Is PCE Inflation Back on Track?

During the period of stable inflation from January 1995 to February 2020, the monthly inflation rate moved systematically with the share of relative price increases (a statistic from the cross-sectional distribution of relative price changes). That systematic relationship continued during the first year of COVID-19, but then shifted up in the spring of 2020.

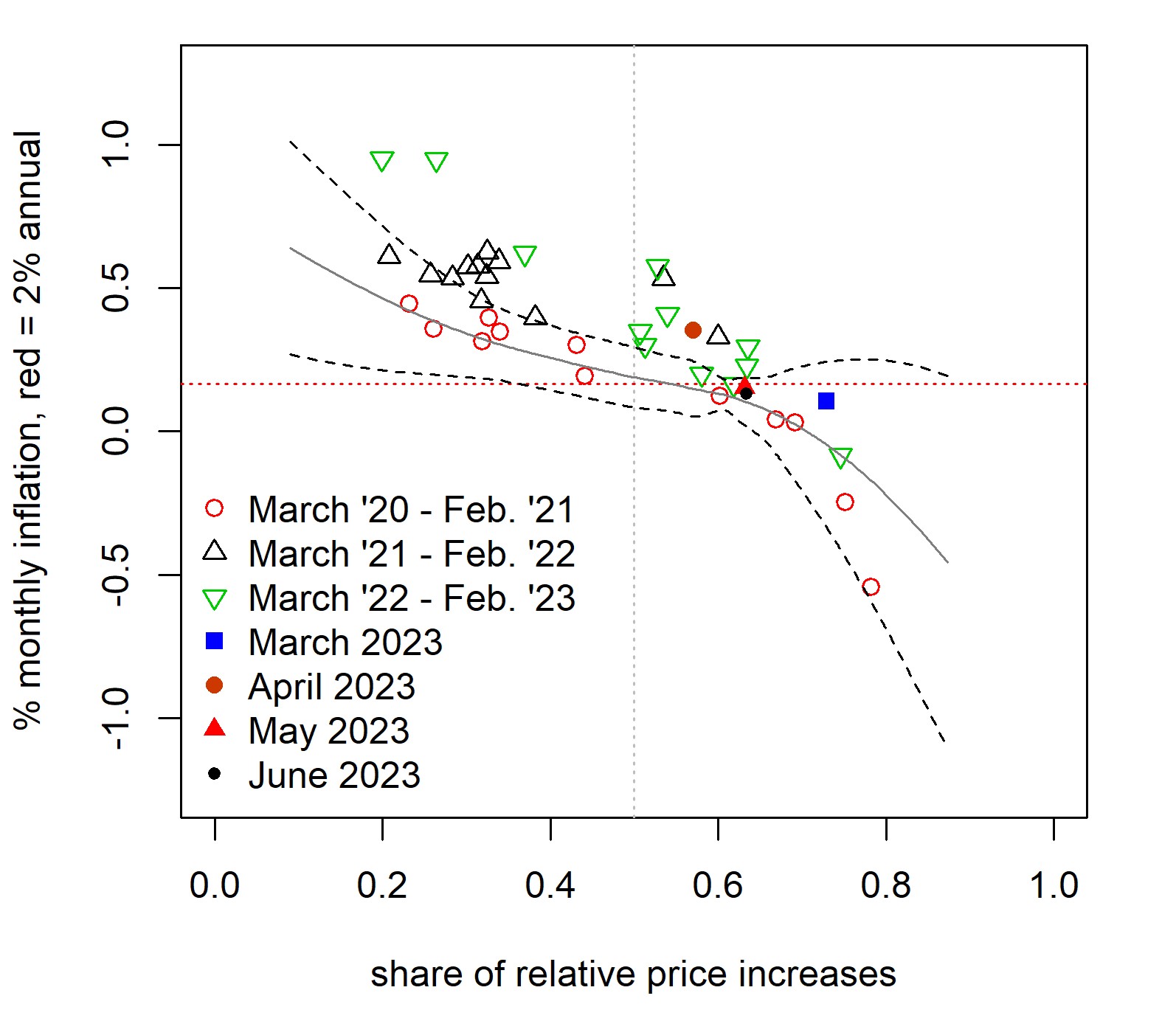

In an article from April, I pointed to tentative signs of a return to the pre-pandemic relationship in data from late 2022 and early 2023. Monthly inflation is volatile, in part because of large shocks to relative prices, making it challenging to tease out the signal. A return to the pre-pandemic relationship between inflation and relative price changes would be an encouraging sign.

This post provides an update based on the last four months of data, which provide more reason for guarded optimism: In three of the last four months, inflation has behaved in a manner consistent with its pre-pandemic relationship to the share of relative price increases.

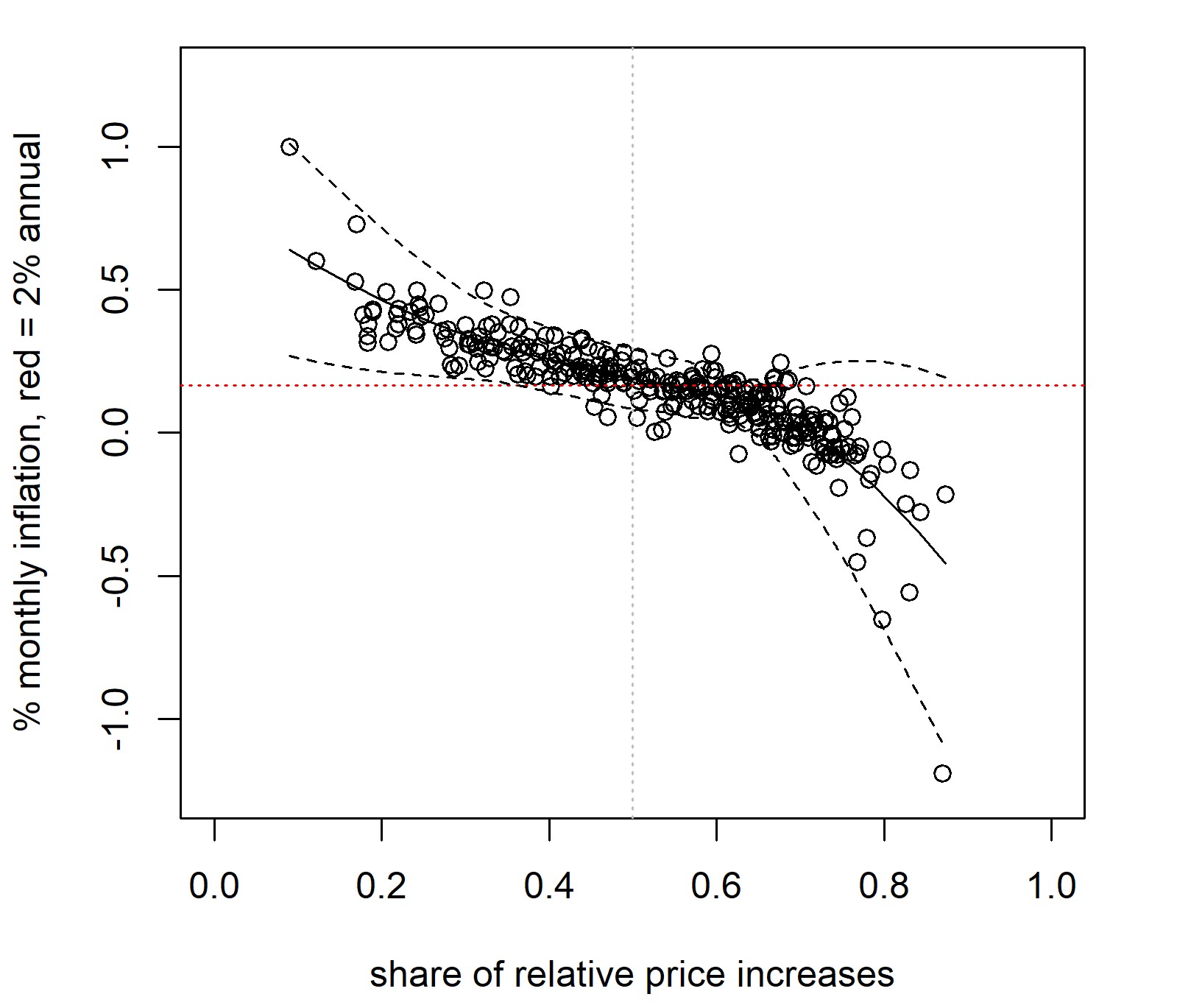

When inflation is generally stable near the Fed's 2 percent target (as it was before the pandemic), it can nonetheless have substantial monthly fluctuations.1 One factor that can cause those fluctuations is sharp changes in supply or demand affecting narrow categories of consumption. The leading example is gasoline: We typically see large price changes for gasoline accompanied by movements in inflation in the same direction. In principle, the same relative price change for gasoline could be accomplished with an unchanged inflation rate. This would require small price changes for all other categories of goods and services in the opposite direction of the gasoline price change. In practice, we don't see that happen. Figure 1 below shows that this characterization applied more broadly when inflation was generally stable from 1995 to 2020: There was a negative relationship between the monthly share of relative price increases and the inflation rate. In the gasoline example, an extremely large increase in the price of gasoline would be a point on the left side of the figure: The share of relative price increases would be small — since only gasoline's relative price increases, and its share is about 2.5 percent of expenditure — and the inflation rate would be high.2

The solid and dashed lines in Figure 1 are the means and two-standard-deviation prediction intervals from a local polynomial regression of inflation on the share of relative price increases. In Figure 2 below, we plot the monthly observations starting in March 2020, together with the pre-pandemic predicted relationship from Figure 1. The open circles and triangles represent the months from March 2020 to February 2023, color coded for the three 12-month intervals. The solid points in Figure 2 represent March through June of this year.

As discussed in my April article, inflation obeyed its previous relationship during the first pandemic year but then "escaped" in the second and third years, with three quarters of the monthly inflation rates coming in above the two-standard-deviation prediction interval.3

In three of the last four months, inflation has been within the prediction interval based on data from the pre-pandemic era, when inflation was stable near the Fed's 2 percent target. This is the first such stretch since May 2021. In Figure 2, one can see that inflation was in the prediction interval for three months during the second pandemic year. However, unlike the current run of three out of the past four months, those months of "on-track" inflation were spread throughout the year, coming in April, July and November of 2022.

The recent observations are encouraging signs that inflation may be back on track, although the recent monthly inflation rates each lie above the point prediction conditional on the share of relative price increases (the solid line in Figure 2). We won't need to wait long to add another data point to the picture: On Aug. 31, the Bureau of Economic Analysis will release PCE data for July.

Prior to the pandemic and early in the pandemic, there was much discussion of inflation having undershot the Fed's 2 percent target. From today's perspective, those undershoots look very small. I view them as consistent with stable inflation near target.

My article from April contains a slightly more detailed discussion of this relationship.

The data shown in my article from April do not line up exactly with the corresponding months in Figure 2 here due to data revisions.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.