Hunting for Holiday Discounts

Next week, Macro Minute takes an extended break due to the Thanksgiving holiday. Since that stretch of time also coincides with some of the biggest retail promotions of the holiday season, this post provides a look at where retail inventory-to-sales ratios may hint at discounts for price-conscious consumers.

Retailers saddled with excess inventories relative to sales often resort to price reductions to balance their stocks with the level of customers' demand. This phenomenon can show up in the economic data in several ways.

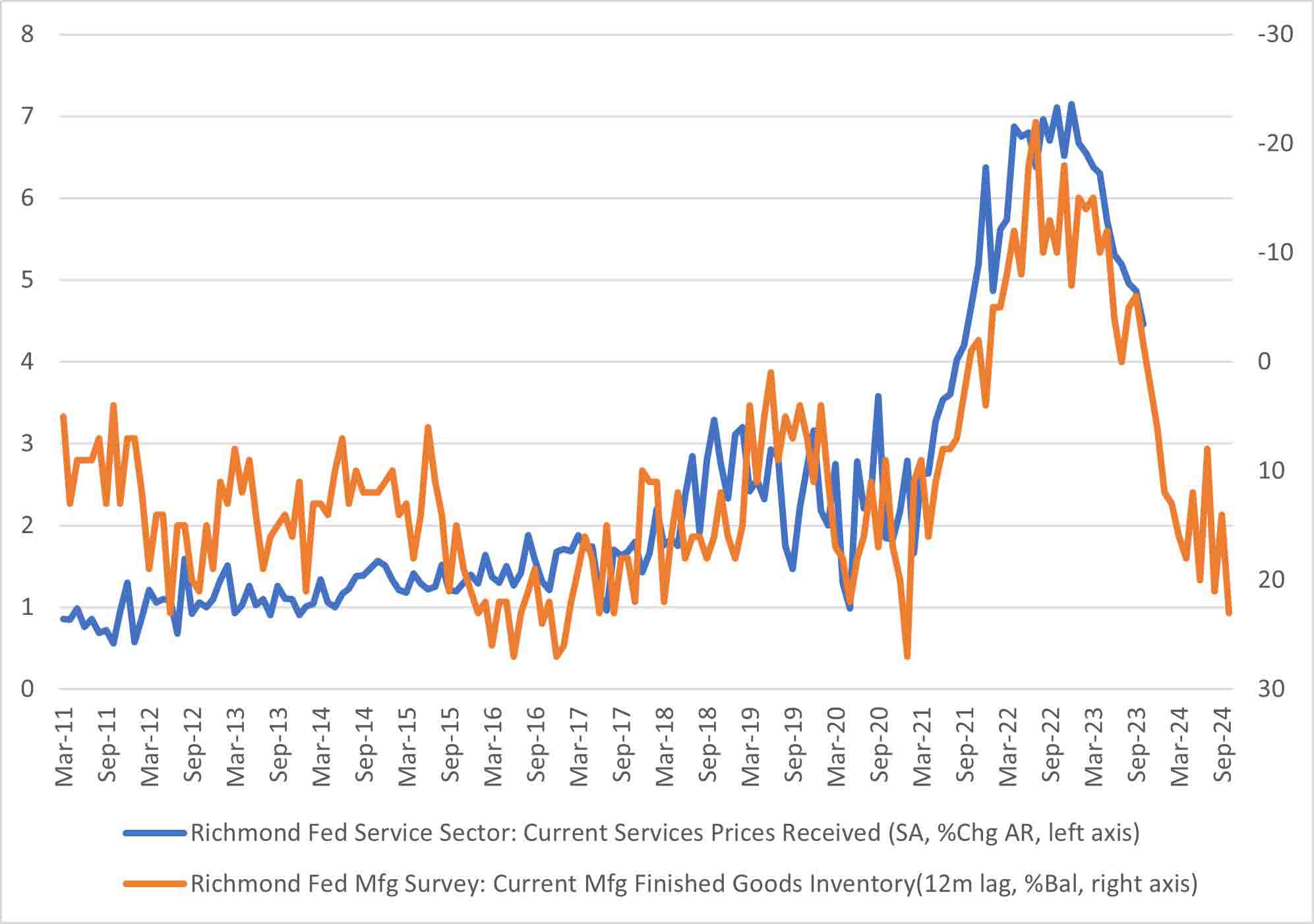

For example, in the Richmond Fed's Manufacturing Activity and Service Sector Activity surveys, we can see a relationship between manufacturers' finished goods inventories and services providers' reported growth in prices received. Figure 1 below shows these inventories on a 12-month lag on an inverted right axis and prices received by service providers on the left axis. We see that finished goods inventories dropped following the COVID-19 recession, and after a lag of about a year, inventory shortages may have spread to the retail level, causing pricing pressures to emerge in the services survey.

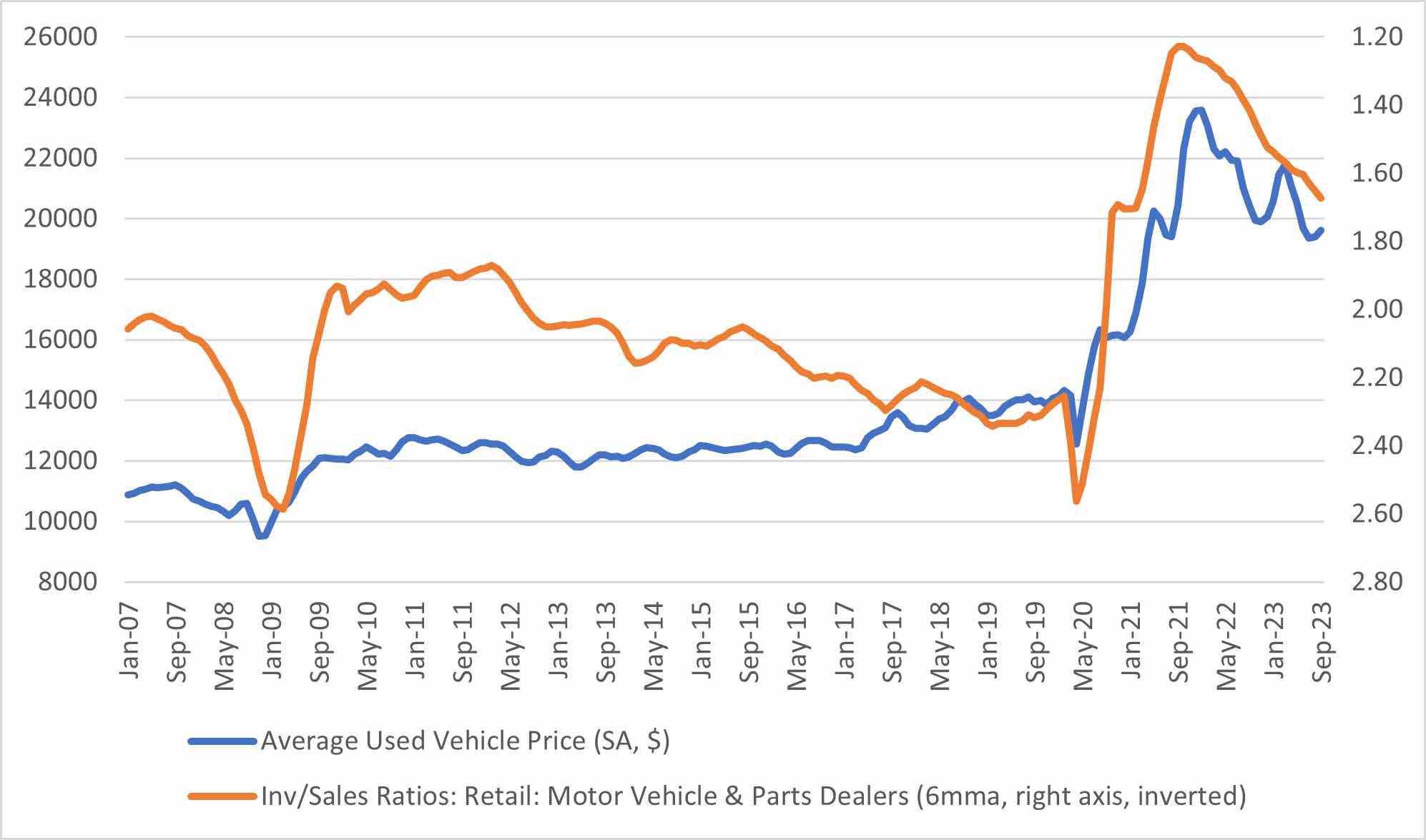

We also see a relationship between inventories and pricing in industry-level data. Figure 2 below shows the relationship between average used vehicle sales prices and the inventory-to-sales ratio for motor vehicle and parts retailers. As inventories fell in the aftermath of the pandemic recession, average sales prices for used vehicles rose. When the inventory-to-sales ratio began to recover in the spring of 2022, sales prices began falling again, though inventories remain low versus pre-pandemic levels. In this picture, there's less of a lag between inventories and their impact on prices, because the inventory series directly measures dealers' inventories, rather than manufacturers' inventories as in Figure 1.

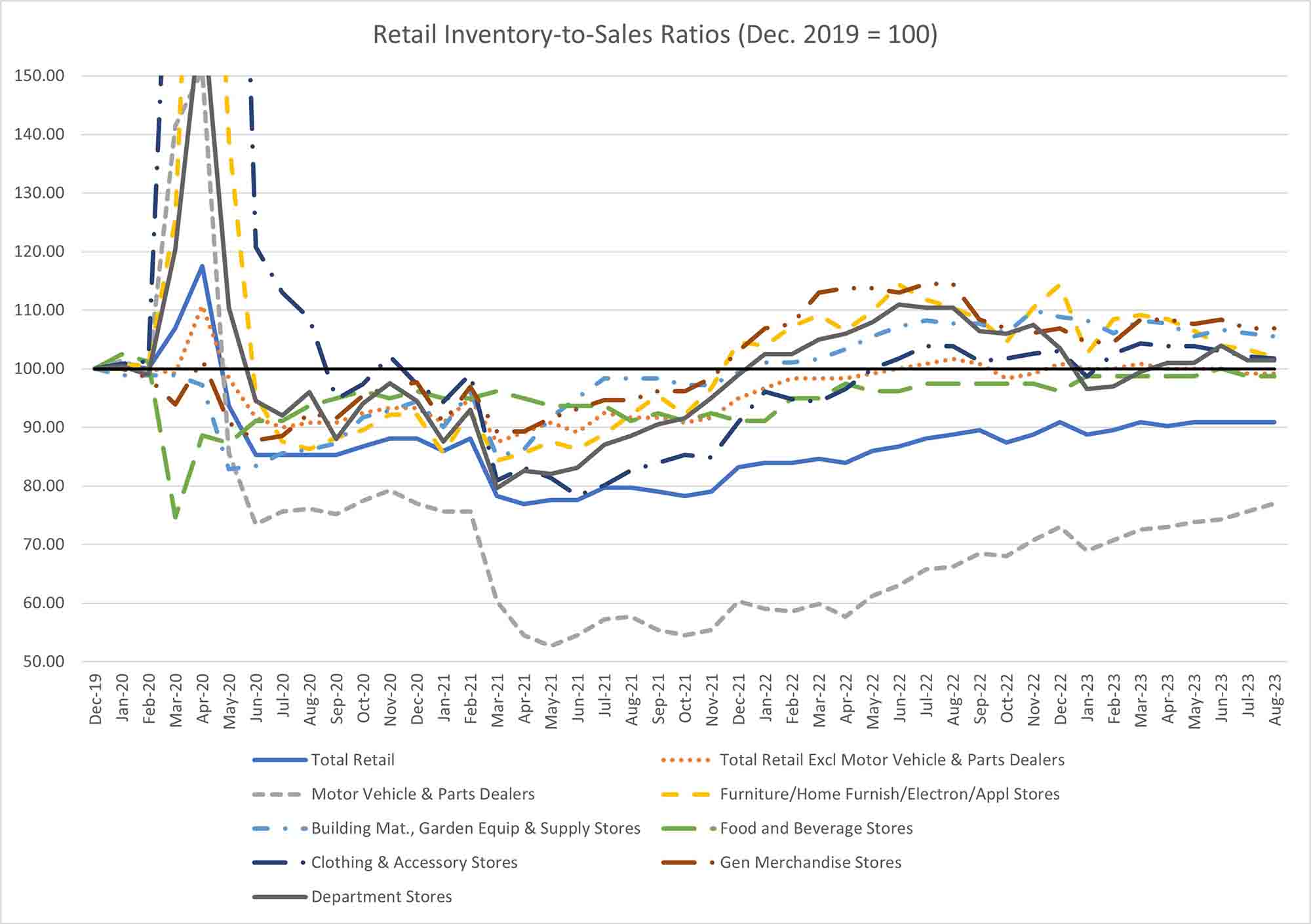

These findings suggest that retailers with elevated inventory-to-sales ratios may offer more discounts this upcoming holiday season. Figure 3 below shows inventory-to-sales ratios for a selection of retail businesses, indexed to December 2019 pre-pandemic levels. Across all retail businesses, inventory-to-sales ratios are about 10 percent lower than pre-pandemic benchmarks, mostly accounted for by motor vehicle and parts dealers. Excluding those businesses, retail inventory-to-sales ratios are roughly at pre-pandemic levels. (Note that there are more categories of retail businesses than are shown in Figure 3.)

In the Monthly Retail Trade report, several types of businesses appear to have higher inventories relative to December 2019 going into the holiday season. General merchandise stores, clothing and accessory stores, furniture and appliance stores, and department stores currently have elevated inventory-to-sales ratios compared to pre-pandemic levels. This suggests that shoppers bearing the brunt of elevated prices during recent years may find some relief over the holidays.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.