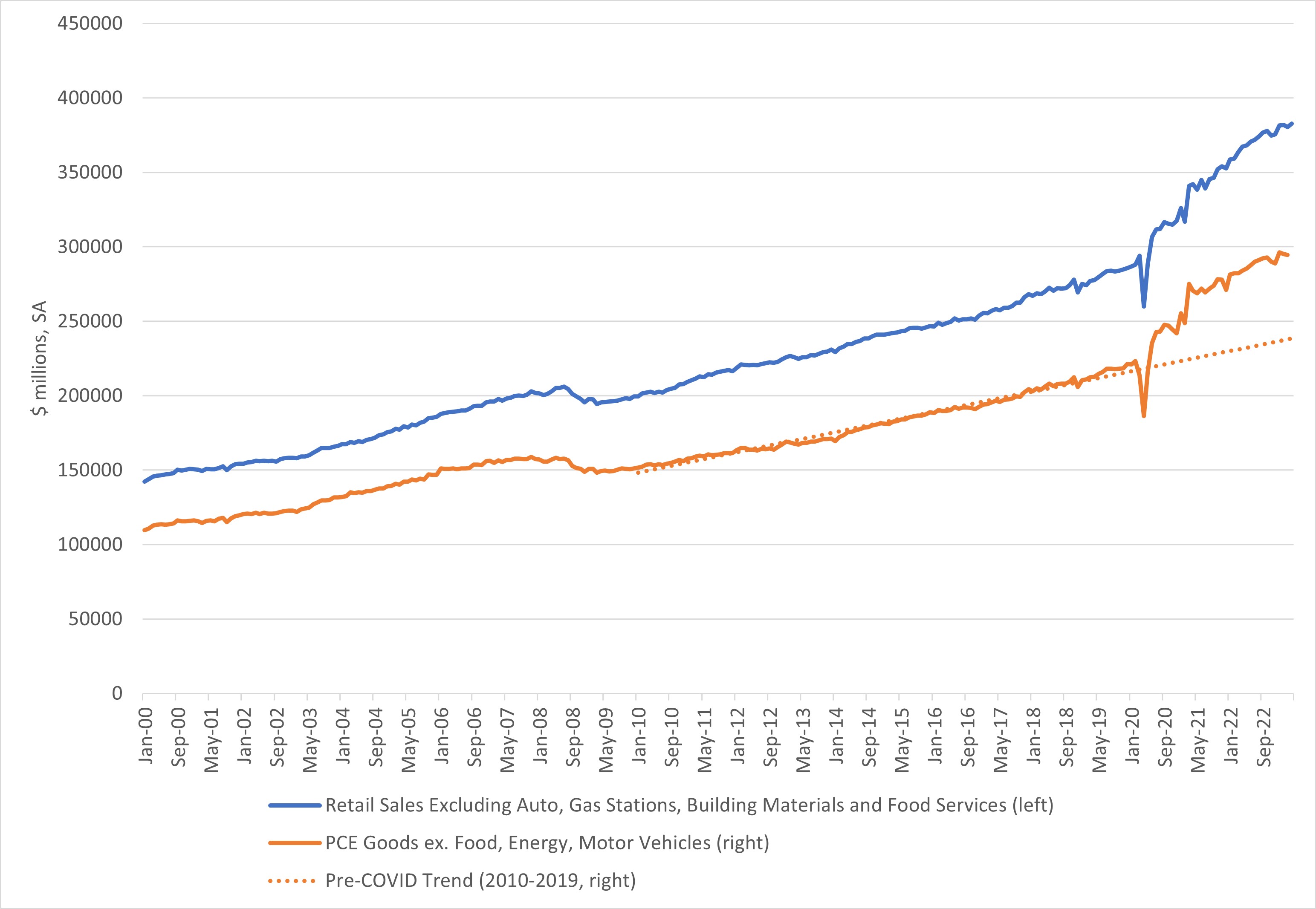

After stripping out these four categories, core retail sales should closely follow nominal PCE of goods ex food, energy and motor vehicles. As shown in Figure 2 below, the two series roughly track each other. Core retail sales may be a quirky measure, but it seems to be telling us that nominal nonauto, core goods spending is on track to continue its impressive streak above its pre-COVID-19 trend.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.