Eyeing Health Insurance Costs and Inflation

Health care costs are a highly visible and closely watched component of the cost of living. In a Washington Post-Schar School poll of swing state voters conducted prior to the election, respondents ranked health care as the fourth-most important issue in determining their voting decision, with inflation ranking as the top concern. Within the health care category, cost and availability of health insurance often receives a lot of attention in the media. This week's post focuses on how health insurance costs are captured in both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index (the Fed's preferred inflation measure).

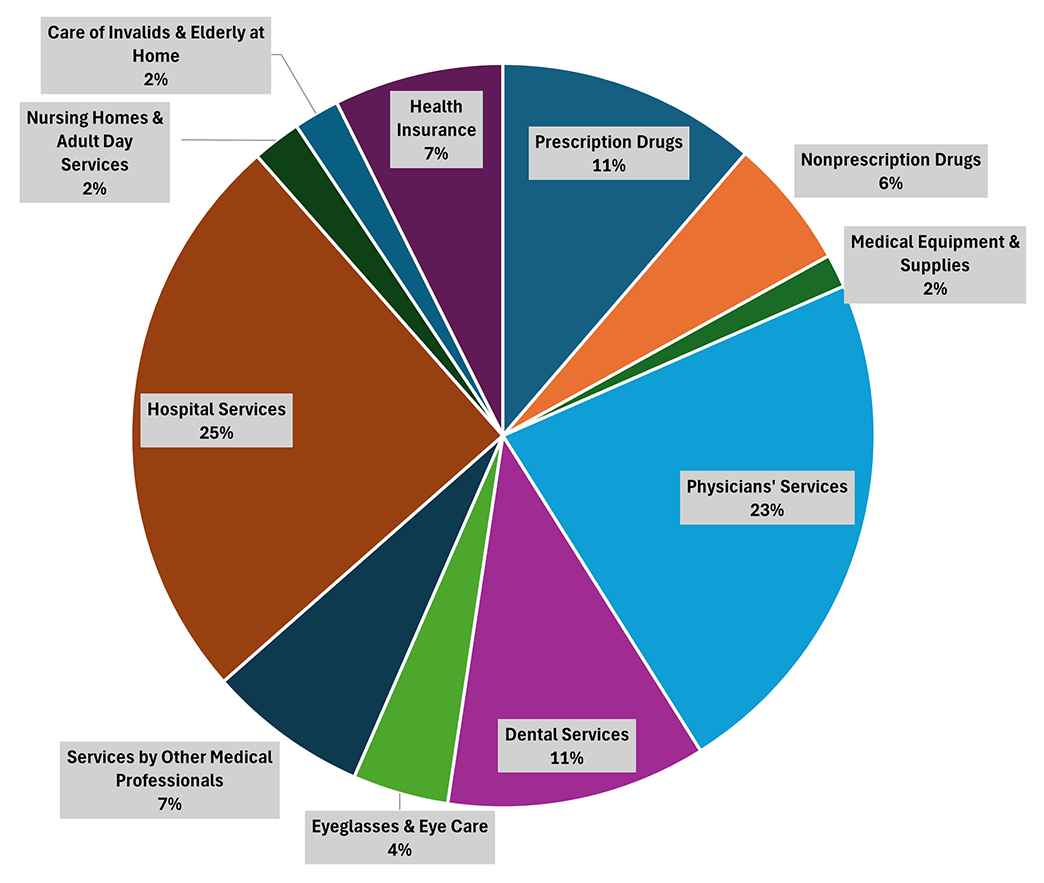

Despite the focus on health insurance, health insurance costs represent a modest share of overall medical care expenditure as shown in Figure 1 below. The figure depicts the average monthly shares of various categories of medical expenditure in CPI in 2024. Health insurance makes up 7 percent of overall medical care expenditures, less than a third the size of the two biggest categories (hospital services and physicians' services). While this may seem surprisingly small from a consumer perspective, this is because statistical agencies attempt to separate insurance reimbursement payments on medical care goods and services from the pure cost of insurance. Thus, the health insurance component of spending reflected in Figure 1 reflects the administrative and overhead costs of providing insurance services, with benefit payouts to health providers falling under other categories of medical care expenditures.

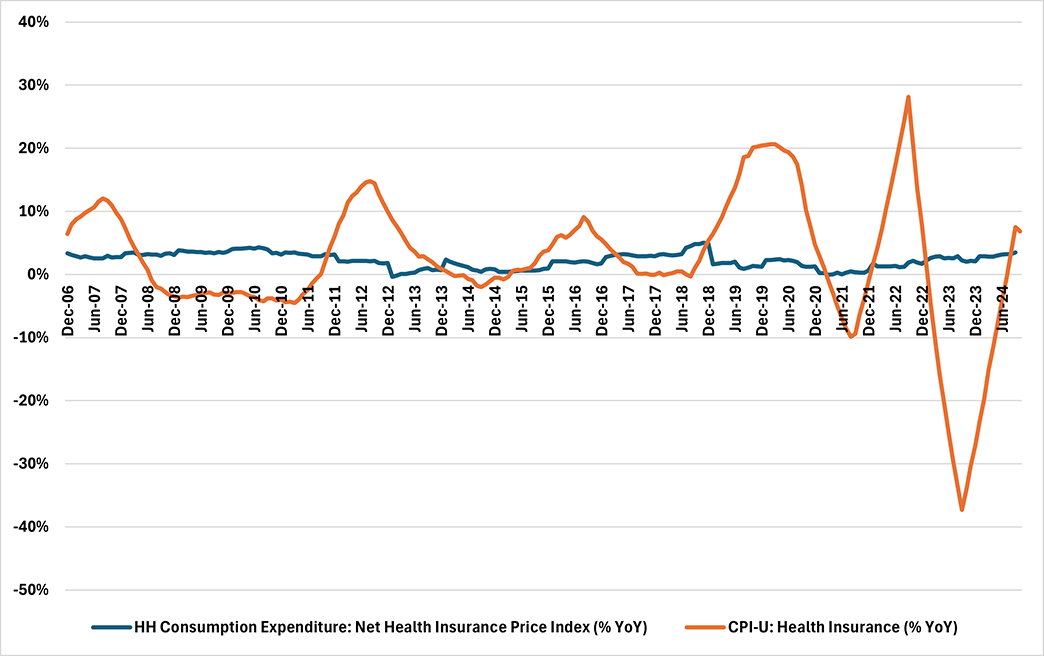

As shown in Figure 2 below, there are significant differences between the CPI and PCE measures of health insurance prices, leading to more volatility in the CPI measure of health insurance price growth. According to the Bureau of Labor Statistics (BLS), the CPI's health insurance price index "...does not directly price health insurance policies. In a direct approach, we would track the movement of insurance premiums, holding constant the quality of insurance, and use these price relatives to build the Health Insurance Index. However, the BLS has been unable to consistently control for changes in quality such as policy benefits and risk factors. Price change between health plans of varying quality cannot be compared, and any quality adjustment methods to facilitate price comparison would be difficult and subjective."

Instead of directly measuring health insurance premiums, the CPI indirectly measures health insurance costs using the "retained earnings method." Under the retained earnings method, the BLS separates health insurance premiums into two components:

- The reimbursements for medical goods and services, also known as benefits paid out

- The cost of administering insurance services, also known as retained earnings

The BLS assumes that if retained earnings rise relative to benefits paid out, then the quality of insurance has decreased relative to its cost. Therefore, the ratio of retained earnings to benefits can form the underlying basis for an index of health insurance costs. Prior to October 2023, the BLS estimated retained earnings using annual financial data reported by health insurance companies; starting in October 2023, the BLS began to calculate updates on a semiannual basis.

In contrast, the health insurance component in the PCE price index directly reflects health insurance premiums. The PCE price index measures health insurance prices via the Producer Price Index (PPI) for direct health and medical insurance carriers. In the PPI, the BLS surveys health insurance companies about premiums associated with an actual insurance policy. To track changes over time, survey respondents can choose between two options:

- Providing current estimates of the premium for a "frozen" policy, which holds the price-determining characteristics of an insurance policy constant over time

- Providing actual premiums for a given policy each year, along with further information on the characteristics of the policy which the BLS uses to factor out "pure" price changes from price changes attributable to changes in benefits

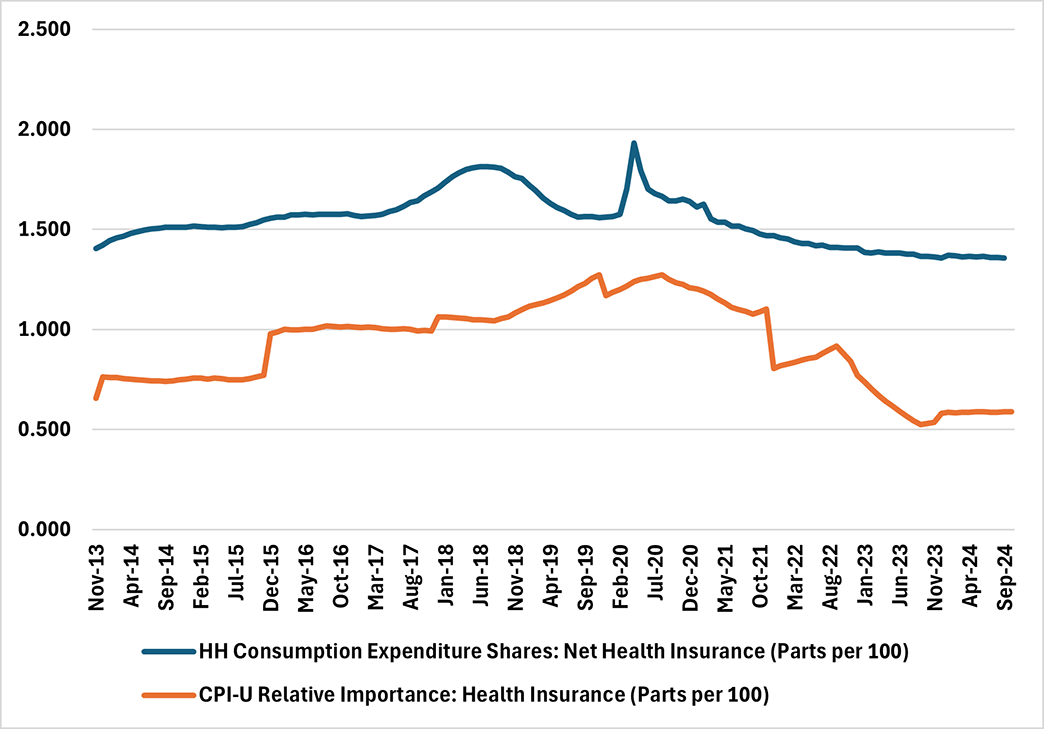

In addition to differences in methodology, the weights associated with health insurance costs differ between the CPI and PCE inflation measures. In particular, health insurance costs receive a higher weight in the PCE spending basket than in the CPI basket. This is because the CPI reflects only out-of-pocket household spending on goods and services, while the PCE measure also includes spending on behalf of households by third-party payers. As a result, government-subsidized and employer-paid health insurance plans are counted in the PCE, but not in the CPI.

Figure 3 below shows that the weight on health insurance in the PCE spending basket is more than twice as large as the weight of health insurance in CPI. The CPI's health insurance weights are also more volatile than the PCE's health insurance weights, with a standard deviation of 0.22 from September 2014 through September 2024, compared to a standard deviation of 0.13 for the PCE weights over the same time period.

These differences in the measurement of health insurance prices used in the CPI and PCE inflation measures are another reason that monthly CPI inflation readings are an imperfect predictor of PCE inflation. With a more volatile category-level price index combined with more volatile spending weights for health insurance expenditure, health insurance prices can sometimes move CPI inflation in a significant manner. For example, on average over the course of 2022, health insurance contributed 15.4 basis points to year-over-year CPI inflation each month, in contrast to a contribution of 2.3 basis points to year-over-year PCE inflation. Months in which the health insurance contribution to CPI inflation is higher than normal do not necessarily imply that PCE inflation will also be elevated in that month.

For the next two weeks we will be on hiatus due to the FOMC blackout. Following that, we will take an additional break due to the upcoming holiday season, so the blog will be on pause for the rest of December. The blog will return Jan. 14, 2025.

Happy holidays and see you in the new year!

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.