Consumer Surveys Show Choosier Shoppers

Although recent signs point to consumer price inflation (CPI) starting to ebb — such as July's CPI report indicating that year-over-year inflation fell from 3.0 percent in June to 2.9 percent in July — there are increasing signs that shoppers are rethinking their spending plans. In this week's post, we look at some of the survey evidence that consumers are starting to pull back on spending.

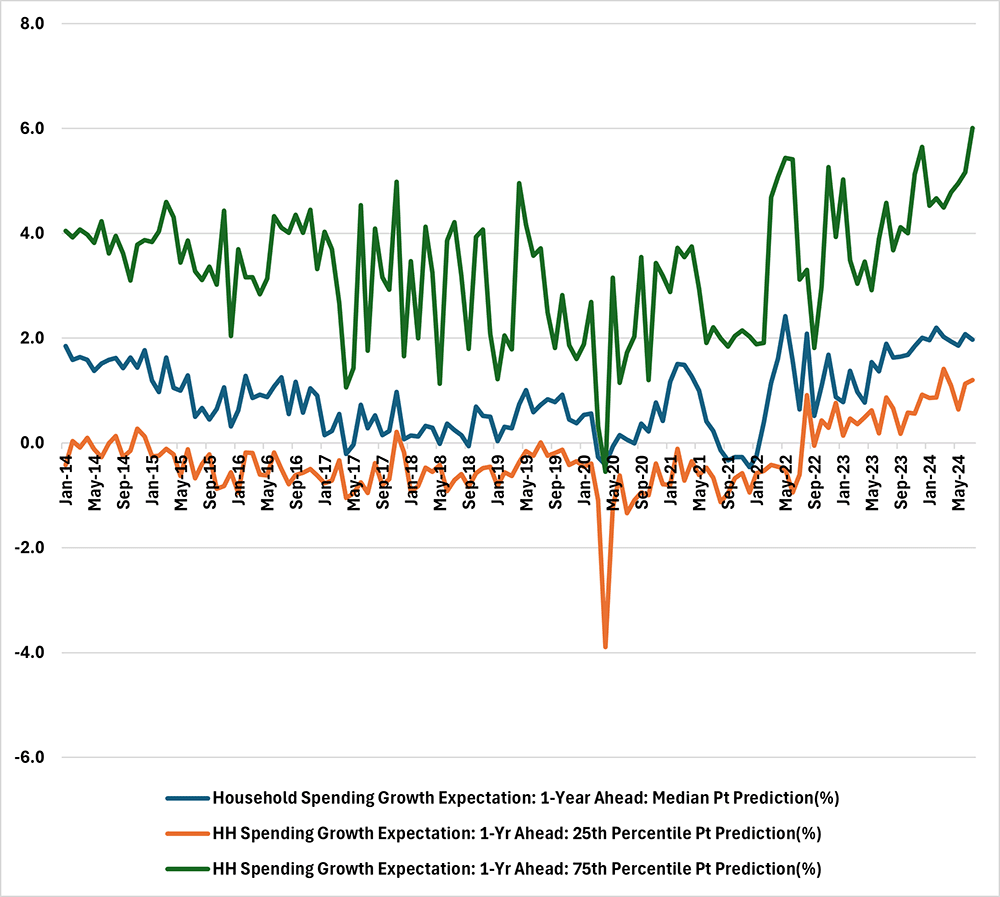

One survey indicating slowing momentum in household spending is the New York Fed's Survey of Consumer Expectations (SCE). In the latest July survey, median expectations for year-ahead spending growth fell to 4.9 percent in July versus 5.1 percent the previous month. Figure 1 below shows that this continues a declining trend in spending growth expectations that started in May 2022, when the median response peaked at 9.0 percent.

Figure 1 also shows the 75th and 25th percentile of responses in the SCE, which reveals an interesting dichotomy between the faster spenders in the 75th percentile and the slower-growing spenders in the 25th percentile:

- Spending growth expectations in the 75th percentile have risen for four straight months.

- Expectations in the 25th percentile are falling slower than the median.

It appears that, although most households expect slower spending ahead, expected spending growth remains higher than pre-pandemic levels. Also, at least a quarter of households expect their spending to grow even faster next year, compared to their expectations at the start of 2024.

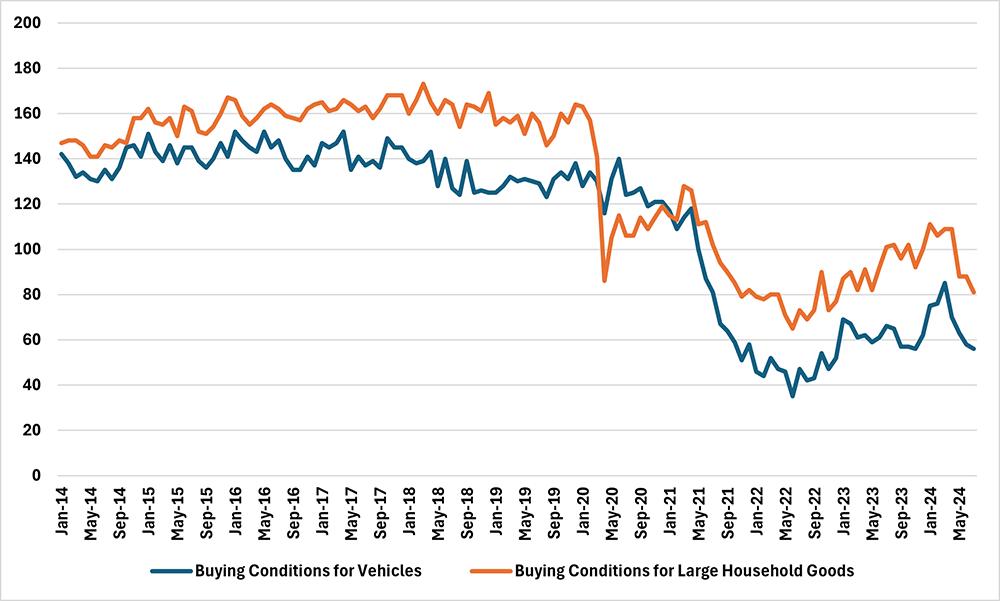

Some of the biggest pullback in consumer spending sentiment is in big-ticket household items and vehicles, which is evident in the University of Michigan's Surveys of Consumers. The Michigan survey asks respondents to assess whether it is a good time to buy large household durables or vehicles. The reported index is the percentage of households who report that it is a good time to buy minus the percentage who report it is a bad time, plus 100. The latest data are plotted in below in Figure 2.

For July, only 26 percent of households thought it was a good time to buy vehicles versus 70 percent who said it was a bad time to buy, leading to a reading of 56 in the index. This remains well below pre-pandemic observations, which topped 120. For large household durables, the index was 81 in July, with nearly 20 percent more households reporting adverse buying conditions than reporting that it was a good time to buy big-ticket items. This latest reading is even lower than the pandemic recession trough of 86 hit in April 2020 and well below pre-pandemic levels of buying sentiment. Durable goods purchases are thought to be more interest rate sensitive than other types of consumption, which may be one reason purchase sentiment remains particularly depressed in Figure 2 compared to Figure 1.

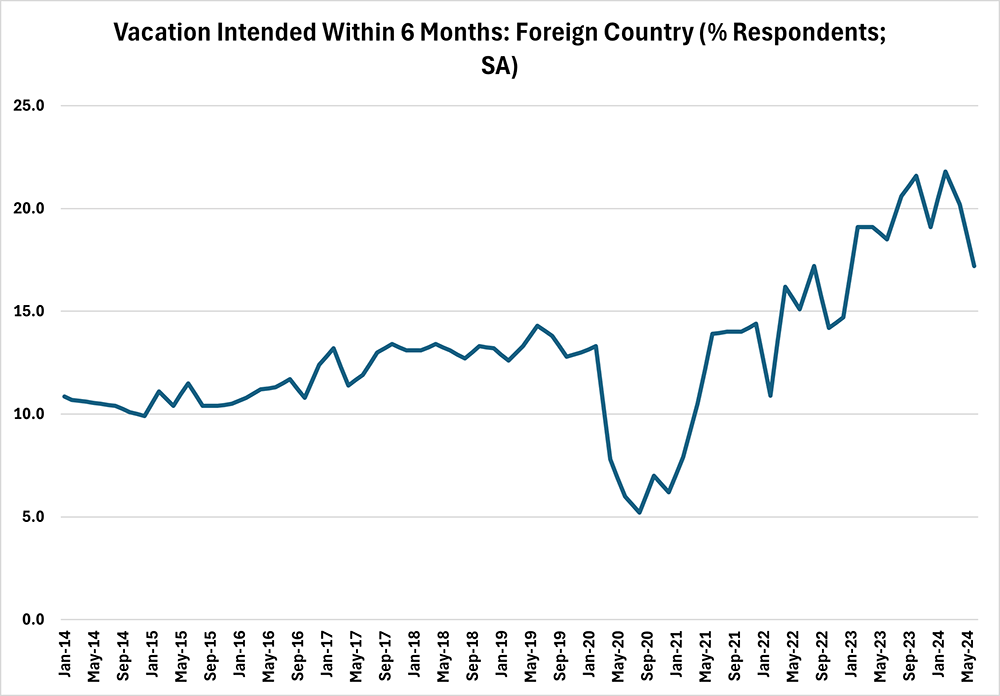

Some survey data may also be pointing to a slowdown in services consumption as well. Figure 3 below shows consumers' intentions to take a foreign vacation in the next six months from the Conference Board's U.S. Consumer Confidence Survey. While this represents only one segment of overall services consumption, it is notable that the changes in this index have mirrored broader trends in services consumption during the pandemic. In the early phases of the pandemic, many services-providing businesses closed their doors, and customers cut back on services consumption due to health concerns and lack of supply. As health concerns diminished, pent-up demand for services consumption led to a sharp rise in services spending. More recently, the wind-down of that pent-up demand may be leading to a normalization toward pre-pandemic levels.

In the latest bimonthly survey, the share of respondents planning to take a foreign vacation fell to 17.2 percent, compared to a reading of 20.2 in April and a peak of 21.8 percent in February. While this share remains elevated versus pre-pandemic levels, recent data support the narrative from other surveys that consumers are starting to pull back in spending.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.