Payroll Revisions: An Upcoming September Surprise?

Following the September FOMC meeting, the Fed highlighted recent signs of slowing labor market momentum, saying that "downside risks to employment have risen." Meanwhile, recent downward revisions to monthly payroll numbers — including revisions resulting from the Bureau of Labor Statistics (BLS) annual preliminary benchmarking process — have focused attention on the uncertainty surrounding estimates of monthly employment growth. In this week's post, we examine whether some months are noisier than others when it comes to estimating payroll employment growth.

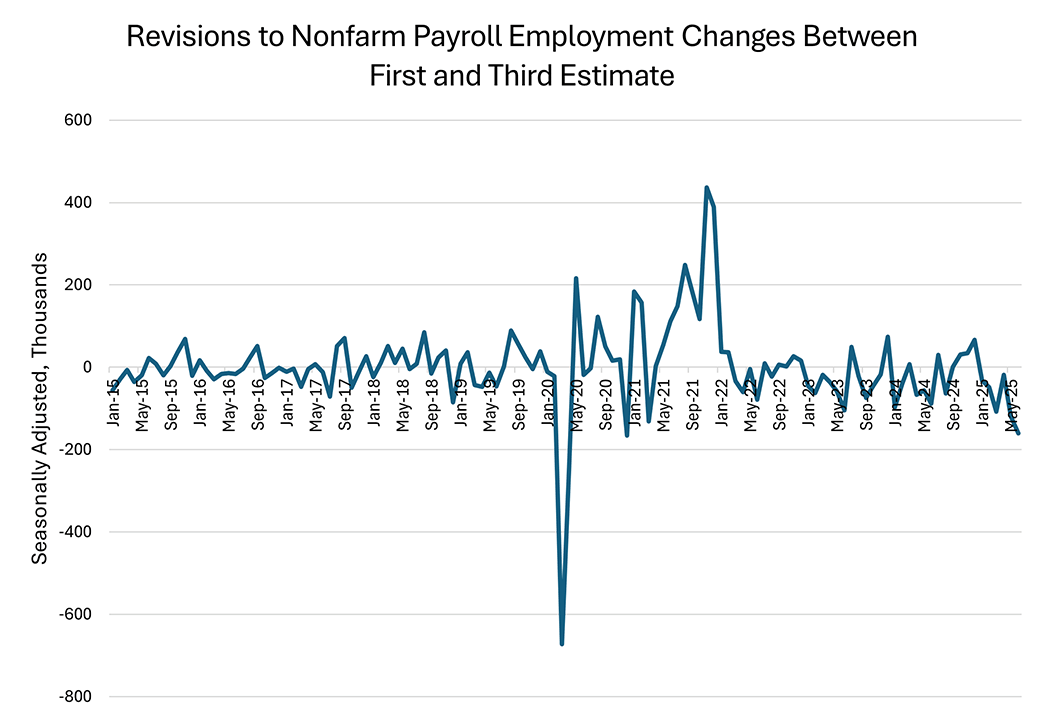

The BLS keeps track of revisions between estimates of monthly payroll growth going back to 1979. For example, Figure 1 below shows the difference between the first estimate and the third estimate of monthly payroll growth from January 2015 through June 2025. Revisions during the pandemic recession and in the early post-recession period were particularly large and volatile, indicating that revisions can be larger when monthly payroll changes are larger. In the analysis that follows, we will normalize monthly revisions by an estimate of the month-over-month change in payrolls.

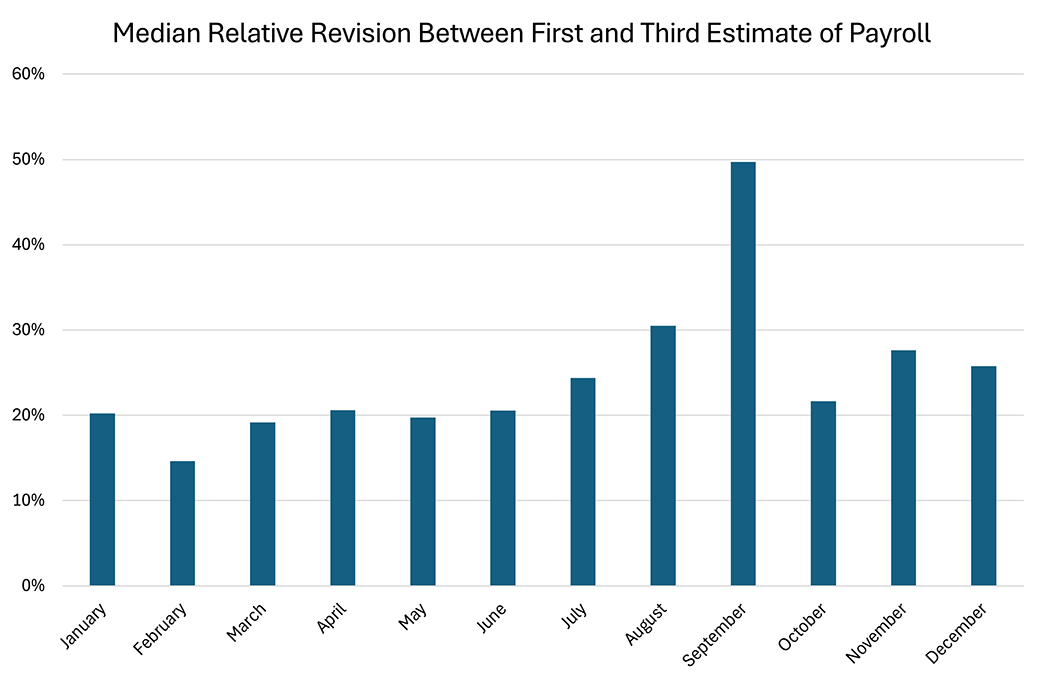

These data can be used to shed light on which months have seen relatively bigger revisions. For each month, we calculate the relative revision, which is then divided by the size of the earlier estimate of monthly payroll growth. We take the absolute value of this ratio and compare the median values of each month to see whether some months tend to have larger revisions.

Figure 2 below plots the median relative revision between the first and third estimates of monthly payroll growth. September is an outlier in terms of having a much higher relative revision compared to other months. On the median, estimates for September payroll growth have been revised by nearly half of the initial estimate by the third revision.

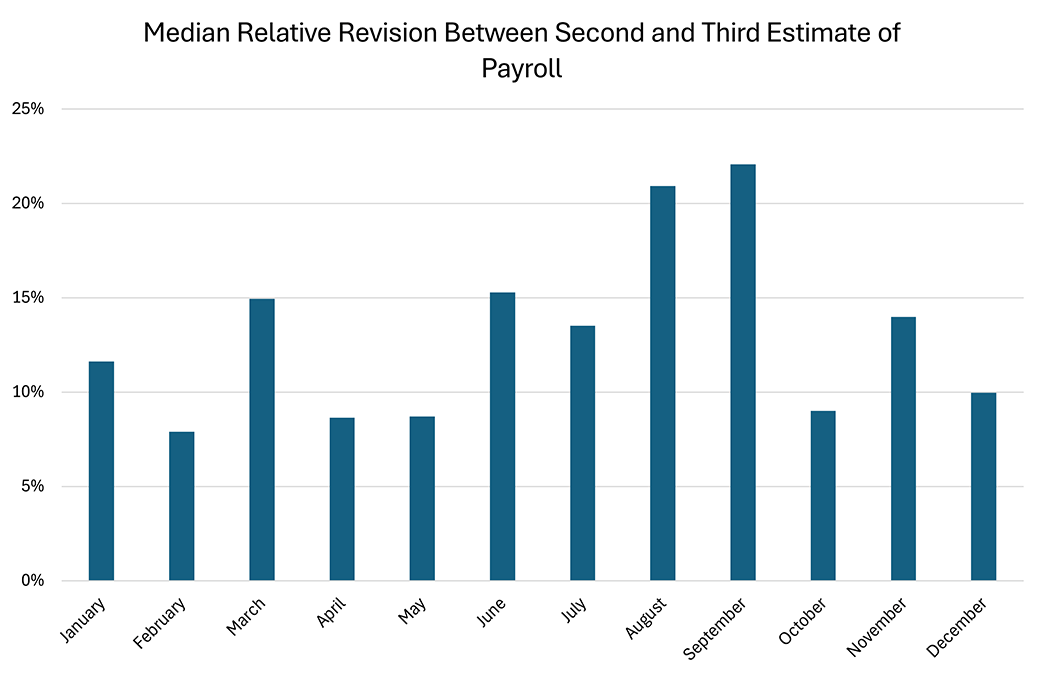

September stands out as an outlier when looking at the sequential revision between the first and second estimates as well. Figure 3 below plots the median relative revision between the first and second estimates of payroll growth. Once again, the median revision in September appears to be higher than those of other months: Nearly 30 percent in September versus just over 20 percent for the next closest month (December).

The historical record suggests that September sees relatively larger estimates between the second and third estimates as well. On the median, the revision between the second and third estimate of September payroll growth has been over 20 percent of the size of the second estimate. August is the only other month that experiences similarly sized revisions between the second and third estimates of payroll growth.

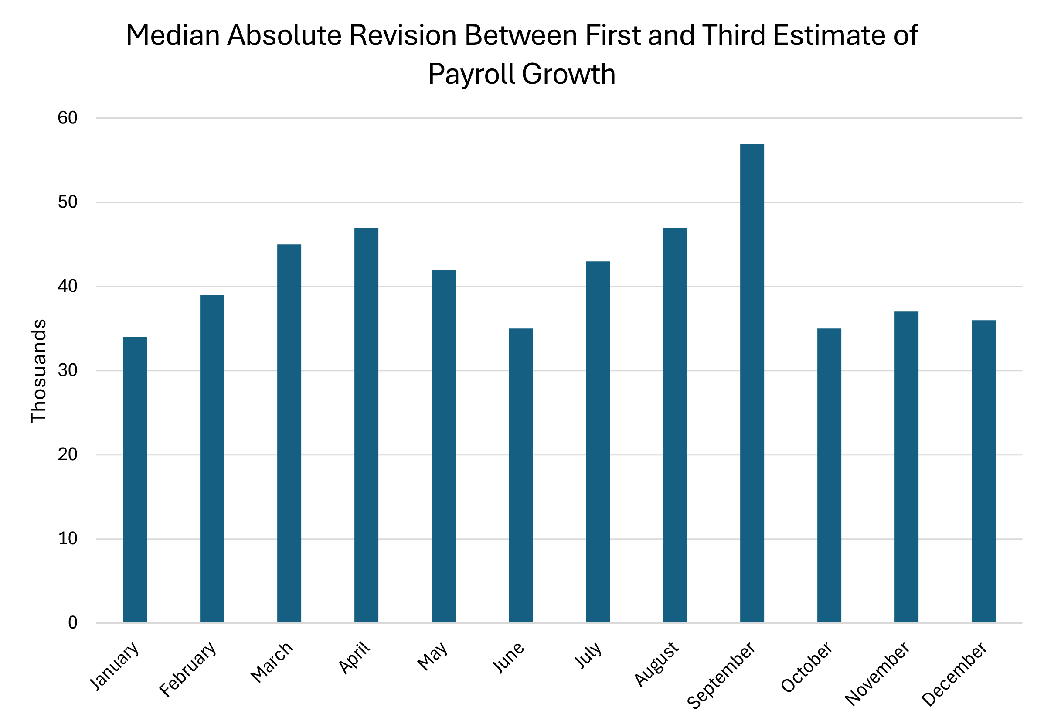

Finally, I check whether normalization has driven these results. In Figure 5 below, I plot the median absolute revision between the first and third estimates of payroll growth. In other words, I show the absolute difference between the first and third estimates of month-over-month payroll growth in thousands, rather than as a percentage of the first estimate.

On the median, September is revised 57,000 between the first and third estimates of monthly payroll growth, compared to a median revision of 39,000 in other months. Thus, September stands out as prone to larger revisions in absolute terms as well as percentage terms.

These findings highlight that the initial estimate of payroll employment growth for September may be particularly noisy and subject to revision compared to other months. Economic data watchers should be cautious in drawing definitive conclusions from next week's estimate of September's nonfarm payroll growth.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.